TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Exiting Options Trade Before Earnings!

“Weekly Options” Members

Profit Up 84% In 2 Days On FedEx Trade!

More Gains Expected?

Wednesday, June 23, 2021

by Ian Harvey

Exiting options trades before earnings by using the advantage of a positive run-up can be very profitable; without relying on the unpredictable direction after the report is presented.

“Weekly Options Members,” using an options call trade on FedEx, made potential profits of 84% in 2 days!

Timing exiting options trade on FedEx Corporation (NYSE:FDX)

Prelude…..

Timing exiting options trade on FedEx Corporation (NYSE:FDX) before earnings was left to the individual member, as all traders have their own risk tolerance. We usually recommend an exit price, but due to the recent past volatility experienced by the stock market, exiting options trade on FedEx seems to be advantageous at this point.

The earnings report is due out Thursday, June 24, 2021, after the market closes.

By exiting options

trade before the report means that we are not to relying on the earnings to

push the options trade prices higher. As has been noticed in the past few

weeks, even the companies that have presented excellent earnings reports have

had pull-backs when not expected.

The Recommended FedEx Options Trade.....

** Buy FDX JUN 25 2021 292.500 CALLS at approximately $5.50.

(Actually bought for $6.35)

FedEx Exiting Options Trade Call Success Explained.....

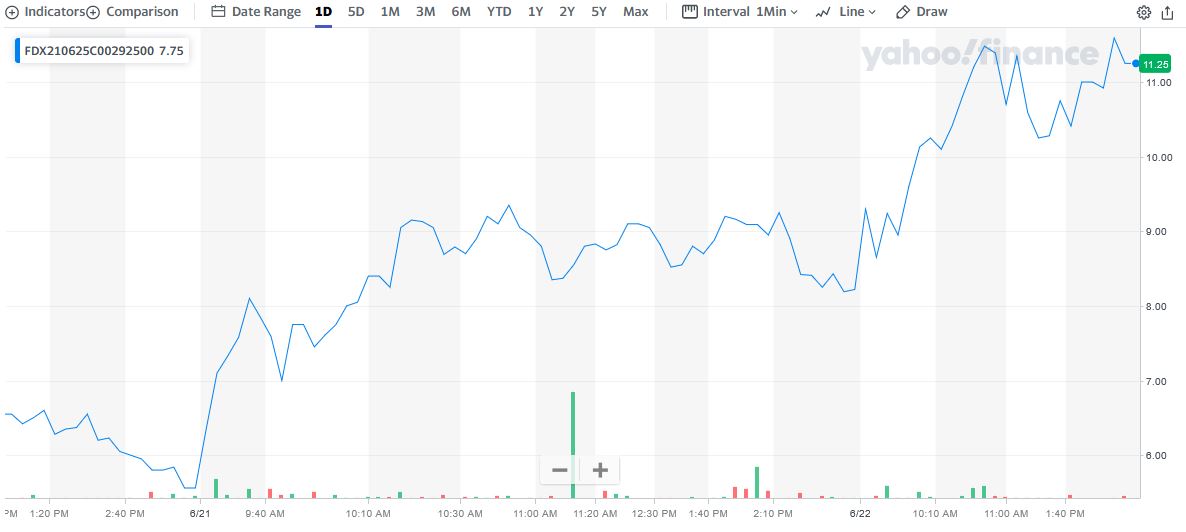

On Monday, June 21, 2021, “Weekly Options Members,” entered the trade mentioned above for $6.35.

By 10:48am the exit price of the options trade had hit $9.35 – a potential profit of 47% or $300 after subtracting the buy price.

However, for those that retained their options trade, Tuesday saw the exit price hit $11.69 – now the potential profit is up 84% or $154.

Here is a different scenario – for members that were exiting options trade on Monday and then took a new trade on Tuesday, the entry price was $6.70 – reaching an exit price of $11.69 – another potential profit of 74% or $499.

The question now is should we exit the trade or wait for more profit?

Why the Recommendation and the Reasoning behind Exiting Options Trade on FedEx

FedEx Corp. is confirmed to report earnings at approximately 4:00 PM ET on Thursday, June 24, 2021.

The Major Catalysts for This Trade.....

1. Earnings.....

The consensus earnings estimate is for $4.99 per share on revenue of $21.39 billion; but the Whisper number is a bit higher at $5.19 per share.

Consensus estimates are for year-over-year earnings growth of 97.23% with revenue increasing by 23.23%.

Short interest has decreased by 5.5% and overall earnings estimates for the quarter has been revised 9.11% higher over the last 30 days to the current level.

“We expect a beat for F4Q21 as many of the LTM trends we have seen will continue. However, more than ever, 4Q results are likely not as important as the FY22 guide, which will be the critical test of how much of the pandemic tailwinds mgmt. believes are sustainable (and deserves to be priced in),” noted Simeon Gutman, equity analyst at Morgan Stanley.

“We see EBIT growth through YE of FY21 driven by both margin improvement and vol. driven rev. growth which is helped by limited Airfreight capacity and an eCommerce surge, though yields are mixed. We continue to see secular threats to Parcel and remain skeptical that these trends will be sustainable but believe that until there is evidence of a reversal in earnings momentum, the stock can trade at its historical multiple (14-15x PE) on current EPS.”

For the last reported quarter, it was expected that FedEx would post earnings of $3.21 per share when it actually produced earnings of $3.47, delivering a surprise of +8.10%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

2. E-commerce Boom.....

Higher

volumes, thanks to the coronavirus-driven rise in e-commerce demand and

door-to-door delivery services are likely to have aided FedEx’s performance in

the to-be-reported quarter.

FedEx’s Ground unit, which handles e-commerce deliveries for many retailers, is

expected to have benefited from higher residential delivery volume growth

during the fiscal fourth quarter. Additionally, the Express segment, buoyed by

international export and U.S. domestic-package volume growth, is anticipated to

have generated higher revenues during the soon-to-be-reported quarter. As for

the Freight segment, higher revenues per shipment and average daily shipments

are likely to have boosted revenues in the fiscal fourth quarter, as was the

case in the previous reported quarter.

Additionally, FedEx’s December 2020 acquisition of ShopRunner, boosting its

e-commerce offerings, is likely to have contributed to the company’s top line.

3. Less Covid-19 Effect.....

The COVID-19 pandemic has loosened its grip in the U.S. since fiscal year 2021 began, but delivery demand remains red-hot for FedEx and other carriers. Room on FedEx’s fleet of airplanes, trucks and vans is harder to come by, giving the company the power to push higher rates and surcharges onto its customers.

There’s been a reduction in air cargo capacity during the COVID-19 pandemic, with many passenger planes grounded. Jack Atkins, a FedEx analyst at Stephens, said in a note the biggest wild card for FedEx's business is how soon international passenger belly capacity returns to pre-pandemic levels.

U.S. airlines carried 41.2 million passengers in March, seasonally adjusted, per the Bureau of Transportation Statistics. That’s an improvement from March 2020 but is still down more than 43% versus the three years previous.

The reduction in competition has been a favorable development for all-cargo airline FedEx Express.

In March, FedEx COO Raj Subramaniam said FedEx Express expects elevated air cargo pricing levels for at least the next year until supply improves, after which FedEx “will flex our networks appropriately” to adjust. If that timeline holds despite the recent uptick in air travel demand, FedEx Express will reap the benefits.

4. In-house Deliveries.....

There has been some decline due to FedEx Ground keeping deliveries in-house that it once would have handed off to the U.S. Postal Service, delivery experience management company Convey co-founder Carson Krieg said. However, he added that this operational adjustment is a “short-term gamble for a long-term payoff” in more efficient delivery routes and the company’s service levels should improve.

“I think they’re doing it at a smart time of year,” Krieg said.

Despite the reported performance slip, businesses are still relying on FedEx to deliver goods to online shoppers more than ever. Atkins is expecting a strong earnings report from the company, as demand remains at dizzying heights.

“With underlying demand trends strong and its network full, we believe FedEx continues to realize healthy pricing improvement as it works to drive improved profitability on its (business-to-consumer) traffic,” he said.

5. FedEx Freight…..

FedEx Freight, a provider of less-than-truckload freight shipping services, is a smaller piece of FedEx’s operations compared to FedEx Express and FedEx Ground. But the company has contributed to FedEx’s overall turnaround, with an operating income and margin this fiscal year well ahead of where it was in 2020.

Jack Atkins, a FedEx analyst at Stephens, said FedEx overall has upside potential “driven by robust demand, improving business mix and strong core yield trends across FDX's three primary business segments (Express, Ground and Freight).”

In its most recently reported quarter, average daily shipments for FedEx Freight were up 3% from the year-before quarter. The company has also been mingling more with other FedEx operating companies of late, delivering more than 1.75 million shipments for Ground in the fiscal year as of March.

6. Analysts’ Opinions.....

Wall Street consensus has improved in the last three months, now standing at an ‘Overweight’ rating based upon 20 ‘Buy’, 3 ‘Overweight’, 6 ‘Hold’, and 1 ‘Underweight’ recommendation. Price targets currently range from a low of $265 to a Street-high $383 while the stock closed Friday’s session just $20 above the low target.

FedEx has also been the subject of a number of research reports.....

- Wells Fargo & Company lifted their price target on shares of FedEx from $336.00 to $351.00 and gave the stock an "overweight" rating in a research report on Thursday, May 20th.

- Raymond James lifted their price target on shares of FedEx from $310.00 to $330.00 and gave the stock an "outperform" rating in a research report on Friday, June 4th.

- Morgan Stanley lifted their price target on shares of FedEx from $250.00 to $265.00 and gave the stock an "equal weight" rating in a research report on Thursday, June 3rd.

- KeyCorp lifted their price target on shares of FedEx from $350.00 to $370.00 and gave the stock an "overweight" rating in a research report on Wednesday, May 26th.

- Finally, Wolfe Research upgraded shares of FedEx from a "peer perform" rating to an "outperform" rating in a research report on Monday, May 3rd.

Summary.....

FedEx ended a strong uptrend at 275 in January 2018 and entered a steep decline that posted a 7-year low in March 2020. The subsequent uptick unfolded in a vertical trajectory, reaching the prior high in October. A breakout into December failed but the stock mounted that peak in May 2021, added a few points, and failed the rally once again at month’s end. It’s now trading just 10 points above the 2018 high.

Therefore…..

Exiting Options Trade On FedEx Before Earnings Has Been A Big Winner!

Will FedEx Stock Price Continue To Climb?

Will We Recommend Further Trades On FedEx Before Earnings With The Plan Exiting Options Trade Early?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Exiting Options Trade