TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Moderna Stock Price Continues To Surge!

Optimism For Growth Prospects!

and, "Weekly Options Members” Make 270% Potential Profit,

up another 101% from the day

before.

More to Come?

April 17, 2021

Moderna stock price continued to surge Friday as optimism for growth prospects by analysts and investors became more apparent.

And, “Weekly Options Members” are now up potential profits of 270%, up another 101% from the day before.

More upwards movement is

expected, and for those that have exited the trade, a new trade may be

considered.

Moderna Inc (NASDAQ: MRNA)

The Actual Recommended Trade…..

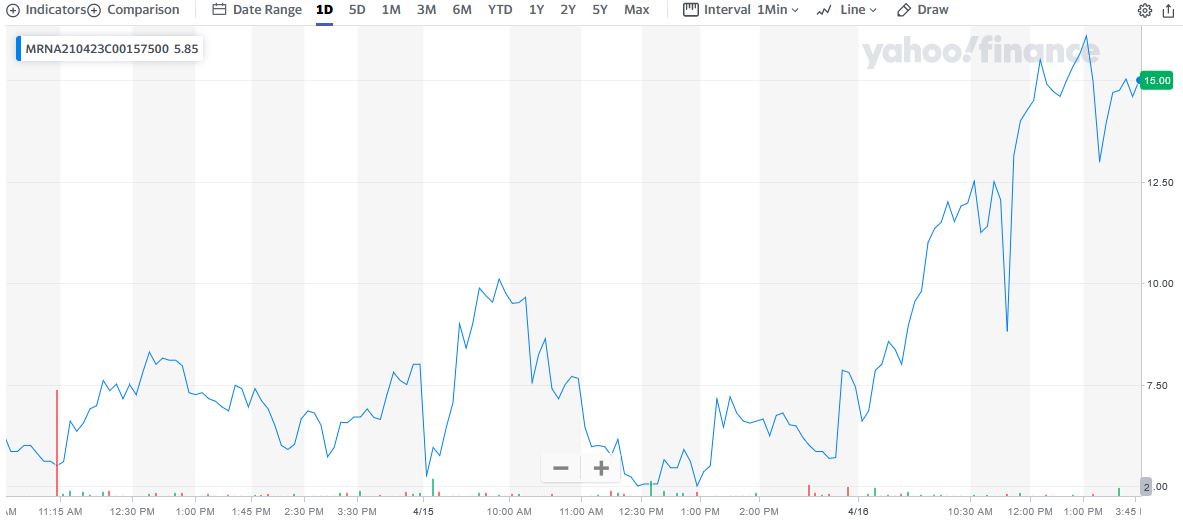

** OPTION TRADE: Buy MRNA APR 23 2021 157.500 CALLS at approximately $2.80.

(actually bought for $4.80)

So the Update on Moderna Stock Profit Explained…..

Weekly Options Members” entered a Moderna trade on Wednesday, April 14, 2021 for $4.35, shortly after the market opened.

By 12:39 the price of the option soared to $8.30 – a nice profit of 91%.

However, Thursday saw the Moderna option price hit $10.25 at 9:55, now providing 169% profit.

Then on Friday the Moderna stock price continued to surge, hitting $171.92 up nearly another 7%.

TOTAL PROFIT FOR 24 hours of TRADING IS 270%

Updated Prelude On Moderna Stock…..

As already mentioned, Moderna stock price continued to surge Friday as optimism for growth prospects by analysts and investors became more apparent.

Edward Tenthoff, an analyst from Piper Sandler, was optimistic in regard to Moderna stock price moving upwards, noting that data from a phase 3 study showed Moderna's authorized coronavirus vaccine, mRNA-1273, continued to demonstrate efficacy against COVID-19 of more than 90% after six months.

Tenthoff projects that Moderna stock will generate mRNA-1273 revenue of $10.85 billion in 2021 and $15.75 billion in 2022.

Tenthoff repeated his overweight rating on Moderna stock and boosted his price forecast from $208 to $234 on Thursday. His new price target represents potential returns to shareholders of roughly 37% from Moderna's current share price near $170.

Previous Prelude Concerning Moderna Stock.....

SVB Leerink analyst Danielle Antalffy believes that governments are looking at “vaccines utilizing mRNA,” such as vaccines from Moderna which will prime the body's immune system to fight off the COVID-19 disease, in preference to vaccines utilizing "adenovirus viral delivery platforms,” such as Johnson & Johnson and AstraZeneca.

Although the clotting risk seems rare in Johnson & Johnson's and AstraZeneca's, "this does not appear to have been the cases of this specific rare thrombotic syndrome in individuals who have received the mRNA COVID vaccines" at all.

In Antalffy's opinion, the broad upshot of this latest news is that use of any vaccine other than one produced by Moderna or Pfizer will now "plummet," while use of those two companies' vaccines will ramp to the limits that production levels permit.

And over the past week this theme has played out!

Why The Trade Recommendation On Moderna Stock?

Shares of Moderna Inc (NASDAQ: MRNA) leapt 7.4% on Tuesday after the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) recommended a temporary halt to Johnson & Johnson's (NYSE:JNJ) COVID-19 vaccine rollout.

And, this situation is not going to change anytime soon.

The company is of course best known for its COVID-19 vaccine and in the near-term that is what will continue to drive the stock price.

In addition to the vaccine currently being administered in the U.S. and several overseas markets, Moderna is developing a next-gen COVID-19 vaccine. It hopes the product can not only be a single shot vaccine but solve the storage conundrum by being able to be stored in regular refrigerators. It is also studying yet another COVID-19 vaccine that is better equipped to protect against the new coronavirus variants.

The Major Catalysts for This Trade.....

1. The Johnson &Johnson Situation.....

The CDC and FDA are asking states to pause immunizations with J&J's drug while they investigate six reported U.S. cases of blood clots in people who received the vaccine. The regulatory agencies noted that these incidents were "extremely rare," as more than 6.8 million doses of J&J's vaccine have been administered.

Additionally, J&J said that it decided to "proactively delay the rollout" of its vaccine in Europe. "We have been working closely with medical experts and health authorities, and we strongly support the open communication of this information to healthcare professionals and the public," the company said in a statement.

Moderna stock and fellow COVID-19 drugmaker Pfizer are expected to help make up for a potential shortfall in J&J's vaccine supply if the pause in its rollout is extended, though it will likely take some time for them to ramp up production.

Moderna said after the market close that it remains on track to deliver a total of 300 million doses to the U.S. government by end of July 2021.

2. Bullish Technical Picture for Moderna Stock.....

Moderna has a bullish technical picture that may appeal to the risk-taking investor.

Moderna's daily chart closed out last week with a bullish continuation wedge pattern. Also similar to the previous two patterns, a wedge pattern forms when two trend lines converge. It is considered one of the more potent formations. The wedge-shaped trend lines suggest that a reversal is underway.

In the case of Moderna, the upside associated with the pattern is substantial. The wedge forecasts that the broader uptrend will resume and that Moderna could climb as high as $210 by early June 2021. Given how volatile the stock has been in recent months, a 50% late spring run could certainly be in the cards.

3. UK Study.....

A UK study into using different COVID-19 vaccines in two-dose inoculations is being expanded to include shots made by Moderna and Novavax, researchers said on Wednesday.

The trial, known as the Com-Cov study, was first launched in February to look at whether giving a first dose of one type of COVID-19 shot, and a second dose of another, elicits an immune response that is as good as using two doses of the same vaccine.

The idea, said Matthew Snape, the Oxford University professor leading the trial, "is to explore whether the multiple COVID-19 vaccines that are available can be used more flexibly".

Britain and many other countries in Europe are currently using AstraZeneca's and Pfizer's COVID-19 vaccines in nationwide immunisation campaigns against the coronavirus pandemic.

But reports of very rare blood clots have prompted some governments - including France and Germany - to say the AstraZeneca shot should only be given to certain age groups, or that people who have had a first dose of AstraZeneca's vaccine should switch to a different one for their second dose.

"If we can show that these mixed schedules generate an immune response that is as good as the standard schedules, and without a significant increase in the vaccine reactions, this will potentially allow more people to complete their COVID-19 immunisation course more rapidly," Snape said.

"This would also create resilience within the system in the event of a shortfall in availability of any of the vaccines."

4. Strong Efficacy.....

Moderna Inc. said late Tuesday that its COVID-19 vaccine continued to show "strong efficacy," including greater than 90% efficacy against cases of COVID-19 and greater than 95% against severe cases of COVID-19 in a median six-month follow-up.

New preclinical data also showed variant-specific booster vaccine candidates working, the company said. "We are looking forward to having the clinical data from our variant-specific booster candidates" as well as clinical data from a study of the vaccine in teens, Chief Executive Stéphane Bancel said in a statement.

Moderna said it has delivered about 132 million doses of its vaccine globally.

5. South Africa.....

Moderna said late Tuesday its updated Covid vaccine generated antibodies against the mutation first discovered in South Africa. The news prodded Moderna stock in after-hours trading.

The company tested two updated vaccines. One specifically targets the variant first discovered in South Africa. The other combines Moderna's authorized vaccine with the updated shot.

Both increased the level of antibodies against viral mutations in mice. The combination approach led to the "broadest level of immunity." Using the variant-specific vaccine as a six-month booster shot also increased antibody levels.

6. Effectiveness of Vaccine.....

As of April 9, the original coronavirus vaccine has proven to be more than 90% effective against Covid and 95% effective against severe cases. This is based on more than 900 cases of Covid among study participants, including roughly 100 severe cases, Moderna said.

Further testing shows antibodies persist for at least six months following the second dose of the Covid vaccine, Moderna said.

As of April 12, the company has delivered 132 million doses of its Covid vaccine globally. It's on track to deliver the second 100 million doses to the U.S. government by the end of May. Following that, Moderna plans to send an additional 100 million doses by the end of July.

Moderna also affirmed its Covid vaccine hasn't been tied to blood clots nor thrombotic events among more than 64.5 million doses administered globally.

Summary.....

The positive headlines could very well keep rolling in for Moderna and help strengthen its leadership position during the pandemic. In the meantime, the technical and fundamentals both seem to agree that this will soon be a $200 stock.

Moderna stock is already on its way to billion-dollar revenue this year. The company in February said advance purchase agreements for its coronavirus vaccine translate into $18.4 billion in sales. And that number may have even increased since. There's no doubt Moderna's vaccine will generate blockbuster-level revenue this year.

Moderna's chief medical officer Tal Zaks said Moderna is on track to have a booster shot ready "by the end of this year." The booster is meant to better protect against new strains of concern. And Moderna could possibly update such a product as new variants arise.

Over the past 90 days, the Consensus Estimate for MRNA's full-year earnings has moved 117.30% higher. This shows that analyst sentiment has improved and the company's earnings outlook is stronger.

Based on the latest available data, MRNA has gained about 34.89% as of Monday this year. Meanwhile, the Medical sector has returned an average of -2.35% on a year-to-date basis. As we can see, Moderna stock is performing better than its sector in the calendar year.

Conclusion.....

Just a day before Moderna’s second annual Vaccines Day, the company has posted an update on its COVID-19 Vaccine Program, including a 6-month look at the COVID-19 shot and new preclinical data that suggest its booster candidates stand a chance against new variants.

COVID-19 Vaccine Additional Data: An updated review of 900-plus COVID-19 cases from the Phase 3 COVE study confirms the jab is more than 90% effective against all cases and over 95% effective against severe cases.

According to results published in the New England Journal of Medicine, an NIH-led Phase 1 study in 33 participants showed that antibodies persisted six months after the second dose.

Moderna believes efficacy starts in two weeks after the second dose.

Moderna stock has 14 different mRNA vaccine candidates in different stages of clinical development so far. HIV and flu vaccines will bring three new candidates to clinical-stage development. However, the company’s COVID-19 vaccine — mRNA-1273 — is its only commercialized vaccine, which was granted emergency use approval in the United States last year for adults, followed by several other countries. The company expects to generate $18.4 billion in 2021 from sales of these vaccines globally.

Final Say.....

With global COVID-19 cases rising rapidly around the world and safety concerns about rival vaccines mounting, demand for Moderna's coronavirus vaccine could soar. Moderna stock price, in turn, appears set to see even more gains in the months ahead.

Therefore…..

Will Moderna Stock Price Continue To Climb?

Will We Recommend Another Trade On Moderna Stock?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

While there are many more areas that can help to explain option trading, this is a basic overview of what stock options are, and where and how they started.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Moderna Stock Price Continues To Surge!