TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Super Micro Computer:

A Smart Play in the AI Infrastructure Boom

Tuesday, June 09, 2025

by Ian Harvey

This article highlights Super Micro Computer, Inc.’s strategic position in the AI and data infrastructure market, emphasizing its recent growth, financial strength, and key partnerships.

It also notes the timely opportunity to enter a weekly call option trade recommended by Weekly Options USA.

Join Us and Get the Trades - More

setups coming... Stay tuned!

" Powering The Future Of AI With Servers, Speed, And A Strategic Trade Opportunity. "

Super Micro Computer, Inc. (NASDAQ: SMCI) is making waves in the AI and server infrastructure space, and savvy investors are already taking notice. A weekly call option trade recommended by Weekly Options USA has already been executed—but there’s still time to enter the trade and potentially benefit from the company’s powerful growth drivers and strategic positioning.

Dominating the Edge of AI Innovation

Supermicro has cemented itself as a leader in the high-performance server and storage market. Its strength lies in building highly customizable, energy-efficient systems tailored for today’s most demanding computing environments—including artificial intelligence, data centers, and cloud infrastructure.

The company is expanding its footprint with cutting-edge Edge AI systems that combine seamlessly with next-gen wireless technologies. This strategic focus allows Supermicro’s solutions to power smart cities, automated factories, healthcare networks, and retail systems—delivering real-time insights through local AI processing in environments where traditional infrastructure may not be feasible.

With a full portfolio of modular servers, from ultra-compact edge devices to high-density rackmount systems, Supermicro is leading the push toward scalable AI adoption across industries.

Financial Foundation to Scale Fast

In its most recent quarter, Supermicro reported nearly 20% year-over-year revenue growth, reaching $4.6 billion. Despite a slight shortfall relative to estimates, the company reiterated strong annual guidance, projecting up to $22.6 billion in revenue—nearly 50% growth over the previous year.

The company maintains a solid financial base with high liquidity, minimal debt, and a consistent track record of profitability. These fundamentals support ongoing investment in manufacturing, innovation, and product development.

Valuation metrics indicate the stock is still trading at a discount to its intrinsic value—especially when compared to other players in the AI and data center hardware space. This pricing mismatch presents a tactical opportunity for both long-term investors and short-term option traders.

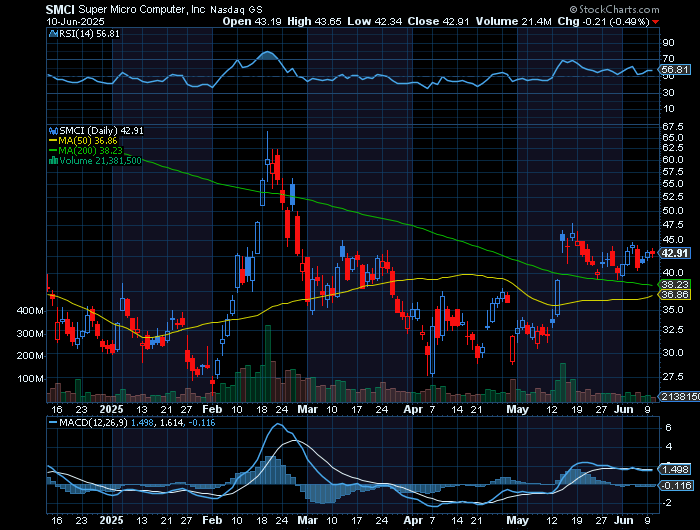

Building Momentum for the Next Move

Analyst sentiment reflects a balanced mix of caution and enthusiasm, with price targets pointing to potential upside. While short-term volatility persists, Supermicro’s long-term prospects are anchored by its proven ability to scale production, ship cutting-edge systems rapidly, and align with the most advanced AI technologies on the market.

With production now topping 5,000 server racks per month—including over 2,000 direct liquid-cooled units—the company is primed to meet the surging demand for infrastructure that can support generative AI, deep learning, and real-time analytics at scale.

Market Recognition and Investor Confidence

Supermicro’s explosive growth has earned it a significant jump on the Fortune 500 list, fueled by more than a doubling in revenue and a sharp increase in net income. The company is now recognized as a pivotal supplier in the global shift toward AI-enabled data infrastructure.

Insiders hold a notable stake in the company, and institutional investors have increased their exposure in recent quarters. This combination signals strong internal confidence and growing external validation from the broader market.

Why the Time to Act Is Now

Though the initial Weekly Options USA call trade has already been placed, the window to enter remains open. The stock’s technical setup, coupled with strong underlying fundamentals and clear momentum catalysts, makes this a timely opportunity for those seeking near-term gains or long-term positioning.

Super Micro Computer continues to scale, innovate, and deliver in a sector that shows no signs of slowing down. For traders and investors alike, this may be the moment to take a closer look.

Note: This article is intended for informational purposes only and is not investment advice. Always consult a financial professional before making trading decisions.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from SMCI

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.