TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Boeing Stock Switches From Toxic To Great!

Weekly Options Members

Are Up 191% Potential Profit

Using A Weekly CALL Option!

Boeing Co (NYSE: BA) was upgraded by RBC Capital to outperform from sector perform, on Tuesday, and set the stock's 12-month price target 25% above where shares ended on Monday, with a price target of $275, up from $200.

As well, Boeing has seen many other positive developments as of late.

This set the scene for Weekly Options USA Members to profit by 191%, using a BA Options trade!

Join Us And Get The Trades – become a member today!

Sunday, December 03, 2023

by Ian Harvey

Boeing Co (NYSE: BA) has seen some positive developments of late.....

- The Federal Aviation Administration (FAA) granted Boeing “type inspection authorization,” allowing the company to commence flight testing its 737 Max 10 jet. This step could be instrumental as Boeing seeks to achieve certification for this potential addition to the company’s popular Max jet lineup.

- Air Lease (NYSE:AL) announced that Boeing has delivered the first of a 25-unit order of 737-8 aircraft to Malaysia Airlines Berhad.

- Furthermore, Thai Airways is considering a “potential order for as many as 90 mostly widebody aircraft” from Airbus (OTC:EADSY) and Boeing. This would be “part of a long-term fleet renewal,” sources indicate.

- Boeing scored an order for six 737 Max-8 planes from Virgin Australia. Deliveries are anticipated in the second half of 2024. With that, Virgin Australia has ordered a total of 14,737 Max-8 units.

Why the Boeing Weekly Options Trade was Originally Executed!

On Tuesday, November 14, 2023, we recommended BA, making a profit of 205%. The shares are still on an upward trajectory!

Boeing Co (NYSE: BA) was upgraded by RBC Capital to outperform from sector perform, on Tuesday, and set the stock's 12-month price target 25% above where shares ended on Monday, with a price target of $275, up from $200.

RBC’s report highlighted the early signs of a shift in investor sentiment regarding Boeing's stock. The analysts pointed out Boeing's strong position in the commercial aerospace cycle, despite its stock underperformance in the last two years due to slow FCF improvements.

“However, we believe buy-side expectations for 2024-2025 FCF reflect conservatism, and as execution on the MAX and 787 continue to gradually improve, we believe the potential for positive revisions is growing,” commented the analysts.

RBC expects continued strong demand in both commercial and defense sectors for Boeing, along with improved production and delivery rates, which should bolster investor confidence in Boeing's FCF prospects.

The Boeing Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy BA DEC 29 2023 225.000 CALLS - price at last close was $4.96 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the BA Weekly Options (CALL) Trade on Wednesday, November 29, 2023 for $4.50.

The BA weekly options contracts hit a high Friday, December 01 at $13.10; a potential profit of191%.

Don’t miss out on further trades – become a member today!

About Boeing.....

The Boeing Company is the world’s largest manufacturer of airplanes and commands more than 50% of the market in some channels and categories. The company and its family of subsidiaries design, develops, manufacture, sell, service, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight, and related services worldwide. The company operates through four segments including Commercial Airplanes; Defense, Space & Security; Global Services; and Boeing Capital providing products and services to end-users in 150 countries.

Boeing got its start in 1910 when William E. Boeing developed a love for aircraft. Soon after he takes his first plane ride which leads him to build a hangar and begin construction of his first plane. The onset of WWI helped spur the company’s growth but business was cut drastically in its wake. The start of WWII was another milestone for the company and one that led to its current position of dominance. The company was incorporated in 1916 and is based in Chicago, Illinois. Boeing employs over 140,000 people in 65 countries making it one of the most diverse employers on the planet.

The Commercial Airplanes segment is built around the iconic 7-series which includes the 737, 747, and 787. The segment provides commercial jet aircraft for passenger and cargo requirements, as well as fleet support services for regional, national, and international air carriers and logistics and freight companies. In terms of global volume, the company estimates about 90% of all air freight is carried aboard one of its jets. This segment also includes the Dreamliner family of planes. The Dreamliner is a game-changing airplane for many carriers as it opens up the potential for new one-stop destinations because of its capacity and range.

The Defense, Space & Security segment develops and manufactures a range of systems including manned and unmanned aircraft, missiles, missile defense systems, satellites, communications equipment, and intelligence systems for governments. Among the many iconic brands within this segment are the AH-64 Apache, Air Force One, B-52, C-17 Globemaster, Chinook, F/A-18, and the V-22 Osprey VTOL aircraft used by the Marines.

The Global Services segment offers a range of products and services that include supply chain and logistics management, engineering, maintenance, upgrades, conversions, spare parts, pilot and maintenance training, technical and maintenance documents, and data analytics to its commercial and defense customers.

Boeing is also a leader in innovation, leveraging its many decades and avenues of experience to further aerospace and defense technology. Among the many innovations is the MQ-25 Stingray which will be the world’s first autonomous aircraft. The Stingray is only one of many areas of research that also include drones and undersea vehicles.

Further Catalysts for the BA Weekly Options Trade…..

Boeing shares are up 15% since the start of the year, despite spending the last nine months in consolidations. The Dow Jones transports leader also received an upgrade to buy from neutral from Deutsche Bank on Nov. 20. Goldman Sachs had added Boeing to its conviction buy list at the start of the month.

That helped boost the stock to a November gain of more than 17% through Monday, turning around a three-month decline.

The RBC note saw the aircraft maker's stance as positive heading into 2024. 2023 ended up being another year of supply chain disruptions, which lowered expectations. The company is poised for production ramps on both the commercial and defense sides of the business, and expects firm demand in both segments.

RBC believes "we are in the early stages of a significant shift in

sentiment on BA stock."

Other Catalysts.....

Deutsche Bank based its Nov. 20 upgrade on the reacceleration of aircraft deliveries.

The jet maker dominated the new order book at the Dubai Airshow, ended Nov. 17. Deutsche Bank saw Boeing sustaining the improved performance, the momentum from which should translate to positive free cash flow revisions. That, in turn, should drive positive share response, the note said.

Goldman Sachs upgrade note said investors had become more focused on near-term disruption risk, losing sight of long-germ fundamentals and normalizing cash flow. That created what Goldman described as a buying opportunity "in this domestic half of the global aircraft manufacturing duopoly."

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for Boeing stock is Moderate Buy based on the current 2 hold ratings and 13 buy ratings for BA. The average twelve-month price prediction for Boeing is $254.06 with a high price target of $300.00 and a low price target of $217.00.

Summary.....

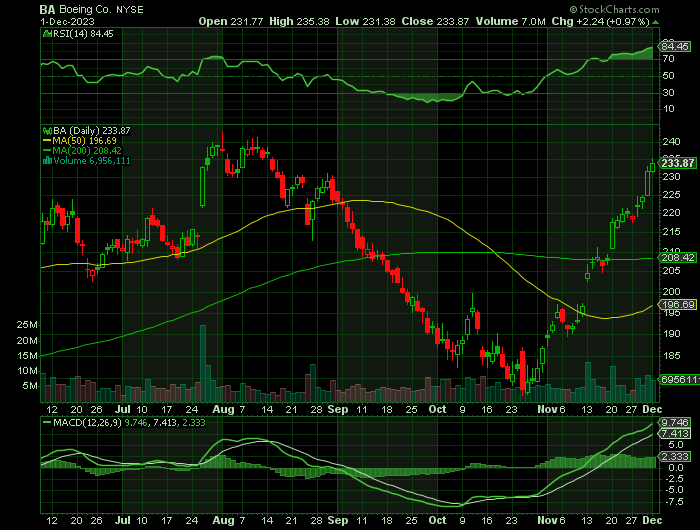

Boeing had a trading volume of 1,945,762 shares, compared to its average volume of 5,626,784. The stock has a 50-day moving average price of $194.47 and a 200-day moving average price of $208.97. The Boeing Company has a 1 year low of $171.70 and a 1 year high of $243.10.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Boeing

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.