TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Advanced Micro Devices (AMD) Provides Quick Profit In

10 Minutes!

Re-enters A New Call Option Trade At A Lower Price!

Members Make Quick Potential Profit of 19%,

By Buying and Selling a Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit OF 19%,

As Advanced Micro Devices (AMD) Continues To Build

On AI

Which Is Likely To Provide The Most Moving Forward.

Where To Now?

CEO Lisa Su believes artificial intelligence is Advanced Micro Devices (AMD) "largest and most strategic long-term growth opportunity."

This set the scene for Weekly Options USA Members to Make Potential Profit Of 19%, in 10 minutes, using an AMD Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, June 27, 2023

by Ian Harvey

Why the AMD Weekly Options Trade was Executed?…..

Advanced Micro Devices, Inc. (NASDAQ AMD) is a business that supplies the technology upon which AI is built and will likely provide the most profit moving forward.

The chipmaker intends to supply the vital processors that power the massive cloud computers that make AI possible.

Advanced Micro Devices has the potential to profit from the development of multiple industries. The company's chip business has granted it solid positions in a variety of markets, with its hardware powering cloud platforms, AI models, game consoles, PCs, and more. As the tech industry expands, more and more companies will be turning to chipmakers like AMD to take their devices to the next level, bolstering the semiconductor company's stock over the long term.

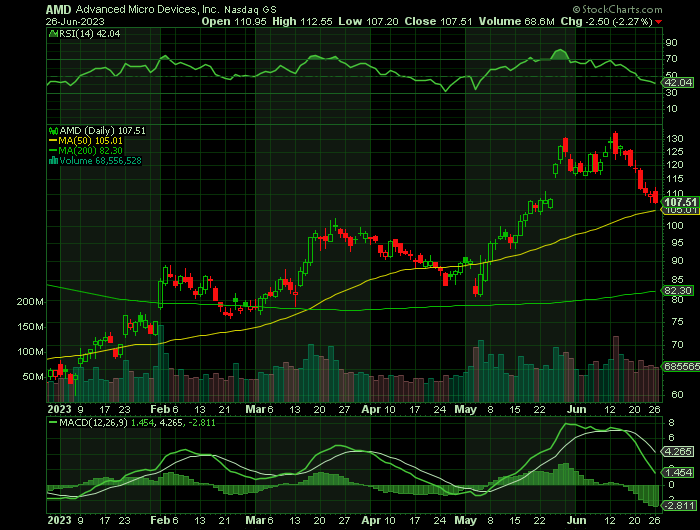

AMD's stock may have taken a deep dive last year, but those who took advantage of the bear market have benefited from its 72% rise since Jan. 1. Wall Street has grown particularly bullish about AMD this year, thanks to its potential in AI. The company's chips can run and develop AI software, with the market expected to expand at a compound annual growth rate of 37% through 2030.

Additionally, AMD's financials are on a solid growth track. Over the last five years, annual revenue has risen 265%, while operating income has increased 180%. Alongside a swiftly expanding business, AMD is an excellent option at almost any time but especially during a bear market.

The AMD Weekly Options Trade Explained.....

** OPTION TRADE: Buy AMD JUL 14 2023 112.000 CALLS - price at last close was $3.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Weekly Options (CALL) Trade on Monday, June 26, 2023, at 9:45, for $3.85.

Sold the AMD Weekly Options contract on Monday, June 26, 2023, at 9:56, for $4.60; a potential profit of 19%.

Re-bought the AMD Weekly Options (CALL) Trade on Monday, June 26, 2023, at 3:57, for $2.50.

Don’t miss out on further trades – become a member today!

About Advanced Micro Devices .....

Advanced Micro Devices, Inc., also known as AMD, is a semiconductor company operating in the global market. The company was incorporated in 1969 and is one of the oldest semiconductor manufacturers on the market today. Headquartered in Santa Clara, California, Advanced Micro Devices is fundamental to most verticals within the global economy.

Advanced Micro Devices operates in two segments; Computing And Graphics and Enterprise, Embedded, and Semi-Custom. Advanced Micro Devices products span a range of semiconductor applications including microprocessors, chipsets, GPUs, data centers, system-on-a-chip, development services, and technology for gaming consoles which gives it some of the broadest exposure of any semiconductor company today.

Advanced Micro Devices markets its high-performance products under a host of brands that include AMD Ryzen, AMD Ryzen PRO, Ryzen Threadripper, Ryzen Threadripper PRO, AMD Athlon, AMD Athlon PRO, AMD FX, AMD A-Series, AMD PRO A-Series, AMD Radeon graphics, and AMD Embedded Radeon graphics brands and there are pro-models available in all categories.

The company serves OEMs across all verticals, cloud service providers, independent distributors, online retailers, and add-in-board manufacturers through a network of direct sales, independent distributors, and sales representatives that have offices in all major markets.

Advanced Micro Devices is run by a team of industry-leading innovators who believe in the concepts of high-performance and adaptive computing. Adaptive Computing is a technology that can learn and alter its functioning and adapt to meet the needs of its users. The push toward adaptive computing is being led by Dr. Lisa Su who joined the team in 2012 as a Senior Vice President and is now Chairman of the Board and CEO. Before joining Advance Micro Devices Dr. Su spent 18 years working in various positions at two other very high-profile semiconductor companies that are still in operation today.

The factor that makes AMD stand out from the crowd is its twin focus on high-performance computing and high-performance graphics. This focus gives AMD an edge over the competition because it is the best at combining the two aspects into custom solutions that are driving innovations and advancements in other industries and fields of research. The latest innovation, and one hailed as the biggest advance in CPU cache technology in over a decade, is the creation of the AMD EPYC processors which include AMDs 3-D V-Cache technology. The V-Cache technology alters the way data is stored in the cache and is resulting in up to 66% improvement in performance.

If quality, performance, leadership, and innovation aren’t enough to sway an investor Advanced Micro Devices is also a leader in the push toward sustainable and green operations. The company is on track to meet the four pillars of its plan which are 1) a 50% reduction in greenhouse gas emissions by 2030 2) reach a 30X increase in efficiency for many of its processors 3) 100% of suppliers must have public GHG goals and 4) 80% of suppliers sourcing renewable energy by 2025.

Further Catalysts for the AMD Weekly Options Trade…..

CEO Lisa Su believes artificial intelligence is AMD's "largest and most strategic long-term growth opportunity." Su is working to integrate the cutting-edge technology across the company's product lines. And she has her sights set on wrestling away market share from Nvidia.

AMD recently unveiled the MI300X, a high-performance graphics processing unit (GPU) designed to accelerate AI workloads. Providers of the most advanced AI applications, such as ChatGPT-creator OpenAI, rely on GPUs to train and run their AI models. "GPUs are enabling generative AI," Su said at an investor event earlier this month.

AMD is also developing software that combines with its chips to further optimize AI workloads. Nvidia's software expertise is a key part of its competitive edge. If AMD's new software can compare favorably -- and early indications suggest that it will -- the chipmaker could quickly become a formidable challenger to Nvidia in the AI arena.

Other Catalysts.....

AMD has yet to announce a major customer win among the leading cloud platforms, but it could be only a matter of time before it does. Amazon is reportedly testing AMD's new chips for its cloud division. Amazon Web Services (AWS) is the largest of all the cloud-computing networks, so a deal with the cloud titan could be a game changer for AMD.

To win more business, AMD is taking a different approach than Nvidia. AMD is offering potential cloud customers a smorgasbord of sorts from which they can choose among an assortment of AMD's AI hardware and software offerings to pair with their own custom-designed chips and parts provided by other suppliers.

AMD's strategy could resonate well with Amazon and other cloud-service providers that like to design their own servers. "We're betting that a lot of people are going to want choice, and they're going to want the ability to customize what they need in their data center," Su said during an interview with Reuters.

A deal with Amazon could allow AMD to quickly capture a sizable chunk of a data center AI accelerator market that's forecasted to increase fivefold to more than $150 billion by 2027, according to Su.

More Than AI.....

AMD, of course, is far more than just an AI story. Its chips power the leading video-game consoles, including Sony's PlayStation 5 and Microsoft's Xbox Series X|S. AMD thus stands to benefit as the global games market expands to over $200 billion in annual sales by 2025, as estimated by Newzoo.

Better still, AMD's nearly $50 billion acquisition of Xilinx in February 2022 made it a leader in the fast-growing adaptive computing market. The deal helped AMD's embedded segment produce $1.6 billion of revenue and $798 million of operating income in the first quarter alone, both of which were up nearly threefold from the prior-year period.

Analysts.....

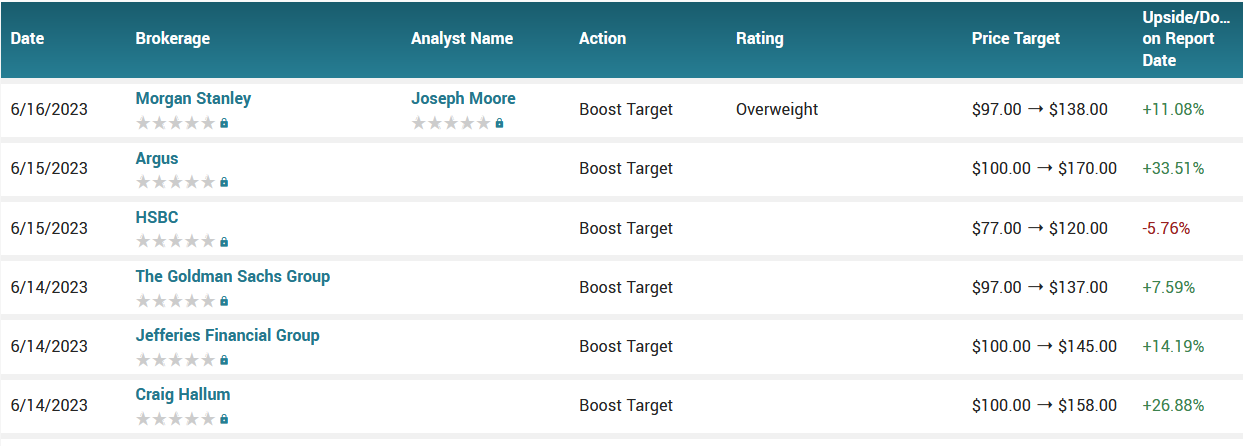

Raymond James upped their target price on Advanced Micro Devices from $110.00 to $145.00 in a research report on Wednesday, June 14th.

According to the issued ratings of 30 analysts in the last year, the consensus rating for Advanced Micro Devices stock is Moderate Buy based on the current 9 hold ratings, 20 buy ratings and 1 strong buy rating for AMD. The average twelve-month price prediction for Advanced Micro Devices is $125.06 with a high price target of $170.00 and a low price target of $80.00.

Summary.....

Advanced Micro Devices stock has a market cap of $177.16 billion, a price-to-earnings ratio of 478.30, and a PEG ratio of 8.32 and a beta of 1.92. The stock has a 50-day moving average of $105.97 and a 200-day moving average of $88.76. The company has a current ratio of 2.38, a quick ratio of 1.74 and a debt-to-equity ratio of 0.05. Advanced Micro Devices, Inc. has a 1-year low of $54.57 and a 1-year high of $132.83.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from AMD

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.