TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Asana Stock Price Keeps Climbing!

“State-of-the-Art” Members

Profit Up 190% In 3 Days!

More Gains Expected?

Friday, June 18, 2021

by Ian Harvey

Asana, operating in the emerging segment for e-collaboration, is in a bullish uptrend. ASAN is a leader in this category, with a broad feature set based around its differentiated Work Graph.

“State-of-the-Art Members,” using an options call trade, made potential profits of 190% in 3 day!

Asana Inc (NYSE: ASAN)

Prelude…..

The tech industry should continue to thrive regardless of how tech stocks perform in the stock market today; and Asana Inc (NYSE: ASAN), based in California, operates a work management software as a service that enables individuals and teams to improve working efficiency while enhancing employee engagement. It allows everyone to monitor the progress of their work that connects to the mission of an organization.

Asana is a late 2020 IPO (direct listing) which provides a leading platform for work management and team collaboration. Revenue has grown to over $50M with growth rates over 50%. It also is a beneficiary of COVID-19 trends such as WFH and work anywhere, which means growth appears highly sustainable.

With a valuation of around $8.7B, and climbing daily, is an excellent alternative investment to Slack and other investors alike.

ASAN stock has been up by over 65% just within the past month.

The Recommended Asana.....

** OPTION TRADE: Buy ASAN

AUG 20 2021 50.000 CALLS at approximately $2.50. (Actually bought for $2.48)

Asana Options Trade Call Success Explained.....

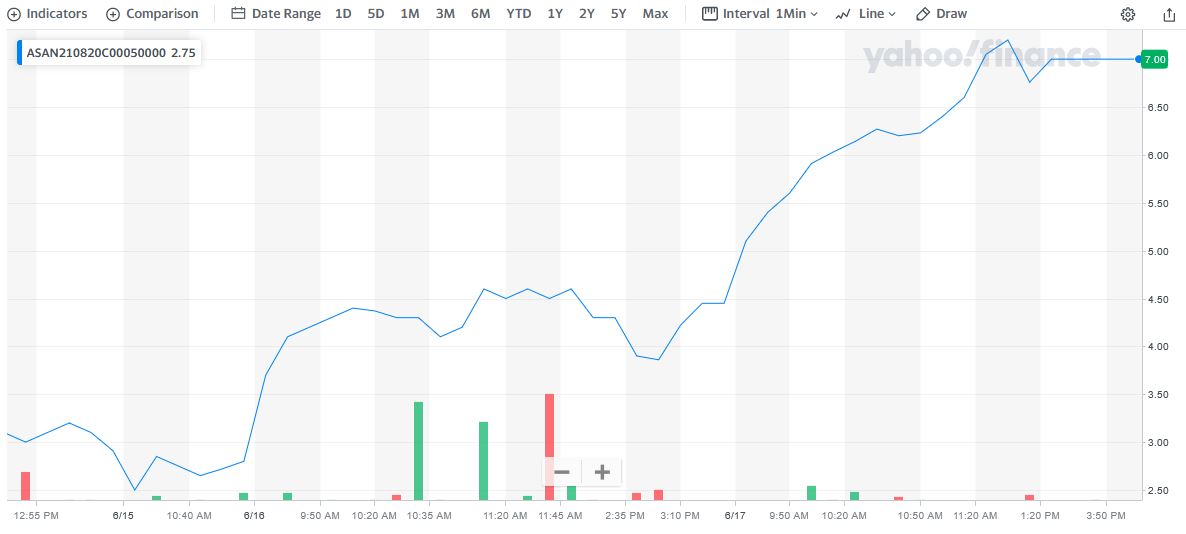

Tuesday, June 15, 2021, “State-of-the-Art Members,” entered the trade mentioned above for $2.48.

By the close of trade Thursday, June 17 – 3 days later – the exit price of the options trade had hit $7.20 – a potential profit of 190%.

At the time of writing the stock price was up another 1.64%.

The question now is should we exit the trade or wait for more profit?

Why the Recommendation for an asana Options Call Trade?

There are many reasons that should be mentioned to understand the continued upward movement.....

1. Earnings Beat Estimates.....

Asana reported a smaller-than-expected loss in the fiscal first quarter of 2022 and beat revenue expectations. Asana is a web and mobile application designed to help teams organize, track, and manage their work.

Shares jumped 6.5% to close at $39.19 on June 4.

The company incurred a loss of $0.21 per share in 1Q, compared to the $0.27 loss per share estimated by analysts. A loss of $0.31 per share was reported in the same quarter last year.

Revenue generated in the quarter was $76.7 million, which grew 61% from the year-ago period and beat analysts’ expectations of $70.17 million.

Asana CEO Dustin Moskovitz said, “Whether teams are fully remote and working from home, or in offices coordinating work across departments and geographies, clarity on who is doing what by when is essential. More and more customers are turning to Asana and the Asana Work Graph to provide a scalable, cross-functional, and easy-to-adopt solution.”

2. Moving Forward.....

For fiscal Q2, the company expects revenues in the range of $81 – $83 million, indicating growth of 56% – 60% year-over-year. The consensus estimate is pegged at $74 million. Non-GAAP net loss per share is expected in the range of $0.27 to $0.26, versus the consensus estimate for a loss of $0.27 per share.

For fiscal 2022, the company expects revenues to come in the range of $336 – $340 million, representing an increase of 48% – 50% year-over-year. The consensus estimate sits at $312.2 million.

3. Influencing Factors…..

Asana calls itself a mission-critical platform. It sees a $32B market by 2023, with over 1B information workers that could benefit from its platform. Aside from this large greenfield opportunity, Asana also estimates that it has only addressed or captured just 3% within its existing customer base. As an e-collaboration platform, it is an obvious beneficiary of COVID-19 trends.

This is also still quite an emerging product category. In particular, although it plays in the same space as Slack, it specializes in “co-ordination” - providing members clarity about their work, about who is doing what and when.

Asana seeks to replace e-mail, spreadsheets, notes, etc. with a superior solution.

Asana accomplishes this by what it calls its Work Graph, which it calls its biggest differentiated feature compared to competitors - the equivalent of Slack's shared channels, perhaps. The Asana Work Graph is an up-to-date map of the work in the organization. This includes the units of works, such as tasks, goals, ideas, agenda items, etc. It includes the information about that work, such as files and status. And it includes connections such as responsibility.

One such differentiated feature of this Work Graph is multi-homing, and Asana claims it is used by 97% of customers who spend over $5k annually. As Asana puts it: "Multi-homing gives people the ability to host a single task in multiple projects at the same time. This feature is unique to Asana and is what allows Asana to serve as a single source of truth for customers working across projects, processes and functions."

Asana believes that its web and mobile application is slowly gaining popularity among organizations. Whether teams are working from home or fully in offices, monitoring work progress would be much easier with its application. After all, clarity on who is doing what and when is essential for the success of any organization.

Asana recently launched Asana Partners, which consists of over 200 partners. Asana is also heavily investing in R&D, which has allowed it to launch many other features in 2020, and more in development. For example, recently Asana launched Universal Reporting, which is aimed at higher-level executives.

4. Analysts Thoughts.....

Asana had its target price lifted by Robert W. Baird from $40.00 to $50.00 in a research report sent to investors Thursday, June 10. Robert W. Baird currently has an outperform rating on the stock.

Also, on June 4, Oppenheimer analyst Ittai Kidron reiterated a Buy rating on the stock but increased his price target to $43.00 from $41.00.

Kidron commented, “Asana delivered a strong overall quarter with encouraging new customer and expansion activity. While spending levels will continue to be elevated, we’re positive on the execution being shown and the long-term opportunity ahead.”

Summary.....

While Asana operates in the emerging segment for e-collaboration, which

is experiencing both short-term and long-term tailwinds (such as from

work-from-home), it addresses a different aspect of work management than many

others: work coordination. Asana is a leader in this category, with a broad

feature set based around its differentiated Work Graph.

Therefore…..

This Asana Options Trade Is A Big Winner!

Will Asana Stock Price Continue To Climb?

Will We Recommend Another Asana Options Trade?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Asana