TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Intel Corporation Stock Price Finally Stabilizing!

Weekly Options Members

Are Up 69% Potential Profit, in 2 days,

Using A Weekly CALL Option!

Semiconductor giant Intel has enjoyed positive earnings estimate revisions across the board.

The CEO of Intel, Patrick Gelsinger, recently made a big splash, acquiring roughly 6800 shares at a total transaction value of $250k.

The company has been consistently posting robust results, exceeding the Consensus EPS Estimate by an average of 130% across its last four quarters.

This set the scene for Weekly Options USA Members to profit by 69%, using an INTC Options trade!

Join Us And Get The Trades – become a member today!

Sunday, November 12, 2023

by Ian Harvey

Why the INTEL Weekly Options Trade was Originally Executed!

The semiconductor space has struggled over the past three months on bets

over persistently higher rates. Now, with signs of the Federal Reserve's

aggressive interest rate hiking campaign nearing an end, we are likely to see a

reversal of the decline in the sector. The expansion of artificial intelligence

(AI) applications holds the promise of ushering in fresh opportunities for

growth within the sector.

Additionally, a spate of strong earnings reports from well-known players like Intel Corporation (NASDAQ:INTC) has instilled confidence in the

sector.

Semiconductor giant Intel has enjoyed positive earnings estimate revisions across the board. The CEO of Intel, Patrick Gelsinger, recently made a big splash, acquiring roughly 6800 shares at a total transaction value of $250k.

The company has been consistently posting robust results, exceeding the Consensus EPS Estimate by an average of 130% across its last four quarters. Just in its latest print, the company posted a 95% EPS beat and posted revenue 5% ahead of the consensus expectation.

Intel’s top line appears to be finally stabilizing.

The INTC Weekly Options Trade Explained.....

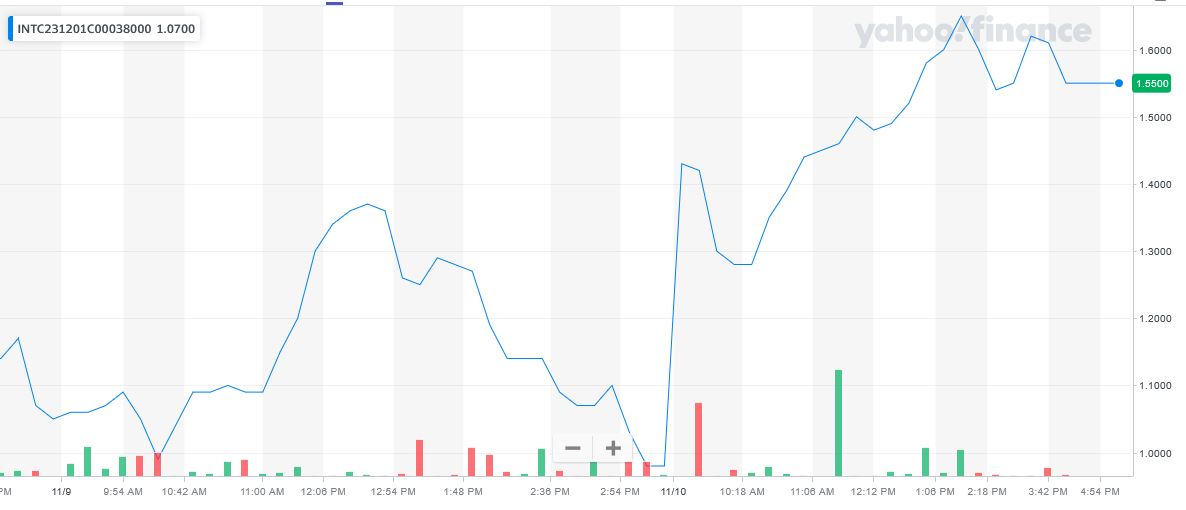

** OPTION TRADE: Buy INTC DEC 01 2023 38.000 CALLS - price at last close was $1.05 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the INTC Weekly Options (CALL) Trade on Thursday, November 09, 2023 for $0.99.

Sold half the INTC weekly options contracts on Friday, November 10, 2023 for $1.67; a potential profit of69%.

Don’t miss out on further trades – become a member today!

About Intel.....

Intel Corporation is among the world’s leading manufacturers of microchips and microchip-enabled products and services. The company engages in the design, manufacture, and sale of computer products and technologies to original equipment manufacturers, original design manufacturers, and cloud service providers. The company was incorporated in 1968 and is headquartered in Santa Clara, California, and is widely regarded as having put the “silicon” in “Silicon Valley”.

Intel was originally a PC-centric semiconductor company but has branched out over its more than 50-year history. The company is now engaged in global digital transformation and is working to provide end-to-end solutions from the largest digital clouds to the smallest IoT and Edge devices. Specifically, Intel is working to advance AI, 5G connectivity, and the digitization of everything.

The now data-centric company operates through 7 segments and is one of the most diversified publicly-traded chipmakers on the market. The company’s 7 segments are CCG (client computing group), DCG (data center group), IOTG (internet of things group), Mobileye (autonomous driving), NSG (non-volatile memory group), PSG (programable solutions group), and All Other segments.

The company operates 6 wafer fabrication sites and 4 assembly test manufacturing sites to ensure the highest standards of quality. The company’s products evolve on the basis of Moore’s law becoming smaller, faster, and more powerful with each generation.

Intel offers platform products such as central processing units and chipsets, and system-on-chip and multichip packages meant to power computers ranging from tablets to supercomputers. Intel also offers non-platform or peripheral products that include accelerators, circuit boards and systems, connectivity products, graphics cards, and memory and storage products. The company’s specialty divisions also provide high-performance computing solutions for targeted verticals as well as embedded solutions for business, industry, and healthcare.

Intel is central to the growth of data centers and the Cloud. The company once boasted a near-100% market share of cloud-based microchip demand but that figure has slipped over the years due to mounting competition. Intel’s cloud solutions provide workload-optimized platforms and related products for cloud service providers, enterprise and government, and communications service providers.

Among the many technologies that Intel is working to advance are self-driving vehicles. Solutions for assisted and autonomous driving include computing platforms, computer vision, and machine learning-based sensing, mapping, and geolocation. Intel Corporation also has a strategic partnership with MILA to develop and apply advances in artificial intelligence methods for improving the search for new drug therapies and applications.

Intel Corporation is committed to corporate responsibility and environmentally sustainable practices. The company seeks to leverage its position to advance not only itself but the industry for the good of mankind.

Further Catalysts for the INTC Weekly Options Trade…..

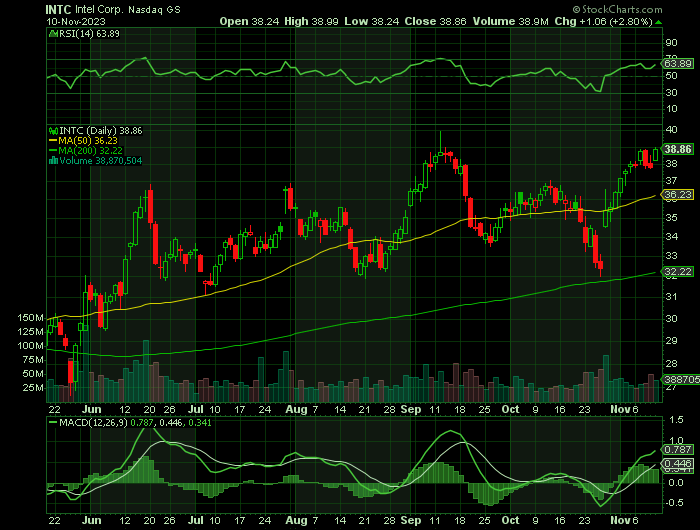

Intel stock has fared well, rising by about 6% over the last five trading days and by about 44% year-to-date amid signs that the big slump in PC sales following Covid-19 lockdowns could be easing.

Intel, the world’s largest chipmaker, beat on both the top and the bottom lines and provided upbeat fourth-quarter revenue guidance. This underscores optimism over the company’s growth prospects.

It reported earnings per share of 41 cents, which beat the Consensus Estimate of 21 cents and increased 11% from the year-ago quarter. Revenues declined 8% year over year to $14.2 billion but came in above the estimated $13.5 billion.

The better-than-expected results were driven by a recovery in the personal computers market. For the current quarter, Intel projects revenues in the range of $14.6 billion to $15.6 billion, while earnings per share are expected to be 44 cent

This indicates that CPU sales to the PC industry could see a rebound after a tough couple of quarters, as manufacturers have worked through inventory they previously built up, with data center inventory also normalizing.

Other Catalysts.....

INTC disclosed that it bought more than a million Arm Holdings American depositary receipts in that company’s September initial public offering.

Chip firm Intel disclosed in a Securities and Exchange Commission form that it owned 1,176,470 Arm ADRs as of the end of September.

Arm ADRs were trading Wednesday at $54, about 6% above the IPO price.

Positive Developments.....

Besides seeing a cyclical turnaround in the PC market, there are some other positive developments for Intel stock. While the big surge in interest in generative AI was initially seen as a negative for Intel, given that cloud computing players have focused on securing graphics processors for AI workloads, rather than on central processing units that Intel sells, Intel indicates that it could also see upside from this trend as its advanced packaging solutions have seen considerable demand from most leading AI chip companies. Moreover, Intel is looking to play a bigger role as a foundry, producing chips for other semiconductor companies, and taking on the likes of TSMC and Samsung Electronics. While investors were skeptical if this capital-intensive bet would pay off, especially considering Intel’s recent struggles with updating its chips to the latest process nodes, the company appears to be progressing. Intel signed up three customers for its 18A process over Q3. The company’s foundry services business generated $311 million in revenue, marking a 299% increase from the same period last year.

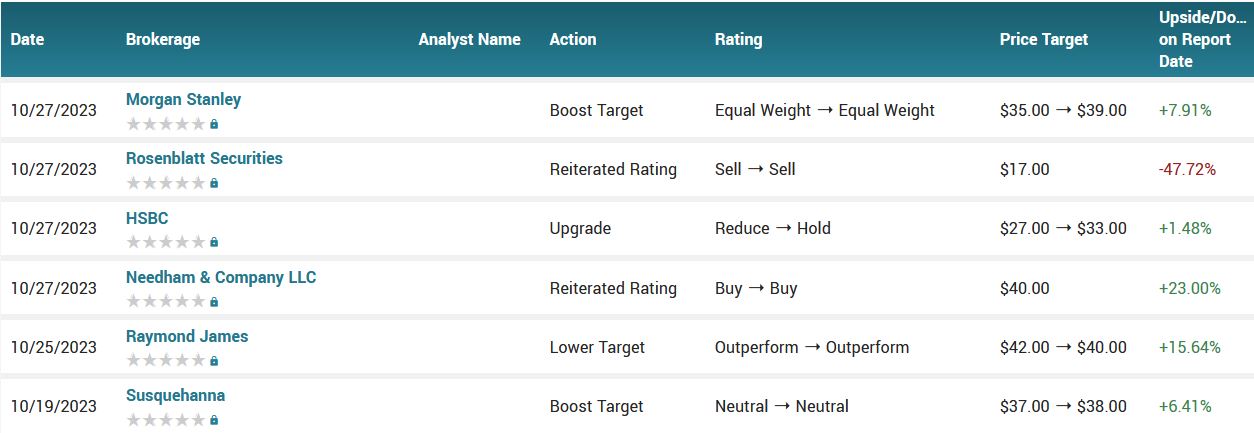

Analysts.....

According to the issued ratings of 30 analysts in the last year, the consensus rating for Intel stock is Hold based on the current 4 sell ratings, 21 hold ratings and 5 buy ratings for INTC. The average twelve-month price prediction for Intel is $35.09 with a high price target of $56.00 and a low price target of $17.00.

Summary.....

INTC stock traded down $0.77 during trading hours on Wednesday, reaching $38.00. 13,817,905 shares of the stock were exchanged, compared to its average volume of 41,856,922. The firm’s 50-day moving average is $36.17 and its 200-day moving average is $33.80. Intel Co. has a 12 month low of $24.73 and a 12 month high of $40.07. The company has a market cap of $160.21 billion, a price-to-earnings ratio of -95.00, and a PEG ratio of 14.14 and a beta of 0.88. The company has a debt-to-equity ratio of 0.44, a current ratio of 1.53 and a quick ratio of 1.13.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from INTEL CORPORATION

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.