TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix (NFLX) Weekly

Options Trade Provides 449% Potential Profit!

Members of “Weekly Options USA,” Using A Weekly CALL Option,

Make Potential Profit Of 449%,

After

JPMorgan

Analyst Doug Anmuth Doubled Down On His Prediction That Netflix Is Still A

Good Buy.

where to now?

Join

Us and GET FUTURE TRADEs!

JPMorgan analyst Doug Anmuth is doubling down on his prediction that Netflix is still a good buy.

Anmuth, who reiterated his outperform rating and 12-month price target of $390 a share, told clients to "buy pullbacks" in the stock.

This set the scene for Weekly Options USA Members to profit by 449%, using a Netflix (NFLX) Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, March 30, 2023

by Ian Harvey

Why the Profit on Netflix (NFLX) Weekly Options?

With 231 million subscribers and 2022 revenue of $31.6 billion, Netflix Inc (NASDAQ: NFLX) is dominant in the streaming and entertainment business. The company has been at the forefront of bringing streaming video entertainment to the masses. Even in a terrible macroeconomic environment, it was able to add 8.9 million net new members and increase sales 6.5% last year.

From a content perspective, Netflix still shines bright. According to data from Nielsen, Netflix commanded 7.3% of total TV viewing time in the U.S. in February, second only behind Alphabet's YouTube. As more households ditch their cable-TV subscriptions, the company can benefit, as it's the top streaming brand.

The Profits Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

The Trade: Buy NFLX APR 06 2023 320.000 CALLS - price at last close was $5.39 - adjust accordingly.

Entered the Netflix Weekly Options (CALL) Trade on Tuesday, March 21, 2023 for $3.90.

Depending on the risk strategy of the member of Weekly Options USA the following scenarios are applicable.....

On Thursday, March 23, 2023 the options trade hit $12.55; a potential profit of 222%.

On Friday, March 24, 2023 the options trade hit $19.15; a potential profit of 391%.

And on Monday, March 27, 2023 the options trade hit $21.40; a potential profit of 449%.

Depending on the strategy taken, half the weekly options contract could have been sold for 222% (as profit is now available even if the trade reverses) and the remaining sold, on speculation, for a higher profit.

The Actual Recommended

Trade for netflix (nflx).....

(READ HERE)

Prelude.....

Not all is it seems for Netflix Inc (NASDAQ: NFLX).

JPMorgan analyst Doug Anmuth is doubling down on his prediction that Netflix is still a good buy—despite user frustration surrounding Netflix's password-sharing crackdown, fears of short-term subscriber churn and a sagging stock price.

Netflix shares, down about 4% since the company's fourth quarter earnings results, have lost more than 17% of gains since hitting a year-to-date high of $369.02 a share on January 26. Wall Street punished the streamer last month after it slashed prices by 50% in about 100 overseas markets.

"We recognize the [near-term] noise and believe in many respects that buying NFLX for 12 months out may be easier than for the next 3-4 months. But overall we remain bullish," Anmuth wrote in a new note on Monday.

Anmuth, who reiterated his outperform rating and 12-month price target of $390 a share, told clients to "buy pullbacks" in the stock. He categorized advertising momentum as one of the main catalysts for his bullish call, coupled with "solid content" and password sharing, which should drive revenue, margin expansion, and free cash flow in 2023.

JPMorgan expects Q1 subscribers to come in at 1.5 million with Q2 net additions hitting 3.25 million.

Further Catalysts for the NFLX Weekly Options Trade…..

Monthly Users.....

On Sunday, it was reported that Netflix's ad-supported service reached roughly 1 million monthly active users in the U.S. after its second month on the market—bucking earlier reports the ad tier was off to a slow start.

The user base grew by more than 500% in the first month from its launch and another 50% in its second month, the report added.

Moving Forward.....

As the company looks to capitalize on more revenue opportunities, games will be another area of focus.

Netflix announced in a blog post on Monday it has 70 games in development with external partners and an additional 16 games in progress at the company's in-house game studios. The streamer has released 55 games so far, with about 40 more slated for later this year.

Broyhill Asset Management.....

Broyhill Asset Management highlighted stocks like Netflix.

Broyhill Asset Management made the following comment about Netflix, Inc. (NASDAQ:NFLX) in its Q4 2022 investor letter:

"Speaking of fresh names, we established a new position in Netflix, Inc. (NASDAQ:NFLX) during the second half. We began accumulating shares after the company reported two consecutive quarters of subscriber losses, which brought the stock down by about 75% from peak to trough. Our investment in Netflix is a good example of what we categorize as a “temporary dislocation” and a great example of the historical investments we’ve made in the tech sector. Unlike other “value” investors, we don’t arbitrarily put tech in the “too hard” pile. We are comfortable and more than happy to underwrite investments in the industry. We just demand a margin of safety when doing it (something often ignored by other investors in the industry). That margin of safety opened up when consensus quickly concluded that Netflix’s growth was over, on the heels of two quarters of subscriber losses, which happened to follow years of surging lock-down-induced demand. The popular narrative was that by pursuing advertising revenue, Netflix was all but admitting that streaming television was completely saturated. We thought otherwise. With ~ 75MM subscribers in the US, even converting a small portion of those 100MM moochers would move the needle3. And given the superiority of the company’s technology and first-party user data, we think the consensus is completely underestimating the long-term potential of a Netflix advertising model."

Price Cuts.....

Competition in the subscription video-on-demand industry has tightened over the last couple of years, with many operators experiencing tepid growth -- or worse, losing customers.

Despite these market challenges, Netflix has opted to try something bold: cutting prices. Last month, the company reduced subscription fees in 30 markets across multiple territories, including Europe, the Middle East, and Africa.

The move may seem counterintuitive -- Netflix is seemingly gambling that it can make up the revenue shortfall by attracting enough new subscribers. However, by some estimates, just 10 million of Netflix's more than 230 million customers will benefit from the revised pricing, so it's ostensibly a risk worth taking.

Revenue Driver....

Netflix has made clear it has several long-term goals, not least of which is to grow the amount of money it makes from advertising.

Before the TV streamer introduced its $6.99 a month Basic with Ads plan in November 2022, the company was purportedly bullish on its prospects; the Wall Street Journal reported Netflix's internal projections pointed toward the company having 40 million customers for its ad-supported tier by the end of its 2023 fiscal third quarter. But sign-up rates were initially lacking, so Netflix had to return some money to its advertisers.

But, Netflix's ad strategy churn doesn't seem to be a major issue for Netflix. As highlighted by Gregory Peters, Netflix's chief operating officer, many investors had raised questions about the risk of Netflix customers transitioning away from higher-cost plans to Basic with Ads. But, Peters says, such churn hasn't been a problem, noting the "unit economy remains very good."

Cheap.....

Perhaps the most compelling reason to snap up Netflix stock right now is that the company's share price is much cheaper than it has been in recent years; in November 2021, Netflix's stock was trading at around $680 apiece. At present, you can purchase shares for around $300 -- a difference of 55%.

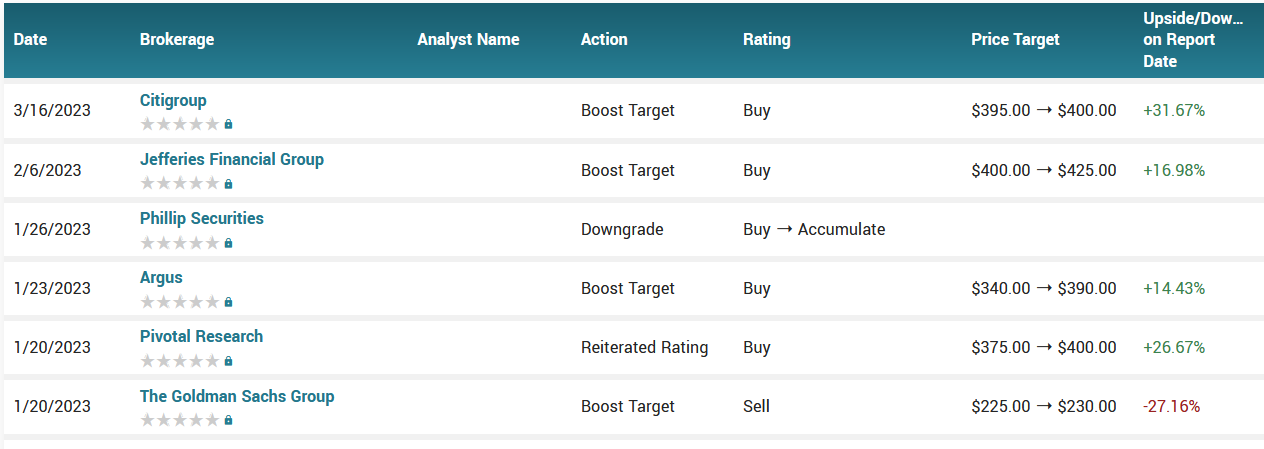

Analysts.....

According to the issued ratings of 41 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 3 sell ratings, 15 hold ratings and 23 buy ratings for NFLX. The average twelve-month price prediction for Netflix is $343.13 with a high price target of $440.00 and a low price target of $215.00.

Summary.....

The streamer is making a solid play for new customers in emerging territories, it's also building out its ad plan without jeopardizing its more expensive offerings. And considering many on Wall Street have faith Netflix's stock has space to climb, the signs are positive.

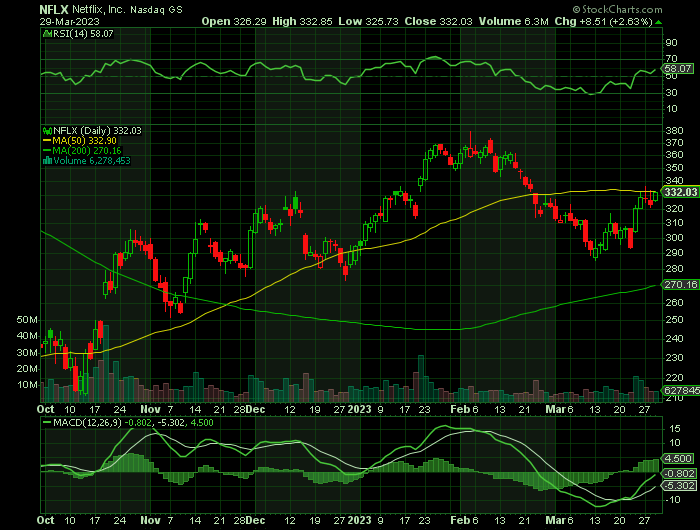

Netflix has a 50 day moving average price of $334.97 and a 200-day moving average price of $293.18. Netflix has a one year low of $162.71 and a one year high of $396.50. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.17 and a quick ratio of 1.17. The stock has a market cap of $136.66 billion, a P/E ratio of 30.50, a P/E/G ratio of 1.41 and a beta of 1.26.

Conclusion…..

After generating positive free cash flow (FCF) of $1.6 billion in 2022, Netflix management predicts the business will produce $3 billion in FCF this year, well on its path to becoming a sustainably profitable company based on this important financial metric. This is a huge milestone for Netflix, and it better positions the business against rivals that find themselves in worse financial conditions.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Netflix NFLX

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.