TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nio Inc

Stock Price Continues Downward!

But, “Weekly Options” Members Are Already Making Profit

Using A Weekly call Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Wednesday, January 26, 2022

by Ian Harvey

Nio Inc – ADR (NYSE: NIO)

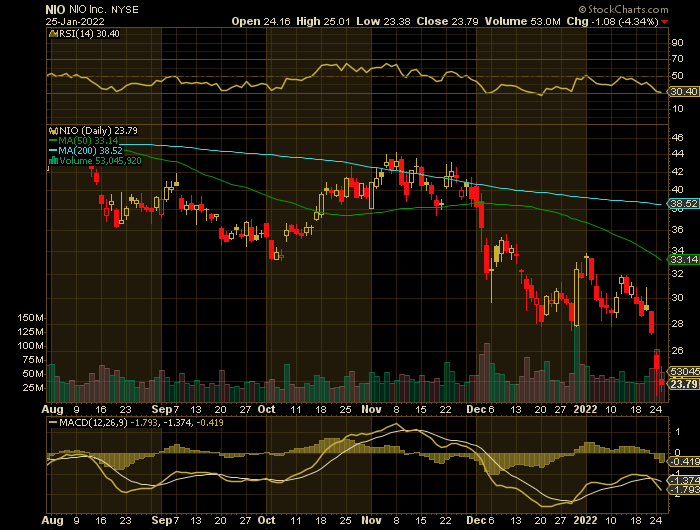

Nio Inc – ADR (NYSE: NIO) dropped 12% Monday – and another 4.34% yesterday – and is down close to 30% year-to-date.

Monday's stock market rout brings with it a fresh wave of major selling pressure in some of the buzziest names in the market that in part, helped drive equities to records in 2021.

And, this downward pressure continued Tuesday.

Nio is defined as a high tech stock with a lot of future promise but no profits, yet. The market has been aggressively selling these types of stocks this past month as investors bet on lower future returns with interest rates headed higher.

With the S&P 500 sliding more than 10% from recent records, bears from the likes of Mizuho International Plc and Bank of America Corp. warn of fresh selling to come as growth momentum eases just as the Federal Reserve amps up borrowing costs.

“There’s probably more downside over the next few months as the market adjusts to the reality of the Fed removing accommodation, earnings slowdown and much less federal stimulus,” said Ed Clissold, the chief U.S. strategist at Ned Davis Research, who late last year predicted a double-digit drop in stocks and today is warning of a correction on the order of 20% from the early January peak.

Investors are coming to terms with a more hawkish Fed that won’t step in to smooth over every market hiccup. They expect policy makers to plow on with higher rates, with a quarter-point hike in March and close to a full percentage point rise for the whole of 2022.

For many, the direction of travel is troublesome for rate-sensitive investing styles.

“We can see this downward pressure on the equity markets being relatively sticky unless there is a catalyst for a much less hawkish Fed and general global central bank reaction,” said Peter Chatwell, head of multi-asset strategy at Mizuho. “The market stress scenario is what we think is happening now.”

Fears of a conflict added to concerns that a years-old bubble in tech will finally burst as the US Federal Reserve puts up interest rates and scales back massive pandemic stimulus.

Stocks which have benefitted from the long era of cheap money and the rise of remote working suffered badly ahead of an apparent return to normal life.

Worries over the market were underscored by purchasing managers’ index data that showed US economic activity slowed during January.

Analysts at investment bank Jefferies said the sell-off may signal markets expect the US will enter a recession. John Canavan from Oxford Economics said the sell-off “highlight[s] the risks of an aggressive Fed”.

The Federal Open Markets Committee is expected to continue a shift towards tighter policy at its Wednesday meeting.

The deteriorating backdrop is starting to show on quarterly earnings reports, which have so far served as reassuring beacons against any doomsday predictions.

After unprecedented successive jumps in earnings growth, the guidance from S&P 500 companies so far for the months ahead is “disappointing” and the information offered by managers in earnings calls is “concerning,” according to a note by Goldman Sachs Group Inc. strategists on Monday.

“The froth is coming out of an equity market that simply got too extended on valuation,” Mike Wilson, a long-term bear at Morgan Stanley, wrote Monday.

A “rocky” stretch for U.S. stocks is far from over, with the tech-heavy Nasdaq indexes poised to fall into bear markets thanks to the Federal Reserve’s newfound zeal to undercut inflation, according to Jeremy Siegel, finance professor at the Wharton School of the University of Pennsylvania.

The long-time market watcher said he expects more than four interest-rate hikes this year, a risk that “equities are not really priced for.” He sees a 20% decline in the Nasdaq 100 from the November record, implying a more than 7% fall from current levels.

“I don’t think the pain is over yet,” Siegel said.

A host of technical signals also suggests that more volatility may be coming. Siegel sees more fundamental challenges ahead, from the Fed struggling to snuff out price pressures to the spreading omicron variant undercutting first-quarter economic expansion.

About Nio Inc…..

Founded in 2014, the company originally operated under the name NextCar, changing it to NIO Inc in July 2017. In its Chinese form, the name translates to "Blue Sky Coming," which stems from management's vision of a future with azure skies absent the pollution from

Raising $1 billion during its initial public offering, NIO debuted as a publicly traded company on the American market in September 2018. On its first day of trading, the stock opened at $6, closed at $6.60, and traded as high as $6.93 for a reasonable pop.

On Sept. 24, 2018, the company achieved a new Guinness World Record when Chen Haiyi from China ascended the Purog Kangri glacier in Tibet and reached an altitude of 18,751 feet in the NIO ES8, setting a record for the highest altitude achieved in an electric car. According to the company, the feat was meant to demonstrate the EV's prowess in high altitude and extreme cold.

While NIO's vehicles may only be seen on the roads of China, the company is drawing on talent from a worldwide pool of employees. In San Jose, California, for example, the company's North America headquarters is home to more than 500 employees who primarily focus on software development. According to the company, the London office works on "commercial Formula E [race car] management, strategic management, and our supercar development." Nearly 200 employees in the Munich office concentrate on product and brand design.

The Major Catalysts for the Nio inc Weekly Options Trade….

Nio Inc was just one of many companies that saw their shares hit hard in early trading on Monday, and this continued Tuesday. Traders and investors are concerned about higher interest rates, which now seem likely amid the highest inflation in years. The U.S. Federal Reserve will begin a two-day meeting on Tuesday that could end with a signal that rates will begin rising as soon as March.

Izzy Englander.....

Israel Englander is one of the most prominent hedge fund managers of all time. In 1989, he started Millennium Management with $35 million in seed money. Over the years, the firm has grown into one of the top hedge funds, currently managing over $57 billion in assets. Englander’s real-time net worth stands at $10.5 billion.

As of Q3 2021, Millennium Management’s 13F portfolio carries a value of $166.7 billion, up from $163 billion from the previous quarter. However, the focus is on the stocks in which Izzy Englander sold during Q3..... During Q3 2021, Millennium Management sold its entire stake in NIO Inc.

Market Setbacks.....

The Dow

Jones Industrial Average at one point fell more than 860 points in Monday's

session, as traders fretted about the outcome of the Fed meeting on Wednesday.

Worries on earnings out of Tesla and Apple this week — and the precarious

situation between Russia and Ukraine — is also hurting sentiment for stocks.

The S&P

500 slipped into correction early on in the session, defined as a 10% decline

from a recent high.

"It certainly is a plethora of pain for investors

this morning. I would be very hesitant of getting in or adding positions in

just about anything before we hear from an increasingly hawkish Federal Reserve

on Wednesday," said The

Strategic Funds managing director Marc LoPresti on Yahoo Finance Live.

As it

stands, the Nasdaq is down 15% so far in 2022, followed by an 11% drop for the

S&P 500 and a 8.1% decline for the Dow.

Inflation.....

Recent sell-offs in tech stocks are mostly tied to inflation, which is at a 40-year high. To prevent a dizzying rise in prices from doing damage to the economy, the Federal Reserve has hinted that it would start raising interest rates this year, and analysts expect the institution to do it at least three times this year, starting in March.

This scenario makes less risky assets, such as Treasury bonds, savings accounts - just as attractive as tech stocks, whose economic model is future growth.

The prospect of better and higher returns on investment from assets judged to be low-risk makes investors less inclined to buy technology stocks that sell promises.

Subsidies.....

Despite the decline in shares of many EV names, the industry is growing. For instance, new-energy vehicles (NEV) sales in China, the largest EV market in the world, are expected to exceed 5 million units in 2022. And EV sales should comprise over 30% of the nation’s auto market, reaching at least 7 million units, by 2025.

However, Chinese authorities are reducing EV subsidies for 2022 and will withdraw them completely in 2023. Moreover, the government has recently removed a long-standing mandate and now allows for “full foreign ownership of passenger car manufacturing” in China.

Analysts.....

Among 26 analysts polled, NIO Inc stock has a consensus buy rating. Also, the consensus of 25 analysts for a 12-month median price target stands around $58.43, implying an upside potential of 95% from current levels. The 12-month price estimates for the stock range between $37.74 and $87.64.

Its trailing price-to-book (P/B) and price-to-sales (P/S) ratios stand at 11.9 and 8.5, respectively. By comparison, these metrics for Tesla (NASDAQ:TSLA) are a P/B of 37.8 and a P/S of 24.7.

Put another way, despite the recent decline, NIO Inc shares still look frothy by traditional valuation metrics. The same holds true for TSLA stock as well.

Yet the company gets significant attention due to its growth potential.

On Wall Street, most back the Morgan Stanley analyst’s take; the stock has a Strong Buy consensus rating, based on 6 Buys vs. 2 Holds. The overall target remains at Graseck’s prior objective of $22.

Summary.....

Nio Inc has a solid product line and offers tangible growth strategies. However, NIO Inc shares could continue to come under pressure in 2022, in part due to tougher competition, higher operational costs and regulatory risks. Given the upcoming tightening moves by the Federal Reserve, investors are also taking money off the table. Therefore, NIO Inc stock could easily continue to slip further.

Therefore…..

How Far Down Will Nio Inc Price Fall!

What Further Nio Inc Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Nio Inc