TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple (AAPL) Shares Are Still On An Upward Move!

Members Make

Potential Profit of 47%, Using A Weekly Call

Option!

Apple Inc. (NASDAQ:AAPL) kept the momentum going last week, and soared higher on Wednesday, after receiving a positive note from Morgan Stanley analyst Erik Woodring, who sees great prospects for Apple in India.

Meantime, several more analysts are jumping on the positive bandwagon.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 47%, using an AAPL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, July 29, 2023

by Ian Harvey

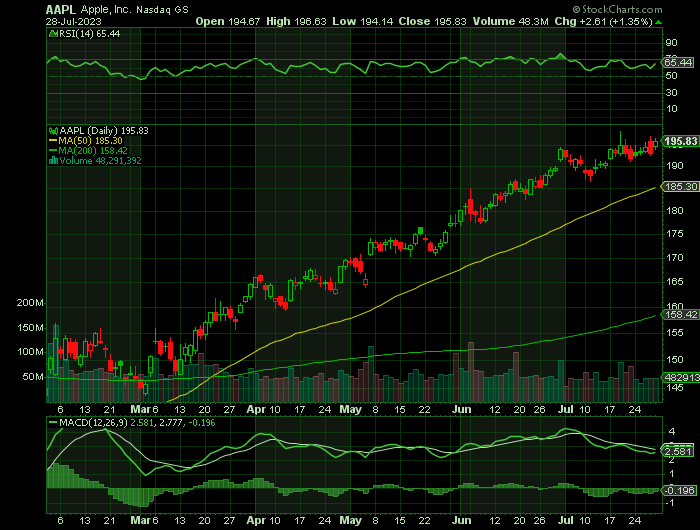

Apple stock has been a top performer this year.

Year to date through Friday's close, Apple stock is up 50.7%. It is trading just below its all-time high of $198.23, reached on July 19.

On the stock market Friday, Apple stock climbed 1.4% to close at $195.83.

"Apple is the most 'boring' buy-rated stock," Jefferies analyst Andrew Uerkwitz said in a recent note to clients. "It lacks a focus on 'efficiency' and buzzwords such as cloud or AI."

He added, "What Apple lacks in investor pizzazz, it makes up for with consistency. Its moat has been, remains, and will be its ability to integrate software services with its hardware that builds a regular replacement cycle, ability to slowly raise prices, and take share. This consistency is what makes it a buy-rated stock — especially in an uncertain economic environment."

Why the AAPL Weekly Options Trade was Executed?…..

Apple Inc. (NASDAQ:AAPL) kept the momentum going last week, and soared higher on Wednesday, after receiving a positive note from Morgan Stanley analyst Erik Woodring, who sees great prospects for Apple in India.

Woodring feels confident predicting that Apple stock will be worth $220 a share within a year (up ~14% from yesterday’s prices). And he’s “overweighting” the stock, and urging investors to buy Apple — Morgan Stanley’s new “top pick” in tech.

Now that Apple stock has pulled back there is another opportunity to profit using another option call.

Read the article “Apple Inc Screams Higher Then Falls Back!”

The AAPL Weekly Options Trade Explained.....

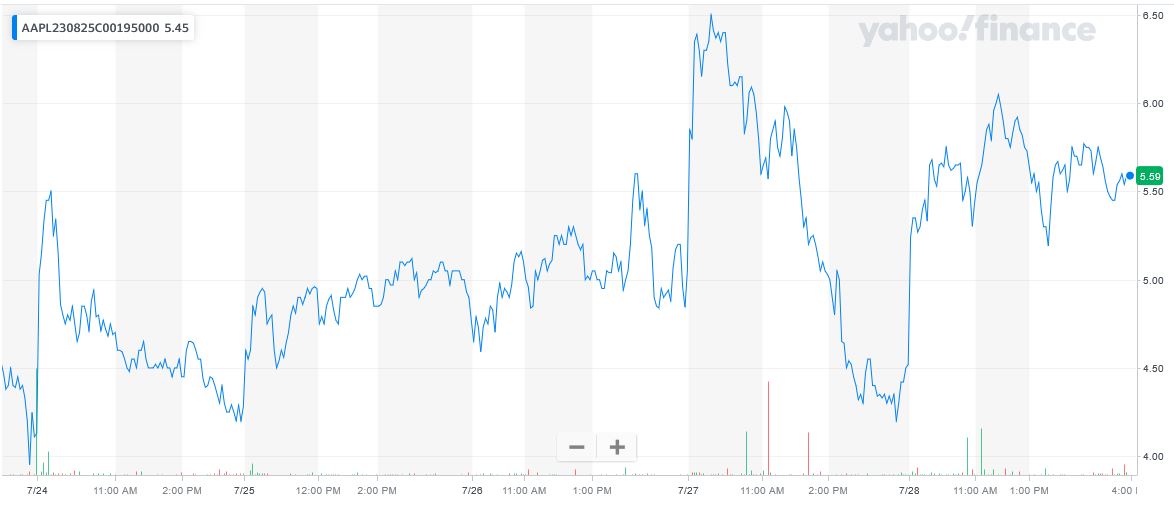

** OPTION TRADE: Buy AAPL AUG 25 2023 195.000 CALLS - price at last close was $4.13 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AAPL Weekly Options (CALL) Trade on Monday, July 24, 2023, for $4.45.

Sold half the AAPL Weekly Options contracts on Thursday, July 27, 2023, for $6.52; a potential profit of 47%.

Holding the remaining AAPL weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

Further Catalysts for the AAPL Weekly Options Trade…..

Apple is slated to report fiscal third-quarter results on August 3 and investment firm Jefferies said the U.S. tech giant is likely to remain a "source of safety" for investors due to its predictability.

Analyst Andrew Uerkwitz, who has a buy rating on Apple, said it’s moat has been, remains, and will be its ability to integrate software services with its hardware that builds a regular replacement cycle, ability to slowly raise prices, and take share," Uerkwitz wrote in an investor note. "This consistency is what makes it a buy-rated stock—especially in an uncertain economic environment."

For the coming June quarter, Uerkwitz, who raised raised his per-share price target to $225 from $210, expects Apple to generate $83.6B in revenue, above the Wall Street consensus, due in part to the iPhone and services, which he said are the " two most important drivers of the stock."

Moving Forward.....

Analysts expect Apple to earn $1.19 a share, down 1% year over year, on sales of $81.7 billion, down 2%, in the June quarter.

Barclay’s analyst Tim Long predicts that Apple will deliver June-quarter results that are in line with Wall Street's consensus estimates. Strong services revenue and stable iPhone sales should offset weaker sales of other hardware in the period, he said.

Goldman Sachs analyst Michael Ng sees Apple getting a lift in the June quarter from better-than-expected sales of Mac computers and services.

He rates Apple stock as buy with a price target of $222.

"We recognize investor concerns around valuation and downside risks, but continue to believe that Apple's growing iPhone installed base serves as the foundation for growing monetization per user," Ng said in a note.

Morgan Stanley analyst Erik Woodring rates Apple stock as overweight and a "top pick" with a price target of $220.

"We expect Apple to post an in-line June quarter but guide September-quarter revenue and gross margin materially higher than current consensus estimates," Woodring said in a recent note. His September-quarter outlook reflects strength in iPhones, Mac computers and services.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from APPLE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.