TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Activision

Blizzard

Options Trade Is A Great Game Play!

“Weekly Options” Members

Profit Up 168% In 3 Days!

Another Trade TO BE CONSIDERED!

Sunday, June 27, 2021

by Ian Harvey

Activision Blizzard was expected to produce fresh highs; and they delivered, moving higher on Thursday, and hitting a high of $93.74on Friday.

“Weekly Options Members,” using an options call trade, made potential profits of 168% in 3 days!

Another trade has been considered.

Activision Blizzard, Inc. (NASDAQ:ATVI)

Prelude…..

Activision Blizzard is still struggling to overcome a ceiling at the $100 level, despite the equity making a home above that region in February, culminating in a February 16 all-time high of $104.53, before pulling back. But, this is now looking to be achievable over the next few days.

ATVI was on track to snap a week-long losing streak, and has finally broken out of the grind, producing positive price action on Thursday and again on Friday.

Activision Blizzard had an exceptional year in 2020, benefiting from the pandemic with their games - Candy Crush and Call of Duty.

The California games company’s market value leapt 57 per cent from the start of 2020 to almost $72bn.

Activision is known for Call of Duty and World of Warcraft and generates over $8 billion a year in bookings (a non-GAAP measure of revenue).

Activision has many good qualities investors look for in an investment. It has eight franchises that have generated $1 billion in lifetime bookings. It has a large player base of over 400 million monthly active users, and management has a great record of allocating capital through acquisitions that create shareholder returns.

Over the last year, the company generated a healthy free cash flow margin of 33% compared to revenue and paid $316 million in dividends to shareholders.

The Recommended Activision Blizzard Options Trade.....

** Buy ATVI JUL 09 2021 95.000 CALLS at approximately $0.65.

(Actually bought for $0.41)

Activision Blizzard Exiting Options Trade Call Success Explained.....

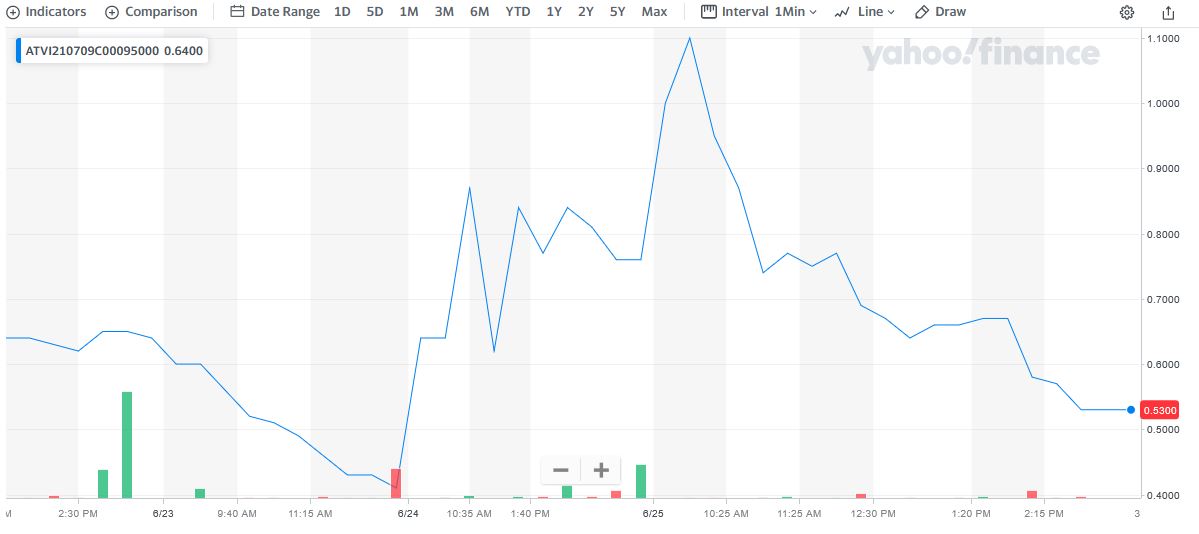

On Wednesday, June 23, 2021, “Weekly Options Members,” entered the trade mentioned above for $0.41.

On Thursday the exit price of the options trade had hit $0.87 – a potential profit of 112% or $46 after subtracting the buy price.

However, for those that retained their options trade, Friday saw the exit price hit $1.10 – now the potential profit is up 168% or $69.

The question now is should we exit the trade or wait for more profit?

Moving Forward…..

The Activision Blizzard option dropped on Friday afternoon (2:20) to a low of $0.53, and continued to do so.

This presents another opportunity on Monday to re-enter the trade, depending on market conditions.

Here is a good chance for you to become a member and find out what we are contemplating!

Why the Recommendation and the Reasoning behind

the Options Trade on Activision

Blizzard ….

Activision Blizzard, Inc. (NASDAQ:ATVI), one of the world's largest gaming companies, owns three publishers: Activision, which is best known for its Call of Duty titles; Blizzard, which publishes games like Overwatch, Diablo, World of Warcraft, and Hearthstone; and King, which conquered smartphones with Candy Crush.

ATVI fared well throughout the pandemic last year as stay-at-home measures prompted people to play more games.

Activision’s revenue rose 25% to $8.08 billion in 2020, and its net income increased 46% to $2.2 billion. Its non-GAAP EPS increased 39%.

Activision's flagship Call of Duty franchise drove most of the company's growth throughout the pandemic. King kept mobile gamers engaged with newer versions of Candy Crush, but Blizzard's aging titles -- namely World of Warcraft, Overwatch, and Hearthstone -- attracted few gamers.

At the end of the first quarter of 2021, Activision had 150 million monthly active users (MAUs), Blizzard had 27 million MAUs, and King had 258 million MAUs. Activision's 47% year-over-year growth in MAUs, which mainly came from Call of Duty, offset its declines at both Blizzard and King during the quarter.

Wall Street expects Activision's revenue and non-GAAP earnings to rise 4% and 8%, respectively, this year. Call of Duty could face tough year-over-year comparisons this year as the pandemic passes, while the newest expansion packs for World of Warcraft and Hearthstone should only help Blizzard tread water instead of swim forward.

The Major Catalysts for This Trade.....

1. Fresh Highs Expected.....

The shares of Activision Blizzard are still struggling to overcome a ceiling at the $100 level, despite the equity making a home above that region in February, culminating in a February 16 all-time high of $104.53, before pulling back.

ATVI is on track to snap a week-long losing streak, and could finally break above its 2021 breakeven mark, should today produces positive price action and then holds. Also, the equity recently pulled back to a historically bullish trendline that could help push the shares back toward record high territory.

Activision Blizzard stock just came within one standard deviation of its 160-day moving average, after spending considerable time above the trendline.

2. Buy On The Dip.....

Year to date, performance has been strong with ATVI delivering a beat and raise in the first quarter of this year. Margins are above 35% and there is still significant top and bottom-line growth. As ATVI continues into the year all signs are pointing to continued success, as their products have all-time momentum and engagement well after a year into their release.

Warzone has led to all-time records in MAUs and engagement while COD Mobile and Candy Crush have reinvigorated the mobile segment. ATVI’s offers a great way to play the secular growth of video games while also gaining exposure to the most popular franchise title and strongest operating model.

In recent days, ATVI has sold off drastically after a solid run up after consolidating earlier this year. With headlines about the release of Diablo and the shareholder meeting over the CEO's pay floating around, there has been volatility in the stock recently. In the past few sessions, ATVI has sold off by 5%.

As the leader in their class, this recent dip provides a solid opportunity to gain exposure to a secular growth story. At this current price, ATVI presents 10% upside to ATH, at a time when the company has never been stronger and the outlook has never looked better.

ATVI recently broke below its 7 and 50 day moving average after breaking out above their trend for a couple weeks. As this breakdown was stark and quick expect a sharp bounce back, especially given the muted atmosphere regarding the sell-off. Recent videogame sales figures pointed to growth against tough comps and offered positivity to the sector narrative. Keep your eyes open for a sharp bounce back and test of the 50 day at $94.50 and an eventual retest of the 7 around $96.20.

3. Earnings.....

The company reported first-quarter 2021 non-GAAP earnings of 98 cents per share, up 28.9% year over year. Consolidated revenues rose 27.2% year over year to $2.27 billion. Adjusting for revenues from non-reportable segments, net effect from the recognition of deferred revenues and elimination of intersegment revenues, total revenues jumped 35% to $1.98 billion. The Consensus Estimate for earnings and revenues was 69 cents per share and $1.75 billion, respectively.

However, Activision Blizzard witnessed a year-over-year rise in Monthly Active Users (MAUs) during the quarter ended Mar 31, 2021. Overall MAUs came in at 435 million in comparison with 407 million as of Mar 31, 2020. As well, the company’s net bookings rose 35.7% year over year to $2.06 billion. Going on, in-game net bookings were $1.34 billion, up 40.5% year over year.

Activision (44.9% of revenues) revenues rose 71.7% year over year to $891 million. The division had 150 million MAUs as of Mar 31, 2021, up 47.1% year over year. The segment’s top-line growth was driven by Call of Duty: Black Ops Cold War and Warzone in-game revenues, strong premium sales, and Call of Duty Mobile.

Also, Call of Duty franchise MAUs climbed sequentially and grew more than 40% year over year in the first quarter.

4. Steady Improvement In Income Margins.....

There has been a steady improvement in income margins in each business segment. As you can note Activision and Blizzards income margins have steadily improved over the last two years while the King segment has stayed relatively flat. This is logical as the King segment is by far the youngest, and thus more emphasis is placed on top-line growth.

As a whole, ATVI has improved margins by almost 2000 basis points from ~25% to ~45% while accelerating growth in their highest margin segment.

Growth in Activision’s segment revenue year over year was 72% while growth in King was 22% year over year.

This quarter demonstrates the power and non-cyclical nature of ATVI’s newfound top and bottom-line growth, which should change how ATVI is valued going forward. Margins in all segments were impressive again especially with Blizzard income margin almost testing all-time highs.

With ATVI's significantly high level of cash on hand, $9.3B in the most recent quarter, and their low debt load, expect significant investment in all sectors without the need for a strain on their heightened profitability. This could produce a powerful growth engine for a couple years and initiate multiple expansions, while ATVI stimulate their business with tactical deployments of cash.

5. Monthly Active Users (MAUs).....

Despite not releasing a COD title in Q1 2021, MAUs in the Blizzard franchise were at 150 million, 22 million players higher than past highs. This is a strong indication that the success ATVI found in this franchise during the pandemic has more legs than one might think. In fact it seems that the game is actually attracting new users and in fact gaining momentum even 12 months after its release.

Despite a year of heightened performance in both the top and bottom line, the market has still not fully priced in the power of the strategic changes, ATVI has deployed. This rise in interest is not just accretive the annual title sale of Call of duty, it is accretive year round with the new free-to-play microtransaction model. This development eliminates cyclicality, extends the live cycle of initial game investment and heightens profitability with an entirely new revenue segment.

6. Re-Acceleration of Growth in the Mobile Segment.....

A highlight to start the year has been the notable re-acceleration of growth in the mobile segment. Despite notable improvements to the re-opening outlook, mobile growth has been strong. ATVI specifically saw momentum in the King advertising segment which grew 77% year over year and highlighted that they expect it to continue. They released a competitive aspect into the game and other updates that have driven engagement and Ad sales.

Segment revenue growth overall was 22% in the mobile segment. Additional growth in this segment was recognized by the COD mobile title which has thrived off of Warzone's momentum with COD segment revenues up 72% Y/Y and income up 100% Y/Y and MAU's up 40% sequentially.

7. China Growth.....

Recent release in China should also fuel the growth in Asia that has been strong in the past year. As the market continues to grow within the US, and ATVI successfully brings its titles into the mobile space, this growth should be supplemented by international interest.

It seems as though a good amount of focus is being placed here currently and that will be the case going forward as they mentioned their focus and investment in the COD Mobile and Diablo Mobile game. This should be the main driver of growth going forward as the console franchises fight against all-time comps and popularity. And ATVI is positioned well to succeed in the space as they noted most top 10 mobile games are based off of pre-existing PC or console titles. As the owner of some of the strongest entertainment franchises in the space, they pose good chances for success here going forward.

8. Video Game Sales Strength.....

Videogame sales were up 3% Y/Y off of tough comps from 2020 when they rose 52% from 2019 numbers. YTD total sales are at $24.02B up 17% from the same period in 2020. Despite doubts, video games have continued their pandemic strength into this year.

The strength within this space is here to stay it seems, even with the current re-opening measures. While growth may dip as a sector, while some companies struggle to produce titles after a year of tightened labor, the trends are strong.

ATVI, as a leader and clear benefactor of the last 12 months poises the best potential to take advantage of this trend and continue their top and bottom line growth. As a secular growth sector, this trend of progression should continue, and it is likely that this pandemic only accelerated this trend both in the US and abroad.

9. Say on Pay Proposal.....

Activision Blizzard Inc. and its shareholders have been at odds about the chief executive’s compensation for years, but as CEO Bobby Kotick’s 2020 pay package hit more than $150 million while the videogame publisher company laid off employees, the battle turned into an all-out war.

At its annual general meeting last week, the “Call of Duty” publisher hit the pause button on an investor vote on its executive compensation, delaying it for a week. Investment firm CtW Investment Group, which had urged shareholders to vote against the “say on pay” proposal, called the company’s move a “desperate attempt to avoid a loss.”

Michael Varner, director of executive compensation research at CtW, told MarketWatch that “while legal, this maneuver is unusual and in poor taste.”

On Monday, Activision said 54% of shareholders approved the say-on-pay proposal.

“We are pleased that, based on exceptional shareholder returns and responsiveness, Activision Blizzard shareholders again approved our say-on-pay proposal and re-elected our Board directors with an average of 96% of votes,” a spokesman for the company said. “The additional time shareholders requested allowed them to thoroughly review the facts about Activision Blizzard’s rigorous pay-for-performance compensation practices as well as changes the Board made to our executive compensation based on extensive feedback from shareholders.”

10. Analysts’ Opinions.....

The brokerage bunch is already majorly optimistic toward the gaming name. Currently, 15 analysts carry a "strong buy" rating, with another two recommending "buy." Meanwhile, just two say "hold," and there's not a "sell" to be seen. Plus, the 12-month consensus price target of $116.41 is a healthy 25.9% premium to current levels.

Activision Blizzard has also been the subject of a number of research reports.....

- BMO Capital Markets raised shares of Activision Blizzard from a “market perform” rating to an “outperform” rating and set a $116.00 price target on the stock in a research note on Monday, May 17th.

- Raymond James reaffirmed a “buy” rating on shares of Activision Blizzard in a research note on Monday, February 22nd.

- Jefferies Financial Group began coverage on shares of Activision Blizzard in a research report on Friday, April 23rd. They set a “buy” rating and a $120.00 target price on the stock.

- Morgan Stanley raised their target price on shares of Activision Blizzard from $115.00 to $120.00 and gave the company an “overweight” rating in a research report on Wednesday, May 5th.

- Finally, Deutsche Bank Aktiengesellschaft raised their target price on shares of Activision Blizzard from $115.00 to $118.00 and gave the company a “buy” rating in a research report on Monday, May 10th.

Summary.....

For second-quarter 2021, Activision Blizzard predicts non-GAAP revenues of $2.13 billion and earnings of 91 cents per share. Net bookings are expected at $1.85 billion. For 2021, Activision Blizzard predicts non-GAAP revenues of $8.37 billion and earnings of $3.42 per share. Net bookings are anticipated to be $8.60 billion. The report will be on August 03, 2021.

Activision has exceptional fundamentals when you look at its trailing 12 months (TTM). The company has profitable earnings, positive cash flow from operations, and more cash and short-term investment than debt.

Activision should remain a good long-term investment. Management believes it can reach 1 billion monthly active users, as the company expands its mobile game business.

Therefore…..

The Options Trade On Activision Blizzard Has Been A Great Winner!

Will Activision Blizzard Stock Price Start To Climb Again?

Will We Recommend Further Trades On Activision Blizzard With The Pullback?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Activision Blizzard