TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

AMAZON Weekly Call Option Provides 81% Profit!

Is There More To Come?

Join Us and Get the Trades!

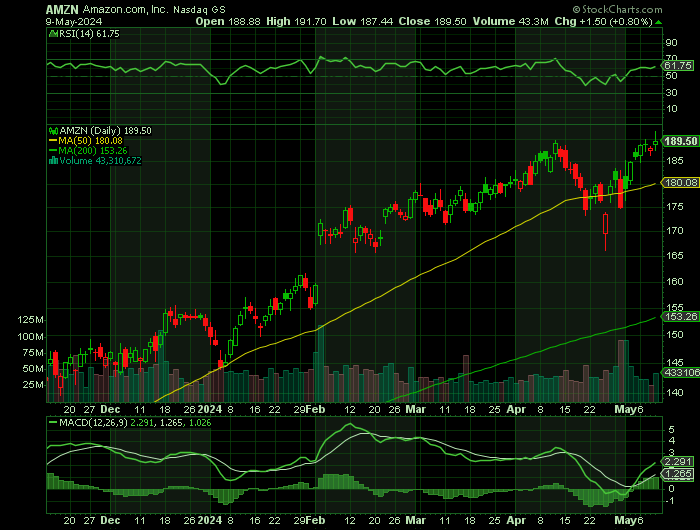

Amazon.com, Inc. (NASDAQ: AMZN) reached an all-time high Thursday hitting a high of $191.70, its first record close since early April.

Amazon has been a major growth driver in the market's recovery, with its stock up 113% since the start of 2023 after tumbling 50% the year before. The company has rallied investors with an impressive turnaround in its e-commerce business and an expanding position in AI.

This set the scene for Weekly Options USA Members to profit by 81% using an AMZN Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, May 09, 2024

by Ian Harvey

UPDATE

Amazon.com, Inc. (NASDAQ: AMZN) reached an all-time high Thursday hitting a high of $191.70, its first record close since early April.

Shares for the Seattle-based tech behemoth have steadily climbed since the company posted strong first-quarter earnings on April 30. Shares have gained six out of the last seven trading days.

For its first quarter, Amazon reported a 216% year-over-year earnings increase, to 98 cents per share, and sales up 13% at $143.3 billion. Both metrics easily beat average estimates from analysts. The company's Amazon Web Services business also reported better-than-expected revenue growth.

Amazon’s cloud unit, Amazon Web Services has been growing at a double-digit rate and saw a 17% year-over-year (YOY) jump in sales to reach $25 billion. With inflation starting to cool down, there is a chance of seeing a higher growth rate in AWS. It accounts for a huge part of the income and has helped increase the profit margins. The segment generated an operating income of $9.4 billion.

Another segment, the advertising services saw an impressive 24% jump in the quarter and generated $11.8 billion. This segment has been growing over the past two quarters, and I believe it will continue to expand. It was the first report since the company started showing ads on the Prime platform, and it shows that we could expect steady revenue growth from advertising.

Overall, Amazon stock has gained 25% this year and 80% over the past 12 months.

Why the Amazon Weekly Options Trade was Originally Executed!

Amazon.com, Inc. (NASDAQ: AMZN) has been a major growth driver in the market's recovery, with its stock up 113% since the start of 2023 after tumbling 50% the year before. The company has rallied investors with an impressive turnaround in its e-commerce business and an expanding position in AI.

Amazon.com's first-quarter revenue of $143.3 billion and per-share earnings of $0.98 both topped estimates and were well up from year-ago levels. Amazon stock edged higher following Tuesday evening's release of the company's first-quarter report.

Amazon's most exciting growth engines at this time is its cloud computing arm. Indeed, Amazon Web Services (or AWS) has grown at a double-digit pace for several years now. This business ran into an alarming wall beginning in mid-2022, though, thanks to the steep costs of operating a cloud computing arm in an environment rife with inflation. AWS's operating income and operating margin rates have been weak since 2022, even though its cloud revenue has continued to grow.

This all seems to have dramatically changed last quarter, however. Following the slight turnaround that started taking shape in the third quarter of last year, AWS's operating margin jumped to a record-breaking 37.6% during the first quarter of this year.

Given that Amazon Web Services accounts for nearly two-thirds of Amazon's operating income, these widening profit margins are a pretty big -- and encouraging -- deal.

The Amazon Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy AMZN MAY 31 2024 190.000 CALLS - price at last close was $3.45 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMZN Weekly Options (CALL) Trade on Monday, May 06, 2024 for $2.90.

Sold the AMZN weekly options contracts on Thursday, May 09, 2024 for $5.45; a potential profit of81%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Amazon.com.....

Amazon, or Amazon.com, is the world's largest and leading portal for eCommerce. It was founded by Jeff Bezos, incorporated in 1994, and later went public in 1997. The company is headquartered in Seattle, Washington, and is a member of the influential FAANG group of stocks. When it comes to stocks, Amazon is proof that small companies can do big things; the AMZN stock price was pennies when it was first listed and now it trades well over $100 (split adjusted) per share.

The company is not a true retailer nor a pure-play manufacturer but in the business of connecting consumers and merchants together. The website was first created as a means of selling books at a discount but it has since grown to include most verticals in the retail sector. A few of the products the company does manufacture are the Kindle and Fire Tablets, Fire TVs, and smart home devices like Echo. Echo is powered by an AI personality named Alexa which can take vocal commands from its users.

Today, Amazon operates in three segments including North America, International, and Amazon Web Services. The first two segments are the core retail business while Amazon Web Services includes a host of Internet-related services for consumers and businesses alike. A little-known fact is that Amazon Web Services is as important to the function of the Internet as Google because of the infrastructure it provides and it hosts so many business websites.

Services provided by Amazon for merchants include listing, fulfillment, and advertising as well as subscriptions. Services provided by Amazon Web Services include cloud computing, storage, database maintenance, analytics, machine learning, and even artificial intelligence. In regard to the company's operations, Amazon Web Services is the smaller of the three segments but is a fast-growing and well-established part of the business that has had a positive influence on the AMZN stock price.

Among the many ancillary services provided by Amazon is Kindle Direct Publishing. This is a cloud-based service that enables writers and publishers to publish their works directly in the Kindle Store. Kindle, if you are unaware, is an Internet-connected tablet designed for reading books but also streams other forms of entertainment. Amazon also develops and publishes its own media content that is available via Kindle or the Amazon App that can be found on most smart TVs.

Amazon is also a disruptor, moving into new digital markets whenever it thinks it can make a profit. The move into streaming is only one example, another is a push into healthcare. Amazon Prime is another disruptive move and is a subscription service that entitles members exclusive access to Amazon services.

Amazon's stock price can be affected by factors including the pace of revenue growth, profitability, growth in the AWS segment, and any stock splits that may occur. The Amazon share price was impacted by splits 4 times between the IPO in 1997 and June 2022 and additional splits should be anticipated. The forecast for Amazon stock, splits aside, is for steadily increasing price action punctuated by pullbacks, corrections, and consolidations. While there is competition for Amazon, this company is entrenched and will stand the test of time because eCommerce is the way businesses thrive in today's markets.

Further Catalysts for the AMZN Weekly Options Trade…..

Amazon's e-commerce operations are finally turning a surprisingly wide profit. After record-breaking fourth-quarter operating income, its Q1 e-commerce operating income of $5.9 billion is another record-breaker for the calendar quarter in question. That's impressive, given how inflation has been a problem for corporations and consumers alike.

Amazon's international e-commerce business is turning profitable again, even though this arm has seen minimal revenue growth since the pandemic-prompted surge. This will help justify the company's continued investment in its overseas operations, where the bulk of its future growth will lie; the North American market is pretty well saturated.

Other Catalysts.....

Advertising and subscription revenue is soaring. Over the course of just the past few years, Amazon's turned up the heat in this business. Last quarter's advertising revenue of $11.8 billion is 24% better than the year-earlier comparison, extending a well-established growth trend. This is high-margin revenue, too.

Amazon's subscription businesses shows great growth. This is predominantly revenue generated by subscriptions to Amazon Prime but can also include other subscription-based services, like digital music or grocery delivery. Last quarter's subscription revenue reached a record-breaking $10.7 billion, up 11% year over year.

Continued Growth.....

These include the company's dominance of the e-commerce market and its ongoing expansion. Amazon Web Services is also a compelling business, regardless of whether its profit margins are improving.

Nevertheless, these details do make the already solid bullish arguments even better. Amazon is handling the big things and the little things well, capitalizing on its unique strengths, like its sheer size and technological capabilities. Few other companies are ever going to be able to match either.

Platform and Advertising Services…..

These digital-based businesses fortify the company's earnings for the long term, making it less vulnerable to macro factors. In Q1 2024, AWS revenue increased by 17% year over year, with advertising sales rising 24%.

Amazon has been a sleeping giant in digital advertising, with companies like Alphabet and Meta Platforms dominating the industry. However, the recent introduction of ads on its streaming platform Prime Video and other expansions in the sector have boosted earnings and will likely continue to do so for the foreseeable future.

Artificial Intelligence…..

According to Grand View Research, the artificial intelligence (AI) market hit a valuation nearing $200 billion last year and is projected to expand at a compound annual growth rate of 37% through 2030. This growth trajectory will see the industry achieve close to $2 trillion in spending. As a result, Amazon's hyperfocus on expanding its role in the industry could pay off in a major way in the coming years.

Since the start of 2023, Amazon has invested heavily in AI, introducing a range of new AI tools on AWS and announcing a venture into chip development. Demand for AI services has skyrocketed over the last year, with businesses increasingly turning to cloud platforms like AWS to boost efficiency with the generative technology.

Meanwhile, AWS holds a leading 31% market share in cloud computing, with its client list boasting tech giants like Netflix, Meta Platforms, and Sony. Amazon's potent role in cloud computing could give it a leg up in AI, compared to rivals like Microsoft's Azure and Google Cloud.

Analysts.....

Analysts expect continued upside, driven by multiple catalysts, including the prospects for its cloud computing unit Amazon Web Services (AWS) in the artificial intelligence (AI) space.

- Amazon.com had its target price lifted by Evercore ISI from $220.00 to $225.00 in a report issued on Wednesday morning. The brokerage currently has an outperform rating on the e-commerce giant’s stock.

- Amazon.com had its target price increased by Piper Sandler from $205.00 to $220.00 in a research report released on Wednesday. The firm currently has an overweight rating on the e-commerce giant’s stock.

- Needham & Company LLC reiterated their buy rating on shares of Amazon.com in a research report published on Wednesday morning. They currently have a $205.00 target price on the e-commerce giant’s stock.

According to the issued ratings of 45 analysts in the last year, the consensus rating for Amazon.com stock is Buy based on the current 1 hold rating, 43 buy ratings and 1 strong buy rating for AMZN. The average twelve-month price prediction for Amazon.com is $211.07 with a high price target of $245.00 and a low price target of $140.00.

Summary.....

The tech giant is on a promising growth path as the biggest name in online retail and as a leader in cloud computing with its platform, Amazon Web Services (AWS). Amazon continued to prove this on April 30, beating earnings estimates once again and delivering glowing results for its first quarter of 2024.

Shares of Amazon climbed 17% year to date but have shown no signs of slowing.

Shares of AMZN stock traded up $1.49 during trading hours on Friday, hitting $186.21. 39,172,004 shares of the company’s stock were exchanged, compared to its average volume of 46,582,852. The company has a quick ratio of 0.84, a current ratio of 1.07 and a debt-to-equity ratio of 0.27. The firm has a market cap of $1.94 trillion, a P/E ratio of 52.16, and a P/E/G ratio of 1.37 and a beta of 1.15. The firm has a 50 day moving average of $179.02 and a two-hundred day moving average of $160.32. Amazon.com, Inc. has a fifty-two week low of $103.31 and a fifty-two week high of $189.77.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from AMAZON

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.