TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Clorox Weekly

Options Up 100% Profit,

In Less Than 4 Hours!

Clorox Co (NYSE: CLX) raised its annual targets on Thursday, after easily beating quarterly earnings expectations.

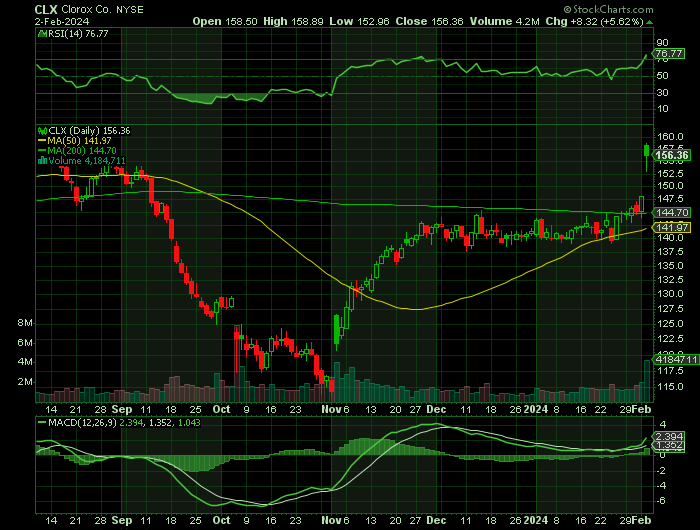

The company's shares jumped about 8% in extended trading.

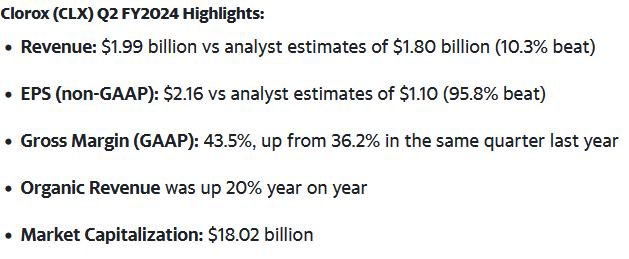

Clorox came out with quarterly earnings of $2.16 per share, beating the Consensus Estimate of $1.08 per share.

This set the scene for Weekly Options USA Members to profit by 100% using a CLX Options trade!

Join Us And Get The Trades – become a member today!

Sunday, February 04, 2024

by Ian Harvey

Why the Clorox Weekly Options Trade was Originally Executed!

Clorox Co (NYSE: CLX) raised its annual targets on Thursday, after easily beating quarterly earnings expectations, as the bleach maker replenished inventory at a faster pace after a production blip in 2023, putting it back on track to meet robust demand.

The company's shares jumped about 8% in extended trading; after it said it was rebuilding retailer inventories ahead of schedule and recouping market share losses, bouncing back from a cyberattack in August that hampered its ability to fulfill orders.

"We made a lot more progress, more quickly than we anticipated... we lost less sales (in the quarter) because we had product back in retailer stores more quickly," CFO Kevin Jacobsen said in an interview.

At the height of the cyberattack, Clorox lost over five market share points, but had recovered to a decline of just one point at December-end and was improving in January, he added.

Clorox's health and wellness segment, home to brands including Pine-Sol cleaning products, saw a 25% surge in sales, mainly driven by higher volumes.

That, coupled with higher prices, drove a 16% jump in the company's second-quarter sales at $1.99 billion, beating LSEG estimates of $1.80 billion.

The CLOROX Weekly Options Potential Profit Explained.....

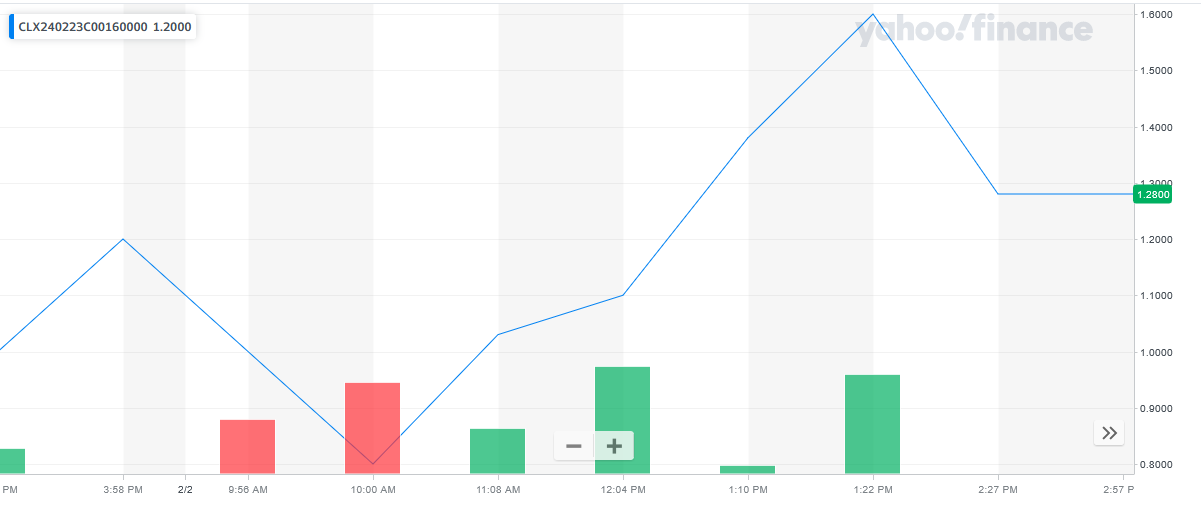

** OPTION TRADE: Buy CLX FEB 09 2024 160.000 CALLS - price at last close was $1.00 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CLX Weekly Options (CALL) Trade on Friday, February 02, 2024, at 10:00, for $0.80.

Sold the CLX weekly options contracts on Friday, February 02, 2024, at 1:22 for $1.60; a potential profit of100%.

Don’t miss out on further trades – become a member today!

About Clorox.....

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International.

The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

The Household segment provides cat litter products under the Fresh Step and Scoop Away brands; bags and wraps under the Glad brand; and grilling products under the Kingsford brand in the United States.

The Lifestyle segment offers dressings, dips, seasonings, and sauces primarily under the Hidden Valley brand; natural personal care products under the Burt's Bees brand; and water-filtration products under the Brita brand in the United States.

The International segment provides laundry additives; home care products; water-filtration systems; digestive health products; grilling products; cat litter products; food products; bags and wraps; natural personal care products; and professional cleaning and disinfecting products internationally primarily under the Clorox, Ayudin, Clorinda, Poett, Pine-Sol, Glad, Brita, RenewLife, Ever Clean and Burt's Bees brands.

It sells its products primarily through mass retailers; grocery outlets; warehouse clubs; dollar stores; home hardware centers; drug, pet, and military stores; third-party and owned e-commerce channels; and distributors, as well as a direct sales force.

The Clorox Company was founded in 1913 and is headquartered in Oakland, California.

Further Catalysts for the CLX Weekly Options Trade…..

Clorox came out with quarterly earnings of $2.16 per share, beating the Consensus Estimate of $1.08 per share. This compares to earnings of $0.98 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 100%. A quarter ago, it was expected that this consumer products maker would post a loss of $0.20 per share when it actually produced earnings of $0.49, delivering a surprise of 345%.

Over the last four quarters, the company has surpassed consensus EPS estimates four times.

"Our second quarter results reflect strong execution on our recovery plan from the August cyberattack," said Chair and CEO Linda Rendle.

Other Catalysts.....

Moving Forward.....

Clorox has updated its fiscal year 2024 outlook, now expecting net sales to be down low single digits, an improvement from previous expectations. Gross margin is anticipated to be up about 200 basis points, and the effective tax rate is expected to be between 22% and 23%. The company's fiscal year diluted EPS is projected to be between $3.06 and $3.26, marking a significant increase from prior estimates. Adjusted EPS is forecasted to be between $5.30 and $5.50, representing an increase of 4% to 8%.

“While there is still more work to do, we’re focused on executing with excellence in what remains a challenging environment to drive top-line growth and rebuild margin.”

Analysts.....

According to the issued ratings of 14 analysts in the last year, the consensus rating for Clorox stock is Reduce based on the current 4 sell ratings, 8 hold ratings and 2 buy ratings for CLX. The average twelve-month price prediction for Clorox is $142.13 with a high price target of $185.00 and a low price target of $117.00.

Summary.....

Clorox remains confident in its recovery plan and its ability to drive top-line growth and rebuild margin in a challenging environment. With a focus on executing with excellence, the company is poised to win with consumers through the strength and value of its brands and ongoing investments in innovation and brand-building.

Shares of CLX traded up $1.63 during mid-day trading on Thursday, hitting $146.88. The company had a trading volume of 698,651 shares, compared to its average volume of 1,194,520. The company has a debt-to-equity ratio of 18.92, a current ratio of 0.86 and a quick ratio of 0.54. The business’s 50-day simple moving average is $142.64 and its 200-day simple moving average is $141.87. The Clorox Company has a 12 month low of $114.68 and a 12 month high of $178.21. The firm has a market cap of $18.22 billion, a P/E ratio of 213.63, a PEG ratio of 3.04 and a beta of 0.41.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from CLOROX

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.