TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Clorox Shares Continue To

Tank!

Weekly Options

Members Are Up 89% Potential Profit

Using A Weekly put Option!

Clorox Co (NYSE: CLX) stock continues to tank after disclosing significant breaches that will impact earnings.

Clorox’s near-term outlook appears disappointing, driven lower by a cybersecurity attack that was disclosed in August.

This set the scene for Weekly Options USA Members to profit by 89%, using a CLX Options trade!

Join Us And Get The Trades – become a member today!

Saturday, October 28, 2023

by Ian Harvey

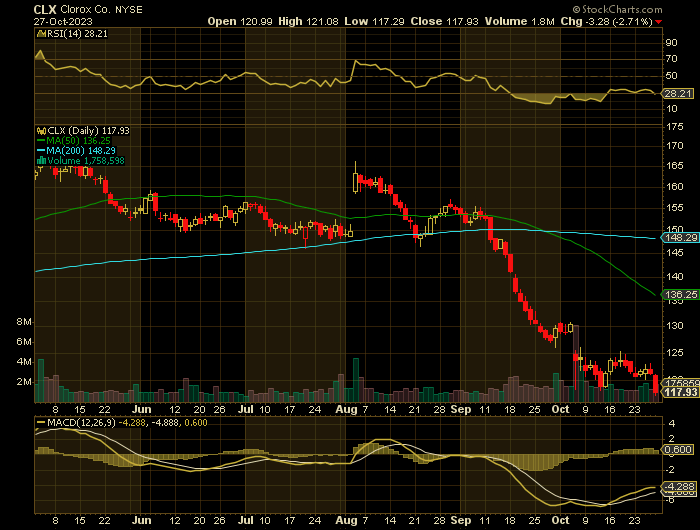

The Clorox Co (NYSE: CLX) Company has been in a downward trend from early May. CLX trades below the bearish 50-day moving average line and the bearish 200-day moving average line.

Clorox shares have been on a rather steady decline after it went on an unsustainable surge at the start of Covid.

Clorox’s near-term outlook appears disappointing, driven lower by a cybersecurity attack that was disclosed in August.

Clorox is set to report earnings on November 1st.

CLX on October 4 outlined preliminary Q1 FY24 financial data. Clorox said sales are expected to decrease by between 28% and 23%, with organic sales “now expected to decrease by 26% to 21%” vs. its prior expectations “of mid-single-digits growth as provided in the Q4 earnings remarks.”

The downbeat outlook “is due to the impacts of the recent cybersecurity attack that was disclosed in August, which caused wide-scale disruption of Clorox's operations, including order processing delays and significant product outages. Shipment and consumption trends prior to the cybersecurity attack were in line with the Company's prior expectations.”

Meanwhile, its adjusted EPS are expected range between a loss of -$0.40 to $0.00, with the cybersecurity attack more than offsetting the “benefits of pricing, cost savings and supply chain optimization.”

Clorox’s FY24 revenue is projected to dip by -5.5%, based on estimates. Meanwhile, its adjusted earnings are expected to decline by 12% YoY. But these estimates could get worse since they don’t yet fully account for the updated Q1 guidance.

Why the CLX Weekly Options Trade was Originally Executed!

Clorox Co (NYSE: CLX) stock continues to tank after disclosing significant breaches that will impact earnings.

On Aug. 14, 2023, Clorox disclosed that it identified unauthorized activity on some of its Information Technology ("IT") systems and that it began taking remediation steps.

Then, on Sept. 18, 2023, Clorox disclosed that the cybersecurity attack caused wide disruptions of the company's operations and that "[d]ue to the order processing delays and elevated level of product outages, the Company now believes the impact will be material on Q1 financial results."

Most recently, on Oct. 4, 2023, Clorox disclosed the cybersecurity attack's impact on preliminary Q1 2024 financial results. The company said that: (1) net sales are expected to decrease by 28% from the prior year quarter; (2) gross margins are expected to be down from the prior year quarter; and (3) diluted EPS is expected to be between a loss of $0.75 to a loss of $0.35.

These reports have driven the price of Clorox shares significantly lower, and are not stopping the descent any time soon.

CLX stock has fallen roughly 25% over the last six months and around 50% from its peaks.

The CLX Weekly Options Trade Explained.....

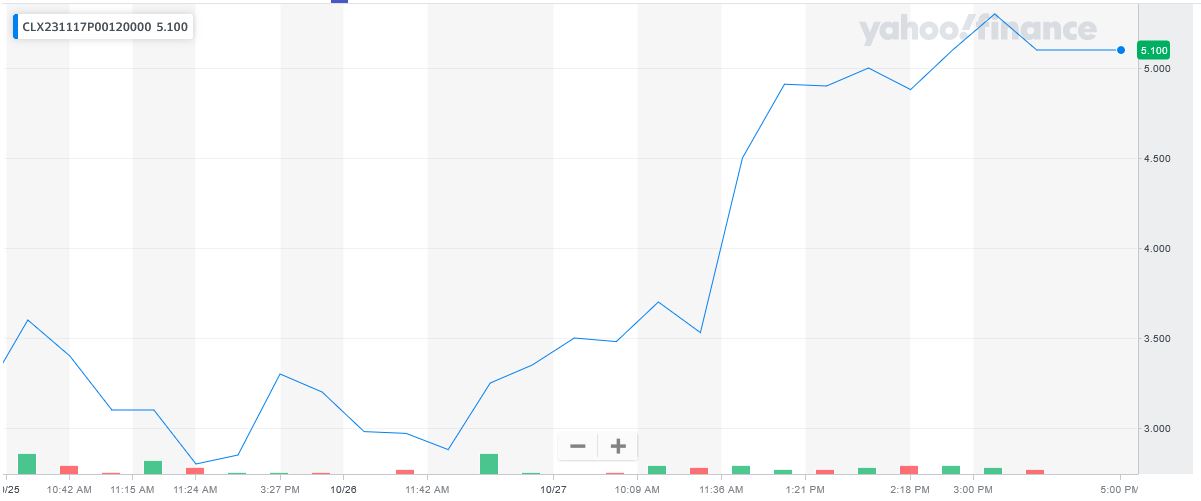

** OPTION TRADE: Buy CLX NOV 17 2023 120.000 PUTS - price at last close was $3.20 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CLX Weekly Options (PUT) Trade on Wednesday, October 25, 2023, for $2.80.

Sold the CLX weekly options contracts on Friday, October 27, 2023 for $5.30; a potential profit of89%.

Don’t miss out on further trades – become a member today!

About Clorox.....

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International.

The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

The Household segment provides cat litter products under the Fresh Step and Scoop Away brands; bags and wraps under the Glad brand; and grilling products under the Kingsford brand in the United States.

The Lifestyle segment offers dressings, dips, seasonings, and sauces primarily under the Hidden Valley brand; natural personal care products under the Burt's Bees brand; and water-filtration products under the Brita brand in the United States.

The International segment provides laundry additives; home care products; water-filtration systems; digestive health products; grilling products; cat litter products; food products; bags and wraps; natural personal care products; and professional cleaning and disinfecting products internationally primarily under the Clorox, Ayudin, Clorinda, Poett, Pine-Sol, Glad, Brita, RenewLife, Ever Clean and Burt's Bees brands.

It sells its products primarily through mass retailers; grocery outlets; warehouse clubs; dollar stores; home hardware centers; drug, pet, and military stores; third-party and owned e-commerce channels; and distributors, as well as a direct sales force.

The Clorox Company was founded in 1913 and is headquartered in Oakland, California.

Further Catalysts for the Weekly Options Trades…..

The Clorox Company has been on a rather steady decline after it went on an unsustainable surge at the start of Covid.

Clorox’s near-term outlook appears disappointing, driven lower by a cybersecurity attack that was disclosed in August. Despite its fall from its peaks, CLX shares are still rather pricey compared to the wider Consumer Staples sector.

Other Catalysts.....

CLX on October 4 outlined preliminary Q1 FY24 financial data. Clorox said sales are expected to decrease by between 28% and 23%, with organic sales “now expected to decrease by 26% to 21%” vs. its prior expectations “of mid-single-digits growth as provided in the Q4 earnings remarks.”

The downbeat outlook “is due to the impacts of the recent cybersecurity attack that was disclosed in August, which caused wide-scale disruption of Clorox's operations, including order processing delays and significant product outages. Shipment and consumption trends prior to the cybersecurity attack were in line with the Company's prior expectations.”

Meanwhile, its adjusted EPS are expected range between a loss of -$0.40 to $0.00, with the cybersecurity attack more than offsetting the “benefits of pricing, cost savings and supply chain optimization.”

Clorox’s FY24 revenue is projected to dip by -5.5%, based on Zacks estimates. Meanwhile, its adjusted earnings are expected to decline by 12% YoY. But these estimates could get worse since they don’t yet fully account for the updated Q1 guidance.

Moving Forward.....

For the full year, the Consensus Estimates are projecting earnings of $4.22 per share and revenue of $6.98 billion, which would represent changes of -17.09% and -5.48%, respectively, from the prior year.

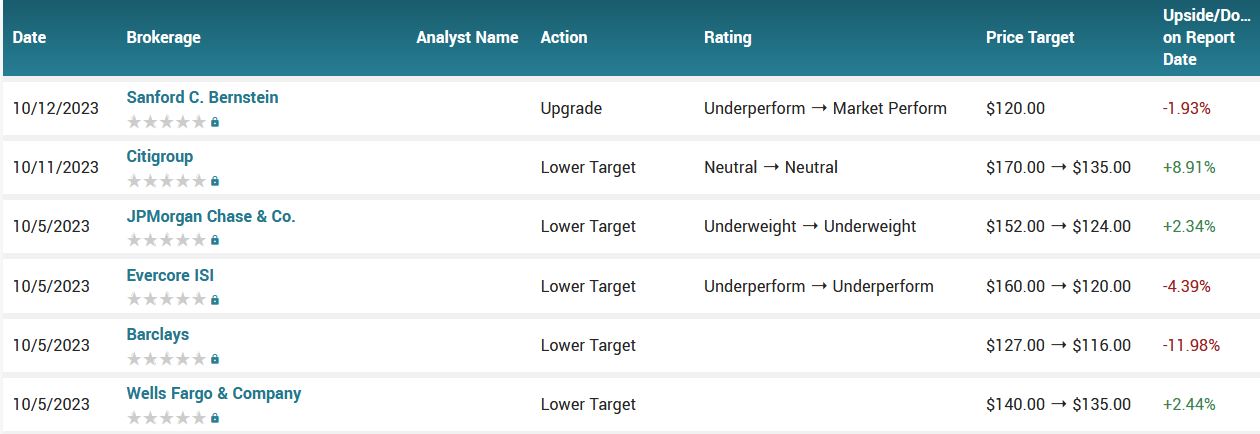

Analysts.....

According to the issued ratings of 16 analysts in the last year, the consensus rating for Clorox stock is Reduce based on the current 7 sell ratings, 8 hold ratings and 1 buy rating for CLX. The average twelve-month price prediction for Clorox is $140.00 with a high price target of $185.00 and a low price target of $116.00.

Summary.....

Clorox has a market cap of $15.22 billion, a price-to-earnings ratio of 103.19, a price-to-earnings-growth ratio of 2.92 and a beta of 0.33. The Clorox Company has a fifty-two week low of $119.51 and a fifty-two week high of $178.21. The firm’s fifty day moving average is $141.09 and its 200-day moving average is $153.29. The company has a debt-to-equity ratio of 6.38, a quick ratio of 0.59 and a current ratio of 0.95.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from CLOROX

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.