TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Amazon Provides 551% profit

Using A Weekly Call Option!

Wall Street expects a year-over-year increase in earnings on higher revenues when Amazon.com, Inc. (NASDAQ: AMZN) reports results on February 1, 2024, for the quarter ended December 2023.

Amazon gained 81% in 2023, its best year on the stock market since 2015.

Amazon's upcoming rollout of advertisements on its Prime Video platform is set to boost the e-commerce giant's profits and stock price in 2024, according to a Wednesday note from Bank of America.

The bank reiterated its "Buy" rating on Amazon and its $168 price target, representing potential upside of 12% for the stock.

This set the scene for Weekly Options USA Members to profit by 551% using an AMZN Options trade!

Join Us And Get The Trades – become a member today!

Saturday, January 27, 2024

by Ian Harvey

Wall Street expects a year-over-year increase in earnings on higher revenues when Amazon.com, Inc. (NASDAQ: AMZN) reports results on February 1, 2024, for the quarter ended December 2023.

This online retailer is expected to post quarterly earnings of $0.80 per share in its upcoming report, which represents a year-over-year change of +281%.

Revenues are expected to be $166.19 billion, up 11.4% from the year-ago quarter.

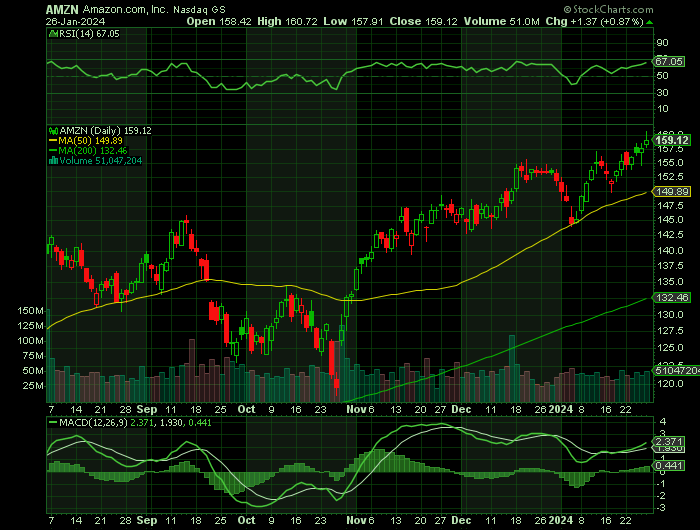

Amazon gained 81% in 2023, its best year on the stock market since 2015.

With a market cap nearing $1.6 trillion, Amazon is among the world's most valuable companies and a market leader in e-commerce, as well as cloud-computing through its Amazon Web Services division.

Why the Amazon Weekly Options Trade was Originally Executed!

Amazon.com, Inc. (NASDAQ: AMZN)'s upcoming rollout of advertisements on its Prime Video platform is set to boost the e-commerce giant's profits and stock price in 2024, according to a Wednesday note from Bank of America.

The bank reiterated its "Buy" rating on Amazon and its $168 price target, representing potential upside of 12% for the stock.

Amazon will introduce ads across its Prime Video platform at the end of January. Users can pay an extra $2.99 per month to avoid seeing the ads, or not pay the extra fee and be subject to a few ads per hour of streamed content.

The rollout of ads on Prime comes just over a year after Netflix rolled out its lowest-priced $7.99 per-month advertising tier, which has since attracted more than 15 million subscribers.

A surprise takeaway from Netflix's ad-tier is that it can generate more revenue per user than its premium subscription options that cost upwards of $20 per month, as it collects both revenue from advertisers and a subscription fee from consumers. That dynamic could bode well for Amazon, according to BofA.

"Netflix commentary suggests that an ad sub[scriber] can monetize better than an ad-free sub, and if we assume Prime has 150 million Video users and 70% choose lower-cost subscription with ads, we estimate $3 billion in potential incremental ad revenue," Bank of America research analyst Justin Post said.

That revenue figure could jump closer to $5 billion when considering the portion of subscribers that decide to pay $2.99 per month for no ads.

The Amazon Weekly Options Potential Profit Explained.....

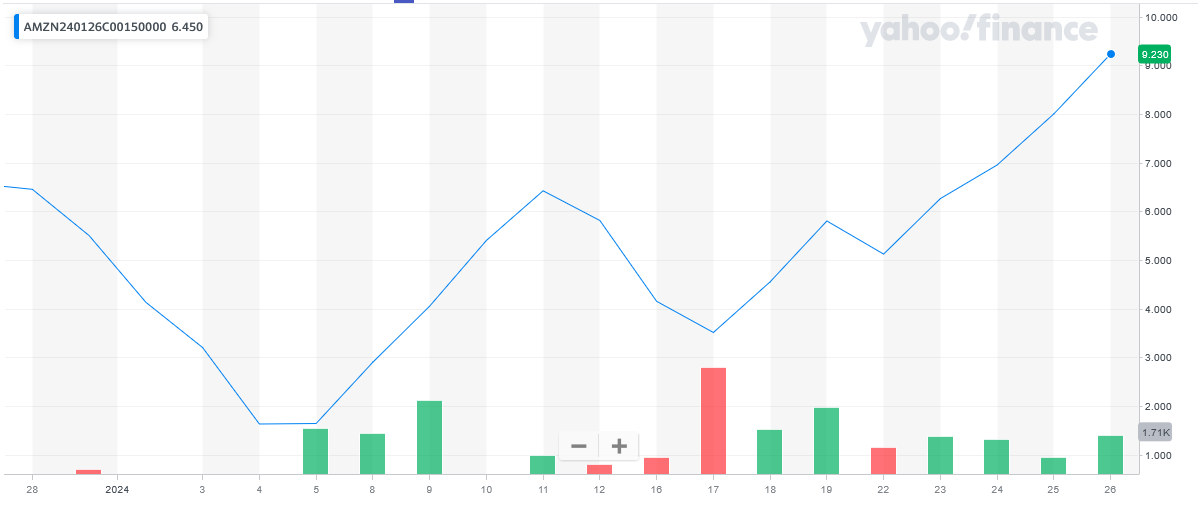

** OPTION TRADE: Buy AMZN JAN 26 2024 150.000 CALLS - price at last close was $3.20 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMZN Weekly Options (CALL) Trade on Thursday, January 04, 2024 for $1.64.

Sold the AMZN weekly options contracts on Friday, January 26, 2024 for $10.67; a potential profit of 551%.

Don’t miss out on further trades – become a member today!

About Amazon.com.....

Amazon, or Amazon.com, is the world's largest and leading portal for eCommerce. It was founded by Jeff Bezos, incorporated in 1994, and later went public in 1997. The company is headquartered in Seattle, Washington, and is a member of the influential FAANG group of stocks. When it comes to stocks, Amazon is proof that small companies can do big things; the AMZN stock price was pennies when it was first listed and now it trades well over $100 (split adjusted) per share.

The company is not a true retailer nor a pure-play manufacturer but in the business of connecting consumers and merchants together. The website was first created as a means of selling books at a discount but it has since grown to include most verticals in the retail sector. A few of the products the company does manufacture are the Kindle and Fire Tablets, Fire TVs, and smart home devices like Echo. Echo is powered by an AI personality named Alexa which can take vocal commands from its users.

Today, Amazon operates in three segments including North America, International, and Amazon Web Services. The first two segments are the core retail business while Amazon Web Services includes a host of Internet-related services for consumers and businesses alike. A little-known fact is that Amazon Web Services is as important to the function of the Internet as Google because of the infrastructure it provides and it hosts so many business websites.

Services provided by Amazon for merchants include listing, fulfillment, and advertising as well as subscriptions. Services provided by Amazon Web Services include cloud computing, storage, database maintenance, analytics, machine learning, and even artificial intelligence. In regard to the company's operations, Amazon Web Services is the smaller of the three segments but is a fast-growing and well-established part of the business that has had a positive influence on the AMZN stock price.

Among the many ancillary services provided by Amazon is Kindle Direct Publishing. This is a cloud-based service that enables writers and publishers to publish their works directly in the Kindle Store. Kindle, if you are unaware, is an Internet-connected tablet designed for reading books but also streams other forms of entertainment. Amazon also develops and publishes its own media content that is available via Kindle or the Amazon App that can be found on most smart TVs.

Amazon is also a disruptor, moving into new digital markets whenever it thinks it can make a profit. The move into streaming is only one example, another is a push into healthcare. Amazon Prime is another disruptive move and is a subscription service that entitles members exclusive access to Amazon services.

Amazon's stock price can be affected by factors including the pace of revenue growth, profitability, growth in the AWS segment, and any stock splits that may occur. The Amazon share price was impacted by splits 4 times between the IPO in 1997 and June 2022 and additional splits should be anticipated. The forecast for Amazon stock, splits aside, is for steadily increasing price action punctuated by pullbacks, corrections, and consolidations. While there is competition for Amazon, this company is entrenched and will stand the test of time because eCommerce is the way businesses thrive in today's markets.

Further Catalysts for the AMZN Weekly Options Trade…..

While some of that new advertising revenue will go towards content spend for the video platform, a chunk of it will go towards boosting Amazon's profit margins, which should be good news for the stock, according to the note.

"Ad revenue strength has the potential to contribute to our margin upside thesis on the stock, as our analysis suggests advertising revenue will contribute 370 basis points to 2023 North America margins," Post explained adding that combined with efficiencies in its retail business, Amazon has big profit upside in 2024.

That profit margin upside could surprise Wall Street in 2024, as their earnings estimates for the e-commerce giant appear conservative.

"We believe Amazon's North American retail margins still have significant room to grow with potential to reach 7% based on Amazon's commentary and our advertising estimates, well above [Wall] Street estimates at 5.7% in 2025," Post said.

Even Bank of America's own projections on Amazon's profit potential in 2024 could be conservative, according to the note.

"We think Street and BofA projections may be conservative given the rate of Amazon's margin improvement in 2023, lack of big investment areas in 2024, and our estimates for close to $3 billion in incremental North American subscription and advertising revenue from Prime Video," Post said.

Other Catalysts.....

CEO Andy Jassy indicated that $7 billion of Amazon's $17 billion 2022 media content spend was for Prime Video content production & licensing. Amazon's recent announcement of a $3 NA monthly premium for ad-free Prime Video suggests that Amazon will ramp up video ads more aggressively in FY24.

Media.....

A recent report from Axios suggests that e-commerce giant Amazon (NASDAQ: AMZN) is discussing a strategic investment and streaming partnership with Diamond Sports Group, which operates Bally Sports, a bundle of U.S. regional sports networks with broadcasting rights to over 40 professional teams across the MLB, NHL, and NBA.

E-commerce is Amazon's claim to fame. It's the runaway leader in the United States with over 37% share of online sales. Its cloud platform, Amazon Web Services (AWS), is also a leader in its field and the company's primary profit maker. But media could emerge as the company's next big business. Management has actively invested in wading deeper into the media industry.

It acquired media studio MGM for $8.5 billion in 2022, giving it rights to over 4,000 films and 17,000 TV episodes. It then bought the rights to broadcast NFL games via Thursday Night Football. It remains to be seen if Amazon strikes a deal with Diamond Sports, but the company's regional networks are home to dozens of professional sports teams in the MLB, NHL, and NBA.

Media companies make money from advertisements, and Amazon has already become a force there. It racked up $32 billion in ad sales through nine months of 2023. Adding more live sports content, arguably the crown jewel of media would naturally draw more eyeballs (and ad dollars) to Amazon's platform. Adding other professional sports content would be a big win for Amazon, considering the NFL season is only a few months long.

Looking Ahead.....

Amazon reported strong third-quarter results and provided a positive outlook for fourth-quarter earnings. While the fourth-quarter revenue projection was slightly below expectations, and there was no clear declaration that the third quarter marked the lowest point for AWS (Amazon Web Services), there were promising signs of growth in AWS deal numbers, optimization efforts, and discussions about the scale of AI usage.

Amazon's management comments indicated a stabilization in reduced client spending on cloud services, which may signify the bottom of AWS's growth rate decline. AWS's growth rate dropped to 12% in the third quarter in constant currency, down from 28% in the third quarter of the previous year and 39% in the third quarter of the year before that. This aligns with similar statements from Microsoft (MSFT) on October 24 regarding the strength of the cloud business, and it could suggest a potential rebound for the industry in 2024.

All in all, the management's comments suggest a likely acceleration in the near future. With AWS poised for growth, North America's operating income surpassing expectations, the international business nearing break-even, and steady double-digit revenue growth, Amazon remains a standout in terms of earnings growth prospects as we enter 2024.

Further Growth.....

Amazon.com is building a global logistics network to support the explosive growth in its online and physical-store operations, as well as to control transportation costs that ballooned to $83.5 billion in 2022 from $16.2 billion in 2016. Most of the e-commerce giant's logistics endeavors begin as internal solutions that evolve into services it can offer shippers inside and outside of its Marketplace.

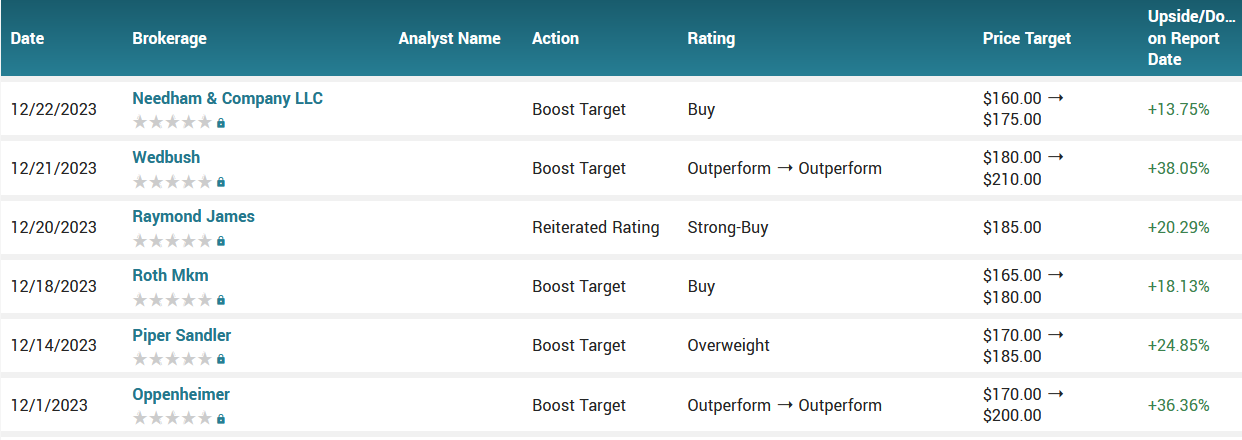

Analysts.....

Amazon bulls are ringing in the new year by highlighting opportunities for the huge online retailer to bulk up its position in multiple realms.

In a report released yesterday, Mark Shmulik from Bernstein maintained a Buy rating on Amazon, with a price target of $175.00. The company’s shares closed yesterday at $149.93.

In a report released yesterday, Bank of America Securities also maintained a Buy rating on the stock with a $168.00 price target.

Advertising checks for ad spending on Amazon.Com Inc remain strong (Skai 4Q marketplace ad spending increased 48% Y/Y through Nov), BofA analyst Justin Post writes.

He expects Amazon's 2024 ad growth to be aided by new initiatives, including more ads in Prime Video and the ramp of new ad partnerships.

Ad revenue strength can potentially contribute to his margin upside thesis on the stock, as his analysis suggests advertising revenue will contribute 370 bps to FY23 North America (NA) margins.

BofA maintained a Buy rating on Amazon with a price target of $168.

In addition to retail efficiencies, the analyst sees potential for ad revenue upside to drive margin upside in 2024.

The Wedbush team, led by Scott Devitt, maintained their Outperform rating and lifted their price target to $210 from $180 in a report titled “Still Day One for Amazon Ads; The Everything Stock.”

According to the issued ratings of 44 analysts in the last year, the consensus rating for Amazon.com stock is Buy based on the current 1 hold rating, 42 buy ratings and 1 strong buy rating for AMZN. The average twelve-month price prediction for Amazon.com is $171.59 with a high price target of $230.00 and a low price target of $116.00.

Summary.....

Amazon.com shares were up +75.7% over the past year. The company is gaining on solid Prime momentum owing to ultrafast delivery services and strong content portfolio. Strengthening relationship with third-party sellers is a positive.

Additionally, strong adoption rate of AWS is aiding the company’s cloud dominance. Expanding AWS services portfolio is continuously helping Amazon in gaining further momentum among the customers. Robust Alexa skills and expanding smart home products portfolio are positives.

The company’s strong global presence and solid momentum among the small and medium businesses remain tailwinds.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from AMAZON

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.