TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft Shares

Jump After Earnings Beat!

Weekly Options

Members Are Up 58% Potential Profit

Using A Weekly CALL Option!

Microsoft Corporation announced its quarterly earnings after the closing bell on Tuesday, beating analysts' expectations on revenue and earnings per share.

Loop Capital has initiated coverage of Microsoft with a Buy rating and $425 price target. The company's growth is set to accelerate driven by its two most strategic businesses, Azure and generative artificial intelligence products, the firm tells investors in a research note.

This set the scene for Weekly Options USA Members to profit by 58%, using a MSFT Options trade!

Join Us And Get The Trades – become a member today!

Thursday, October 26, 2023

by Ian Harvey

Microsoft Corporation (NASDAQ:MSFT) announced its quarterly earnings after the closing bell on Tuesday, beating analysts' expectations on revenue and earnings per share. The tech giant reported revenue of $56.5 billion in the quarter, above consensus estimates of $54.5 billion.

Adjusted earnings per share (EPS) topped out at $2.99 compared to an anticipated $2.66 per share. The company saw adjusted EPS of $2.35 during the same quarter last year.

Microsoft's Intelligent Cloud segment, which includes its Azure business, brought in $24.3 billion in the quarter. Wall Street was looking for revenue of $23.6 billion. Azure and other cloud services revenue jumped 29% in the quarter, beating Wall Street's expectations of 27%.

"With copilots, we are making the age of AI real for people and businesses everywhere," Microsoft CEO Satya Nadella said in a statement. "We are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers.”

The company's Productivity & Business Processes, meanwhile, saw revenue of $18.6 billion, while More Personal Computing took in revenue of $13.7 billion, versus analysts' expectations of $18.3 billion and $12.9 billion respectively.

Why the MSFT Weekly Options Trade was Originally Executed!

Microsoft Corporation stock is holding firm despite market volatility as investors look ahead to Microsoft earnings next week.

And now, Loop Capital has initiated coverage of Microsoft with a Buy rating and $425 price target. The company's growth is set to accelerate driven by its two most strategic businesses, Azure and generative artificial intelligence products, the firm tells investors in a research note.

Meanwhile, Amazon is reportedly set to deploy Microsoft 365, a set of cloud-focused office and productivity tools, among its workforce. The deal will reportedly see Amazon spend $1 billion over five years to Microsoft for workforce licenses. An insider said Amazon was previously wary of using cloud-based software from competitors.

The MSFT Weekly Options Trade Explained.....

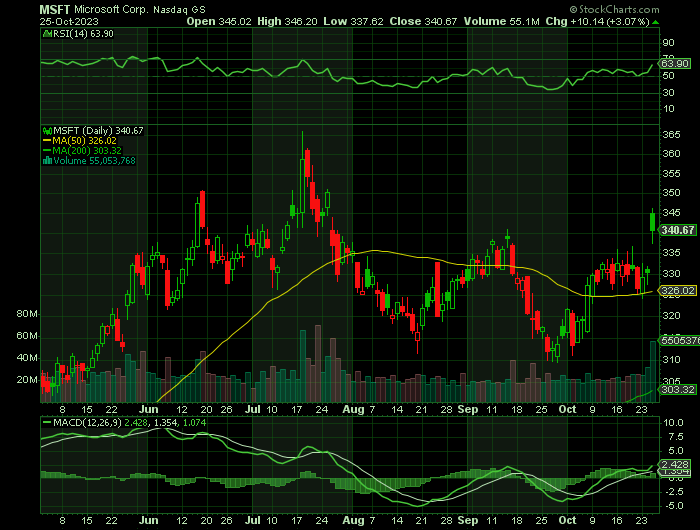

** OPTION TRADE: Buy MSFT OCT 27 2023 340.000 CALLS - price at last close was $4.40 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Thursday, October 19, 2023, for $5.05.

Sold the MSFT weekly options contracts on Wednesday, October 25, 2023 for $8.00; a potential profit of 58%.

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Microsoft's total revenue last quarter alone was more than $56 billion.

Microsoft is set to report first-quarter

fiscal 2024 results on Oct 24.

The Consensus Estimate for revenues is pegged at $54.42 billion, indicating

growth of 8.57% from the figure reported in the year-ago quarter.

The consensus mark for earnings has been unchanged at $2.65 per share over the

past 30 days, suggesting 12.77% year-over-year growth.

Microsoft reported revenues of $56.19 billion in the last reported quarter,

representing a year-over-year change of +8.3%. EPS of $2.69 for the same period

compares with $2.23 a year ago.

Compared to the Consensus Estimate of $55.36 billion, the reported revenues represent a surprise of +1.5%. The EPS surprise was +5.91%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates three times over this period.

Strength in Intelligent Cloud and Productivity and Business Processes has been driven by growth in Teams, Azure and other cloud services.

Teams, Microsoft’s workspace communication offering, is expanding customer base and features have been helping MSFT win shares in the enterprise communication market against Zoom. Teams’ user growth is expected to have been driven by the hybrid/flexible work model.

Microsoft expects revenue growth in the Productivity and Business processes segment between 9% and 11% to a range of $18-$18.3 billion.

MSFT

expanded the availability of Microsoft 365 Copilot to a wider range of

customers, which is expected to have boosted revenue growth.

Strong adoption of Dynamics 365 is expected to have driven top-line growth in

the to-be-reported quarter. Our model estimate for Dynamic 365 is pegged at

revenue growth of 29.5% at cc.

Microsoft and OpenAI's shared commitment to building generative artificial

intelligence (AI) systems and products that are trustworthy and safe.

In the to-be-reported quarter, Microsoft entered into a groundbreaking

agreement with KPMG, aiming to make AI a central component of professional

services. The company also extended its partnership with Teladoc to incorporate

AI in documenting patient visits.

Other Catalysts.....

It’s fall, and that means it’s gaming’s most important time of the year.

The games business lives and dies by fourth quarter sales, as consumers snatch up titles for their favorite people to unwrap.

And with video game revenue coming off of a down year in 2022 — revenue was off 5.2% compared to 2021 — the 2023 holiday season will be incredibly important for the games industry as it seeks to return to growth.

Microsoft’s “Starfield,” which launched Sept. 6, has earned its share of attention. The title, developed by Bethesda, which Microsoft acquired for $7.5 billion in 2021, takes the studio’s well-trodden open-world formula to space.

Analysts.....

In a new report from Bank of America suggests that Microsoft’s fortunes are looking up in the near term and will likely see not only good news for its latest earnings report but also for the rest of the year.

The word came from Bank of America analyst Brad Sills, who currently has a Buy rating on Microsoft, along with a $405 price target. The recent word suggests that Microsoft’s Azure is seeing “sustained, healthy” workloads, which in turn should provide a decent bump to Microsoft’s bottom line for the quarter. With AI subscriptions to Azure on the rise, along with rising use of Copilot and declining headwinds connected to PC use—the PC may well be making a comeback—that all spells at least reasonably good news for Microsoft in the short- and medium-term.

According to the issued ratings of 39 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 5 hold ratings and 34 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $377.85 with a high price target of $440.00 and a low price target of $232.00.

Summary.....

Microsoft has a market capitalization of $2.47 trillion, a P/E ratio of 34.33, a PEG ratio of 2.43 and a beta of 0.91. The company has a quick ratio of 1.75, a current ratio of 1.77 and a debt-to-equity ratio of 0.20. The company has a 50-day simple moving average of $324.95 and a 200 day simple moving average of $322.21. Microsoft has a fifty-two week low of $213.43 and a fifty-two week high of $366.78.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.