TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Costco Weekly Call Option Jumps 108.26% since yesterday!

Members Are Now Up 195% Potential Profit!

Join Us and Get the Trades!

Costco Wholesale Corporation (NASDAQ:COST), the warehouse club retailing giant, has outperformed the market by consistently gaining share in a highly competitive industry. Costco's growth rate rarely disappoints, and its earnings are much more stable than its peers thanks to a steady stream of subscription fee income.

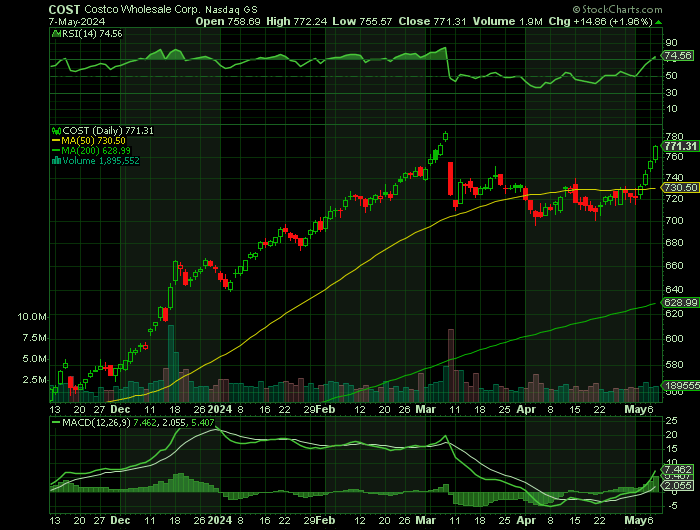

The stock is up 14% year-to-date and 49% in the past 12 months. It also pays a dividend and has a yield of 0.62%. It announced a hike from $1.02 to $1.16 per share, a 13.7% YOY rise.

For Members that haven’t sold their Weekly Call Options Contracts as yet, on Tuesday, May 07, 2024, the Costco Option is up $22.45 (up 108.26% from yesterday) providing a Potential Profit of 195%!

Join Us And Get The Trades – become a member today!

Tuesday, May 07, 2024

by Ian Harvey

UPDATE

Costco Wholesale Corporation (NASDAQ:COST) has survived inflation and recessions and is standing strong today. The company is popular because it sells products at a low cost and generates profits from membership fees. The best thing about Costco is that it has not raised membership prices since 2017, which has helped gain new members and maintain high renewal rates.

The company is also growing its physical stores and has 875 stores right now. It is expanding across Europe and Asia with more warehouses, and the growing number of stores should help improve revenue. It plans to open stores at another 31 new locations this year.

The stock is up 14% year-to-date and 49% in the past 12 months. It also pays a dividend and has a yield of 0.62%. It announced a hike from $1.02 to $1.16 per share, a 13.7% YOY rise.

Why the Costco Weekly Options Trade was Originally Executed!

Warehouse club Costco Wholesale Corporation (NASDAQ:COST) has been a tremendous investment virtually any time you bought shares but especially when its stock dipped lower.

The warehouse club retailing giant has outperformed the market by consistently gaining share in a highly competitive industry. Costco's growth rate rarely disappoints, and its earnings are much more stable than its peers thanks to a steady stream of subscription fee income.

During the Great Recession of the late-2000s, Costco lost half its value. But beginning in March 2009, the warehouse club mounted a comeback that would go on for 12 years and generate total returns far above 1,100%. Another brief detour south in 2021 was only a prelude to another 150% run higher. And it lost 20% of its value last year but is now up 50% over the past 12 months.

After hitting an all-time high last month, Costco stock has pulled back 8%. That makes it another great chance to buy in with this weekly option. The warehouse club’s low-margin business gets hurt in high inflation, high-interest rate environments like we’re in but can make up in volume what it loses on each individual sale. Indeed, the warehouse club’s earnings have tripled over the past decade.

Costco's surest path to positive shareholder returns is to boost sales at a faster clip than its peers. It's been doing a great job on this score lately, with same-store sales rising 6% in the most recent quarter, compared to Walmart's 4% uptick.

Also, there is a lever Costco is waiting to pull that will see an immediate effect on its top and bottom lines. An increase in membership prices typically happens every five or six years. We’re way past that threshold now and the retailer will pull that lever soon. The influx of revenue it causes will flow through its financial statements without losing any momentum and should spark the next big rally.

The Costco Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy COST MAY 10 2024 750.000 CALLS - price at last close was $7.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the COST Weekly Options (CALL) Trade on Friday, April 12, 2024 for $7.60.

Sold half the COST weekly options contracts on Friday, April 12, 2024 for $10.42; a potential profit of37%.

Sold the remaining COST weekly options contracts on Monday, May 06, 2024 for $10.78; a potential profit of 42%.

For Members that haven’t sold their Weekly Call Options Contracts as yet, on Tuesday, May 07, 2024, the Costco Option is up $22.45 (up 108.26% from yesterday) providing a Potential Profit of 195%!

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Now Read the previous article “Costco Weekly Call Option Provides 42% Profit!”

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from COSTCO

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.