TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

ChargePoint

Stock Ready To Move Upwards?

See What Trade

Members of Weekly Options USA

Have Executed!

Sunday, February 06, 2022

by Ian HarveyChargePoint had a good year last year, as far as the top line shows, even though electric vehicle stocks have corrected sharply in the last couple of weeks.

Revenues rose in 2021, and the 3Q results – the last reported – came in at $65 million, for a 79% year-over-year increase.

However, the EV charging company fell 27% in January providing a great opportunity for an options entry.

ChargePoint Holdings Inc (NYSE: CHPT)

ChargePoint Holdings Inc (NYSE: CHPT) had a good year last year, as far as the top line shows, even though electric vehicle stocks have corrected sharply in the last couple of weeks.

Revenues rose in 2021, and the 3Q results – the last reported – came in at $65 million, for a 79% year-over-year increase.

Despite rising sales, ChargePoint’s stock is down. The shares were volatile in 2021, but the falling-off trend was clear – and CHPT was down 63% in the last 12 months.

However, last week saw ChargePoint close nearly 10% higher. Shares of the operator of an electric vehicle (EV) charging network benefited from an award from a notable U.S. consulting company.

The electric vehicle (EV) revolution is in full swing and the critical component driving it forward is batteries – and battery stocks.

The market for the batteries that power EVs is red-hot as the switch from gasoline-powered vehicles surges ahead. The EV battery market is expected to reach $175.11 billion by 2028 for a compound annual growth rate (CAGR) of 26%.

Influencing

Factors for Chargepoint trade

ChargePoint has built an extensive EV charging network across North America and is now expanding in Europe.

It focuses on developing software-led charging solutions which it provides to customers to provide charging wherever they may need it. It complements its offering with robust cloud and subscription-based software services.

Customers join its charging network and can seamlessly scale their EV adoption anytime. With this distinct growth strategy, ChargePoint has rapidly expanded its reach and effectively secured its position as the leading end-to-end solution provider for EV charging, leading to its place as the first publicly traded charging company with a global footprint.

Frost & Sullivan.....

Frost & Sullivan, named ChargePoint the winner of its Best Practices Market Leadership award in Europe's EV charging market on Monday.

Frost & Sullivan was impressed that ChargePoint has carved out the highest market share on that continent, out of the more than 18 charging companies it surveyed.

ChargePoint said in a press release touting its award that Frost & Sullivan believed it "offers a robust portfolio of hardware, software, and support services catering to commercial, fleet, and residential EV customers."

The company is indisputably a major player in these relatively early days of EV charging networks. It has over 163,000 charging points that are operational; of these, 45,000 are in Europe, an important market for the company.

"ChargePoint's brand strength, product differentiation, customer ownership experience, and successful growth strategy cement its position as a market leader and will continue to strengthen its brand and presence in the EV charging space," explained Prajyot Sathe, Research Manager. With its strong overall performance, ChargePoint earns the 2021 Frost & Sullivan Market Leadership Award.

JPMorgan’s Viewpoint .....

Campbell, California-based ChargePoint just got a big jolt of electricity after JPMorgan Chase (NYSE:JPM) upgraded the company’s stock to “outperform” from “neutral,” along with a $20 price target, and his $20 price target shows his confidence in a 40% one-year upside potential.

CHPT stock shot up 10% on the day that JPMorgan made the upgrade, noting in its assessment that ChargePoint has a huge growth opportunity ahead of it and that investors are overly concerned about profits in the near-term for the company that operates the biggest network of electric vehicle battery charging stations in the world.

“We think investors may be too pessimistic on ChargePoint’s expenses and path to profitability,” wrote JPMorgan analyst Bill Peterson.

JPMorgan’s Bill Peterson sees several reasons for investors to assume a turnaround for ChargePoint, and writes that the current pullback equals an opportunity.

“We have developed more confidence around the ChargePoint story. Given the stock’s recent pullback, we see a good opportunity for investors... Specifically, the company is well-positioned to benefit from growth in all customer verticals in the US, and increasingly so in Europe…. we think investors may be too pessimistic on ChargePoint’s expenses and path to profitability; for us, the added investments in its go-to market efforts are key to seed the company’s target markets. Thus, the reward should be strong, sustainable growth with an expanding customer base,” Peterson wrote.

"We anticipate ChargePoint driving significant growth over the next 5-10 years, with revenues outpacing the growth range of EVs in the US and Europe driven by new opportunities in commercial and fleet operations," stated Peterson.

He added that the company's "software and services business provides ChargePoint an attractive recurring revenue model."

Earnings.....

ChargePoint is

expected to report its next quarterly earnings results on Tuesday, March 1st.

Based on analysts' forecasts, the consensus EPS forecast for the quarter is $-0.19.

Brokerages expect ChargePoint to post sales of $76.23 million for the current fiscal quarter. Eight analysts have provided estimates for ChargePoint’s earnings. The lowest sales estimate is $73.30 million and the highest is $78.48 million. The firm

Analysts expect that ChargePoint will report full year sales of $237.91 million for the current fiscal year, with estimates ranging from $235.00 million to $240.15 million. For the next year, analysts forecast that the business will report sales of $379.73 million, with estimates ranging from $350.70 million to $406.68 million.

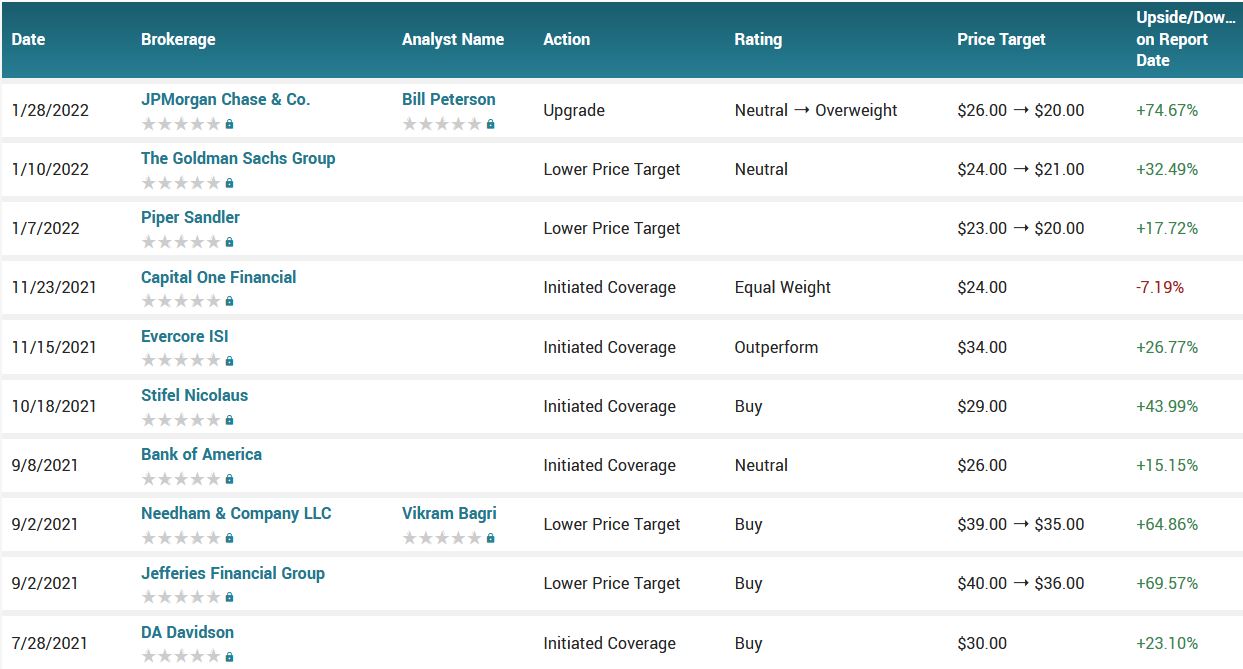

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for ChargePoint stock is Buy based on the current 5 hold ratings and 10 buy ratings for CHPT. The average twelve-month price target for ChargePoint is $30.40 with a high price target of $46.00 and a low price target of $20.00.

Summary.....

Both in operational and fundamental terms, the company continues to grow robustly in its clear ambition to achieve scale.

Making it more attractive is that ChargePoint stock's forward price-to-sales (P/S) ratio has fallen to nearly 11 from more than 28 in July last year. The ratio is also lower than ChargePoint's average ratio of 19 in the last year.

ChargePoint's ratio compares favorably with its peers Blink Charging and EVgo, though it's higher than Volta's ratio.

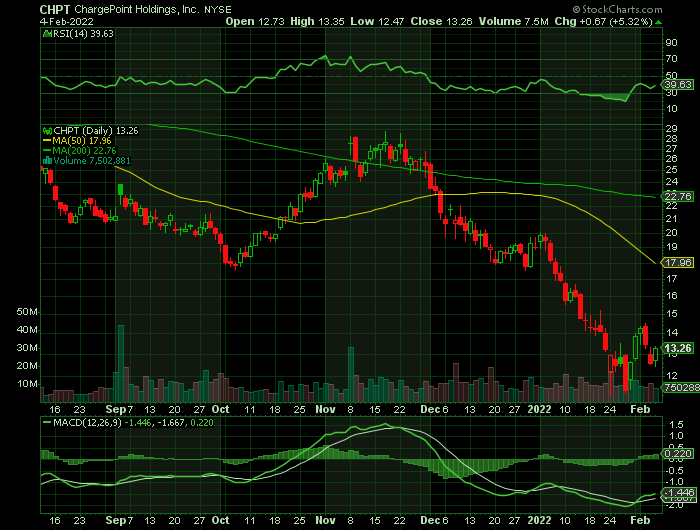

The stock’s fifty day simple moving average is $17.59 and its two-hundred day simple moving average is $20.95. ChargePoint Holdings, Inc. has a 1-year low of $11.21 and a 1-year high of $43.00.

Therefore…..

What Weekly Trades Will We Recommend For ChargePoint?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from ChargePoint