TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UPDATED - 231% Profit

Using A Meta Platforms Weekly Option!

Join Us and Get the Trades!

Meta Platforms Inc (NASDAQ: META), the owner of social media platforms like Facebook, Instagram, Threads, WhatsApp, and Messenger, is deploying AI in multiple ways, including how we communicate with those who don't speak the same language.

Shares of Meta Platforms Inc (NASDAQ: META) moved higher yesterday after the social media giant got a bullish analyst note that morning from Jefferies. In addition, the rising tide in the market today, after Fed Chair Jerome Powell reassured investors about rate cuts yesterday, seemed to benefit Meta.

Jefferies raised its price target on Meta stock from $550 to $585 and maintained a buy rating. More importantly, the research firm said that after a new market share analysis, it believed Meta could capture 50% of incremental ad dollars in the industry in 2024, its highest ever.

This set the scene for Weekly Options USA Members to profit by 231% using a META Weekly Options trade!

Become a Member Today and get the trades!

Friday, April 05, 2024

by Ian Harvey

LATEST UPDATE

Shares of Meta Platforms Inc (NASDAQ: META) moved higher yesterday after the social media giant got a bullish analyst note that morning from Jefferies. In addition, the rising tide in the market today, after Fed Chair Jerome Powell reassured investors about rate cuts yesterday, seemed to benefit Meta.

Jefferies raised its price target on Meta stock from $550 to $585 and maintained a buy rating. More importantly, the research firm said that after a new market share analysis, it believed Meta could capture 50% of incremental ad dollars in the industry in 2024, its highest ever.

The analyst predicted its revenue could grow 20%, compared to just 9% for the digital ad industry overall, driven in part by new generative artificial intelligence (AI) tools. It also expected its market share gains to accelerate this year and said it could outgrow Amazon for the first time since 2015.

The social media stock has been a top performer since the start of 2023, and if Jefferies is correct, it's likely to continue gaining this year.

Previous UPDATE – 26th March, 2024 – Read “Weekly Options Members Up 65% With A Meta Platforms Trade!”

Meta Platforms (NASDAQ: META), the owner of social media platforms like Facebook, Instagram, Threads, WhatsApp, and Messenger, is deploying AI in multiple ways, including how we communicate with those who don't speak the same language.

Social media products are also benefiting from AI on the business side, as it helps create ads catered to individuals. Over the long term, this will likely increase the cost per ad due to their efficiency, and Meta profits from this rise. With Meta's ads becoming more effective, it's only a matter of time before costs start to rise.

Meta Reality Labs division is working on its Ego model and glasses, which could help bring technology like augmented reality, currently used for games or other leisure activities, to training aids, allowing users to learn a new skill.

Why the Meta Weekly Options Trade was Originally Executed!

Many tech stocks surged over the past year thanks to factors such as the artificial intelligence (AI) boom. One stock that more than doubled in that time is Meta Platforms Inc (NASDAQ: META).

Meta is the parent behind the world's top social media assets. Collectively, Facebook, WhatsApp, Instagram, and Facebook Messenger are four of the most downloaded apps globally and were responsible for luring nearly 4 billion monthly active users during the December-ended quarter.

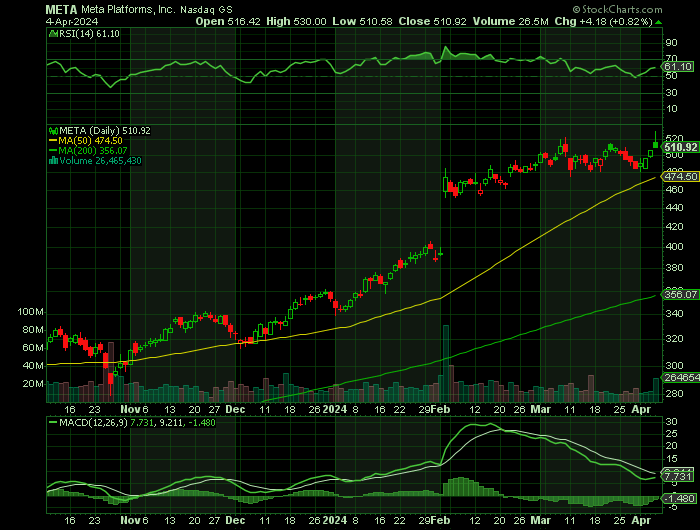

The Facebook parent was at a 52-week low of $197.90 last March, but made an incredible reversal, and this March, it reached a high of $523.57.

Up 41% year to date, Meta Platforms is nevertheless an under-the-radar AI stock. This dichotomy is related to Meta's biggest strength -- it paradoxically combines the traits of a cash cow and a tech start-up.

The company generated nearly $135 billion in revenue last year, nearly all of it coming from advertising across its Facebook, Instagram, and WhatsApp platforms. Thanks to Meta's asset-light business model, 35% of that revenue, or $47 billion, was converted into operating profit. That's a fantastic rate, and it helps explain why the company introduced a regular dividend payment for shareholders.

Yet, Meta is more than just a profitable tech giant. The company is investing billions of dollars in AI research. In fact, Meta is one of the largest buyers of Nvidia's flagship AI chip, the H100. None other than founder Mark Zuckerberg announced that Meta would be running upwards of 350,000 H100s this year to train its AI models.

Meta has several ambitious goals, such as perfecting its version of the metaverse and developing Artificial General Intelligence.

The Meta Weekly Options Potential Profit Explained.....

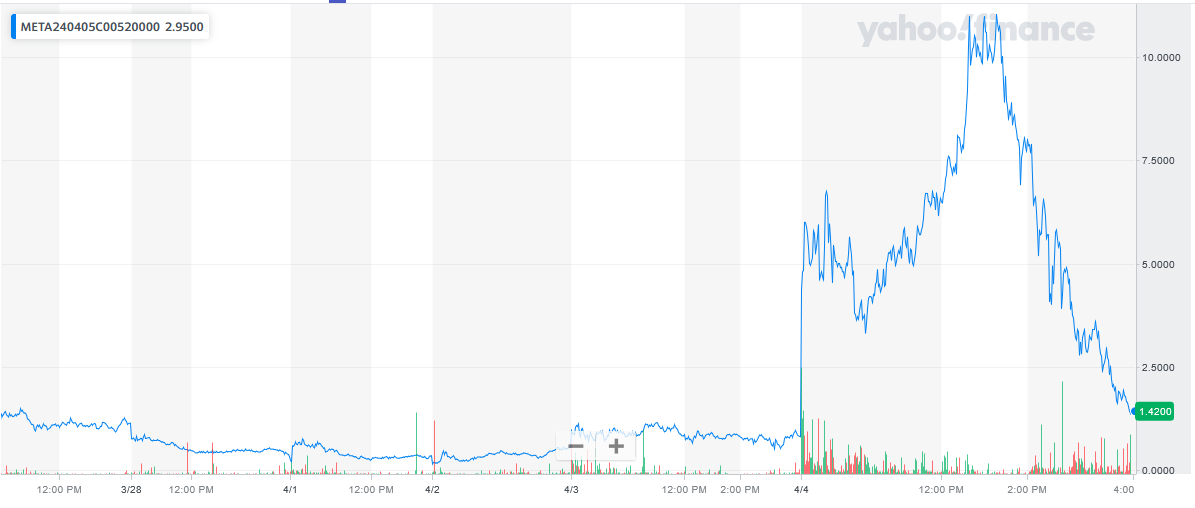

** OPTION TRADE: Buy META APR 05 2024 520.000 CALLS - price at last close was $6.60 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the META Weekly Options (CALL) Trade on Monday, March 25, 2024 for $3.43.

Sold some META weekly options contracts on Monday, March 25, 2024, within 3 hours, for $4.95; a potential profit of 44%.

Sold more of the META weekly options contracts on Tuesday, March 26, 2024 for $5.65; a potential profit of 65%.

Sold the remaining META weekly options contracts on Thursday, April 04, 2024 for $11.35; a potential profit of 231%.

(This will vary for members depending on their entry and exit strategies).

BECOME A MEMBER AND GET FURTHER TRADES!

About Meta Platforms.....

Meta Platforms, Inc. is a US-based multinational technology company and 1 of the Big 5 US tech companies. It is a member of the FAANG group holding the first position with its original name, Facebook.

Meta Platforms, Inc life began in 2004 as a digital “face book” for Harvard students. The company was founded by Mark Zuckerburg and a group of friends but now only Zuckerburg remains. The company quickly grew and expanded into other universities and then opened itself to the public in 2006. As of 2006, anyone over the age of 13 can be a Facebook user which is the company’s primary source of income. As of 2022, the company claimed more than 2.9 billion monthly active Facebook users.

Facebook, Inc filed for its IPO on January 1st 2012. The prospectus stated the company was seeking to raise $5 billion but it got so much more. The day before the IPO execs announced it would sell 25% more stock than it had previously stated because of the high demand. The company wound up raising more than $16 billion making it the 3rd largest IPO in history at the time.

The massive IPO valuation earned Facebook a spot in the S&P 500 in the first year of its public life. Although its valuation has deteriorated in the wake of scandal and consumer trends within social media, early investors were treated to gains in excess of 1000% at the peak of the stock run. Mark Zuckerburg retained 22% ownership in the company following the IPO, and 57% of the voting rights. As of 2022, those holdings were down to about 14% of the company and 54% of the voting rights.

Over the years, Facebook acquired a large number of apps and other businesses that include but are not limited to Instagram and WhatsApp. The company changed its name to Meta Platforms DBA Meta in 2021 to reflect its business and mission better. The new name describes the metaverse and refers to the seamless social interaction provided by Meta’s social media application universe.

Today, Meta develops digital applications that allow people to connect with family, friends, businesses, and merchants through Internet connections. Applications are available for mobile, PC, VR, and smart homes.

The company’s primary operating segment is the Family of Apps. The family of Apps includes Facebook and all the other digital applications. This segment produces virtually all of the revenue which is in turn 97% advertising oriented. The other operating segment is Reality Labs. Reality Labs develops and markets a line of virtual and augmented-reality products.

BECOME A MEMBER AND GET FUTURE TRADES!

Further Catalysts for the META Weekly Options Trade…..

Meta has staged a comeback. The advertising market recovered in 2023, allowing Meta to achieve full-year revenue of $134.9 billion, a 16% year-over-year gain.

A year ago, investors were worried about Meta Platforms' slowing growth and its ballooning expenses, yet those concerns have completely fallen away over the last few quarters. The social media giant is not only boosting its user base but improving the economics around its ads.

Large advertisers are sticking with the Facebook and Instagram platforms even as they pull back on spending elsewhere. Ad impressions rose 21% in the fourth quarter, contributing to a 25% increase in revenue. Combine that success with dramatic cost-cutting moves (its employee headcount was down 22% last quarter), and you've got the ingredients you need for soaring earnings.

This helped to bring 2023 costs and expenses to $88.2 billion. Although this figure was a modest increase from $87.7 billion in 2022, it was a vast improvement over the 23% jump between 2021's $71.2 billion in expenses and 2022.

These cost cuts helped Meta generate strong free cash flow (FCF) of $43 billion last year, a substantial increase from $18.4 billion in 2022. FCF provides insight into the cash available to invest in the business, pay debt obligations, repurchase shares, and fund dividends.

Consequently, Meta declared its first dividend in company history on Feb. 1. This news, its cost cuts, and strong revenue rebound all contributed to the share price shooting skyward.

BECOME A MEMBER AND GET FUTURE TRADES!

Other Catalysts.....

Year-over-year revenue gains are likely to continue, at least in 2024. The advertising industry forecasts digital ad spending to increase this year by more than 13% over 2023, serving as a tailwind for Meta's revenue growth.

The company expects first-quarter revenue of at least $34.5 billion, which would be a double-digit increase over 2023's $28.6 billion. Beyond advertising, Meta looks toward the twin tech innovations of the metaverse and AI for its business growth.

Last year, Meta released the latest version of its smart glasses, now infused with AI, that allow the wearer to livestream to Facebook and Instagram. Zuckerberg described this product as "a good example of how our AI and metaverse visions are connected."

Analysts.....

According to the issued ratings of 44 analysts in the last year, the consensus rating for Meta Platforms stock is Moderate Buy based on the current 1 sell rating, 2 hold ratings, 39 buy ratings and 2 strong buy ratings for META. The average twelve-month price prediction for Meta Platforms is $496.35 with a high price target of $609.00 and a low price target of $280.00.

Summary.....

Meta Platforms shares traded up $1.82 during mid-day trading on Friday, reaching $509.58. The company had a trading volume of 8,120,593 shares, compared to its average volume of 14,901,565. The company’s 50-day moving average is $457.19 and its 200-day moving average is $371.13. Meta Platforms, Inc. has a twelve month low of $197.90 and a twelve month high of $523.57. The company has a market capitalization of $1.30 trillion, a P/E ratio of 34.20, and a P/E/G ratio of 1.31 and a beta of 1.21. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.67 and a quick ratio of 2.67.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from META PLATFORMS

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.