TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

BILL Holdings Surges on Strong Earnings,

Validating

Weekly Options USA’s Call Option Strategy

Monday, September 01, 2025

by Ian Harvey

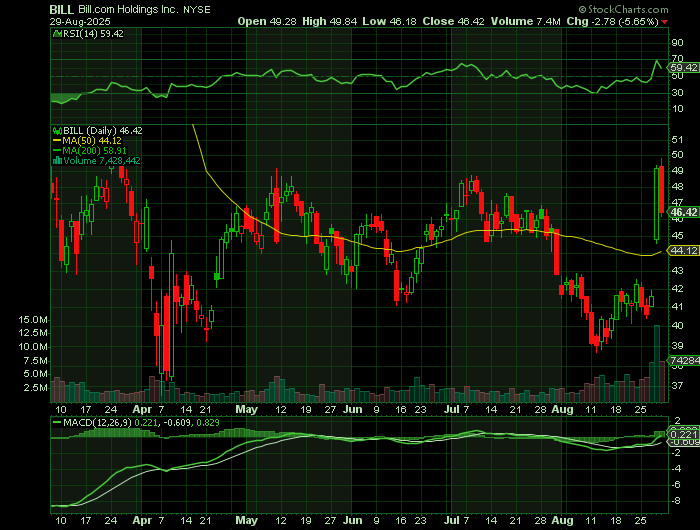

BILL Holdings (NYSE: BILL) surged over 18% after delivering strong fiscal Q4 2025 results, with revenues and earnings surpassing Wall Street expectations and management issuing a solid growth outlook for 2026.

Weekly Options USA’s call option trade on BILL quickly paid off, gaining 107% in just three days.

Analysts remain optimistic, citing BILL’s AI-driven automation, institutional support, and long-term growth potential as key drivers for continued momentum.

Join Us and Get the Trades - More

setups coming... Stay tuned!

Why the Recommendation Was Made

BILL Holdings, Inc. (NYSE: BILL), a leading provider of financial automation solutions for small and midsize businesses, has been on the radar of investors due to its consistent growth and innovation in financial technology. Weekly Options USA identified the stock as an opportunity for a weekly call option trade, citing several compelling factors.

BILL’s cloud-based platform simplifies accounts payable, accounts receivable, spend management, and supplier interactions, helping businesses improve efficiency and cash flow management. The company’s commitment to artificial intelligence and automation tools has differentiated it from peers and driven long-term adoption.

Financially, BILL projected fiscal 2025 revenues between $1.45 billion and $1.46 billion, representing year-over-year growth of 12–13%. Analysts expected fourth-quarter revenues of $375.7 million, reflecting a 9.3% increase from the prior year. Importantly, BILL had consistently outperformed Wall Street expectations in previous quarters.

Wall Street analysts also showed confidence in the company’s trajectory. Of 19 analysts covering the stock, 11 rated it a “Buy,” 7 a “Hold,” and only one a “Sell,” giving BILL a consensus “Moderate Buy.” The average price target of $62.61 suggested significant upside from the pre-trade price near $41. Notably, BTIG reiterated its “Buy” rating with a $60 target, calling BILL one of the best small-cap growth opportunities in the market. Canaccord Genuity also reaffirmed a “Buy” rating, trimming its target from $105 to $75 while underscoring long-term confidence.

Institutional support further strengthened the case. Nearly 98% of BILL’s stock was held by large investors, with firms like Price T Rowe Associates, Dimensional Fund Advisors, and Frontier Capital Management increasing positions. This level of backing signaled strong confidence in BILL’s growth outlook.

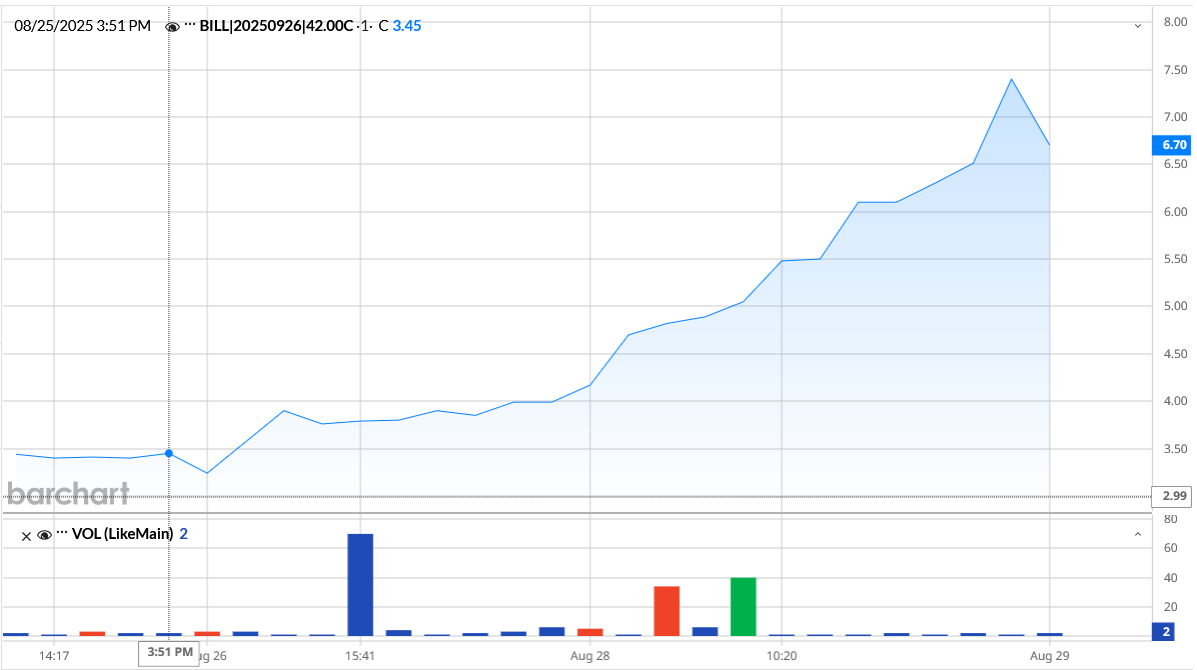

With these bullish fundamentals, Weekly Options USA recommended the BILL September 26, 2025 $42.00 calls at $3.45 per contract.

The Results: A Triple-Digit Gain in Just Three Days

The timing of this trade proved exceptional. Shortly after the recommendation, BILL reported its fiscal fourth-quarter and full-year 2025 earnings, delivering results that far exceeded expectations.

BILL’s revenue surged 12% year-over-year to $383 million, beating consensus estimates of $376.5 million. Core revenues—subscription and transaction fees—jumped 15% to $346 million, with transaction fees leading the way at 18% growth. Adjusted earnings of $0.53 per share also beat forecasts of $0.41. The company processed $86 billion in total payment volume and 33 million transactions in the quarter, underscoring strong platform adoption.

Management guided fiscal 2026 revenues to a range of $1.59–$1.63 billion, a 9–11% increase, and projected adjusted net income of $236–$260 million ($2.00–$2.20 per share). Additionally, BILL authorized a $300 million share buyback program, reflecting confidence in its cash flow and growth strategy.

The market responded swiftly. BILL’s stock price surged more than 18% in a single session, climbing to $49.14 per share. This dramatic move propelled the recommended call option trade to a 107% gain within just three days.

Analysts’ Take After Earnings

Analysts reinforced their optimism following the earnings release. Some analysts highlighted BILL’s consistent ability to beat expectations and applauded the share repurchase program as a signal of strength. Others emphasized BILL’s ability to deliver “outstanding fourth-quarter earnings” that crushed projections despite near-term challenges.

Management’s focus on AI-powered automation, product innovation like Supplier Payments Plus, and expansion into mid-market and accounting firm channels was also noted as a catalyst for sustained growth. While guidance for the next quarter was cautious due to macroeconomic headwinds, analysts viewed BILL’s long-term trajectory as solid, given its innovative platform and expanding customer base of nearly 500,000 businesses.

Positioned for the Next Move

The recent success of the BILL call option trade underscores the value of identifying high-growth companies with strong fundamentals and institutional backing. Weekly Options USA’s strategy of seizing near-term opportunities on the back of powerful earnings momentum has once again proven effective.

With the stock up sharply and trading momentum strong, another trade may be in the making. Given BILL’s innovation in AI-driven financial automation, robust institutional support, and analyst endorsements, the company remains well positioned to deliver continued shareholder value in the months ahead.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from BILL HOLDINGS

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.