TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Advanced Micro Devices Continues To Outperform!

Weekly Options Members

Are Up 182% Potential Profit

Using A Weekly CALL Option!

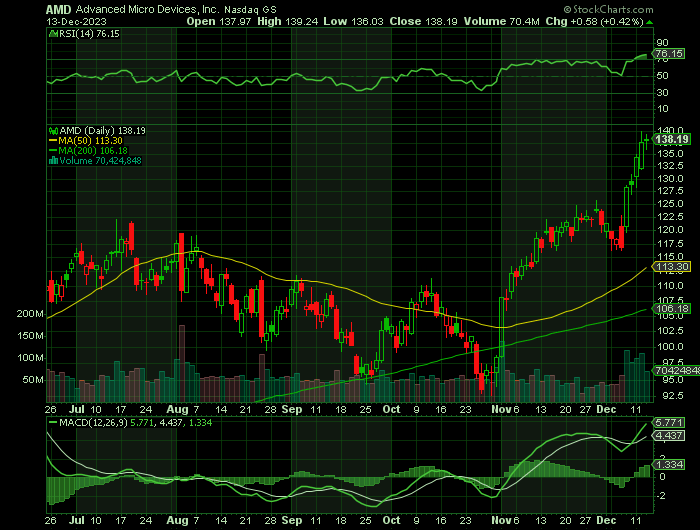

After a lackluster performance in 2022, shares of semiconductor giant Advanced Micro Devices have made a strong recovery and are up by nearly 100% so far in 2023. However, there are still many reasons the stock could go even higher in the coming months.

AMD CEO Lisa Su refuses to play second fiddle in the AI chip race to rival Nvidia, led by the black-leather-jacket-wearing Jensen Huang.

"There are going to be multiple winners in this market," Su said. "I think there's a great growth opportunity for us; we expect to gain market share."

This set the scene for Weekly Options USA Members to profit by 182%, using an AMD Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, December 13, 2023

by Ian Harvey

After a lackluster performance in 2022, shares of semiconductor giant Advanced Micro Devices, Inc. (NASDAQ AMD) have made a strong recovery and are up by nearly 100% so far in 2023. However, there are still many reasons the stock could go even higher in the coming months.

AMD's data center segment reported an impressive 21% sequential growth in revenue to $1.6 billion thanks to the widespread adoption of its third- and fourth-generation Epyc-brand processors by enterprises, cloud computing infrastructure providers, and AI infrastructure providers.

AMD is also focusing on the early ramp of its next-generation Instinct MI300 graphics processing units (GPUs), optimized for high-performance computing and AI workloads in the cloud.

The PC market seems to be on the verge of recovery, starting in the fourth quarter and continuing throughout 2024. The growth in the PC market is expected to be partly driven by increasing demand for AI processors and AI-enabled PCs.

The Advanced Micro Devices Weekly Options Potential Profit Explained.....

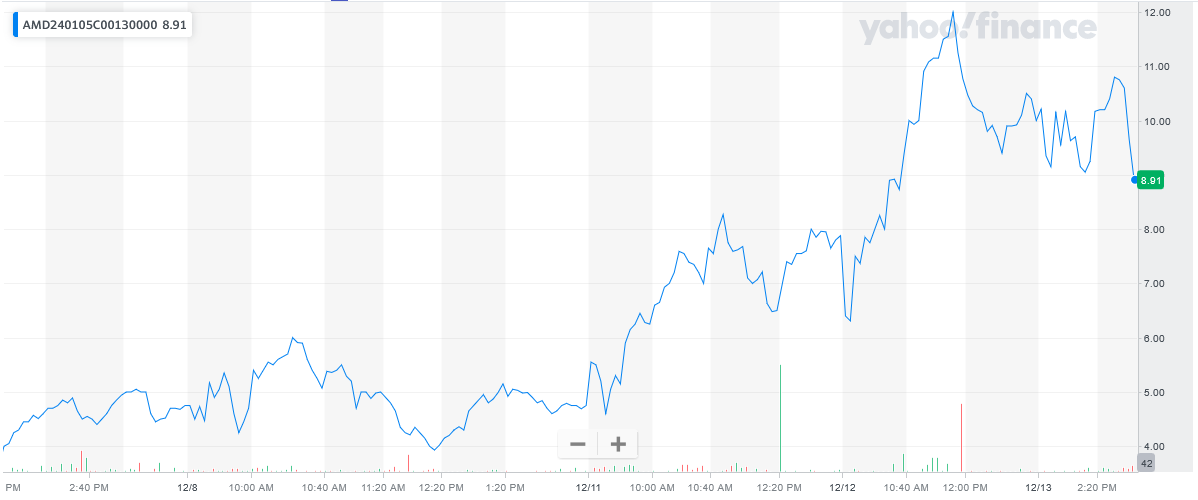

** OPTION TRADE: Buy AMD JAN 05 2024 130.000 CALLS - price at last close was $4.75 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Weekly Options (CALL) Trade on Friday, December 08, 2023 for $4.25.

The AMD weekly options contracts hit a high Tuesday, December 12 at $12.00; a potential profit of 182%.

Don’t miss out on further trades – become a member today!

Why the Advanced Micro Devices Weekly Options Trade was Originally Executed!

AMD CEO Lisa Su refuses to play second fiddle in the AI chip race to rival Nvidia, led by the black-leather-jacket-wearing Jensen Huang.

"There are going to be multiple winners in this market," Su said. "I think there's a great growth opportunity for us; we expect to gain market share."

Su just took her big shot at swiping the AI chip title from Nvidia (NVDA).

At its "Advancing AI" event held in Silicon Valley on Wednesday, AMD (AMD) unveiled its most advanced chip yet targeted at generative AI.

Dubbed the MI300x, it can use up to 192GB of memory, and boasts an astounding 153 billion transistors. Throughout her onstage presentation, Su played up the chip's better performance potential relative to "competitors" — a not so thinly veiled reference to Nvidia.

The beefy memory capabilities mean AMD's new chip could be used to train large language models — such as OpenAI's ChatGPT — commonly known as "LLMs."

Su tells us she has a "line of sight" to $2 billion in sales from this chip alone in 2024, and teased its potential upside.

"What we also said is we plan for success. From my perspective, customer demand is very high. We continue to work with our customers to deploy as quickly as possible, and we have much more supply than $2 billion. I do believe as we go through next year, we'll be able to update those numbers," Su added.

AMD estimated there was a $45 billion market for its data center artificial intelligence processors this year as it launched a new generation of AI chips on Wednesday.

The total addressable market forecast is up from AMD's $30 billion estimate in June.

Advanced Micro Devices announced not one, but two new AI data center chips from its MI300 lineup: one focused on generative AI applications, and a second chip geared toward supercomputers. The version of the processor for generative AI, the MI300X, includes advanced high-bandwidth memory that improves performance. For next year, AMD has a "significant" supply of AI chips that is "well above" $2 billion worth, CEO Lisa Su said at a press briefing. "So there's a lot of supply that we have - let's call it reserved - and we have a lot of customers, well above the $2 billion as well," Su said.

As AMD launched the new processors, company executives outlined how rapidly demand for AI chips has increased. The company said it now expects the market for data center AI chips to grow to roughly $400 billion by 2027.

Wall Street is warming up to the notion the AI chip race could see two horses lead the way. The Street gave Su high marks on Thursday for her presentation and team's powerful new chip.

"Rapidly-unfolding hyperscaler engagements, highly competitive AI architecture specs, along with accelerated new product roadmap, bode well for share gains and continued acceleration in AI-related revenue for AMD beyond 2024, while faster-than-expected rate of adoption so far could potentially drive upside in the AI revenue outlook for 2024, in our view. Significant software milestones place AMD on track for high-volume deployments ahead," said Baird analyst Tristan Gerra in a client note.

Gerra rates AMD's stock at outperform with a $125 price target, or about 5% above current price levels.

Conclusion.....

AMD is well-positioned to benefit from this industrywide trend thanks to the robust uptake of its Ryzen 7000 series PC processors, including Ryzen AI on-chip accelerators. All these tailwinds make AMD an attractive AI stock now.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Advanced Micro Devices

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.