TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Dollar General Stock Weekly Options Trade Provides 52% Potential Profit!

Members of “Weekly Options USA,” Using A Weekly Call Option, Are Up 52%

Due To Combating Inflation With Soaring Costs!

More to come?

Join

Us and GET FUTURE TRADEs!

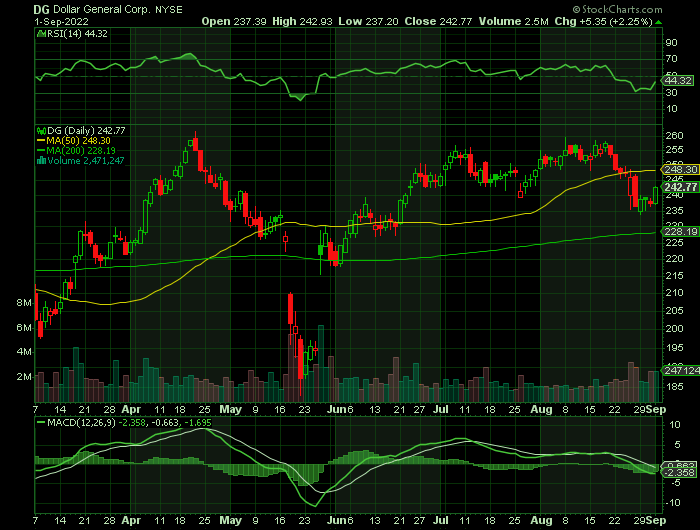

Dollar General stock exploded yesterday, even though the market was negative in most areas, as the current inflationary environment is driving consumers to seek out cheaper goods, putting the dollar store chain in a prime position to capture business.

This set the scene for Weekly Options USA Members to profit by 52% using a Weekly Call Option!

Join Us And Get The Trades – become a member today!

Friday, September 02, 2022

by Ian Harvey

Why the Profit on Dollar General Stock?

2020 will probably go down in history as the year of COVID-19. 2021 could be known as the year of the reopening. How will 2022 be remembered? Perhaps as the year of sky-high inflation.

Prices of goods and services are at levels not seen in four decades. Soaring inflation could even lead to a recession. On an unofficial basis, it already has with the U.S. economy contracting for two consecutive quarters.

There are signs that inflation could decline. However, it could still remain at high levels and cause challenges for the economy and the stock market. But inflation isn't problematic for every stock.

However, Dollar General Corp. (NYSE: DG) recently reported second-quarter results that showed strong growth year-over-year. The current inflationary environment is driving consumers to seek out cheaper goods, putting the dollar store chain in a prime position to capture business.

The Profits Explained.....

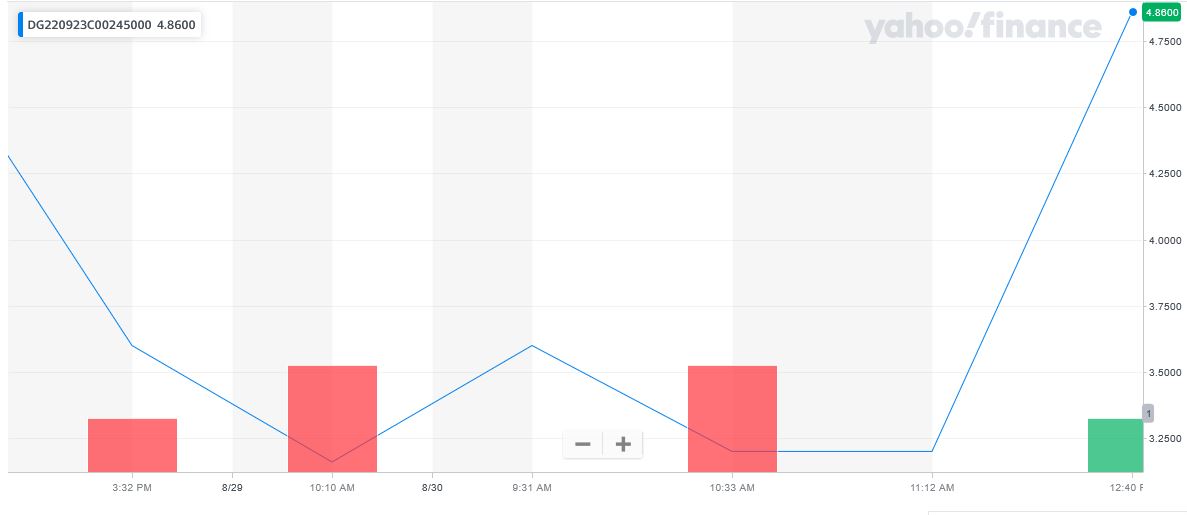

Entered the Dollar General stock trade on Tuesday, August 30, 2022 at $3.20.

Exited the trade Thursday, September 01 for $4.80, for a potential profit of 52%.

Why the Initial Weekly Options Call Trade on

Dollar General Stock.....

Dollar General reported its second quarter earnings results earlier this month. Revenue grew 9% year-over-year to $9.43 billion, which was $26 million ahead of Wall Street analysts estimates. Adjusted earnings per share of $2.98 was above last years $2.69 and was 5 cents better than excepted.

Same-store sales, a much clearer view of the companys performance then just total revenue, were up 4.6%. (further details below)

The growth in same-store sales is a positive, especially following last years 4.7% decline. Recall that the second quarter of 2021 was up against a difficult period that benefited from Covid-19 panic buying. Over the last three years, Dollar Generals second-quarter comparable sales growth rate is nearly 19%.

Merchandise levels have gotten larger, up 25.1% per store to $6.9 billion. The increase was due to products with higher values, such as those found in the Home and Seasonal categories, and inflation pressure. This will be an area to watch as high levels of inventory could mean an eventual markdown in product prices.

As with other retailers, inflation is impacting Dollar Generals business results. The company has taken steps to reduce this impact, including the rollout of DG Fresh, which is Dollar Generals move to distribute frozen and refrigerated goods. The company delivers these products from its own facilities to all of its stores, which has helped lower product cost in these areas. Leadership expects that it will be able to deliver produce to approximately half of its store locations eventually.

To improve the shopping experience, Dollar General stock has invested heavily in not only opening new stores, but also remodeling and relocating existing locations to further increase their product offerings. Along with new openings, the company remodeled 533 stores and relocated another 30. Leadership noted that the company will open as many as 1,060 new stores this year, remodel almost 1,800 and relocate another 125. The majority of new stores will be larger format as well, allowing the company a wider range of products to market.

The major market indexes remain in negative territory this year. However, Dollar General has delivered a positive return. In May, the company even raised its full-year 2022 sales guidance after reporting better-than-expected Q2 results. That's a surefire sign that inflation isn't hurting Dollar General.

About Dollar General Stock.....

Dollar General Corporation, a discount retailer, provides various merchandise products in the southern, southwestern, Midwestern, and eastern United States.

It offers consumable products, including paper and cleaning products, such as paper towels, bath tissues, paper dinnerware, trash and storage bags, disinfectants, and laundry products; packaged food comprising cereals, pasta, canned soups, fruits and vegetables, condiments, spices, sugar, and flour; and perishables that include milk, eggs, bread, refrigerated and frozen food, beer, and wine.

The company's consumable products also comprise snacks, such as candies, cookies, crackers, salty snacks, and carbonated beverages; health and beauty products, including over-the-counter medicines and personal care products, such as soaps, body washes, shampoos, cosmetics, and dental hygiene and foot care products; pet supplies and pet food; and tobacco products.

In addition, it offers seasonal products comprising holiday items, toys, batteries, small electronics, greeting cards, stationery, prepaid phones and accessories, gardening supplies, hardware, and automotive and home office supplies; and home products that include kitchen supplies, cookware, small appliances, light bulbs, storage containers, frames, candles, craft supplies and kitchen, and bed and bath soft goods.

Further, the company provides apparel, which comprise casual everyday apparel for infants, toddlers, girls, boys, women, and men, as well as socks, underwear, disposable diapers, shoes, and accessories.

As of February 25, 2022, it operated 18,190 stores in 47 states in the United States. The company was formerly known as J.L. Turner & Son, Inc. and changed its name to Dollar General Corporation in 1968. Dollar General Corporation was founded in 1939 and is based in Goodlettsville, Tennessee.

Further Catalysts for the Dollar General Stock Weekly Options Trade…..

Earnings.....

Traffic was up slightly and average basket size did increase, though mostly due to inflationary costs. The real strength was in consumable products; this area was the main driver of growth during the quarter. At the same time, higher-end non-consumables declined from the prior-year period.

Gross margins improved 69 basis points to 32.3% as the company benefited from an increase in inventory markups. This was partially offset by higher transportation and distribution costs, a larger percentage of revenue from lower-margin product categories and markdowns.

Rounding out the quarter, Dollar General opened 227 new stores and repurchased 1.5 million shares at an average price of $233.46. After adding an additional $2 billion to its current share repurchase authorization, the company has a total of $3 billion, or 5.6% of its market capitalization, with which it can buy back stock in the future.

Leadership provided partially revised guidance for 2022. The company still expects adjusted earnings per share to grow 12% to 14% from 2021. Revenue is now projected to grow 11%, compared to prior estimates of 10% to 10.5%. Comparable sales are forecasted to be up 4% to 4.5% for the year.

Future Earnings.....

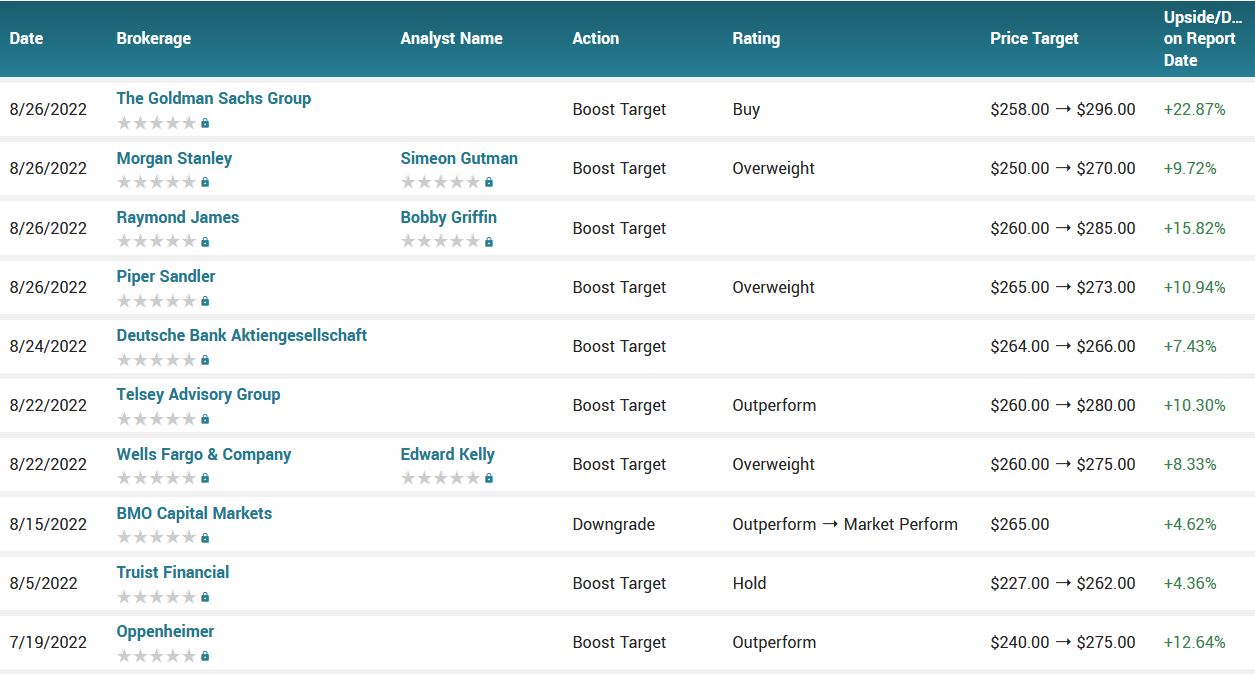

Research analysts at Telsey Advisory Group upped their FY2023 EPS estimates for shares of Dollar General in a research report issued on Friday, August 26th. Telsey Advisory Group analyst J. Feldman now expects that the company will post earnings per share of $11.65 for the year, up from their previous estimate of $11.60. Telsey Advisory Group has a “Outperform” rating and a $280.00 price target on the stock. The consensus estimate for Dollar General’s current full-year earnings is $11.56 per share. Telsey Advisory Group also issued estimates for Dollar General’s Q1 2024 earnings at $2.85 EPS, Q2 2024 earnings at $3.37 EPS, Q3 2024 earnings at $2.92 EPS, Q4 2024 earnings at $3.81 EPS and FY2024 earnings at $12.93 EPS.

Focusing on Improvements….

The company has focused on adding to areas that help drive customers to stores. For example, Dollar General installed more than 17,000 cooler doors during the period and has plans to install more than 65,000 this year.

The company is expanding its health offerings as well, with as many as 400 additional products being rolled out to 4,000 stores by the end of 2022. Long-term, Dollar General stock aims to improve its health care product line and services through its stores. This could be especially important in rural areas of the U.S., which often dont have a big box retailer to provide basic over-the-counter medications. Appealing to these underserved areas could help to grow the companys customer base. Three-quarters of the country lives within five miles of a Dollar General location, which should only increase as the company aggressively expands its store count.

Pricing Powers.....

Dollar General's large footprint gives it pricing power with retailers, allowing it to bring the country's best-known brands at a low cost to a location near most of the country's population. The low prices make it appealing to cash-strapped customers. And its proximity to consumers and its selection help it to undercut convenience stores and grocers.

Higher Inflation.....

Discount retailers like Dollar General stock are good stocks to buy in good times because they can help low- and middle-income consumers stretch their budgets further. But during periods of high inflation and elevated gas prices, they become downright essential.

Having made investments in its business years ago that allowed it to offer more consumables, the discount chain today is reaping the benefits as those categories contribute to its market share gains.

Grocery Importance....

For the 13-week period that ended July 29, Dollar General's sales increased 9% year over year to $9.4 billion. That was also 35% above what it generated in fiscal Q2 2019, indicating how well-aligned the retailer is becoming with consumer needs in difficult times. Same-store sales were up 4.6% in the quarter as stronger customer traffic helped accelerate its market share growth in the highly consumable products segment.

The discount chain's management is even more bullish about its prospects. Having already raised its full-year outlook when it reported on its fiscal first quarter, Dollar General increased it yet again last week. It now forecasts revenue growth of 11% for the year (versus its previous guidance of a 10% to 10.5% gain) with comps expected to rise by 4% to 4.5% (compared to the prior forecasts of 3% to 3.5%). Customers are spending more on consumables like food, but less on apparel, seasonal goods, and home products.

"Looking ahead, we are confident that our strategic actions, which have transformed this company in recent years and solidified Dollar General stock as the clear leader in small-box discount retail, have positioned us well for continued success, while supporting long-term shareholder value creation."

Analysts.....

Although e-commerce has expanded massively over the past decade, that doesn't mean the end is yet in sight for brick-and-mortar stores, one analyst argued.

"It's extraordinarily exaggerated," Morning Consult Retail & E-commerce Analyst Claire Tassin said. "The vast majority — about 85% — of retail in the U.S. happens in physical stores. More stores in 2021 opened than closed."

More than 4,000 stores have opened in the U.S. this year, more than twice as many than those that have closed, according to Coresight Research data, building on last year’s trend. The retail sector reported 36% more openings in 2021 versus 2020, with discount stores leading the momentum and accounting for 39% of the total stores opened.

Data has indicated that shoppers still prefer feeling and seeing products in person before making their purchases. According to Morning Consult's semi-annual State of Retail & E-Commerce report, more than two-thirds of consumers prefer shopping in stores for home furnishings and appliances as well as beauty and personal care products. Meanwhile, only one-third prefers shopping online for apparel, shoes, and accessories.

A recent Mastercard SpendingPulse survey showed in-store sales continue to rise, climbing 11.1% year-over-year in July and up 13.9% from 2019. On the other hand, e-commerce sales grew at a slower pace than total retail sales in the second quarter. Commerce Department data showed a 6.8% rise in e-commerce spending from a year ago versus shoppers spending 7.2% more overall.

Tassin stated that the misconception of brick-and-mortar's doom has more to do with empty storefronts, which are more driven by retailers adapting to the current economic environment, rather than declining sales.

"The U.S. has a real legacy of excessive retail square footage," she said. "I know I see it here in my hometown in Chicago, where you're seeing there's maybe some empty storefronts, but a lot of that is just retailers finding the right space to be closer to their customers and understanding how shoppers are using stores differently than they used to. So, for example, prioritizing some of that square footage for click and collect fulfillment."

Also, Raymond James analyst Bobby Griffin reiterated a Strong Buy rating on Dollar General stock and raised the price target to $285 from $260, implying an 19% upside.

The analyst raised the price target after the company reported better-than-expected Q2 earnings. Griffin thinks Dollar General stock will remain an attractive investment opportunity in a wide variety of economic environments.

He added that DG has the capabilities, real estate growth strategy, and right strategic in-store investments to continue to gain market share by targeting quick "fill-in" trips for cash-strapped consumers.

DG management noted stronger growth in categories such as canned meat, dry pasta, soup, rice, beans, and core proteins like eggs, in addition to continued demand for $1 priced items, the analyst specified.

Griffin opined the shift in purchasing habits should continue to benefit Dollar General's share of wallet in the coming quarters.

As well, Telsey Advisory Group analyst Joseph Feldman reiterated an Outperform rating on the shares of Dollar General stock with a price target of $280.00.

The analyst noted that DG reported a Q2 earnings beat, driven by better-than-anticipated sales and profitability, reflecting the impact of inflation and consumers continuing to increase reliance on Dollar General amidst a challenging economic environment.

The analyst said the Q2 comparable sales reflect increases in both traffic and average ticket, with sales being strongest in consumables. Feldman added that, like most retailers, Dollar General is facing pressures from lapping the U.S. government stimulus and elevated costs.

The analyst expects the company’s business to grow as consumers continue to increase their reliance on Dollar General stock. He also cited Dollar General’s performance to be driven by new stores and remodels and a number of initiatives, including the expansion of cooler doors, DG Fresh supply chain upgrades, Fast Track inventory/labor management, and the expansion of non-consumables initiatives.

According to the issued ratings of 14 analysts in the last year, the consensus rating for Dollar General stock is Moderate Buy based on the current 3 hold ratings and 11 buy ratings for DG. The average twelve-month price prediction for Dollar General is $267.54 with a high price target of $296.00 and a low price target of $210.00.

Summary.....

Revenue should pick up as the company expects 11% revenue growth for fiscal 2022. This makes it likely that it should continue to prosper for the foreseeable future, and its 25 P/E ratio makes it slightly cheaper than Walmart and Costco, a factor that will probably work in its favor with some investors.

Dollar General stock would likely hold up much better than fellow retailers in a recessionary environment as 80% of its products are priced at $5 or below. Consumers often trade down during tough economic conditions, with dollar stores being an ideal way to make money stretch further. It was noted on the conference call that some of the increase in store traffic was a result of more affluent shoppers, those with incomes approaching $100,000, visiting locations more frequently.

Guidance remains positive for Dollar General stock. Top-line projections will benefit from an additional week for the year, but a return to positive same-store sales is a good sign. Dollar General's comparable sales fell 2.8% in 2021.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Dollar General Stock

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.