TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

General Motors Weekly Options Up 63% Profit,

In Less

Than 2 Hours!

General Motors Co (NYSE: GM) announced earnings before the market opened on Tuesday and the results were much better than most investors expected.

General Motors shares traded up $2.77 during mid-day trading on Tuesday, hitting $38.16.

The stock continued to trend upwards on Wednesday.

GM's resurgence as the U.S. market leader is a testament to its strong brand equity and customer loyalty.

This set the scene for Weekly Options USA Members to profit by 63% in less than 2 hours, using a GM Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, January 31, 2024

by Ian Harvey

Why the General Motors Weekly Options Trade was Originally Executed!

General Motors Co (NYSE: GM) announced earnings before the market opened on Tuesday and the results were much better than most investors expected. Not only were revenue and free cash flow strong, the company gave strong guidance for 2024, including a big increase in earnings per share after recent share buybacks.

The upbeat earnings report comes as GM looks to shake off the effects of the UAW strike and recalibrate its electric vehicle rollout, which the company admits has "created some uncertainty."

"Consensus is growing that the US economy, the job market and auto sales will continue to be resilient, and at GM, we expect healthy industry sales of about 16 million units with the mix of EVs continuing to grow," GM CEO and chair Mary Barra said in her shareholder letter.

GM's resurgence as the U.S. market leader is a testament to its strong brand equity and customer loyalty. The company's portfolio, particularly its full-size ICE SUVs and pickup trucks, continues to drive profitability, reflecting GM's ability to meet consumer demands effectively. This strength is bolstered by GM's strategic focus on maintaining a competitive edge in design, quality, safety, and innovation.

The General Motors Weekly Options Potential Profit Explained.....

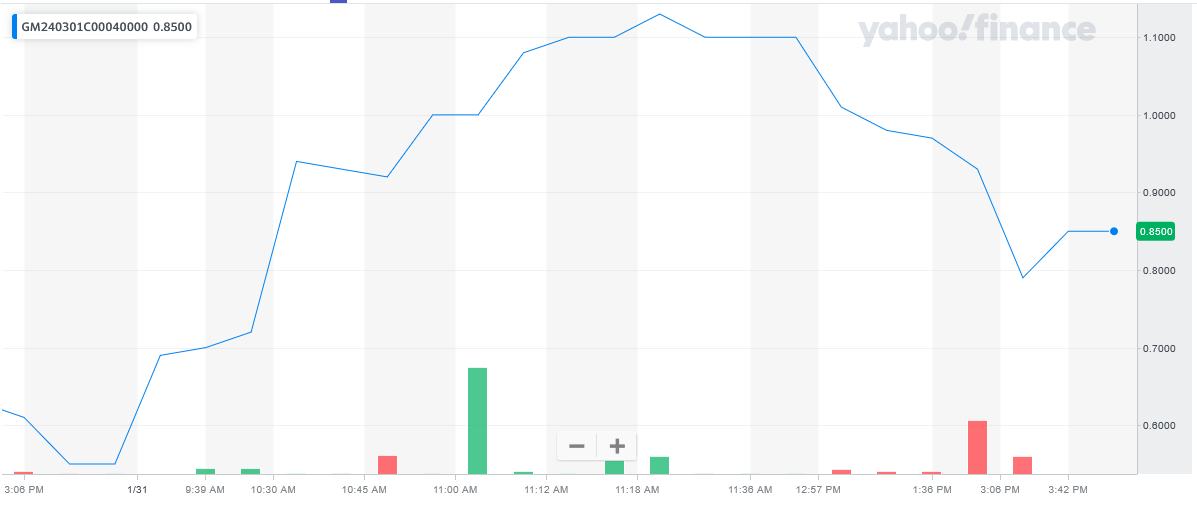

** OPTION TRADE: Buy GM MAR 01 2024 40.000 CALLS - price at last close was $0.55 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the GM Weekly Options (CALL) Trade on Wednesday, January 31, 2024, at 9:39, for $0.70.

Sold half the gm weekly options contracts on Wednesday, January 31, 2024, at 11:19 for

$1.14; a potential profit of 63%.

Holding the remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

About General Motors.....

General Motors Company, a multinational corporation, has been a leading player in the global automotive industry for over a century. Founded in 1908 by William C. Durant, GM has become one of the world's largest automakers, with a worldwide presence across North America, South America and international markets.

General Motors is the largest automaker in the United States, with a market share of around 17%. It produces a range of vehicles, including cars, trucks and SUVs, under various brands, such as Chevrolet, Buick, Cadillac and GMC.

One of GM's key growth areas is its electric vehicle (EV) business, which is gaining momentum worldwide. The company has plans to launch 30 new electric models globally by 2025 and has committed to investing $35 billion in EV and autonomous vehicle technology over the next five years. With a growing focus on sustainability, the company has set ambitious goals to become carbon neutral by 2040 and to achieve 100% renewable energy usage in its U.S. operations by 2030.

General Motors has also recently improved its environmental, social and governance (ESG) performance. In addition to its commitments to sustainability, the company has also committed to investing in diverse suppliers and increasing the diversity of its workforce. In 2021, the company was named to the Dow Jones Sustainability Indices (DJSI) North America for the third consecutive year, reflecting its strong ESG performance.

Despite its strong market position and ESG performance, General Motors faces risks associated with the cyclical nature of the automotive industry. The industry is subject to fluctuating economic demand, such as in the recent COVID-19 pandemic. The company also faces ongoing legal challenges related to multiple recalls revolving around several vehicle platforms.

GM has demonstrated resilience and the ability to adapt to changing market conditions. During the pandemic, GM ramped production of its popular trucks and SUVs, which helped drive strong financial results for the third quarter of 2022. After the pandemic, the company reported record sales growth due in part to increased demand for its vehicles and a rebound in production and sales.

Overall, General Motors is a well-established player in the global automotive industry with a strong market position in North America and a growing electric vehicle business. The company's commitment to improving its ESG performance and sustainability practices is notable and reflects its focus on long-term growth and responsible business practices. While investors should be aware of the risks associated with the industry's cyclical nature, General Motors' track record of innovation and resilience makes it a key player to watch in the years ahead.

Further Catalysts for the GM Weekly Options Trade…..

General Motors leapt Tuesday after providing a bullish outlook and a less harsh-than-expected Q4 report. Shares of the automaker surged to a buy zone.

General Motors reported a 41.5% decline in adjusted earnings to $1.24 per share, the company's first earnings drop in five quarters. Revenue ticked down a fraction to $42.98 billion to mark its first sales decrease in seven quarters. Results were hindered by several factors, most notably unsold electric vehicles, as well as the 40-day strike that curtailed various company operations.

Analysts expected a 45% decline to $1.16 per share adjusted on about a 10% revenue decline to $38.8 billion.

During 2023, General Motors delivered 2.6 million vehicles in the U.S., up 14% year-over-year. The company touted a 16.2% total market share in the U.S. in 2023. Meanwhile, the company and its joint ventures delivered 2.1 million cars to China last year.

GM took a $1.6 billion charge, the impact of unsold EVs. The company also reported an $800 million charge during the quarter tied to the recall of Chevy Bolt batteries.

Other Catalysts.....

GM CEO and chair Mary Barra reiterated on the earnings call that the company has the ability to refocus production and "flexibility" to build more hybrids if necessary but that EV growth is the top priority for the company.

In addition to reinstating its profit outlook last November, GM revealed a $10 billion “accelerated share repurchase” (ASR) program with the intention of boosting its common stock dividend by 33% starting in January. As opposed to a traditional staged share buyback, GM says its program will begin immediately.

"Everyone on the team is focused on strong execution to sustain our momentum and create shareholder value, and we are deeply committed and accountable to do exactly that," Barra said in her letter.

GM's vision for an all-electric future is supported by its Ultium platform, a flexible EV propulsion architecture that promises to revolutionize the market. With plans to have an annual EV capacity of one million units in North America by 2025, GM is positioning itself as a leader in the EV space. Additionally, the company's investments in AV technology, despite recent setbacks, underscore its commitment to innovation and future mobility solutions.

Moving Forward.....

GM forecast total US auto industry sales to hit 16 million in 2024, which would be a strong improvement post-pandemic; only 13.4 million vehicles were sold in 2022, the lowest in a decade.

GM's commitment to scaling EV production and expanding its software-enabled services presents significant growth opportunities. The company's focus on software platforms like OnStar and ADAS, including Super Cruise technology, positions it to capitalize on the increasing demand for connected and autonomous driving experiences. These initiatives could attract new customers and open revenue streams beyond traditional vehicle sales.

“At Cruise AV business unit, we are committed to earning back the trust of regulators and the public through our commitments and our actions,” Barra said.

"This was an important quarter to help regain Street confidence that has been shaken the last few quarters with the EV vision in flux and Cruise black eye," Wedbush analyst Dan Ives tweeted on Tuesday morning. "GM said it would spend $1 billion less on Cruise than in '23."

GM's incubation of new businesses, such as GM Defense, offers the opportunity to diversify its revenue base and leverage its technological expertise in new markets. By addressing the needs of defense and government customers for electric, autonomous, and connected solutions, GM can tap into a niche yet potentially lucrative market segment.

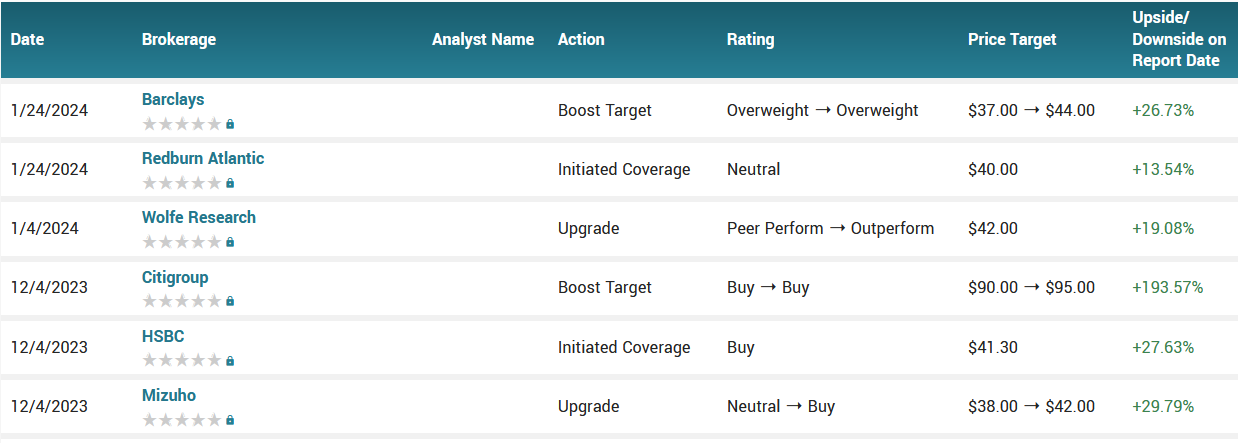

Analysts.....

According to the issued ratings of 16 analysts in the last year, the consensus rating for General Motors stock is Moderate Buy based on the current 1 sell rating, 2 hold ratings, 12 buy ratings and 1 strong buy rating for GM. The average twelve-month price prediction for General Motors is $49.72 with a high price target of $95.00 and a low price target of $27.00.

Summary.....

Overall, GM said sales jumped 14.1% to 2.6 million vehicles for 2023, making it the company's best year since 2019. The automaker also grew its market share by 0.3% to 16.3% overall in the US. GM said it was No. 1 in full-size pickup sales in the US (841,000 units) and No. 1 in full-size SUV sales (245,000 units).

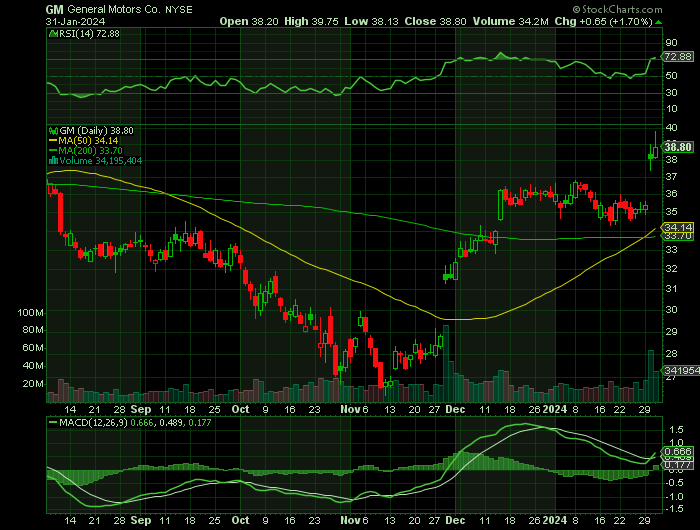

General Motors shares traded up $2.77 during mid-day trading on Tuesday, hitting $38.16. 57,950,926 shares of the company traded hands, compared to its average volume of 19,344,701. General Motors has a one year low of $26.30 and a one year high of $43.63. The company has a current ratio of 1.14, a quick ratio of 0.96 and a debt-to-equity ratio of 1.02. The business has a 50-day moving average of $34.20 and a 200 day moving average of $33.19. The stock has a market capitalization of $52.25 billion, a price-to-earnings ratio of 5.37, and a PEG ratio of 0.59 and a beta of 1.52.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from GM

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.