TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UPDATED - Microsoft Shares Continue On An Upward Trajectory!

Weekly Options Members

Are Up 150% Potential Profit

Using A Weekly CALL Option!

Some companies are far more able to adapt to changes in the marketplace than others. And, Microsoft Corporation (NASDAQ:MSFT) has been readily able to create new solutions or repurpose old ones.

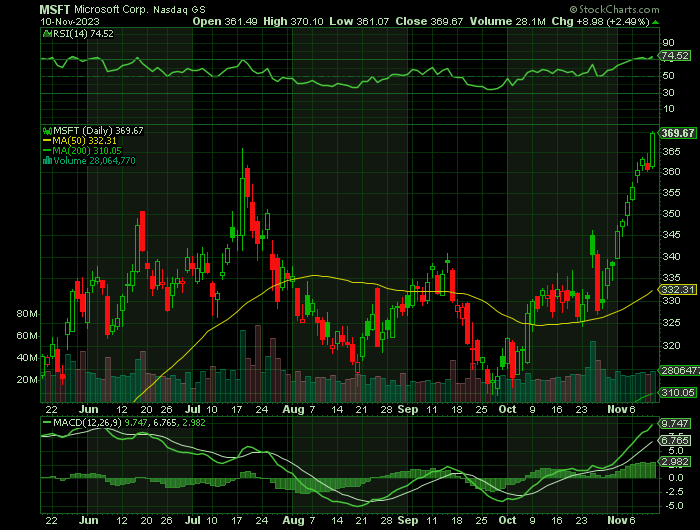

Microsoft shares, on Friday, set a new all-time high as the company prepares to announce its latest advancements in artificial intelligence at a conference next week.

The company once again delivered strong quarterly earnings as other businesses struggled.

This set the scene for Weekly Options USA Members to profit by 150%, using a MSFT Options trade!

Join Us And Get The Trades – become a member today!

Saturday, November 11, 2023

by Ian Harvey

Microsoft shares on Friday set a new all-time high as the company prepares to announce its latest advancements in artificial intelligence at a conference next week.

In intraday trading on the stock market Friday, Microsoft stock reached a record high of $370.09.

On a conference call with analysts, Microsoft Chief Executive Satya Nadella touted the company's AI initiatives, including its Copilot products.

Microsoft will discuss its latest AI initiatives on Wednesday in a keynote presentation at its Ignite conference in Seattle. That could be the next catalyst for MSFT stock.

Why the Microsoft Weekly Options Trade was Originally Executed!

Some companies are far more able to adapt to changes in the marketplace than others.

And, Microsoft Corporation (NASDAQ:MSFT) has been readily able to create new solutions or repurpose old ones. For instance, the software that powers its Xbox game consoles is a retooled part of its Windows operating system called DirectX. Office productivity programs like Word and Excel started out as standalone software titles installed on individual personal computers. Now these tools are browser-based, accessible by subscribers anywhere. Indeed, cloud computing wasn't even a profit center for Microsoft until 2008, when the company unveiled its now-lauded Azure platform.

The company once again delivered strong quarterly earnings as other businesses struggled.

Microsoft produces a ton of reliable cash from its legacy product portfolio, and it also has strong growth catalysts from its gaming, cloud computing, and artificial intelligence businesses. The tech giant isn't going anywhere, but it also has some upside potential, which is rare.

Microsoft reported 28% higher sales in its Azure cloud services segment for the selling period that ran through late September, and some of that growth came directly from the flood of new AI integrations that Microsoft is adding throughout its platform.

The segment was more profitable, too, with gross profit margin rising by 3 percentage points in the fiscal first quarter. "Higher-than-expected AI consumption contributed to revenue growth in Azure," chief financial officer Amy Hood said in a conference call with investors.

There was good news on the financial front as well. Microsoft generated $27 billion of operating profit, up 24% year over year and translating into a blazing profit margin of 48% of sales. The company produces plenty of cash, too, and is sitting on $144 billion in cash on the books right now.

The MSFT Weekly Options Trade Explained.....

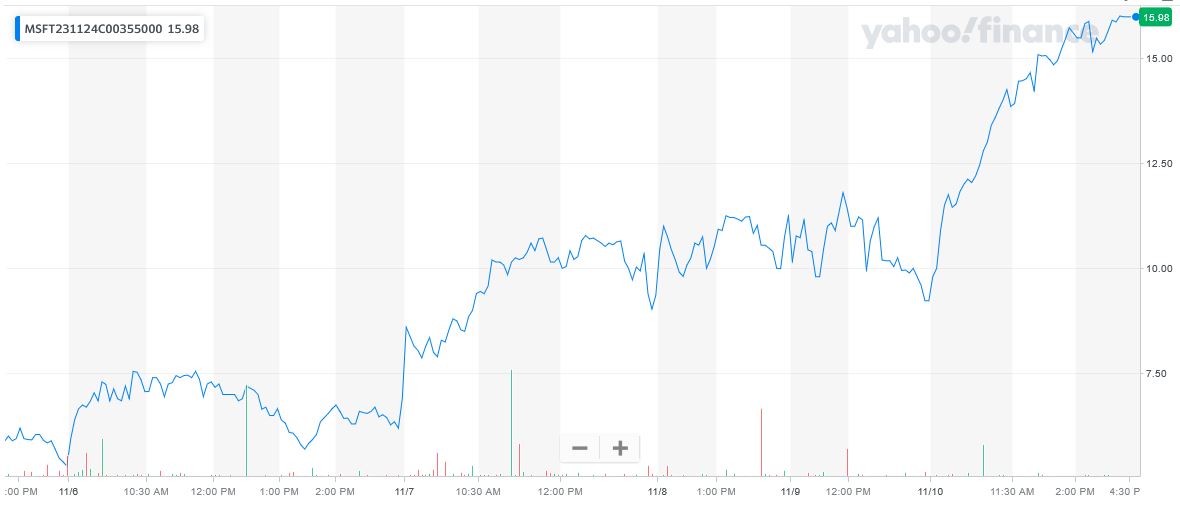

** OPTION TRADE: Buy MSFT NOV 24 2023 355.000 CALLS - price at last close was $5.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Monday, November 06, 2023, at 9:31, for $6.40.

Sold half the MSFT weekly options contracts on Tuesday, November 07, 2023 for $10.78; a potential profit of68%.

Sold the remaining MSFT weekly options contracts on Friday, November 10, 2023 for $16.00; a potential profit of 150%.

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Analysts expect Microsoft to maintain this growth pace well into the foreseeable future. They're calling for a top line of nearly $385 billion in 2028, up from this year's estimate of just under $228 billion. Earnings should grow just as well, if not better.

The key to this consistent progress is the way Microsoft is increasingly billing for its software and technology solutions. A great deal of it is bought on a subscription basis, with customers paying affordable monthly or annual fees for access to these tools that they often end up not being able to live without. Although the software giant doesn't divulge every detail about its recurring revenue, we do know that as of the end of last quarter, Microsoft was sitting on $212 billion worth of these contractual sales that's yet to be converted into actual revenue. Only a little less than half of that is expected to be booked within the next 12 months. The rest of it will be booked a year or more down the road. The company's going to add more of this recurring revenue between now and then, of course.

Other Catalysts.....

The company recently began rolling out its Copilot personal assistant for enterprises, and it's already seeing very encouraging results. Over 37,000 organizations signed up for the early access business version of Copilot, and 40% of Fortune 100 companies are already on board with the service.

Beyond these forefront AI initiatives, Microsoft also has leading positions in operating system software, video games, and other categories. Almost every conceivable area of its business stands to benefit from AI integration.

The company's wide breadth of offerings gives it multiple ways to win with AI. Nearly all of the company's products and services will also be sources of data that can be fed into algorithms and used to drive advancements capable of creating benefits across its ecosystem. Microsoft's early AI lead should become even more entrenched with time.

Analysts.....

According to the issued ratings of 38 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 4 hold ratings and 34 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $384.34 with a high price target of $450.00 and a low price target of $232.00.

Summary.....

Microsoft's Azure fits within its existing businesses, like its business productivity products, the best. Microsoft has also been trusted with business data for years, which increases client confidence.

Microsoft could be the strongest overall player in AI right now. Not only does the company already have leadership positions in many key AI categories, but its competitive advantages are set up to keep getting stronger from here on out.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.