TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Lucid Group Continues To Tank!

And, “Weekly Options” Members

Profit Up 149%

In 1 Day Using A Put Option!

Further Downside Expected!

Friday, December 10, 2021

by Ian HarveyLucid Group closed down more than 18% yesterday due to continued investigation by the SEC, as well as announcing that it is offering $1.75 billion in senior convertible notes to raise money to take on further debt.

But, “Weekly Options” Members potential profit is up 149% in 1 day using a Put Option!

Lucid Group Inc (NASDAQ: LCID)

On Thursday, December 09, 2021, a Lucid Group Weekly Options Put trade was recommended to our members based on several catalysts.

READ Details of the Original Lucid Group Weekly Options Recommendation Further Below.....

Lucid Group closed the market Thursday down 18.34% (-$8.20) to settle at $36.52.

It appears that this trend has set in as the after-hours market continued to pressure the stock price downwards.

This downward movement is due to two major factors.....

- The SEC Probe – which is discussed further below in the major catalysts, and

- The Proposed Convertible Senior Notes Offering – Yesterday Lucid Group announced its intention to offer, subject to market and other conditions, $1,750,000,000 aggregate principal amount of convertible senior notes due 2026 (the "notes") in a private offering.

A senior convertible note is a debt instrument that companies use to raise money from investors. Markets are reacting unfavorably to Lucid issuing nearly $2 billion of senior convertible notes because the company is taking on debt to fund its operations, which is viewed as a negative.

Additionally, senior convertible notes are eventually converted into a predefined amount of the issuer’s shares that are given to investors in exchange for financing. This conversion results in a company issuing more of its own shares, which leads to stock dilution. This is also viewed negatively by investors.

Lucid Group said that it plans to use the money to finance or refinance its ongoing operations, including the manufacturing of its Lucid Air electric sedan and various energy storage systems. Lucid also said it will use the proceeds of the offering to expand and grow its overall business and for “general corporate purposes.”

The added debt and resulting stock dilution didn’t sit well with existing shareholders who see it as having a negative impact on their investment. Lucid Group likely needs to raise the funds to ensure that it meets its stated goal of producing 20,000 vehicles in 2022 and 50,000 in 2023. Its first vehicle, the Lucid Air, entered production in October of this year.

News of the debt financing comes when Lucid Group stock was already under pressure.

The Actual Recommended Lucid Group Weekly Options Trade.....

** OPTION TRADE: Buy LCID DEC 23 2021 40.000 PUTS - at close yesterday the price was $1.60 – but after hours the stock had dropped about 6% - you need to adjust accordingly.

Lucid Group Weekly Options Trade Put Success Explained.....

Thursday, December 09, 2021

- Bought at 9:30 for $2.35

- Sold at 3:55 for $5.85

Total Potential Profit is 149%

It is very likely that a new Lucid Group stock Weekly Options Put trade, if recommended, will be also successful.

Join us and see what we are proposing!

The Original Major Catalysts for the Lucid Group Weekly Options Trade…..

Prelude.....

Even though Lucid Group Inc (NASDAQ: LCID) has incredibly impressive technology, high manufacturing capacity, and strong demand for its cars, it is suffering due to a subpoena last Friday from the SEC “requesting the production of certain documents related to an investigation,” according to a filing issued Monday morning.

Lucid Group has gained a lot of attention since it went public by merging with a special purpose acquisition company (SPAC) earlier this year. The electric vehicle (EV) maker only started shipping its first batch of vehicles in late October, but it's already valued at more than $74 billion.

That's 34 times the $2.2 billion in sales Lucid hopes to generate in 2022 by shipping 20,000 vehicles, and makes it nearly as valuable as Ford (NYSE: F) -- which shipped 4.2 million vehicles last year but trades at less than one times this year's sales.

Shares of Lucid Group were down by as much as 19.5% during trading Monday morning following the electric vehicle start-up disclosing a probe by the U.S. Securities and Exchange Commission likely into the company’s SPAC deal to go public.

Lucid said although there is “no assurance as to the scope or outcome of this matter, the investigation appears to concern the business combination” between the automaker and blank-check company Churchill Capital Corp. IV.

“The Company is cooperating fully with the SEC in its review,” Lucid said in the filing.

Lucid’s stock recovered Monday afternoon to close at $44.73 a share, down by 5.1%. The company’s market cap is nearly $73 billion.

Tuesday close was at $43.82, and yesterday the stock was up slightly to close at $44.72.

However, after the market closed the stock dropped to $42.00 – down 6.08%.

It appears that there is still further downside expected!

About Lucid Group…..

Lucid Group, Inc. a technology and automotive company, develops electric vehicle (EV) technologies.

The company designs, engineers, and builds electric vehicles, EV powertrains, and battery systems.

As

of June 30, 2021, it operated eight retail studios in the United States. The

company is headquartered in Newark, California.

The Major Catalysts for the Lucid Group Weekly Options Trade…..

SEC Probe.....

Lucid is the

latest EV start-up to go public via a SPAC deal that’s been investigated by the

SEC. Others have included Nikola Corp., Canoo and Lordstown Motors.

Most SPAC

deals involving EV start-ups were initially celebrated by investors, sending

shares through the roof and making some founders millionaires, if not

billionaires, overnight. But the tides have turned against many of the

companies after crackdowns this year by the SEC, including investigations,

warnings to investors and potential changes to accounting guidelines.

As of now,

we don't know the details of what the SEC is looking at. What we do know is

that the July 23 merger with Churchill Capital Corp IV gave Lucid the critical

$4.4 billion in cash needed to fund its 2022 operations. So making sure that

the merger was legit is vital to Lucid's long-term future. However, the part

that really sticks out to me is the comment on "certain projections and statements."

A big issue with all SPACs, not just ones in the EV space, has been borderline exaggerated projections into how a company expects to perform into the future. When talking about companies like Lucid that have next to no sales and are far away from profitability, these projections are closer to speculation. As mentioned in the past, the forecasts that Lucid laid out in its February, May, and July presentations should be taken with a grain of salt. The picture that these projections paint is an idealistic scenario that is probably not going to happen as hoped and is potentially unhelpful to investors. In many ways, the idea that the SEC could be cracking down on these forecasts is something that investors should welcome.

Potential Claims.....Many investors are being encouraged by law firms to seek compensation for losses due to investigation concerns as to whether Lucid has violated the federal securities laws and/or engaged in other unlawful business practices.

On December 6, 2021, Lucid disclosed in a filing with the U.S. Securities and Exchange Commission ("SEC") that "[o]n December 3, 2021, [Lucid] received a subpoena from the [SEC] requesting the production of certain documents related to an investigation by the SEC. Although there is no assurance as to the scope or outcome of this matter, the investigation appears to concern the business combination between the Company (f/k/a Churchill Capital Corp. IV) and Atieva, Inc. and certain projections and statements."

Analyst Thoughts....

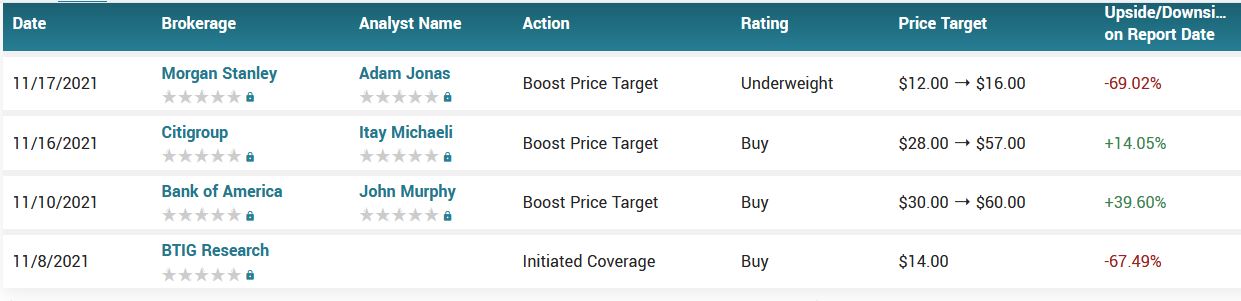

According to the issued ratings of 4 analysts in the last year, the consensus rating for Lucid Group stock is Buy based on the current 1 sell rating and 3 buy ratings for LCID. The average twelve-month price target for Lucid Group is 36.75 with a high price target of 60.00 and a low price target of 14.00.

Summary.....

Lucid is a very risky investment, and investors shouldn't be surprised if any negative headlines or setbacks suddenly cut the stock in half. EV start-ups could fail for many reasons, including poor technology, too much competition, or lack of execution.

And the SPAC process brings in another layer of risk. Prior to becoming public, these operating companies are able to give potential investors projections and predictions without the accountability of public companies.

That doesn't mean Lucid did anything wrong here. We simply don't know exactly what the SEC is looking into. And the company has so far remained on its timeline for producing its first vehicles.

Conclusion.....

Over the past five days, the stock is down roughly 35%. Those declines look set to continue as concerns intensify about the company and its operations. The negative sentiment is surprising given how bullish Wall Street had been on Lucid. Many analysts had said that the company, with its focus on luxury electric vehicles, was one of the few legitimate competitors likely to challenge market leader Tesla.

The combined effect of the SEC investigation and the large debt offering in the same week continues to push the company’s share price down sharply. How deep the rout goes is not yet known.

Therefore…..

The Lucid Group Weekly Options Trade Has Been A Big Winner!

What Further Lucid Group Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Lucid Group