TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Amazon (AMZN) Provides Profit With Quick Trades!

And Members Make Quick

Potential Profits, 28% and 19%,

As Well As Setting Up For A Future Trade,

By

Buying and Selling Weekly Call Options!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profits Of 28% and 19%,

As well As Re-buying A New Contract ,

As J.P. Morgan Analysts Doug Anmuth And Bryan M. Smilek See

Amazon Dominating In Two Lucrative

Industries: E-Commerce And Cloud Computing.

Where To Now?

The growth of Amazon shows the sort of resilience that Wall Street has been hoping to see out of e-commerce businesses, which had a tough 2022.

This year, Amazon's GMV is growing due to "solid growth in under-penetrated categories" like grocery and apparel, "faster delivery speeds, with 2023 tracking toward Amazon’s fastest delivery speeds ever,

This set the scene for Weekly Options USA Members to profit by Make Potential Profits Of 28% and 19%, as well being set for future profits using an AMZN Weekly Options trades!

Join Us And Get The Trades – become a member today!

Wednesday, June 28, 2023

by Ian Harvey

Why the AMZN Weekly Options Trade was Executed?…..

Amazon.com, Inc. (NASDAQ: AMZN) is set to hit a major milestone in 2024: Becoming the largest retailer in the US, according to J.P. Morgan analysts Doug Anmuth and Bryan M. Smilek. Amazon dominates two lucrative industries: e-commerce and cloud computing.

If this comes to pass, Amazon will be unseating Walmart (WMT) as the country's largest retailer. It would be a seismic shift, one driven by increased e-commerce penetration, faster delivery times, and the stickiness of Amazon Prime. J.P. Morgan estimates show that, in 2023, Amazon's gross merchandise volume, or GMV, will grow 11.6% year-over-over to $477 billion.

Amazon's e-commerce business will also benefit from increased business-to-business capabilities, new fintech offerings like Buy With Prime, and estimated growth in the number of third-party sellers operating in the company's marketplace, they added.

J.P. Morgan estimates that there will be about 300 million Prime members globally by the end of this year. In 2021, then-CEO Jeff Bezos said the company had "more than 200 million Prime members worldwide."

Also, Amazon's Prime customer loyalty service is among the company's crown jewels. The company offers free overnight and second-day shipping on a broad cross-section of the products on its site, but that's just the beginning.

The AMZN Weekly Options Trade Explained.....

** OPTION TRADE: Buy AMZN JUL 14 2023 130.000 CALLS - price at last close was $3.47 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

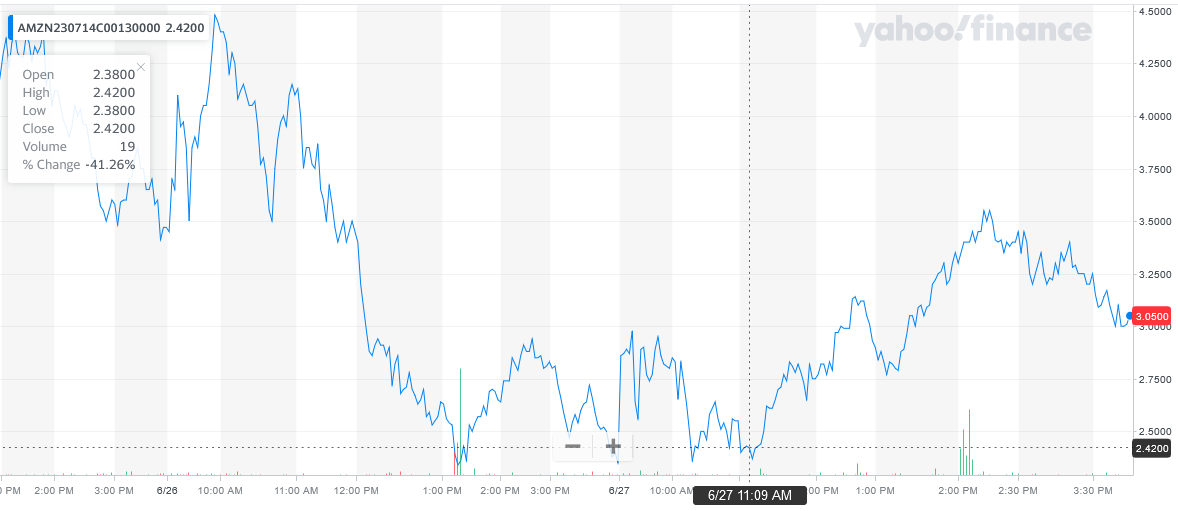

Entered the AMZN Weekly Options (CALL) Trade on Monday, June 26, 2023, at 9:42, for $3.50.

Sold the AMZN Weekly Options Contracts on Monday, June 26, 2023, at 9:58, for $4.48; a potential profit of 28%.

Re-entered the AMZN Weekly Options (CALL) Trade on Monday, June 26, 2023, at 10:42, for $3.50.

Re-sold the AMZN Weekly Options Contracts on Monday, June 26, 2023, at 10:56, for $4.15; a potential profit of 19%.

Re-bought the AMZN Weekly Options (CALL) Trade on Monday, June 26, 2023, at 1:14, for $2.34.

Re-sold HALF the AMZN Weekly Options Contracts on Tuesday, June 27, 2023, for $3.55; a potential profit of 62%.

Holding the remaining AMZN weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Amazon.com.....

Amazon, or Amazon.com, is the world's largest and leading portal for eCommerce. It was founded by Jeff Bezos, incorporated in 1994, and later went public in 1997. The company is headquartered in Seattle, Washington, and is a member of the influential FAANG group of stocks. When it comes to stocks, Amazon is proof that small companies can do big things; the AMZN stock price was pennies when it was first listed and now it trades well over $100 (split adjusted) per share.

The company is not a true retailer nor a pure-play manufacturer but in the business of connecting consumers and merchants together. The website was first created as a means of selling books at a discount but it has since grown to include most verticals in the retail sector. A few of the products the company does manufacture are the Kindle and Fire Tablets, Fire TVs, and smart home devices like Echo. Echo is powered by an AI personality named Alexa which can take vocal commands from its users.

Today, Amazon operates in three segments including North America, International, and Amazon Web Services. The first two segments are the core retail business while Amazon Web Services includes a host of Internet-related services for consumers and businesses alike. A little-known fact is that Amazon Web Services is as important to the function of the Internet as Google because of the infrastructure it provides and it hosts so many business websites.

Services provided by Amazon for merchants include listing, fulfillment, and advertising as well as subscriptions. Services provided by Amazon Web Services include cloud computing, storage, database maintenance, analytics, machine learning, and even artificial intelligence. In regard to the company's operations, Amazon Web Services is the smaller of the three segments but is a fast-growing and well-established part of the business that has had a positive influence on the AMZN stock price.

Among the many ancillary services provided by Amazon is Kindle Direct Publishing. This is a cloud-based service that enables writers and publishers to publish their works directly in the Kindle Store. Kindle, if you are unaware, is an Internet-connected tablet designed for reading books but also streams other forms of entertainment. Amazon also develops and publishes its own media content that is available via Kindle or the Amazon App that can be found on most smart TVs.

Amazon is also a disruptor, moving into new digital markets whenever it thinks it can make a profit. The move into streaming is only one example, another is a push into healthcare. Amazon Prime is another disruptive move and is a subscription service that entitles members exclusive access to Amazon services.

Amazon's stock price can be affected by factors including the pace of revenue growth, profitability, growth in the AWS segment, and any stock splits that may occur. The Amazon share price was impacted by splits 4 times between the IPO in 1997 and June 2022 and additional splits should be anticipated. The forecast for Amazon stock, splits aside, is for steadily increasing price action punctuated by pullbacks, corrections, and consolidations. While there is competition for Amazon, this company is entrenched and will stand the test of time because eCommerce is the way businesses thrive in today's markets.

Abbreviated.....

Amazon is the world's largest online retailer by market cap. The company began as an online bookseller and has since grown to encompass virtually every category of retail. Besides selling products through its e-commerce platform, Amazon owns subsidiaries including Whole Foods Market and home security company Ring. Amazon's fastest-growing areas of business are cloud computing services, subscription products like Amazon Prime, and streaming movies and other entertainment.

- Revenue (TTM): $502.19 billion

- Net Income (TTM): $11.32 billion

- Market Cap: $916.82 billion

- 1-Year Trailing Total Return: -44.35%

Further Catalysts for the AMZN Weekly Options Trade…..

The growth of Amazon shows the sort of resilience that Wall Street has been hoping to see out of e-commerce businesses, which had a tough 2022. Though e-commerce businesses like Amazon saw major booms during the pandemic, last year saw a pullback. It was the first year since 2009 that US e-commerce grew less than 10%, the analysts noted, adding just 8.5% year-over-year, "likely driven by macro pressures, the resurgence of [brick-and-mortar] retailers, and the shift toward omni-channel retail following the pandemic," Anmuth and Smilek wrote on June 20.

This year, Amazon's GMV is growing due to "solid growth in under-penetrated categories" like grocery and apparel, "faster delivery speeds, with 2023 tracking toward Amazon’s fastest delivery speeds ever," and the "Prime flywheel," the idea that the company's much-discussed subscription service builds momentum at every step in the experience, the analysts wrote.

Amazon also has a massive grip on the e-commerce marketplace and, at the end of 2023, J.P. Morgan analysts expect the company's e-commerce market share to be 42.2%, an increase of 106 basis points year-over-year.

J.P. Morgan's bullishness on Amazon also ties back to the belief that the company will leverage generative AI in its e-commerce operations, suggesting that a "ChatGPT-style product search would create an interactive conversational experience" which the analysts believe would "enable Amazon other retailers to provide a more personalized customer experience" and that AI could also "could enable Amazon and other retailers to leverage a breadth of customer purchase history and data and enhance personalized recommendations."

Other Catalysts.....

In the U.S., the tech company holds a 38% market share in e-commerce, with the second-largest share being Walmart, at 6%. Amazon's dominance in online retail means it has the most to gain from the industry's growth. Meanwhile, data from eMarketer shows the e-commerce market hit $5.7 trillion in 2022, with online sales making up about 20% of all retail purchases. That percentage is projected to hit 24% by 2026, with the market rising to a value of $8 trillion.

Also, Amazon has a solid position in the booming artificial intelligence (AI) industry as the home of the world's biggest cloud platform, Amazon Web Services. The cloud service boasts a leading 32% share of the market, ahead of competitors like Microsoft's Azure and Alphabet's Google Cloud

AI & Code Whisperer.....

Previously, Amazon used AI and machine learning for functions like product recommendations and inventory management. It also uses it for practical considerations like the fastest and cheapest modes of fulfillment and delivery. With Amazon's years of data through probably billions of purchases, these are powerful tools that generate higher sales, efficiency, and customers satisfaction.

Recent technological developments have changed generative AI from what was lackluster performance to incredible results, which resulted in the explosion of ChatGPT and similar tools when they were introduced a few months ago. Never one to sit out what could be a lucrative opportunity, Amazon has entered the generative AI ring as well.

In April, management announced that it was launching generative AI capabilities for AWS, and they have significant far-reaching consequences that will change how programmers work. The effort is underpinned by technology called Amazon Bedrock. Amazon Bedrock is a foundation model (FM), or a large-language model, that is so developed from machine learning and myriad data points that it can provide truly productive and reliable generative AI tasks.

Another service Amazon launched is called Code Whisperer. This service lets developers give a prompt for what code they want to develop, and the system provides the code.

Both of these tools use technology similar to AutoGPT, a next-level tool that works with ChatGPT. Users provide it with an overarching goal, and the technology self-generates the prompts necessary for each step of attaining that goal. It's even more humanlike than ChatGPT, and it can learn and improve as it generates results.

Loyalty Service.....

Subscribers gain access to streaming movies and television shows via Amazon Prime Video, more than 100 million songs via Amazon Music, video games via Prime Gaming, discounts at the company's Whole Foods Market grocery store, and digital books via Prime Reading. Customers get all this and more included with the cost of subscription, which runs $139 per year, or $14.99 per month.

Subscribers are keen to get their money's worth, too, which is why Prime subscribers tend to lay out much more than nonmembers, according to estimates compiled by Consumer Intelligence Research Partners (CIRP). Figures released last year by CIRP estimate that Prime customers spend roughly $1,200 per year on average, double the $600 per year spent by nonmember customers.

That alone illustrates the value of Amazon's customer loyalty program -- but that's just the tip of the iceberg.

One of the more useful trappings of Amazon Prime is Subscribe & Save (S&S), the company's recurring shipments service. The program allows customers to opt for regularly scheduled deliveries of their most-used or favorite items at set intervals.

Analysts.....

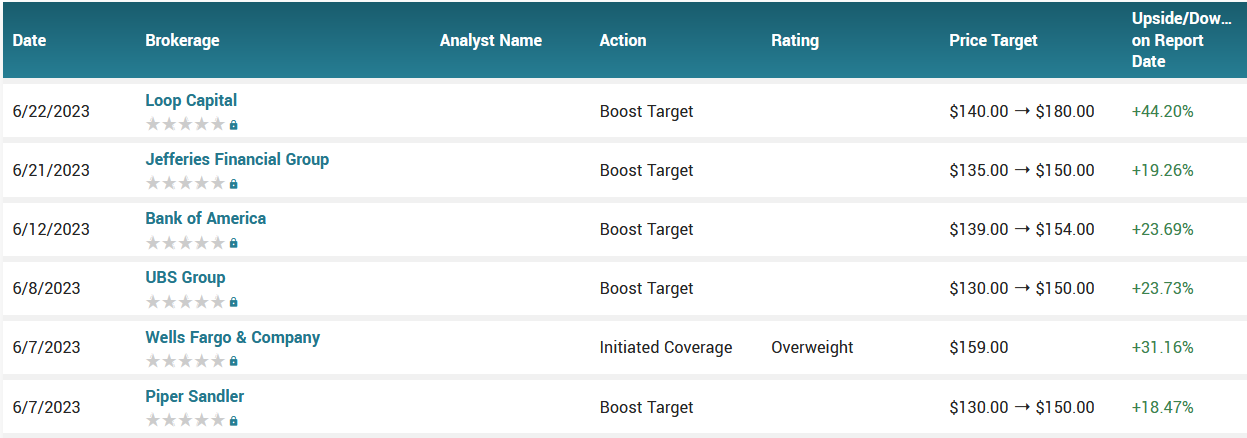

Amazon. had its price target raised by analysts at Loop Capital from $140.00 to $180.00 in a research note issued on Thursday. Loop Capital’s price objective would suggest a potential upside of 39.18% from the stock’s current price.

On June 21, Jefferies analyst Brent Thill raised his price target on AMZN stock to $150 from $135. The analyst maintains a bullish outlook on the company’s prospects and expects it to benefit from improving profitability, recovery in the AWS segment, and artificial intelligence.

While AWS is likely to support growth, JPMorgan analyst Doug Anmuth believes Amazon could become the largest U.S. retailer in 2024, surpassing Walmart. Anmuth termed AMZN stock as the “Best Idea” in its sector and reiterated a Buy rating on June 20.

Earlier in May, Mizuho Securities analyst James Lee highlighted that the “AWS’ Gen-AI (Generative AI) demand has been accelerating due to its ease-of-transition and product differentiation.” Further, due to the premium pricing of AWS’ Gen-AI, it will likely support revenue and margins.

According to the issued ratings of 43 analysts in the last year, the consensus rating for Amazon.com stock is Moderate Buy based on the current 2 hold ratings and 41 buy ratings for AMZN. The average twelve-month price prediction for Amazon.com is $146.41 with a high price target of $270.00 and a low price target of $111.00.

Summary.....

The easing of inflationary cost headwinds, reacceleration in AWS’ growth rate, cost-saving measures, and benefits from AI tailwinds position AMZN well to deliver solid financial performances in the future.

Amazon stock is up 54% so far this year, and investors should expect continued upward movement as it innovates with new technology and dominates new fields.

Amazon.com has a quick ratio of 0.69, a current ratio of 0.92 and a debt-to-equity ratio of 0.43. Amazon.com has a 52-week low of $81.43 and a 52-week high of $146.57. The business’s 50-day moving average price is $115.35 and its 200 day moving average price is $102.12. The firm has a market cap of $1.33 trillion, a P/E ratio of 307.93, and a P/E/G ratio of 2.44 and a beta of 1.26.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from AMAZON

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.