TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nvidia Powers Ahead: AI

Dominance, UK Expansion

and Analyst Confidence Drive 2025 Momentum

Tuesday, June 09, 2025

by Ian Harvey

Nvidia is surging in 2025, driven by strong AI demand, major UK expansion plans, and bullish analyst sentiment.

The stock is up 35% on a Weekly Options USA call, with a consensus price target of $171.66.

With cutting-edge Blackwell chips, strong earnings, and widespread institutional support, Nvidia remains a top AI investment pick.

Join Us and Get the Trades - More

setups coming... Stay tuned!

" AI Giant Nvidia Rides High on UK Deals, Analyst Buzz, and Options Win"

Expansion, and Analyst Confidence Drive 2025 Momentum

Nvidia (NASDAQ: NVDA) continues to demonstrate why it's a leading force in the artificial intelligence revolution, surging ahead in market value, infrastructure leadership, and investor confidence. As of June 2025, the company is up more than 35% on the Weekly Options USA call recommendation—an impressive testament to the bullish sentiment surrounding the chipmaking titan.

Strategic Expansion into the U.K.’s AI Ecosystem

Nvidia made headlines at London Tech Week with a flurry of initiatives aimed at strengthening the United Kingdom's AI capabilities. In partnership with cloud providers Nscale and Nebius, Nvidia will deploy 14,000 of its latest Blackwell GPUs in the UK by 2026. These high-performance chips will support research, healthcare, academia, and public services like the NHS.

Moreover, Nvidia is launching an AI Technology Center in the UK to train developers in foundational models, materials science, and earth system modeling—reinforcing its role as a cornerstone in sovereign AI development. CEO Jensen Huang described the UK as being in a “Goldilocks circumstance” for AI, citing its deep talent pool, university excellence, and commitment to expanding AI infrastructure.

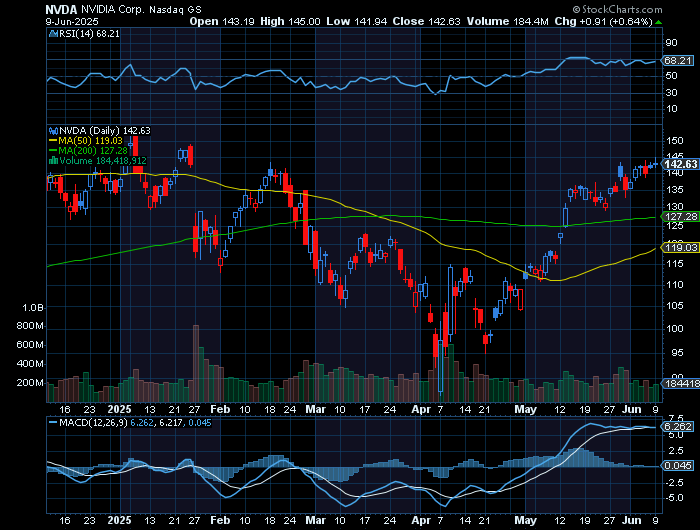

Market Strength and Technical Momentum

Nvidia stock is climbing steadily, recently closing at $142.63 and sitting just 7% below its all-time high. It has reclaimed a place on the prestigious IBD 50 list of high-performing growth stocks, holding a remarkable 97 Composite Rating and a near-perfect 99 EPS Rating. With its 21-day and 50-day moving averages rising, Nvidia's technical signals point to continued bullishness. The company is also in an early-stage consolidation phase with a buy point at $153.13.

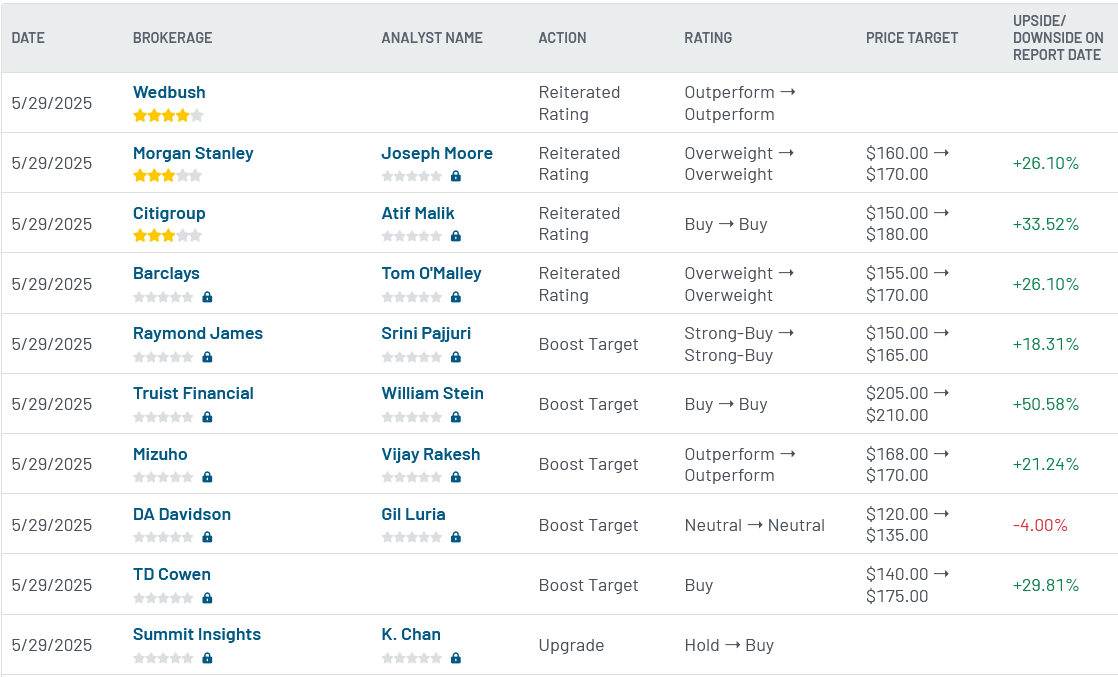

Analyst Ratings: Overwhelming Buy Consensus

The consensus among 44 Wall Street analysts is overwhelmingly positive, with a "Moderate Buy" rating. Thirty-six analysts have given a Buy, three a Strong Buy, and only one has issued a Sell. The average price target is $171.66, representing a projected upside of 20.95% from current levels. Top firms like UBS, Citi, and BofA Securities have reiterated Buy ratings, highlighting Nvidia’s leadership in AI performance, developer support, and infrastructure buildout.

Jim Cramer called Nvidia “the only ace in our hand” regarding U.S.–China chip policy, underlining the company's strategic importance in geopolitics and technology alike.

Financial Performance and Outlook

Despite macroeconomic concerns and U.S. export restrictions, Nvidia’s financials remain robust. The company posted 69% year-over-year revenue growth in Q1, with EPS of $0.81 beating expectations. Its data center segment alone contributed over $39 billion, fueled by AI demand from mega-cap clients such as Microsoft, Meta, and Amazon.

Importantly, Nvidia maintains industry-leading gross margins above 70% and projects them to rise into the mid-70% range later this year, driven by its Blackwell architecture. With $53 billion in cash reserves, Nvidia is well-positioned to navigate global uncertainties and fund aggressive growth initiatives.

Investor Enthusiasm: Institutions, Insiders, and the Options Market

Institutional investors continue to add to their Nvidia holdings. PVG Asset Management recently invested $834,000, while hedge funds like Bridgewater and Ethos Financial have made strategic adjustments reflecting Nvidia's long-term appeal. Insiders, including Director Mark Stevens, have sold shares to capitalize on recent gains, though insider ownership remains strong at over 4%.

Meanwhile, retail momentum is robust. Weekly Options USA's call option recommendation already netting a 35% gain signals confidence in short-term price movement—and possibly much more upside ahead.

The Road Ahead: AI, Innovation, and Resilience

From co-founding the GPU revolution to spearheading the global AI race, Nvidia has shown an uncanny ability to innovate and scale. Analysts predict the AI market will top $2 trillion early next decade, with Nvidia leading the charge thanks to its unmatched technology stack and strategic agility.

Despite export restrictions and macro tensions, Nvidia’s diversified product line—from gaming GPUs to data center solutions and robotics—keeps it resilient. Its Blackwell chips, tailored for AI inference and training, are outperforming competitors in benchmarks, while sovereign deals in the UK and Middle East offset potential revenue losses from China.

Conclusion

Nvidia's story in 2025 is one of strength, innovation, and continued promise. With a solid foundation, visionary leadership, and bullish analyst sentiment, the company is well on its way to becoming the biggest AI winner of the year—and possibly the first $5 trillion company in history. Whether you’re a long-term holder or a savvy options trader, Nvidia remains a name to watch—and own.

Become a member of Weekly Options USA today.

You’ll gain immediate access to our trade alerts, strategic guidance, and real-time updates—ensuring you're in position for opportunities like this when they arise.

Want in?

Become a member now and receive our next trade alert.

Let’s trade smarter—together.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.