TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Micron Technology Stock Screams Higher After Earnings!

And, “Weekly Options” Members

Profit Up 187%

Using A Weekly Call Option!

Is Further upside Expected?

Wednesday, December 22, 2021

by Ian HarveyMicron Technology reported first-quarter fiscal 2022 results on Monday, December 20, after the market closed. Micron reported Q1 revenue of $7.69 billion, up 33.2% year-on-year, above the consensus of $7.67 billion. Adjusted EPS of $2.16 beat the consensus of $2.11.

And, “Weekly Options” Members potential profit is up 187% using a Weekly Call Option!

Micron Technology, Inc. (NASDAQ: MU)

Prelude…..

On Friday, December 17, 2021, a Micron Technology Weekly Call Options trade was recommended to our members based on several catalysts.

MU reported first-quarter fiscal 2022 results on Monday, December 20, after the market closed.

Micron's fiscal 2022 first-quarter guidance shows that it won't be running out of steam. The company anticipates $2.10 per share in adjusted earnings on revenue of $7.65 billion this quarter, while the non-GAAP gross margin is expected to land at 47%. These numbers point toward a huge improvement over the prior-year period.

An article “Micron Technology Earnings” was available to all readers on December 19, 2021…..CLICK HERE to read the details.

The Actual Recommended Micron Technology Weekly Options Trade.....

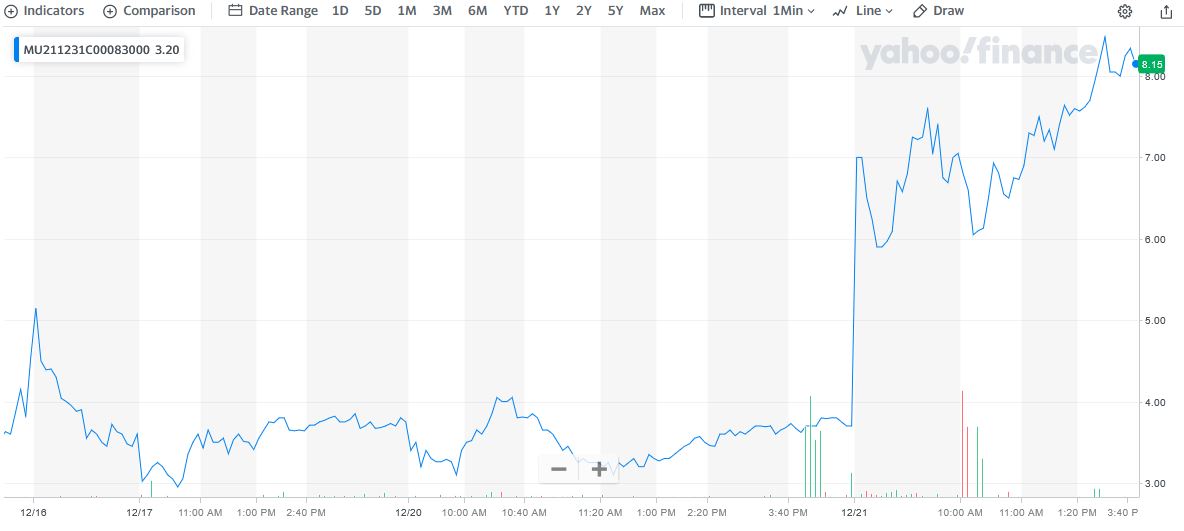

** OPTION TRADE: Buy MU DEC 31 2021 83.000 CALLS at approximately $3.50.

(Actually bought for $2.95)

Micron Technology Weekly Call Options Trade Success Explained.....

Friday, December 17, 2021

- Bought at 10:24 for $2.95

Tuesday, December 21, 2021

- Sold at 2:19 for $8.48

Total Potential Profit is 187%

It is very likely that Micron Technology stock will continue to climb if the market continues in a positive way.

Join us and see what other trades we are proposing!

Micron Technology Earnings Report…..

Micron Technology Inc. shares shot to their best gain in more than a year Tuesday, after the memory-chip specialist provided a forecast for 2022 that offered more optimism than analysts expected. The stock was up nearly 10% on Tuesday and was heading back toward the all-time highs hit earlier this year.

Micron reported Q1 revenue of $7.69 billion, up 33.2% year-on-year, above the consensus of $7.67 billion. Adjusted EPS of $2.16 beat the consensus of $2.11.

On a year-over-year basis, Micron earnings jumped 161% while sales rose 33%.

Micron sees Q2 revenue of $7.3 billion - $7.7 billion above the consensus of $7.28 billion. It considers an adjusted EPS of $1.85 - $2.05 above the consensus of $1.86.

Perhaps the most important phrase of the earnings release and management commentary was from CEO Sanjay Mehrotra:

With the successful ramp of 1α DRAM and 176-layer NAND products across major end markets, we are several quarters ahead of the industry in market deployment of these leading-edge process technologies. The combination of 1α and 1z DRAM nodes represents the majority of our DRAM bit production.

When Mehrotra took over as Micron's CEO in May 2017, the company's memory technologies lagged behind its two main competitors, Samsung and SK Hynix.

However, it appears that Mehrotra's operational discipline has enabled Micron to leapfrog its two main competitors in DRAM, and it's now also a leader in the larger NAND flash sector as well, which has about six major competitors.

Analysts Are Delighted.....

Any fears that Micron will pull back on capital spending were put to rest with Monday’s report, analysts said.

“We believe management’s comments help alleviate bear concerns that the memory market is heading toward another downturn, which in turn, could stall capital spending plans,” Stifel analysts wrote, while maintaining a “strong buy” rating. “The company believes 2022 likely will see a ‘healthy supply-demand dynamic’ in both DRAM and NAND, which is consistent with our outlook (and if anything, we believe there could be a return to a supply imbalance versus a strong demand outlook).”

Wedbush analyst Matt Bryson named his note “Memory winter turns into spring,” and noted that Micron executives’ forecast was a surprise given “typical conservatism” from the company’s management team.

“Micron surprised us and the Street by providing robust guidance that suggests both Micron and the memory market are nearing a very shallow cyclical trough rather than the harsh wintery downturn some had projected,” Bryson wrote, while increasing his price target to $100 from $85. “While we believe forward expectations for memory fundamentals have indeed improved through the course of the quarter discounting the likelihood of a longer cyclical decline, management surprised us by providing guidance that anticipates stabilizing conditions in light of their bias towards conservatism.”

At Raymond James, analyst Chris Caso said in his note to clients: "As compared to three months ago, Micron has seen some stabilization in the PC market."

"We believe Micron remains well-poised to benefit from sustained demand drivers (PC, data center, 5G smartphone) heading into calendar 2022 as data-centric and data-intensive applications continue to proliferate across most platforms," JPMorgan analyst Harlan Sur said in a recent report.

He added: "From a long-term perspective, MU stock is executing well on cost-downs and management expects DRAM and NAND cost-per-bit (manufacturing) declines to be in line with the industry in fiscal 2022."

Deutsche Bank analyst Sidney Ho in a report said the outlook for Micron's core DRAM memory chip market "appears to be better-than-feared."

"We continue to believe that the current DRAM trough will be less severe and shorter than previously expected," Ho added.

"Over the last 10 years, semiconductor stocks have enjoyed significant multiple expansion — with multiples increasing from 13 times to 15 times free cash flow to 20 times to 25 times," said Credit Suisse analyst John Pitzer in a report.

Pitzer went on to say, "During that same period, MU's multiple, while cyclically volatile, has remained mostly unchanged. More consistent returns and recognition of memory's growing importance to the Data Economy will drive meaningful FCF growth and multiple expansion."

At least 17 of the 36 analysts who track Micron increased their price targets in response to the earnings, while cheering a bullish forecast from executives.....

- Summit Insights analyst Kinngai Chan upgraded to Buy from Hold. Chan contends that the downside risk of Micron's customers buying ahead of demand is now priced into the stock.

- Baird analyst Tristan Gerra raised the PT to $90 from $70 (9.7% upside) and kept a Neutral.

- Goldman Sachs analyst Toshiya Hari raised the PT to $101 from $88 (23.1% upside) and kept a Buy.

- Raymond James analyst Chris Caso raised the PT from $100 to $115 (40.2% upside) and kept a Strong Buy.

- Credit Suisse analyst John Pitzer maintained an Outperform and increased the PT from $110 to $130 (58.5% upside).

- Mizuho analyst Vijay Rakesh reiterated a Buy and raised the PT from $95 to $98 (19.5% upside).

- B of A Securities analyst Vivek Arya upgraded from Neutral to Buy and increased the PT from $76 to $100 (21.9% upside).

- Piper Sandler raised the PT from $70 to $90,

- Deutsche Bank increased from $90 to $100,

- BMO Capital lifted from $105 to $115, and

- Wedbush from $85 to $100.

Conclusion.....

Micron in September issued guidance for its fiscal first quarter, which ended Dec. 2, that was well short of estimates. Management pointed to weakness in the personal computer market.

But its earnings report eased worries.

"Micron's in-line fiscal Q1 but strong February quarter outlook addresses our key prior concern — a prolonged inventory digestion (and related price pressure) in the PC market," Bank of America analyst Vivek Arya said in a note to clients. "Fiscal Q2 will likely be the bottom of this (mini) cycle."

Micron shares have increased 20.6% so far this year, roughly in line with a 21.6% gain for the S&P 500 index SPX.

Therefore…..

The Micron Technology Trade Has Been A Big Winner!

Should We Hold The Micron Technology Trade For Further Profit?

What Further Micron Technology Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Micron Technology