TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

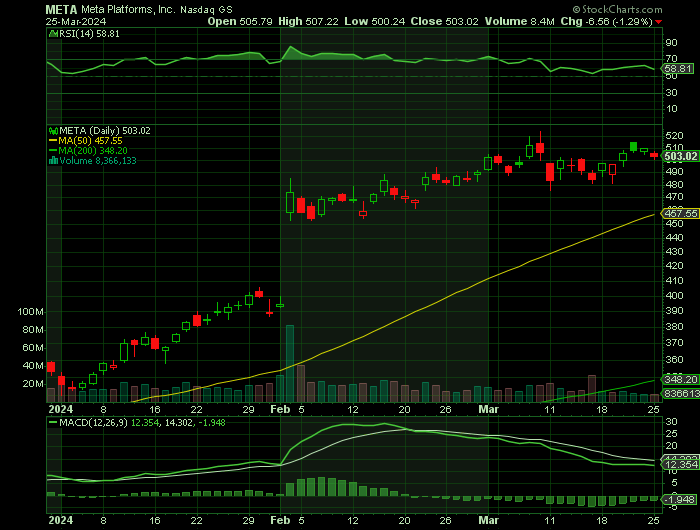

Meta Platforms Weekly Call Option Up 44% In

3 Hours!

Pull-back Allows For Another Trade!

Become a Member and Get the Trade.

Many tech stocks surged over the past year thanks to factors such as the artificial intelligence (AI) boom. One stock that more than doubled in that time is Meta Platforms Inc (NASDAQ: META).

Meta is the parent behind the world's top social media assets. Collectively, Facebook, WhatsApp, Instagram, and Facebook Messenger are four of the most downloaded apps globally and were responsible for luring nearly 4 billion monthly active users during the December-ended quarter.

This set the scene for Weekly Options USA Members to profit by 44% using a META Weekly Options trade!

Become a Member Today and get the trade!

Monday, March 25, 2024

by Ian Harvey

Many tech stocks surged over the past year thanks to factors such as the artificial intelligence (AI) boom. One stock that more than doubled in that time is Meta Platforms Inc (NASDAQ: META).

Meta is the parent behind the world's top social media assets. Collectively, Facebook, WhatsApp, Instagram, and Facebook Messenger are four of the most downloaded apps globally and were responsible for luring nearly 4 billion monthly active users during the December-ended quarter.

The Facebook parent was at a 52-week low of $197.90 last March, but made an incredible reversal, and this March, it reached a high of $523.57.

Up 41% year to date, Meta Platforms is nevertheless an under-the-radar AI stock. This dichotomy is related to Meta's biggest strength -- it paradoxically combines the traits of a cash cow and a tech start-up.

The company generated nearly $135 billion in revenue last year, nearly all of it coming from advertising across its Facebook, Instagram, and WhatsApp platforms. Thanks to Meta's asset-light business model, 35% of that revenue, or $47 billion, was converted into operating profit. That's a fantastic rate, and it helps explain why the company introduced a regular dividend payment for shareholders.

Yet, Meta is more than just a profitable tech giant. The company is investing billions of dollars in AI research. In fact, Meta is one of the largest buyers of Nvidia's flagship AI chip, the H100. None other than founder Mark Zuckerberg announced that Meta would be running upwards of 350,000 H100s this year to train its AI models.

Meta has several ambitious goals, such as perfecting its version of the metaverse and developing Artificial General Intelligence.

BECOME A MEMBER AND GET THE TRADE!

About Meta Platforms.....

Meta Platforms, Inc. is a US-based multinational technology company and 1 of the Big 5 US tech companies. It is a member of the FAANG group holding the first position with its original name, Facebook.

Meta Platforms, Inc life began in 2004 as a digital “face book” for Harvard students. The company was founded by Mark Zuckerburg and a group of friends but now only Zuckerburg remains. The company quickly grew and expanded into other universities and then opened itself to the public in 2006. As of 2006, anyone over the age of 13 can be a Facebook user which is the company’s primary source of income. As of 2022, the company claimed more than 2.9 billion monthly active Facebook users.

Facebook, Inc filed for its IPO on January 1st 2012. The prospectus stated the company was seeking to raise $5 billion but it got so much more. The day before the IPO execs announced it would sell 25% more stock than it had previously stated because of the high demand. The company wound up raising more than $16 billion making it the 3rd largest IPO in history at the time.

The massive IPO valuation earned Facebook a spot in the S&P 500 in the first year of its public life. Although its valuation has deteriorated in the wake of scandal and consumer trends within social media, early investors were treated to gains in excess of 1000% at the peak of the stock run. Mark Zuckerburg retained 22% ownership in the company following the IPO, and 57% of the voting rights. As of 2022, those holdings were down to about 14% of the company and 54% of the voting rights.

Over the years, Facebook acquired a large number of apps and other businesses that include but are not limited to Instagram and WhatsApp. The company changed its name to Meta Platforms DBA Meta in 2021 to reflect its business and mission better. The new name describes the metaverse and refers to the seamless social interaction provided by Meta’s social media application universe.

Today, Meta develops digital applications that allow people to connect with family, friends, businesses, and merchants through Internet connections. Applications are available for mobile, PC, VR, and smart homes.

The company’s primary operating segment is the Family of Apps. The family of Apps includes Facebook and all the other digital applications. This segment produces virtually all of the revenue which is in turn 97% advertising oriented. The other operating segment is Reality Labs. Reality Labs develops and markets a line of virtual and augmented-reality products.

BECOME A MEMBER AND GET THE TRADE!

Further Catalysts for the META Weekly Options Trade…..

Meta has staged a comeback. The advertising market recovered in 2023, allowing Meta to achieve full-year revenue of $134.9 billion, a 16% year-over-year gain.

A year ago, investors were worried about Meta Platforms' slowing growth and its ballooning expenses, yet those concerns have completely fallen away over the last few quarters. The social media giant is not only boosting its user base but improving the economics around its ads.

Large advertisers are sticking with the Facebook and Instagram platforms even as they pull back on spending elsewhere. Ad impressions rose 21% in the fourth quarter, contributing to a 25% increase in revenue. Combine that success with dramatic cost-cutting moves (its employee headcount was down 22% last quarter), and you've got the ingredients you need for soaring earnings.

This helped to bring 2023 costs and expenses to $88.2 billion. Although this figure was a modest increase from $87.7 billion in 2022, it was a vast improvement over the 23% jump between 2021's $71.2 billion in expenses and 2022.

These cost cuts helped Meta generate strong free cash flow (FCF) of $43 billion last year, a substantial increase from $18.4 billion in 2022. FCF provides insight into the cash available to invest in the business, pay debt obligations, repurchase shares, and fund dividends.

Consequently, Meta declared its first dividend in company history on Feb. 1. This news, its cost cuts, and strong revenue rebound all contributed to the share price shooting skyward.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from META PLATFORMS

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.