TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

C3.ai MONTHLY Call Option Up 30% In 1 DAY!

First Day of Monthly Stock Options Is A Winner!

More Profit Expected!

Become a Member and Get the Trade.

C3.ai was the world's first enterprise AI company when it was founded in 2009. It delivers AI-as-a-service by providing businesses with advanced, turnkey AI applications to accelerate their adoption of the technology.

C3.ai has an incredible amount of potential. CEO Thomas Siebel compares AI to the dawn of the internet and the smartphone, and Wall Street forecasts suggest the technology could add anywhere between $7 trillion and $200 trillion to the global economy in the coming decade.

This set the scene for Monthly Options USA Members to profit by 30% using an AI Monthly Options trade!

Become a Member Today and get the trade!

Monday, April 22, 2024

by Ian Harvey

While artificial intelligence stocks may have dropped recently, it is still the hottest investing trend in 2024.

Sometimes enterprise artificial intelligence company C3.ai Inc (NYSE: AI) is in favor on Wall Street; other times, C3.ai stock gets sold off. The sell-offs are great opportunities to buy shares on the cheap, as the bull case for C3.ai hasn’t changed.

C3.ai was the world's first enterprise AI company when it was founded in 2009. It delivers AI-as-a-service by providing businesses with advanced, turnkey AI applications to accelerate their adoption of the technology.

In a recent development, C3.ai is teaming up with Paradyme for an enhanced partnership to deliver AI solutions for federal U.S. intelligence agencies. Paradyme is a technology-solutions company that will “accelerate” its “joint selling and delivery efforts” to the government in this collaboration.

C3.ai will bring its public-sector-focused products to the table. These include the C3 AI Defense and Intelligence Suite as well as C3 Generative AI for Defense and C3 AI Law Enforcement.

Investors should be glad to see C3.ai making a concerted effort with Paradyme to ramp up its federal business. Paradyme could leverage its government connections, while C3.ai can provide the software solutions. Ultimately, this could be a win-win as federal contracts can be quite lucrative.

C3.ai is worth just $3.1 billion, but considering AI could add trillions of dollars to the global economy based on Wall Street's early forecasts, this small company might be primed for significant growth.

C3.ai has over 40 ready-made AI applications designed for 10 industries, all of which can be tailored to suit the needs of individual companies. For the financial services industry, C3.ai's anti-money laundering tool helps banks identify three times more suspicious transactions than traditional methods of detection. Similarly, its smart lending application reduces the amount of time it takes to assess and approve a potential borrower by 30%.

C3.ai has an incredible amount of potential. CEO Thomas Siebel compares AI to the dawn of the internet and the smartphone, and Wall Street forecasts suggest the technology could add anywhere between $7 trillion and $200 trillion to the global economy in the coming decade.

C3.ai stock could deliver substantial upside if it captures even a fraction of that value. Plus, its business is on the upswing right now, which means this is an ideal time to buy C3.ai options.

BECOME A MEMBER AND GET THE TRADE!

About C3.ai.....

C3.ai is a leading enterprise software company that offers artificial intelligence (AI) solutions to help organizations optimize their operations and improve decision-making. The company was founded in 2009 by Thomas Siebel, a renowned technology entrepreneur and is headquartered in Redwood City, California. C3.ai provides software-as-a-service (SaaS) applications designed to help companies across various industries, including manufacturing, healthcare, energy and financial services, harness the power of AI and machine learning to drive digital transformation.

C3.ai has a strong leadership team focused on driving innovation and growth. The company's CEO is Thomas Siebel, who has over 40 years of experience in the technology industry and has been recognized as a pioneer in enterprise software. Other key members of the management team include Edward Abbo, President and CTO, who has over 25 years of experience in the software industry and Houman Behzadi, Chief Product Officer, who has over 20 years of experience in software development and engineering.

C3.ai went public in December 2020, raising $651 million in its IPO. C3.ai has experienced flat revenue growth over the past few years. C3.ai has maintained a fair profit margin, with a net income close to or exceeding expenses. This has allowed the company to maintain a debt-to-equity ratio of close to 0.00. Overall, C3.ai's valuation metrics suggest that the market has high expectations for the company's future growth potential.

C3.ai operates in the AI software market, which is expected to continue to grow at a rapid pace in the coming years. The global AI software market is projected to grow from $22.6 billion in 2020 to $126.0 billion by 2025 at a compound annual growth rate (CAGR) of 41.2% during the forecast period. C3.ai competes with other AI software companies, such as IBM, Microsoft and Google, but the market is still relatively fragmented, providing significant growth opportunities.

C3.ai has several potential growth opportunities in the coming years. One key area of focus is the healthcare industry, where the company's AI solutions can help providers improve patient outcomes and reduce costs. C3.ai has also been expanding into new geographic markets, such as Europe and Asia, which provide significant growth opportunities. In addition, the company has been investing in research and development to enhance its AI technology and develop new applications.

Another potential growth opportunity for C3.ai is in the energy industry. The company has partnered with several energy companies, including Shell and Enel, to help them improve their operations and reduce their carbon emissions using AI. As the world continues to focus on reducing greenhouse gas emissions, C3.ai's solutions could be in high demand.

C3.ai has been exploring potential acquisitions to expand its offerings and reach new markets. While C3.ai has significant growth opportunities, the company also faces several risks and challenges. One of the biggest challenges is competition from other AI software companies, IBM, Microsoft and Google. These companies have resources and could outcompete C3.ai in specific markets.

C3.ai also operates in a highly regulated industry, which could challenge compliance with data privacy and security regulations. The company must ensure its solutions comply with regulations such as the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

In addition, the AI industry is still relatively new, and there is a risk that AI technology may not live up to its hype or that the market may not grow as quickly as anticipated. If this were to happen, C3.ai's growth prospects could be limited.

BECOME A MEMBER AND GET THE TRADE!

Further Catalysts for the AI Weekly Options Trade…..

In the first quarter of fiscal 2024, C3.ai grew its revenue 10.8% year over year (YOY) from $65.308 million to $72.362 million. Then, the company increased its revenue by 17% YOY to $73.2 million in the second quarter. After that, C3.ai expanded its revenue by 18% YOY to $78.4 million in fiscal 2024’s third quarter.

Also in the third quarter, C3.ai CEO Thomas Siebel reported that customer engagement grew 80% YOY. “Our significant first mover advantage in Enterprise AI is generating tailwinds as market interest in adopting AI accelerates,” Siebel commented.

C3.ai has about $700 million of cash, unencumbered of debt - giving it plenty of financial flexibility as it works toward its goal of hitting pro forma breakeven by the end of FY24. Cash burn is minimizing quickly.

Management continues to cite a healthy pipeline of deals going forward. Per CEO Tom Siebel's remarks on the Q3 earnings call:

The market for enterprise -- the market interest in enterprise AI is staggering. Virtually all commercial, military and government organizations are focused today on leveraging AI to improve their operations, optimize their processes and transform their businesses.

Our qualified opportunity pipeline has increased by 73% from a year ago. Now this is led by C3 Generative AI opportunities. Our go-to-market with partners is driving strong pilot additions, and it's still in the earliest innings.

In the third quarter, we closed 62% more bookings with our partner network than we did in Q2 - 337% more bookings than a year ago. Bottom line, the market demand for enterprise AI products is overwhelming."

BECOME A MEMBER AND GET THE TRADE!

Other Catalysts.....

The company has been signing on more and more new deals, with both commercial and government clients. Revenue from federal clients has increased more than 100% y/y, and we note that while C3.ai began as a primarily commercial software vendor, peer Palantir generates half of its revenue from governmental clients, spelling out a large market opportunity for C3.ai.

State/local government and federal deals represented more than half of C3.ai's bookings in its most recent quarter, finally opening up a market that has long been lucrative for AI rival Palantir.

Partnerships.....

AI is a "horizontal" technology, meaning it can be equally applied and benefited from by companies in any industry. Historically, C3.ai has concentrated in heavy manufacturing and oil, due to its relationship with Baker Hughes. More recently, however, the company has expanded applications in production to cover customers in financial services, healthcare, and other expansion industries for C3.ai.

C3.ai is well-embedded with Amazon AWS, Google Cloud, and Microsoft Azure, with specific enterprise applications that are optimized for different cloud environments. C3.ai's cloud-agnostic approach gives it broader reach across all potential customers.

Demand…..

The company reported $17.1 million of revenue in its fourth quarter, up 80% year over year. It's also unprofitable but moving quickly toward the break-even mark. It fourth quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss narrowed from $18.8 million a year ago to $3.7 million.

The company continues to sign up new customers, such as Stellantis, and it's testing a pilot with Peugeot, Opel, and Vauxhall. In the restaurant industry, it's added Jersey Mike's, Krispy Kreme, and White Castle, among others.

STILL TIME TO GET IN ON THIS TRADE!

Analysts.....

According to the issued ratings of 10 analysts in the last year, the consensus rating for C3.ai stock is Hold based on the current 2 sell ratings, 5 hold ratings and 3 buy ratings for AI. The average twelve-month price prediction for C3.ai is $29.91 with a high price target of $40.00 and a low price target of $14.00.

Summary.....

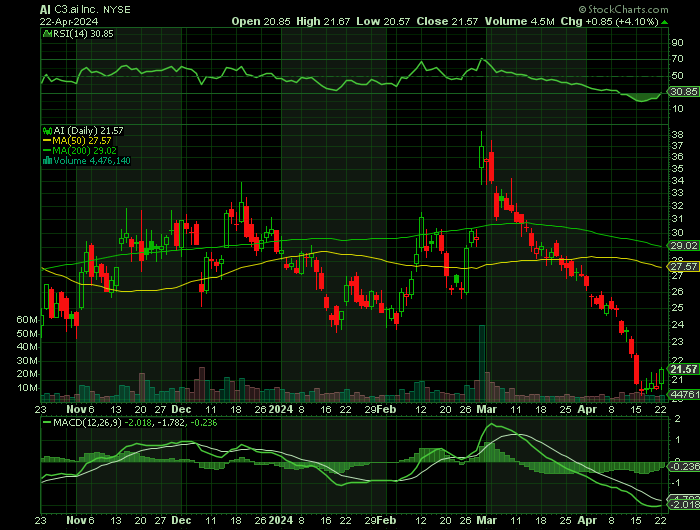

C3.ai stock has a market cap of $2.51 billion, a P/E ratio of -8.84 and a beta of 1.70. The stock’s 50-day moving average price is $27.97 and its two-hundred day moving average price is $27.44. C3.ai has a 1 year low of $16.79 and a 1 year high of $48.87.

Therefore…..

For future trades, join us here at Monthly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from C3AI

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.