TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Carnival

Corp (CCL) Shares Continue To Climb!

And Members Are Up 100%

Potential Profit

Using A Weekly Call Option!

Cruise ships are seeing more people come on board this summer. 31.5 million people are expected to cruise this year. That would be more than the last full year before the pandemic.

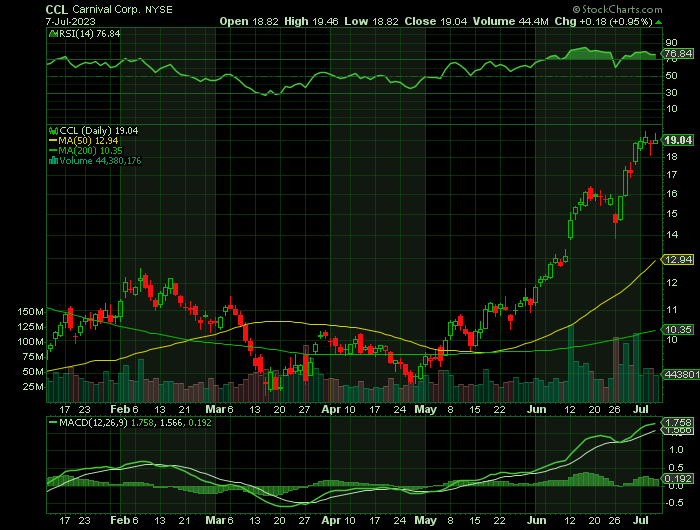

Carnival Corp (NYSE: CCL) stock has been a hot buy in 2023 with travel demand soaring. Year to date, it has risen 140%. But after the cruise line operator reported its latest quarterly results last month, its shares fell despite what looked to be a strong performance as investors may have been expecting more.

However, Carnival's stock should remain a great buy.

This set the scene for Weekly Options USA Members to profit by 100%, using a CCL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, July 08, 2023

by Ian Harvey

Cruise ships are seeing more people come on board this summer. 31.5 million people are expected to cruise this year. That would be more than the last full year before the pandemic.

The cruise industry is seeing a spike in demand as more people are looking to spend their vacations on the water this year.

This is the first full summer without travel restrictions since the pandemic and cruiser goers are excited to get back to their wanderlust.

Carnival Corp (NYSE: CCL) stock has been a hot buy in 2023 with travel demand soaring. Year to date, it has risen 140%. But after the cruise line operator reported its latest quarterly results last month, its shares fell despite what looked to be a strong performance as investors may have been expecting more.

However, Carnival's stock should remain a great buy.

Why the CCL Weekly Options Trade was Originally Executed on June 13!

Shares of Carnival Corp spiked in during Monday's trading session, as the stock was upgraded with bullish ratings from two analysts.

JPMorgan Chase & Co. analyst Matthew Boss upgraded shares of Carnival Corp (NYSE: CCL) from a neutral rating to an overweight rating in a report released on Monday morning. JPMorgan Chase & Co. currently has $16.00 target price on the stock, up from their prior target price of $11.00.

During meetings hosted by JPMorgan, the senior management of Carnival and peers Norwegian Cruise Line Holdings Ltd and Royal Caribbean Cruises Ltd maintained a “bullish tone on current trends” as well as on bookings in the first half of 2024, with “zero signs of momentum slowing,” Boss said in the upgrade note.

These dynamics are occurring as “pent-up loyalist demand a year ago transitions to new-to-cruise strength today,” he added. The analyst further stated that these companies had more balance sheet flexibility, with "ample liquidity for debt pay-down."

BofA Securities analyst Andrew Didora upgraded the rating from Neutral to Buy, while raising the price target from $11 to $20.

Meetings with Carnival, Norwegian Cruise Line and Royal Caribbean Cruises suggested that industry demand “remains steady in a time of consumer uncertainty, the pricing environment is rational, and booking curves are in line with company expectations,” Didora said in the upgrade note.

“In our opinion, the cruise industry's long booking window and strong current demand could allow it to be less susceptible to a slowdown in the leisure consumer relative to other areas of travel,” he added.

The CCL Weekly Options Trade Explained.....

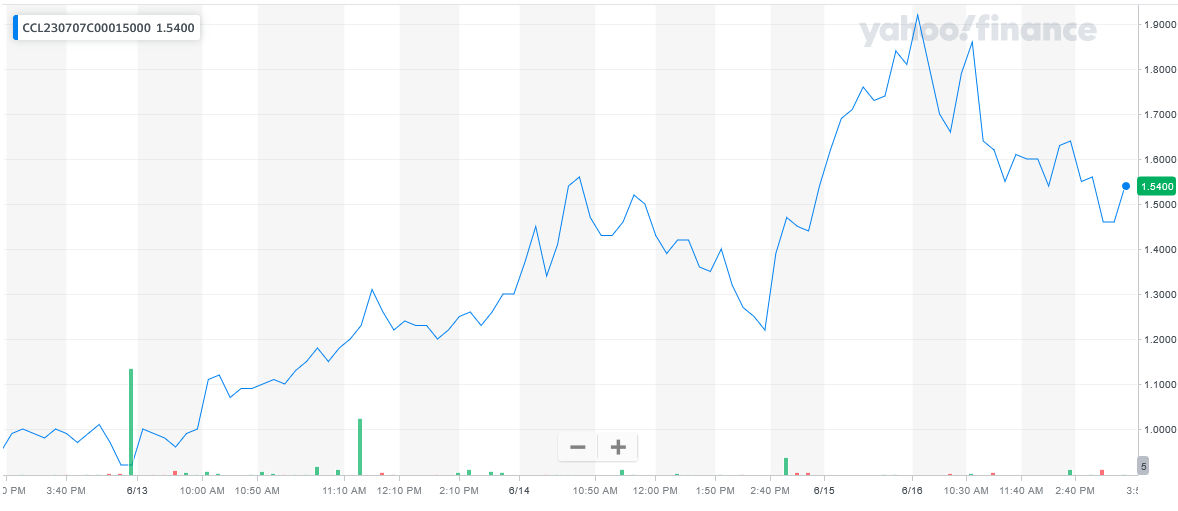

** OPTION TRADE: Buy CCL JUL 07 2023 15.000 CALLS - price at last close was $0.92 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CCL Weekly Options (CALL) Trade on Tuesday, June 13, 2023, for $0.96.

Sold half the CCL weekly options contracts on Friday, June 16, 2023, for $1.92; a potential profit of 100%.

Sold the other half of the CCL weekly options contracts on Friday, July 07, 2023.

Don’t miss out on further trades – become a member today!

Further Catalysts for A FUTURE CCL Weekly Options Trade…..

Carnival's stock should remain a great buy for the following reasons.

- Carnival is projecting that over the next three years, its annual adjusted free cash flow will total at least $3 billion. During that time, it also expects to reduce its debt by $8 billion, making it a safer investment that could attract those who have previously been concerned about the business' long-term risks.

- Now, with its operations pretty well back to normal, Carnival is generating positive cash flow that is approaching pre-pandemic levels.

- As of the end of its fiscal second quarter on May 31, Carnival reported available liquidity of $7.3 billion. That gives it a good buffer in the event that economic conditions worsen.

- In its fiscal Q2, the company reported encouraging results, even posting an operating profit of $120 million versus its loss of nearly $1.5 billion in the prior-year period.

It also reported many records and all-time highs:

- Revenue of $4.9 billion was a second-quarter record.

- Customer deposits hit an all-time high of $7.2 billion as of the end of May.

- Booking volumes in Q2 also set a record, topping the prior high set in Q1.

Business shows no signs of slowing down, either. Management projects that for fiscal Q3, ship occupancy levels will hit 107% -- or higher.

Conclusion....

If CCL can continue performing well and its bottom line improves, there could be much more upside for the stock.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from CARNIVAL CORP

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.