TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Delta Air Lines (DAL) Gains Analyst Support!

Weekly Options Members

Are Up 108% Potential Profit

Using A Weekly CALL Option!

Morgan Stanley analyst Ravi Shanker, an airline expert, covers Delta – and he starts off by listing a set of factors that provided support in the earnings report.

Looking ahead, Shanker puts an Overweight (Buy) rating on Delta’s shares, with a $77 price target that implies a robust gain of 115%.

This set the scene for Weekly Options USA Members to profit by 108%, using a DAL Options trade!

Join Us And Get The Trades – become a member today!

Saturday, December 02, 2023

by Ian Harvey

Delta Air Lines, Inc. (NYSE:DAL) announced that more than 5.3 million customers availed its flights in the Nov 17-26 timeframe. DAL operated more than 43,000 flights systemwide during the period to meet the buoyant air travel demand witnessed during the Thanksgiving holiday period. The figures are in line with its Nov 17-28 projection, where it is expected 6.2-6.4 million passengers to avail its flights. The forecast implied that 515,000-530,000 passengers will fly per day.

Why the Delta Air Lines Weekly Options Trade was Originally Executed!

On Friday, November 10, 2023, we recommended DAL, making a profit of 217%. The shares are still on an upward trajectory!

Morgan Stanley analyst Ravi Shanker, an airline expert, covers Delta – and he starts off by listing a set of factors that provided support in the earnings report. Shanker wrote, “The strong brand, premium customer demand, metered growth plans, exposure to corporate/international tailwind, partial fuel hedge from the refinery, controlled cost esp. with maintenance costs pulled forward, all put DAL on a path to $7+ EPS in 2024 and potentially $10+ by 2027 (which we expect will be announced at the mid 2024 investor day). At a historical multiple of 8-10x, we think DAL stock should be at least doubled, if not tripled from current levels.”

While the turbulence of the low-end Domestic demand and capacity debates continues to rage, DAL’s earnings power seems to be putting them at a different cruising altitude altogether,” Shanker goes on to add. “Unless consumer demand for travel were to suddenly collapse, we believe the market should gravitate towards DAL’s compounding growth story (esp. with a now-restored dividend and near investment-grade balance sheet).”

Looking ahead, Shanker puts an Overweight (Buy) rating on Delta’s shares, with a $77 price target that implies a robust gain of 115%.

The Delta Air Lines Weekly Options Potential Profit Explained.....

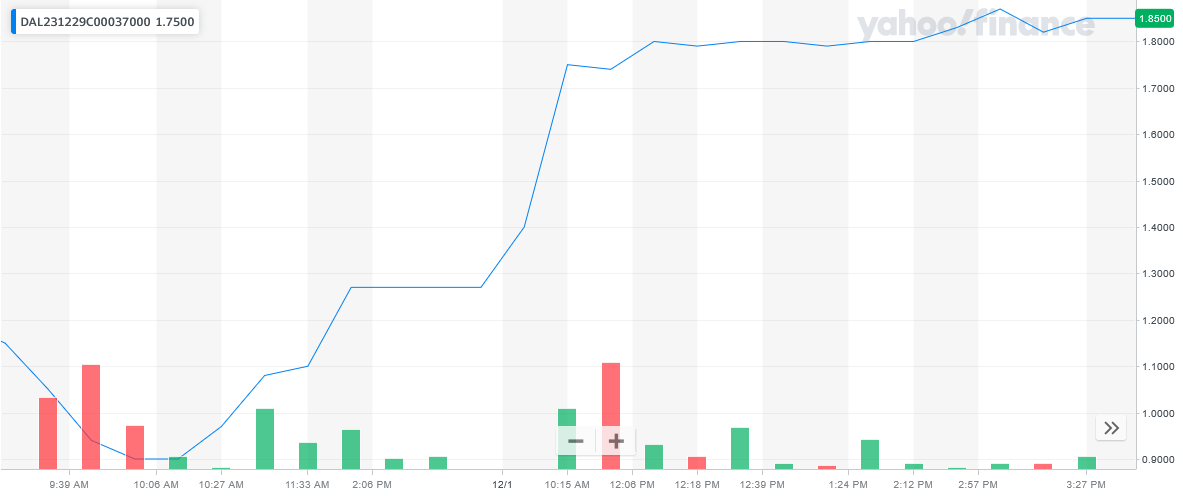

** OPTION TRADE: Buy DAL DEC 29 2023 37.000 CALLS - price at last close was $1.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the DAL Weekly Options (CALL) Trade on Thursday, November 30 for $0.90.

The DAL weekly options contracts hit a high Friday, December 01 at $1.87; a potential profit of108%.

Don’t miss out on further trades – become a member today!

About Delta Air Lines.....

Delta Air Lines Inc. is a major airline providing domestic and international air travel services. Based in Atlanta, Georgia, Delta is one of the largest airlines in the world, operating a fleet of over 900 aircraft that serves more than 325 destinations across six continents. Delta has a long history in the airline industry. It is known for its exceptional customer service, operational reliability and industry-leading innovation.

As of the end of the fourth quarter of 2022, Delta Air Lines Inc. had a market capitalization of $24.5 billion, with over 720 million outstanding shares. The company has a strong financial position, with total revenue for the full year 2022 reaching $38.6 billion, an increase of 20% compared to the previous year. Delta's net income for the same period was $2.7 billion, up from $1.2 billion in 2021.

Delta's strong financial performance comes from several factors, including its strategic focus on customer service, operational efficiency and technological innovation. The company has invested heavily in its fleet and infrastructure and is committed to delivering passengers a safe and comfortable travel experience. Delta has also made significant investments in technology, such as its Fly Delta app and biometric boarding, which have helped to streamline the travel experience and improve customer satisfaction.

Delta is also committed to sustainable business practices, focusing on reducing its environmental impact. The company has set ambitious goals to reduce carbon emissions by 50% by 2050 and has invested in fuel-efficient aircraft and sustainable aviation fuel. In addition, Delta has a comprehensive recycling program and has implemented measures to reduce waste in its operations.

Delta's strong brand recognition, customer loyalty and strategic partnerships support its competitive position in the airline industry. The company has alliances with several international airlines, such as Air France-KLM and Virgin Atlantic, enabling it to provide its customers with seamless travel experiences. Delta also has a strong presence in key markets, such as New York, Atlanta and Los Angeles, which have helped to drive its growth and profitability.

Delta also faces significant challenges in the airline industry, including intense competition from other major airlines and the ongoing impact of the COVID-19 pandemic. The pandemic severely impacted the airline industry, with reduced demand for air travel and significant disruptions to operations. Delta responded to these challenges by implementing cost-cutting measures, such as reducing its workforce, retiring older aircraft and focusing on its core customer service and operational efficiency strengths.

Further Catalysts for the DAL Weekly Options Trade…..

Analysts.....

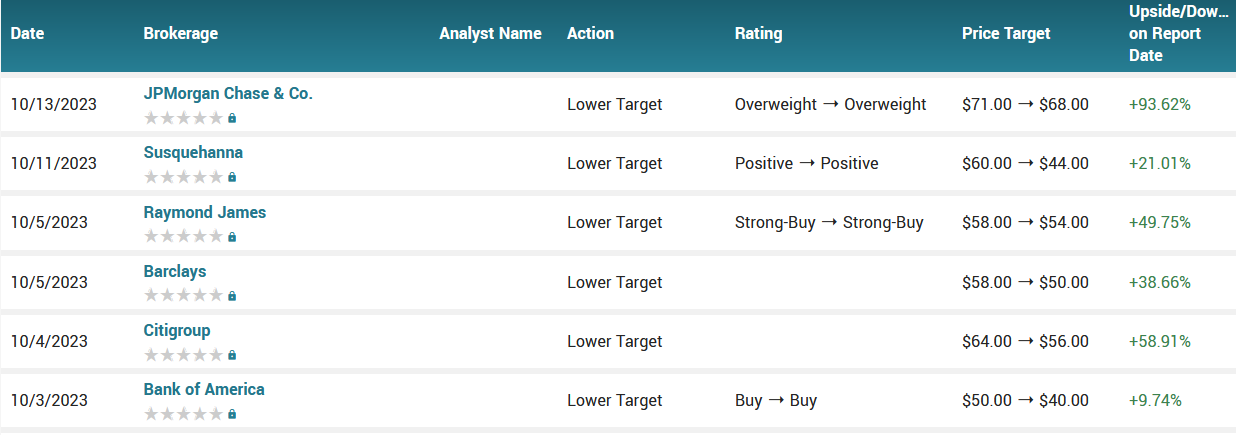

According to the issued ratings of 13 analysts in the last year, the consensus rating for Delta Air Lines stock is Buy based on the current 12 buy ratings and 1 strong buy rating for DAL. The average twelve-month price prediction for Delta Air Lines is $54.40 with a high price target of $77.00 and a low price target of $39.00.

Summary.....

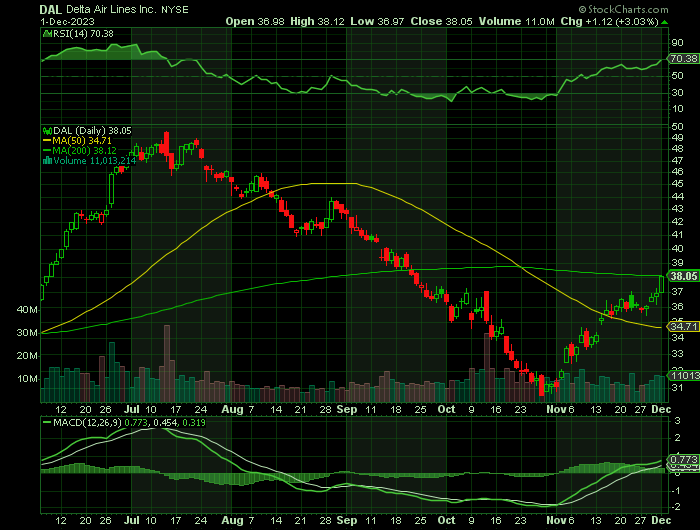

Delta Air Lines traded up $0.65 on Wednesday, reaching $36.69. 2,374,288 shares of the company's stock were exchanged, compared to its average volume of 10,098,771. The company has a debt-to-equity ratio of 1.90, a current ratio of 0.44 and a quick ratio of 0.39. The firm has a market cap of $23.61 billion, a price-to-earnings ratio of 6.82, and a P/E/G ratio of 0.18 and a beta of 1.36. Delta Air Lines, Inc. has a 52 week low of $30.60 and a 52 week high of $49.81. The stock has a fifty day simple moving average of $34.77 and a 200-day simple moving average of $39.75.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Delta Air Lines

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.