TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Cloudflare Provides 92% Potential Profit

Using A

Weekly Option!

Cloudflare Inc (NYSE: NET), an emerging leader in next-gen internet infrastructure, cybersecurity, and cloud-based app development tools -- remains on a solid growth trajectory. Despite a big slowdown for many cloud-based software companies in 2023, Cloudflare had a solid showing with full-year revenue growth of 33% to $1.3 billion.

Consensus estimates call for EPS to grow from 58 cents in 2024 to $10 by 2030, with revenue expansion from $1.7 billion to $11.5 billion. The company’s growth story still has miles to run.

Cloudflare went public in 2019. Cloudflare's stock subsequently rallied more than 550%.

This set the scene for Weekly Options USA Members to profit by 92% using a NET Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, March 18, 2024

by Ian Harvey

UPDATE

Cloudflare Inc (NYSE: NET) is a cloud-based content delivery network (CDN) provider that accelerates the delivery of digital content for websites. It accomplishes that by storing cached copies of the websites on "edge" servers that are located closer to their visitors than the original servers. It also shields those websites from bot-based attacks.

Cloudflare already powers over 76% of websites using content delivery networks, which are critical for performance and search engine optimization (SEO). The company has ample room for continued expansion alongside the internet.

Consensus estimates call for EPS to grow from 58 cents in 2024 to $10 by 2030, with revenue expansion from $1.7 billion to $11.5 billion. The company’s growth story still has miles to run.

Cloudflare went public in 2019. Cloudflare's stock subsequently rallied more than 550%.

Why the Cloudflare Weekly Options Trade was Originally Executed!

Cloudflare Inc (NYSE: NET), an emerging leader in next-gen internet infrastructure, cybersecurity, and cloud-based app development tools -- remains on a solid growth trajectory. Despite a big slowdown for many cloud-based software companies in 2023, Cloudflare had a solid showing with full-year revenue growth of 33% to $1.3 billion.

Artificial intelligence (AI) has been at least some of the fuel sending the stock higher, but the stock is ramping up much faster than actual business expansion. Shares have more than doubled in value since the start of 2023. That has some wondering if the stock is getting more hype than is warranted.

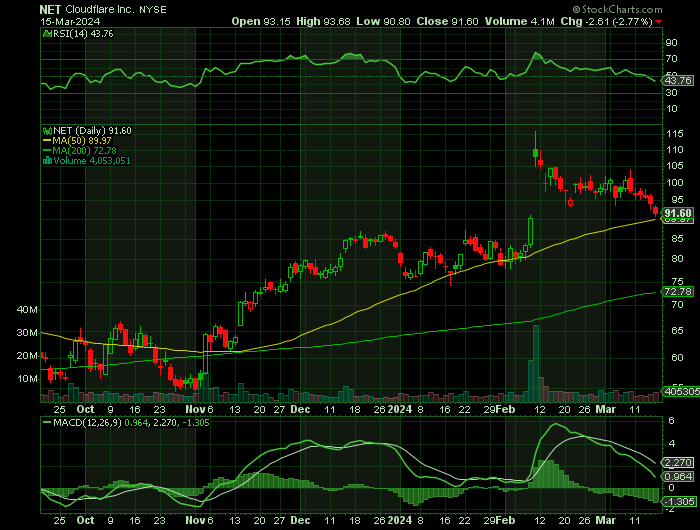

Cloudflare stock has shot up an impressive 40% in the past three months. And the company's latest quarterly results suggest that its red-hot rally is here to stay.

Cloudflare stock shot up 20% the day after it released its fourth-quarter and full-year 2023 results on Feb. 8. Investors liked the company's better-than-expected numbers and the solid outlook that points to robust growth ahead.

Cloudflare serves a massive addressable market, which it expects to be worth $164 billion in 2024 and then grow to $204 billion in 2026. The company points out that AI presents an incremental growth opportunity, and it has already started gaining impressive traction in this market.

The Cloudflare Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy NET MAR 22 2024 100.000 CALLS - price at last close was $4.85 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NET Weekly Options (CALL) Trade on Tuesday, February 20, 2024 for $3.33.

Sold the NET weekly options contracts on Friday, March 08, 2024 for $6.40; a potential profit of 92%.

(This will vary for members depending on their entry and exit strategies).

Is it time to re-buy a weekly option for NET?

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Cloudfare.....

Cloudflare, Inc. is a leading cloud-based security and performance solutions provider for websites and internet applications. The company's mission is to help build a better internet by making it faster, safer, and more reliable. Founded in 2009, Cloudflare has become one of the largest and most respected names in the cybersecurity industry. The company offers cloud-based products and services, including website security, performance optimization, content delivery, and domain name services.

Millions of websites and internet applications worldwide use Cloudflare's products, ranging from small businesses to large enterprises. Key customers include Shopify, HubSpot, and Zendesk, among others.

The company is headquartered in San Francisco, California, with additional offices in London, Singapore, and several other locations. Cloudflare has received numerous awards and recognition for its innovative products and services, including being named one of Fast Company's "World's Most Innovative Companies" in 2020.

Cloudflare's leadership team is led by co-founders Matthew Prince (Chief Executive Officer) and Michelle Zatlyn (Chief Operating Officer). Prince has a background in law and technology, while Zatlyn has experience in finance and operations.

Cloudflare's financial performance has been relatively mixed over the past few years. The company's revenue has grown steadily for several years. However, the company has never reported a profit. The company's net income has been negative in the past three years, as it has invested heavily in research and development and sales and marketing to support its growth. Cloudflare's debt levels are relatively high. However, the company does maintain enough assets to cover all liabilities.

Cloudflare's relatively high valuation metrics reflect the company's strong growth prospects and competitive positioning. The company's price-to-earnings and price-to-book ratio are significantly higher than the industry average. Cloudflare's stock has recently been incredibly volatile, ranging between approximately $30 and $80. The significant price movements have been in response to news and events affecting the broader tech industry.

Cloudflare operates in the highly competitive cybersecurity industry, characterized by rapid technological change, intense competition, and evolving regulatory and legal frameworks. The company's main competitors include Akamai Technologies, Incapsula, Imperva, and Fastly.

Cloudflare's competitive advantages include its global network of servers, which enables it to deliver fast and reliable services to customers worldwide and its innovative security solutions that combine multiple layers of protection. The company's cloud-based approach also provides scalability and flexibility, allowing customers to quickly scale their security and performance needs as their businesses grow.

The cybersecurity industry is experiencing strong growth, driven by the increasing number of cyber threats and the growing awareness among businesses of the importance of protecting their digital assets. According to recent research, the global cybersecurity market is expected to reach $326.4 billion by 2027, growing at a CAGR of 10.0% from 2022 to 2027.

However, the industry also faces challenges and risks. Rapid technological advancements can quickly make security solutions obsolete, requiring companies like Cloudflare to continuously innovate and adapt to new threats. Additionally, the industry is subject to evolving regulations and privacy concerns, which could impact how companies handle and protect user data.

Cloudflare has positioned itself well within the industry by offering a comprehensive suite of solutions that address security and performance needs. The company's broad customer base and strong brand reputation give it a competitive edge. Furthermore, Cloudflare's strategic partnerships with leading technology companies, such as Microsoft and Google, enhance its market reach and enable it to tap into new customer segments.

Cloudflare has several growth opportunities that could drive its future performance. One key opportunity lies in the increasing adoption of cloud-based services and the growing demand for secure and performant Internet applications. As businesses continue to shift their operations to the cloud, they require reliable and scalable security solutions, which Cloudflare is well-positioned to provide.

The company also has opportunities for expansion into new markets. Cloudflare has been investing in international expansion to capture the growing demand for its services globally. Expanding its presence in regions like Asia-Pacific and Europe presents significant growth potential.

While Cloudflare has promising growth prospects, it also faces risks and challenges that could impact its performance. One key challenge is the highly competitive nature of the cybersecurity industry. The company faces intense competition from established players and emerging startups, which could result in pricing pressures and the need for continuous investment in research and development to stay ahead.

Another potential risk is the evolving regulatory landscape. Changes in data protection regulations and privacy laws can significantly impact how Cloudflare operates and handles customer data. Compliance with these regulations requires ongoing investment in resources and expertise.

Moreover, as technology evolves, new and sophisticated cyber threats may emerge, which could bypass existing security measures. Cloudflare must remain vigilant and invest in advanced threat detection and prevention technologies to avoid these threats.

Further Catalysts for the NET Weekly Options Trade…..

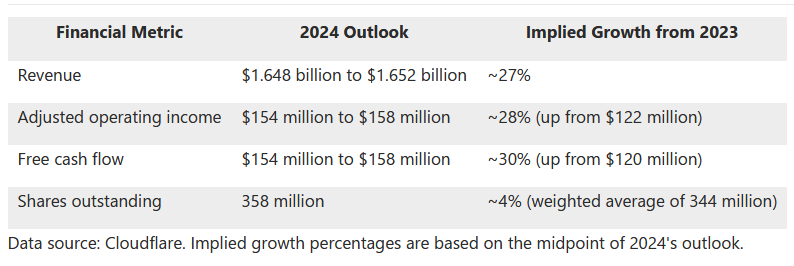

Cloudflare's fourth-quarter revenue increased 32% year over year to $362 million, exceeding the consensus estimate of $353 million. The company's full-year revenue was up 32% to $1.3 billion.

Cloudflare's adjusted earnings saw a significant jump as well, increasing from $0.06 per share in the year-ago period to $0.15 per share, and exceeding the $0.12 per share consensus estimate. Full-year earnings increased to $0.49 per share from $0.13 in 2022.

Cloudflare, which provides cloud-based internet infrastructure services that speed up internet connections while improving performance, security, and reliability, delivered stronger-than-expected growth thanks to robust customer spending, as well as an increase in its customer base.

Cloudflare ended the fourth quarter of 2023 with 189,000 paying customers, up 16% from the year-ago period. However, it is worth noting that Cloudflare gets more than 60% of its top line from large customers who have generated more than $100,000 in annualized revenue for the company. The company finished 2023 with 2,756 of these large customers, an increase of 35% over the prior year.

Other Catalysts.....

Long gone are the days of Cloudflare putting up revenue growth of 50% or more. That's not surprising. This isn't a small tech business anymore.

But that doesn't mean Cloudflare's go-to-market strategy -- making new tools for small businesses and individual developers, perfecting those products, and then moving on to larger customers -- isn't paying off anymore. On the contrary, the early guidance for 2024 is solid.

A record number of large users (those who pay at least $100,000 a year) of the Cloudflare platform were added at the end of 2023. CEO Matthew Prince said its large customer base ended 2023 at 2,756, up 35% from the year prior. And after spending much of 2023 realigning the sales team to drive better efficiency, management thinks 2024 will be a great year.

AI Adoption.....

In September 2023, Cloudflare launched Workers AI, a platform that allows developers to build AI applications on its network without having to invest in expensive infrastructure. Workers AI gives customers access to graphics processing units (GPUs) on Cloudflare's network so that developers can "run well-known AI models on serverless GPUs" and "build and deploy ambitious AI applications that run near your users, wherever they are."

These models allow developers to run various models meant for text generation, automatic speech recognition, image classification, and translation. Workers AI has gained terrific traction among Cloudflare customers. On its latest earnings conference call last week, CEO Matthew Prince said:

From our launch in September to the month of December, the average number of daily Workers AI requests increased 9x. Furthermore, one-third of the thousands of Workers AI accounts are new to the Workers platform, suggesting that Workers AI is not just [a] significant opportunity in and of itself, but also a potential accelerant to [the] adoption of the Workers overall platform.

It won't be surprising to see this platform witnessing stronger adoption. By the end of 2023, Cloudflare had deployed GPUs in 120 cities, exceeding its target of 100 cities. Even better, the company aims to have "inference-tuned GPUs deployed in nearly every city that makes up Cloudflare's global network and within milliseconds of nearly every device connected to the internet worldwide."

Given that Cloudflare's global network covers 300 cities, the company's aim to deploy AI GPUs across its vast network could help it capitalize on the fast-growing AI-as-a-service market.

Analysts.....

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $109.6.

- An analyst from Wells Fargo persists with their Overweight rating on Cloudflare, maintaining a target price of $125.

- Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Cloudflare, targeting a price of $135.

- An analyst from JMP Securities has decided to maintain their Market Outperform rating on Cloudflare, which currently sits at a price target of $90.

- Maintaining their stance, an analyst from RBC Capital continues to hold an Outperform rating for Cloudflare, targeting a price of $108.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Cloudflare, which currently sits at a price target of $90.

According to the issued ratings of 23 analysts in the last year, the consensus rating for Cloudflare stock is Hold based on the current 4 sell ratings, 10 hold ratings and 9 buy ratings for NET. The average twelve-month price prediction for Cloudflare is $87.50 with a high price target of $135.00 and a low price target of $43.00.

Summary.....

So, Cloudflare is pulling the right strings to make the most of this fast-growing niche AI, and this could help the company maintain its solid growth. Not surprisingly, Cloudflare expects its revenue in 2024 to jump 27% to $1.65 billion. Analysts are expecting the company to sustain its robust growth in the coming years.

Cloudflare has a 50-day simple moving average of $83.90 and a two-hundred day simple moving average of $71.25. The company has a quick ratio of 3.89, a current ratio of 3.89 and a debt-to-equity ratio of 1.83. The company has a market capitalization of $33.08 billion, a PE ratio of -179.11 and a beta of 1.10. Cloudflare, Inc. has a 52 week low of $39.90 and a 52 week high of $116.00.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Cloudflare

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.