TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UPDATED - 328%

Profit Using A Dell Technologies Weekly Option!

Dell Technologies Inc (NYSE: DELL)’s stock has spiked to record highs as the PC and enterprise hardware company’s shares catch a wave from the market’s enthusiasm for artificial-intelligence hardware plays.

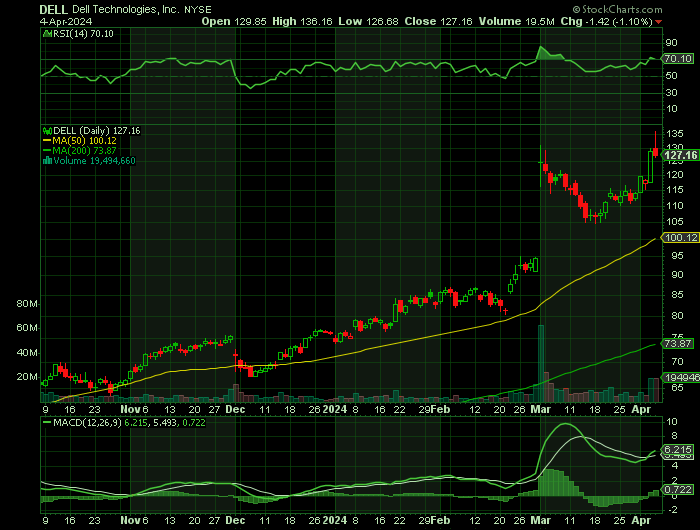

The stock has rallied more than 20% over the past five trading days. Dell shares have rallied 72% for the year and 227% over the past 12 months.

This set the scene for Weekly Options USA Members to profit by 328% using a DELL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, April 05, 2024

by Ian Harvey

Dell Technologies Inc (NYSE: DELL)’s stock has spiked to record highs as the PC and enterprise hardware company’s shares catch a wave from the market’s enthusiasm for artificial-intelligence hardware plays.

The stock has rallied more than 20% over the past five trading days. Dell shares have rallied 72% for the year and 227% over the past 12 months.

On Feb. 29, Dell posted better-than-expected financial results for the January quarter, driven in particular by strong demand for AI servers powered by Nvidia H100 chips.

The AI trend continues picking up speed and if management is correct that AI will increasingly be powered by on-premise servers, Dell could be in an optimal position to profit over the long term. Additionally, its current results are muted by the normal cyclicality of its PC business, but eventually this could pick back up and provide an additional boost.

Therefore, Dell stock could have more long-term upside.

Previous UPDATE – 21st March, 2024 – Read “25% Profit, In Less Than 2 Half Hours, Using A Dell Technologies Weekly Option!”

Why the Dell Technologies Weekly Options Trade was Originally Executed!

Dell Technologies Inc (NYSE: DELL) shares have been on a roll—the 40-year-old PC and enterprise hardware company has rallied 40% for the year to date, and 187% over the last 12 months. All of that is thanks in no small measure to the company’s growing position as an AI play.

Like PC rivals HP Inc. and Lenovo, Dell is getting ready to roll out AI-powered personal computers later this year. But what has the stock jumping lately is the rapidly expanding demand for the company’s AI servers to handle and run AI large language models. In reporting January quarter financial results, Dell said it has a $2.9 backlog of AI servers, up from just $800 million two quarters earlier, most of them powered by Nvidia H100 chips. And the company said it has a pipeline of interest in AI servers that is “multiples” higher than the current backlog.

All of that helps explain a flurry of joint announcements from Dell and Nvidia at the chip maker’s GTC developers event on Monday in San Jose. Dell unveiled a platform it calls “Dell AI Factory with Nvidia.” The new offering combines Dell servers, storage, PCs, software and networking with Nvidia AI infrastructure and software. Dell said the platform is intended to “help enterprises quickly capitalize on AI investments.”

Dell Technologies desperately wants people to know that it’s not a seller of obsolete PCs anymore. In the 2020s, Dell is doing everything it can do to rebrand itself as an AI hardware company.

This is evident in Dell Technologies Chief Operating Officer Jeff Clarke’s quote: “We have positioned ourselves well in AI.”

Clarke also said, “We’ve just started to touch the AI opportunities ahead of us.” He also said, “[W]e believe Dell is uniquely positioned with our broad portfolio to help customers build gen-AI solutions that meet performance, cost and security requirements.”

The Dell Technologies Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy DELL APR 26 2024 113.000 CALLS - price at last close was $4.16 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the DELL Weekly Options (CALL) Trade on Thursday, March 21, 2024, at 10:00, for $5.03.

Sold half the DELL weekly options contracts on Thursday, March 21, 2024, at 12:19, for $6.30; a potential profit of25%.

Sold the remaining DELL weekly options contracts on Thursday, April 04, 2024 for $21.55; a potential profit of 328%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Dell Technologies.....

Dell Technologies Inc., founded in 1984, is a multinational computer technology company headquartered in Round Rock, Texas. The company designs, develops, sells, and supports personal computers, servers, data storage devices, network switches, software, and other related technologies. Consumers, small businesses, and large enterprises worldwide use Dell Technologies Inc.'s products and services.

Dell Technologies Inc. has achieved many key highlights and achievements throughout its history. In 2016, the company completed the most significant tech merger in history by acquiring EMC Corporation for $67 billion. Additionally, Dell has been recognized for its sustainability efforts, including being named to the Dow Jones Sustainability Index for several consecutive years.

Michael Dell is the founder and Chief Executive Officer of Dell Technologies Inc. He has been with the company since its inception in 1984, leading it through many changes and challenges. Jeff Clarke is the Vice Chairman and Chief Operating Officer, responsible for global operations, customer support, and supply chain management.

Dell Technologies Inc. has reported healthy financial results in recent years. With average revenue in the billions of dollars and a 1 - 3% increase yearly for several years. The company's average gross profit margin stays between 25 to 35%. Depending on the year, Dell Technologies Inc. maintains debt levels either slightly below or above its current assets. Dell Technologies Inc.'s price-to-earnings ratio and price-to-book ratios are slightly below the industry average, indicating that Dell Technologies Inc.'s stock is undervalued compared to its peers. Dell Technologies Inc.'s stock performance has been strong recently but became volatile in Q1 of 2022 amid investor fears of a recession. Despite these issues, Dell Technologies Inc.'s stock price is still positive, over 80% in a five-year timeframe. Dell Technologies Inc.'s stock has also outperformed the broader market, with the S&P 500 increasing by approximately 60% over the same period.

Further Catalysts for the DELL Weekly Options Trade…..

Dell also said it is working with Nvidia to offer liquid-cooled systems based on Nvidia’s new GB200 “superchips,” which were also unveiled today.

Dell also announced that its PowerEdge XE9680 rack servers will support several new Nvidia chips, including the B200, B100 and H200 Tensor Core graphics processing units, or GPUs, starting later this year.

Dell has gone all in on AI, ratcheting up competition with hardware rivals like Hewlett Packard Enterprise and Super Micro Computer.

Other Catalysts.....

RWS, a unique, world-leading provider of technology-enabled language, content and intellectual property solutions, today announces that Dell Technologies ("Dell") has signed a multi-year agreement for Evolve, RWS’s groundbreaking linguistic AI solution.

Evolve, which offers transformative efficiency gains across the supply chain for organizations with substantial translation demands, will become a cornerstone of Dell's AI-powered localization strategy, supporting the next stage of the company’s growth. From marketing materials and technical documentation to support resources and multimedia, Evolve is set to translate over 400 million words annually into 27 core languages for Dell, enhancing global communication and digital customer experience.

"Our translation supply chain is incredibly complex and we’re always looking for opportunities to drive efficiencies," explains Wayne Bourland, Director of Translation at Dell. "Moving to Evolve – a truly groundbreaking linguistic AI solution – supports Dell’s overall AI strategy and will radically transform our approach to localization, enabling us to stay ahead of future content and translation challenges."

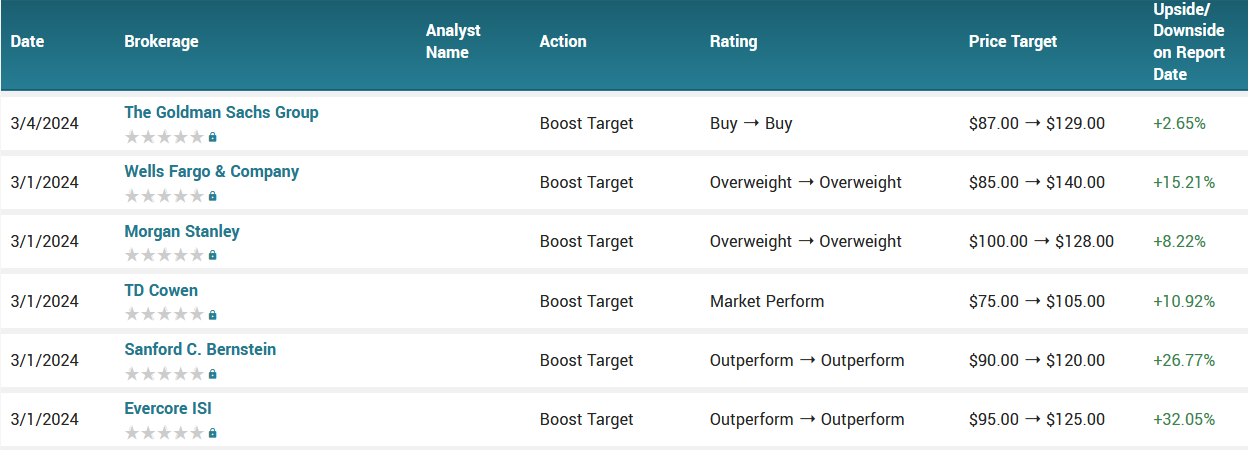

Analysts.....

According to the issued ratings of 14 analysts in the last year, the consensus rating for Dell Technologies stock is Moderate Buy based on the current 1 sell rating, 1 hold rating and 12 buy ratings for DELL. The average twelve-month price prediction for Dell Technologies is $102.88 with a high price target of $140.00 and a low price target of $74.00.

Summary.....

The market, and the company itself, seem to believe that Dell Technologies will stage an epic comeback based on huge AI PC sales in the coming quarters.

Suddenly, based on AI hype and growth assumptions, the market really likes Dell Technologies. During the past year, DELL stock has soared from $37 to more than $100.

Dell Technologies opened at $111.06 on Thursday. The stock has a market capitalization of $79.03 billion, a P/E ratio of 25.41, and a price-to-earnings-growth ratio of 1.43 and a beta of 0.91. The stock's 50-day moving average price is $92.74 and its 200-day moving average price is $78.64. Dell Technologies Inc. has a 12-month low of $36.81 and a 12-month high of $131.06.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Dell Technologies

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.