TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft

Continues To Rally Providing 137% Profit!

Members Use A Weekly Call Option!

Join Us and Get the Trades!

Microsoft Corporation (NASDAQ:MSFT) reported its fiscal third quarter earnings Thursday, April 25, beating analysts' estimates on the top and bottom lines on the strength of its cloud computing business.

Shares in Microsoft have popped 35% since May 2023, rallying investors with consistent growth across its business and an expanding position in artificial intelligence (AI).

This set the scene for Weekly Options USA Members to profit by 137% using a MSFT Monthly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, May 23, 2024

by Ian Harvey

UPDATE

Shares in Microsoft Corporation (NASDAQ:MSFT) have popped 35% since May 2023, rallying investors with consistent growth across its business and an expanding position in artificial intelligence (AI).

Microsoft has come a long way since its founding nearly 50 years ago. The company is a king in software, attracting billions of users to products like Windows, its Office productivity suite, various Xbox offerings, LinkedIn, and its cloud platform Azure. The success of these products has catapulted Microsoft to being the world's most-valuable company, with a market cap above $3 trillion.

However, recent developments indicate the company is still nowhere near hitting its ceiling. Microsoft has gotten a head start in AI that could see it surpass its rivals. Meanwhile, the tech giant is benefiting from the tailwinds of multiple other markets.

Why the Microsoft Weekly Options Trade was Originally Executed!

Microsoft Corporation (NASDAQ:MSFT) reported its fiscal third quarter earnings Thursday, beating analysts' estimates on the top and bottom lines on the strength of its cloud computing business.

“Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry," Microsoft CEO Satya Nadella said in a statement.

Microsoft has been among the bigger winners in the AI race thanks to its close relationship with ChatGPT maker OpenAI. The company has woven the startup’s technology into an array of products called Copilot, which are AI assistants that plug into key offerings like its workplace software suite, Microsoft 365.

Artificial intelligence is also boosting demand for its cloud services. Microsoft’s Azure cloud services rose 31% during the quarter.

Microsoft is hoping that Copilot will become a major contributor of new revenue to its software business. Some analysts believe it could end up adding billions to the company’s top line.

“They have been a leader in AI,” said Gil Luria, a software analyst at D.A. Davidson. “They’re really the only ones that can put their finger on actual AI revenue.”

Microsoft reported earnings per share (EPS) of $2.94 on revenue of $61.9 billion. Wall Street was anticipating EPS of $2.83 on revenue of $60.88 billion.

Microsoft's overall commercial cloud revenue came in at $35.1 billion, ahead of Wall Street estimates of $33.93 billion. On a segment bases, Microsoft saw Productivity and Business Processes revenue of $19.57 billion, beating expectations of $19.54 billion. Intelligent Cloud and More Personal Computing revenue came in at $26.71 billion and $15.58 billion, respectively. That was better than the $26.25 billion and $15.07 billion analysts expected, respectively.

Shares of Microsoft are up more than 10% year to date. Over the last 12 months, Microsoft’s shares have climbed 32%.

The Walmart Monthly Options Potential Profit Explained.....

** OPTION TRADE: Buy MSFT MAY 24 2024 430.000 CALLS - price at last close was $5.15 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Monthly Options (CALL) Trade on Friday, April 26, 2024 for $2.49.

Sold the MSFT Monthly options contracts on Tuesday, May 21, 2024 for $5.90; a potential profit of175%.

(This result will vary for members depending on their entry and exit strategies).

Holding remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Microsoft said its AI services contributed 7 percentage points of growth to its Azure and other cloud services revenue. That's up from 6 percentage points in Q2, and 3 points in Q1. Microsoft first broke out its AI percentage contributions to Azure in Q4 last year, saying it added 1 percentage point to Azure revenue at the time.

The company also said it anticipates Q4 revenue of between $63.5 billion and $64.5 billion, just a head of analysts' expectations of $64.7 billion.

Microsoft CFO Amy Hood said during the company's earnings call that the tech giant is seeing near term AI demand outstrip available capacity.

The revenue beat in More Personal Computing was driven by 11% growth in Windows OEM sales to PC manufacturers and 62% growth in Xbox content and services sales with 61% attributable to the net impact of Microsoft's acquisition of Activision Blizzard.

Other Catalysts.....

Microsoft’s AI ambitions got a healthy boost on Tuesday when it announced that Coca-Cola (KO) signed a five-year, $1.1 billion agreement to use the software giant’s Azure cloud services and AI technology.

“Through our long-term partnership, we have made significant progress to accelerate system-wide AI transformation across The Coca-Cola Company and its network of independent bottlers worldwide,” Microsoft executive vice president and chief commercial officer Judson Althoff said in a statement.

Microsoft has unleashed a torrent of new AI features and services for its enterprise and productivity apps and consumer platforms ever since it first debuted its revamped version of Bing and its AI chatbot in February 2023.

In March, Microsoft announced that it hired DeepMind AI and Inflection AI co-founder Mustafa Suleyman, fellow Inflection AI co-founder Karén Simonyan, as well as a number of the company’s staff members. Suleyman is taking up a new post at Microsoft as CEO of the Microsoft AI division.

In February, Microsoft announced a multiyear partnership with French AI startup Mistral that would allow Microsoft to offer the company’s models on its Azure platform.

Analysts.....

According to the issued ratings of 38 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 3 hold ratings and 35 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $434.05 with a high price target of $600.00 and a low price target of $232.00.

Summary.....

Microsoft’s AI success has helped push its market value above $3 trillion this year. It has surpassed Apple’s, making it the world’s biggest company by that measure.

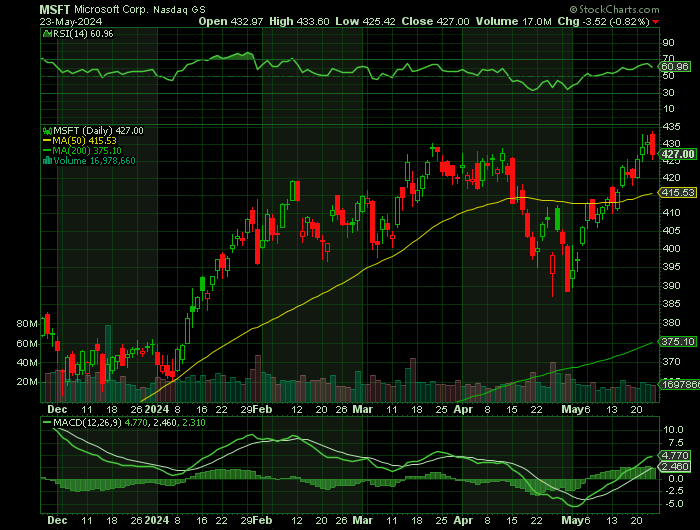

Microsoft stock opened at $399.04 on Friday. Microsoft Co. has a 52-week low of $292.73 and a 52-week high of $430.82. The company has a fifty day moving average price of $414.44 and a 200-day moving average price of $387.17. The company has a market capitalization of $2.97 trillion, a P/E ratio of 36.08, and a PEG ratio of 2.20 and a beta of 0.89. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.20 and a current ratio of 1.22.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.