TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Honeywell Shares Are On The Move Again!

Weekly Options Members

Are Up 136% Potential Profit

Using A Weekly Call Option!

Honeywell International is a diversified conglomerate with a strong presence in the aerospace and defense sectors.

The company has significant potential, particularly in the building technologies sector, with IoT opportunities for future growth.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 136%, using a HON Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, September 19, 2023

by Ian Harvey

Why the HON Weekly Options Trade was Originally Executed!

Honeywell International Inc. (NYSE:HON) is a diversified conglomerate with a strong presence in the aerospace and defense sectors. It’s also a significant player in quantum computing, employing trapped-ion technology similar to IonQ (NYSE:IONQ). Honeywell’s merger with Cambridge Quantum positions it for a comprehensive quantum business.

As well, the company has significant potential, particularly in the building technologies sector, with IoT opportunities for future growth. Despite recent slower growth, Honeywell’s expected improvement in revenue growth and earnings in 2023 and 2024 makes it a promising options trade.

The company also exhibited $35.4 billion revenue in 2022, a modest 3% year-over-year growth. It is backed by its foray into quantum computing through strategic partnerships, which could boost its financial performance.

About Honeywell…..

Honeywell International Inc. operates as a diversified technology and manufacturing company worldwide.

Its Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; and thermal systems, as well as wireless connectivity and management services.

The company's Honeywell Building Technologies segment provides software applications for building control and optimization; sensors, switches, control systems, and instruments for energy management; access control; video surveillance; fire products; and installation, maintenance, and upgrades of systems.

Its Performance Materials and Technologies segment offers automation control, instrumentation, and software and related services; catalysts and adsorbents, equipment, and consulting; and materials to manufacture end products, such as bullet-resistant armor, nylon, computer chips, and pharmaceutical packaging, as well as provides materials based on hydrofluoro-olefin technology.

The company's Safety and Productivity Solutions segment provides personal protection equipment, apparel, gear, and footwear; gas detection technology; cloud-based notification and emergency messaging; mobile devices and software; supply chain and warehouse automation equipment, and software solutions; custom-engineered sensors, switches, and controls; and data and asset management productivity software solutions.

The company was founded in 1885 and is headquartered in Charlotte, North Carolina.

The HON Weekly Options Trade Explained.....

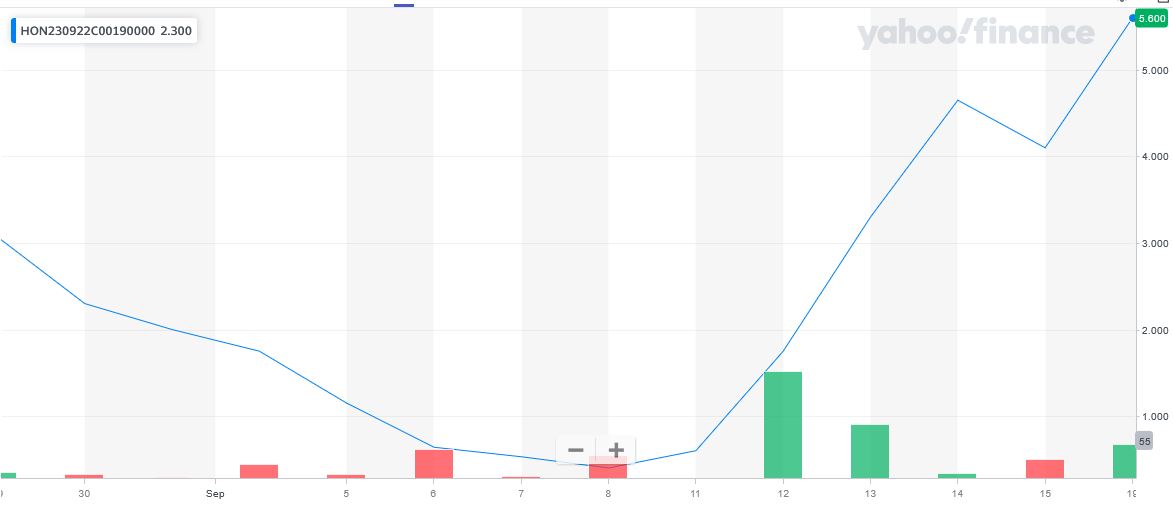

** OPTION TRADE: Buy HON SEP 22 2023 190.000 CALLS - price at last close was $2.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the HON Weekly Options (CALL) Trade on Tuesday, August 29, 2023, for $2.37.

Sold the HON weekly options contracts on Monday, September 18, 2023 for $5.60; a potential profit of136%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the HON Weekly Options Trade…..

Honeywell Aerospace is back - Honeywell's Aerospace segment is its largest by sales and profit. But it was the hardest hit during the COVID-19 pandemic. And for good reason.

The business is heavily dependent on the commercial airline industry. But it also provides navigation systems, actuation systems, and a variety of other small and large solutions for naval and commercial ground transportation, helicopters, the defense industry, the oil and gas industry, and more. Simply put, if there's a vessel that demands mechanical and electric work, Honeywell is probably involved in some capacity.

Honeywell's market position makes it heavily dependent on the strength of the broader economy, but more specifically, global commerce and the transportation of goods as well as people traveling for work or leisure. Honeywell's second-quarter 2023 results indicate that the aerospace segment is officially back.

Other Catalysts.....

Honeywell's long-term strategy is centered on margin growth and operating a more efficient, leaner business.

Like many diversified industrials, Honeywell became clunky in years past and struggled to achieve meaningful organic growth, often having to resort to acquisitions. However, the company's 2023 guidance puts it close to its long-term targets. And some segments, like Aerospace and Honeywell Building Technologies, have already achieved segment margins above 25%.

Revenue.....

Honeywell's operating margin sits at just under 20%. A 20% operating margin is excellent, especially for a company with so many moving parts like Honeywell. It means that the company is taking home 20 cents in operating income for every dollar in revenue. So, although revenue hasn't changed much in 15 years, the company's operating margin is up more than threefold.

Operating income and growing earnings are far more important than revenue. It isn't too hard for Honeywell to simply crank out more products and discount them to boost sales. The real trick comes from getting more profit out of each dollar in sales and then gradually increasing sales in lockstep with a stable operating margin.

Analysts.....

According to the issued ratings of 12 analysts in the last year, the consensus rating for Honeywell International stock is Hold based on the current 1 sell rating, 6 hold ratings and 5 buy ratings for HON. The average twelve-month price prediction for Honeywell International is $215.07 with a high price target of $242.00 and a low price target of $180.00.

Summary.....

Recovery

in commercial flight hours, strength in process solutions and UOP businesses

augur well for Honeywell’s growth. Solid operational execution, pricing actions

and cost-control measures continue to drive the company’s top line. HON’s

bullish forecast for 2023 holds promise.

Honeywell

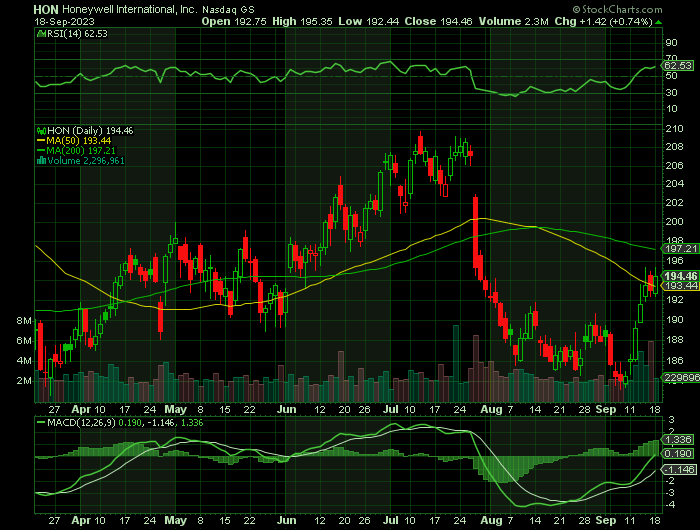

International has a market cap of $123.70 billion, a P/E ratio of 23.06, a

P/E/G ratio of 2.27 and a beta of 1.07. The firm’s 50 day simple moving average

is $197.33 and its 200 day simple moving average is $195.38. The company has a

debt-to-equity ratio of 0.98, a quick ratio of 1.07 and a current ratio of

1.41. Honeywell International Inc. has a 1-year low of $166.63 and a 1-year high

of $220.96.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from HONEYWELL

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.