TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Alphabet

Inc Provides 63%

Potential Profit Using A Weekly Option

In Less Than 5 Hours!

Members of “Weekly Options USA,” Using A Weekly Call Option, Make Potential

Profit Of 63%,

After Hedge Fund Managers Scooped Up Shares Of Alphabet On

The Dip!

where to now?

Join

Us and GET FUTURE TRADEs!

Shares of Alphabet Inc (NASDAQ: GOOG, GOOGL) have continued to move higher after unveiling its latest AI tools at a developer’s conference last week.

This set the scene for Weekly Options USA Members to profit by 63%, in less than 5 hours, using a GOOGL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, May 17, 2023

by Ian Harvey

Why the Alphabet Inc Weekly Options Trade was Executed?

Several famous hedge fund managers seem to be helping Alphabet Inc (NASDAQ: GOOG, GOOGL) rise above the market.

In the first quarter, Alphabet suffered a barrage of questions around how AI might pose a threat to its businesses. Matters weren't helped at all when the company made a hastily put-together demonstration of its ChatGPT competitor Bard on Feb. 8. The chatbot gave a wrong answer at the demonstration, upon which Alphabet's stock fell.

But it looks as if several prominent hedge fund managers who practice value investing thought those fears were far overdone, and scooped ups shares on the dip.

That roster of managers looks like a who's who of famous value investors, including Baupost Group's Seth Klarman, who wrote the book Margin of Safety; Appaloosa's David Tepper; and Point72's Steve Cohen, all of whom boosted their stakes in Alphabet in the first quarter.

Perhaps the most notable buy came from Pershing Square Holdings' Bill Ackman, who runs the most concentrated, high-conviction portfolio of them all. In the first quarter, Ackman initiated a new position in Alphabet, with the purchase of both A and C shares combining to make up 10.4% of Pershing Square's portfolio at the end of the first quarter.

Shares in the Google-owner had lagged behind other megacaps this year amid fears it was losing ground in the race to deploy AI products. Yet since it unveiled its latest AI tools at a developer’s conference last week, the stock has advanced 12%, adding $160 billion in market value and erasing its underperformance against peers like Apple Inc. and Microsoft Corp.

“Investors are questioning whether Alphabet is a winner or loser as AI changes the landscape,” said Jason Benowitz, senior portfolio manager at CI Roosevelt. “This puts them more solidly in the winner camp.”

Alphabet continued its outperformance on Tuesday, rising 3.3%.

The Alphabet Inc Weekly Options Trade Explained.....

** OPTION TRADE: Buy GOOGL JUN 02 2023 120.000 CALLS - price at last close was $2.60 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the GOOGL Weekly Options (CALL) Trade on Wednesday, May 17, 2023, at 9:53, for $2.30.

Sold half the APPL weekly options contracts on Wednesday, May 17, 2023 for $3.75; a potential profit of 63%.

Holding the remaining GOOGL weekly options contracts for further profit as the week progresses.

About Alphabet (NASDAQ:GOOGL).....

Alphabet Inc. is the parent company of a host of technology services that include the iconic Google search engine and all the associated apps that go with it. The company is the G in the FAANG stock acronym and a blue-chip operator of Internet infrastructure. The company was founded on September 4 1998 by Larry Page and Sergey Brin while the two were Ph.D. students at Stanford.

The original product was a tool for searching the rapidly growing Internet that revolutionized the budding Search Engine industry. Since its founding, Google has become the world’s premier and leading search engine commanding an estimated 86% of the search market in 2021. The company abruptly changed its name and operating structure in 2015 making it a parent company with Google a subsidiary. This provided some protection against anti-trust lawsuits, improved accounting, and allowed the company to expand into areas outside of search.

Alphabet provides various products and platforms globally, where it is permitted, and operates in three broad segments. The three operating segments are Google Services, Google Cloud, and Other Bets. The company is headquartered in Mountain View, California, and is located within a sprawling complex of modernized and new buildings called the Googleplex. The Googleplex is prominently located within the San Francisco Bay Area and is the company’s largest complex. Employees working in the Googleplex are afforded free transportation on the company’s shuttle bus system as well as other ground-breaking perks.

Further Catalysts for the GOOGL Weekly Options Trade…..

Google is not exactly a slouch when it comes to artificial intelligence (AI), especially after it acquired DeepMind in 2014. At its recent I/O conference, CEO Sundar Pichai highlighted several AI innovations, noting that AI features were used 180 billion times in Google Workspace last year.

Pichai also unveiled PaLM, the company's newest large-language model used for generative AI, which can write computer code, translate 100 languages, and is now powering the oft-maligned Bard.

Services.....

Using AI and machine learning technologies, Alphabet can offer users more personalized and relevant experiences, increasing engagement and usage of its existing products, including search, YouTube, and others.

An improved user experience, in turn, will keep users coming back for more of its services. A happy customer cohort will, ultimately, benefit Alphabet's monetization efforts -- think advertising.

AI will also have a more direct impact on Alphabet's advertising business. For example, by using machine learning algorithms to target ads more effectively to users, Google can increase the efficacy of its advertising, leading to higher click-through rates (and ad revenue). So advertisers get more exposure, individual users receive more relevant ads, and Google gets more revenue. A win-win for all parties!

Google Cloud.....

By incorporating AI technologies, Google Cloud can offer its customers more sophisticated and personalized services. For example, the cloud operator can provide a range of machine learning (ML) services that enable organizations to build, train, and deploy their ML models without requiring AI or data science expertise. With these personalized ML models, companies can enhance their services and products and improve operational efficiency.

Besides, Google Cloud's AI capabilities can provide enhanced security and threat detection, which is increasingly important as businesses face more advanced cyber threats. On top of that, by leveraging AI in big data analytics, the tech company can provide customers with more sophisticated data analysis capabilities and help them gain deeper insights into their operations, customers, and markets.

In short, by equipping its platform with advanced AI capabilities, Google Cloud is well positioned to capture a larger share of the cloud computing market in the future. From 2020 to 2022, the company's global cloud computing market share grew from 7% to 10%. This trend could continue in the coming years as it further leverages AI in its cloud offerings.

Earnings.....

Alphabet last issued its earnings results on Tuesday, April 25th.

The information services provider reported $1.17 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $1.06 by $0.11. Alphabet had a return on equity of 22.84% and a net margin of 20.58%.

The firm had revenue of $69.79 billion for the quarter, compared to analysts’ expectations of $57.19 billion.

During the same quarter last year, the business earned $1.23 earnings per share. As a group, analysts forecast that Alphabet Inc. will post 5.39 earnings per share for the current fiscal year.

Moving Forward.....

Alphabet's investments in advanced AI could also open up entirely new business opportunities.

The development of its self-driving car technology, which relies heavily on advanced AI algorithms to interpret and respond to real-world driving scenarios, is an excellent example. While it's still early, Alphabet has incorporated Waymo, a leading self-driving car business, to develop further and commercialize its self-driving technologies.

Another example is its life science subsidiary, Verily Life Science, which uses AI to analyze large amounts of medical data to develop new treatments and cures for various diseases. By leveraging machine learning algorithms, Verily can identify patterns that would be difficult or impossible for humans to detect. And as AI technologies continue improving, Verily could develop more effective and targeted treatments, revolutionizing the healthcare industry

Alphabet's investment in AI and machine learning technologies has positioned the company for success in multiple areas.

Alphabet can leverage AI technologies to improve its core offerings, such as search and cloud computing. Additionally, AI has the potential to open new income streams for the company, revolutionizing industries such as healthcare and transportation.

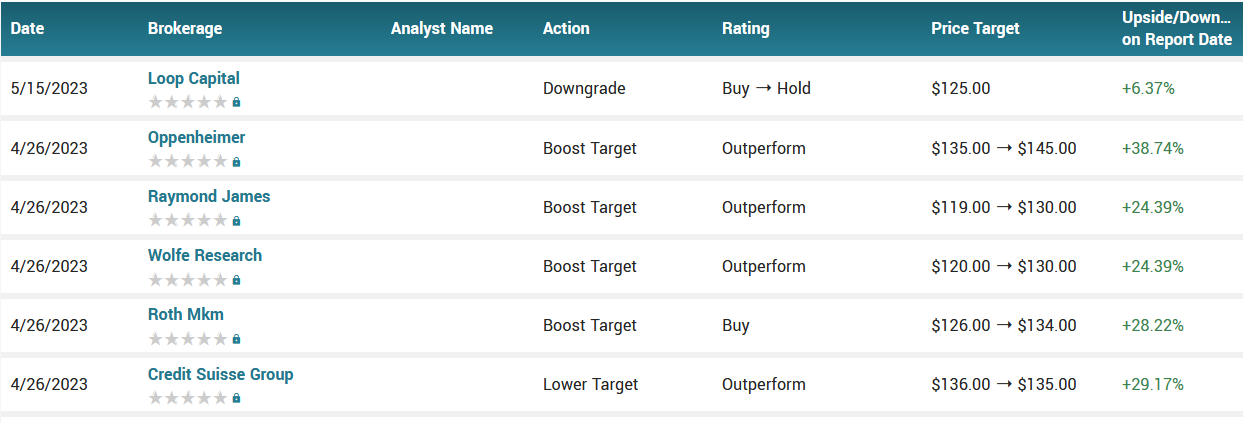

Analysts.....

Last week’s announcement of a more conversational search engine and that the company is making its AI-powered chatbot more broadly available provided a timely boost.

Morgan Stanley analyst Brian Nowak was among Wall Street analysts heartened by Google’s presentation after what he called “AI overhang” in the stock.

If the company can successfully integrate the new AI features to its products that serve hundreds of millions of people, it should “build further confidence in AI driven upside to come,” Nowak wrote in a research note after the event.

The potential of AI could also lead to new opportunities, especially for Alphabet's cloud division, which turned a profit for the first time ever last quarter.

According to the issued ratings of 38 analysts in the last year, the consensus rating for Alphabet stock is Moderate Buy based on the current 4 hold ratings, 33 buy ratings and 1 strong buy rating for GOOGL. The average twelve-month price prediction for Alphabet is $130.06 with a high price target of $160.00 and a low price target of $113.00.

Summary.....

The potential of AI could also lead to new opportunities, especially for Alphabet's cloud division, which turned a profit for the first time ever last quarter.

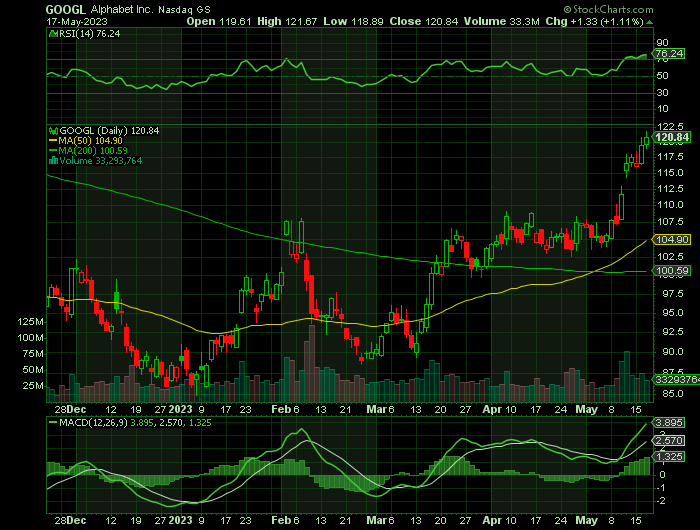

GOOGL traded up $3.00 during midday trading on Tuesday, reaching $119.51. 44,155,355 shares of the company were exchanged, compared to its average volume of 38,125,863. The company has a debt-to-equity ratio of 0.05, a quick ratio of 2.32 and a current ratio of 2.35. Alphabet Inc. has a one year low of $83.34 and a one year high of $122.43. The stock has a market capitalization of $1.52 trillion, a P/E ratio of 25.95, a PEG ratio of 1.35 and a beta of 1.10. The stock’s 50-day simple moving average is $104.14 and its 200 day simple moving average is $97.43.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ALPHABET INC

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.