TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Cameco Corporation Delivers a 136% Weekly Options

Profit:

A Strategic Win for Investors

Wednesday, June 11, 2025

by Ian Harvey

Cameco Corporation delivered a remarkable 136% profit on a weekly call option, driven by strong financial forecasts, bullish analyst upgrades, and strategic exposure to Westinghouse Electric.

Recent U.S. policy shifts and rising global demand for nuclear energy have positioned Cameco as a key beneficiary of a nuclear renaissance.

With long-term growth prospects and short-term trading appeal, Cameco stands out as both a tactical and strategic investment opportunity.

Join Us and Get the Trades - More

setups coming... Stay tuned!

“Cameco’s 136% options gain highlights its rising role in the global nuclear energy revival.”

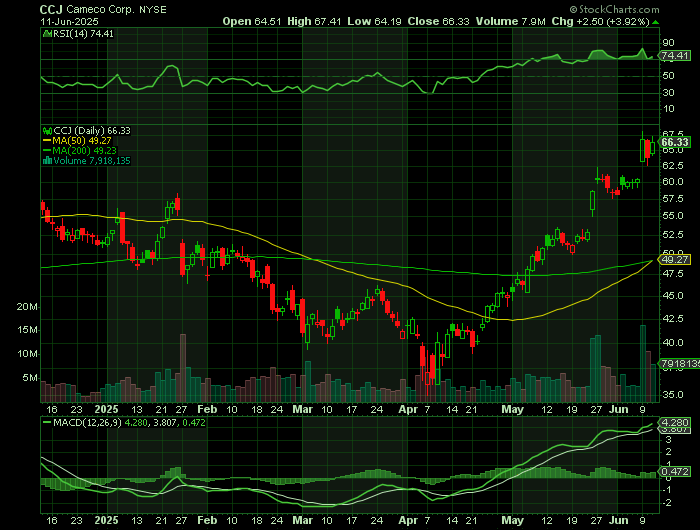

Cameco Corporation (NYSE: CCJ), a leading force in the global nuclear energy industry, has recently provided a powerful return for investors, with a weekly call option trade yielding a remarkable 136% profit. This surge not only highlights Cameco’s explosive short-term momentum but also reinforces its long-term value as a cornerstone of the clean energy transition.

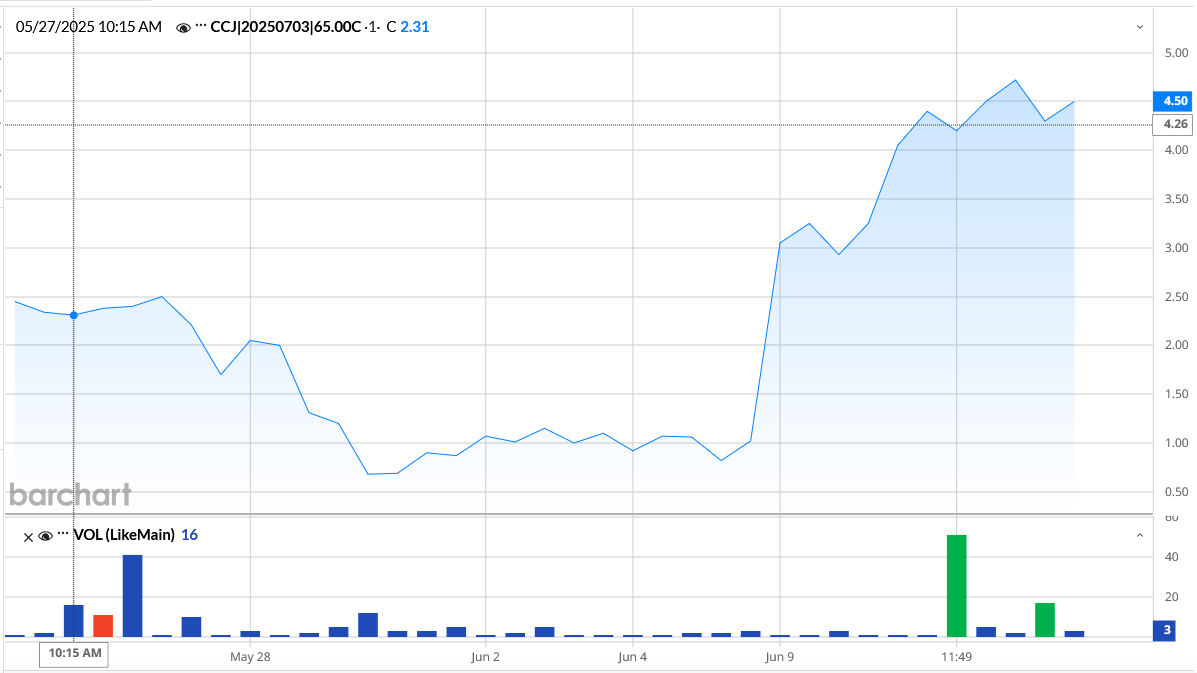

Part 1: The Trade That Paid Off—136% in Just Days

A weekly call option on Cameco—executed on May 28, 2025, with a strike price of $65 and expiring July 3—was recommended by Weekly Options USA. Entered at $2.00 per contract, the trade has now gained an astounding 136%, driven by a series of catalysts that caught the attention of institutional investors, analysts, and retail traders alike.

This success was not an accident. The trade aligned with significant financial developments, positive analyst sentiment, and supportive macro trends in the nuclear energy sector. Market timing, technical strength, and sound risk management—highlighted by a pre-determined 50% gain threshold and a 60% stop-loss—made this a textbook example of a profitable short-term strategy.

Part 2: Why the Trade Was Made—Strong Fundamentals and Bullish Outlook

Nuclear Renaissance and Strategic Positioning

The decision to target Cameco for a weekly options play was grounded in solid fundamentals and forward-looking optimism. Cameco’s recent announcement of an expected $170 million increase in its 49% equity share of Westinghouse’s Q2 and annual adjusted EBITDA served as a key trigger. This boost stems from Westinghouse’s role in constructing two nuclear reactors at the Dukovany power plant in the Czech Republic—an initiative expected to bring sustained financial gains over multiple years.

A Wave of Analyst Upgrades

The bullish narrative surrounding Cameco has been echoed by major analysts:

- CIBC raised its price target to $95 from $80, reaffirming an Outperformer rating.

- Raymond James increased its target to C$96 from C$88, noting Cameco’s substantial long-term value through its Westinghouse partnership.

- Stifel pushed its target even higher to C$105 from C$90, citing revenue and margin gains from Westinghouse’s international projects.

These upgrades validate Cameco’s momentum and add credibility to its strategic investments and long-term positioning.

Fundamental Strength and Industry Tailwinds

Cameco: An Integrated Nuclear Powerhouse

Headquartered in Saskatoon, Saskatchewan, Cameco is the world’s second-largest uranium producer, controlling approximately 17% of global uranium output. With vertically integrated operations across mining, milling, and fuel services, it supplies nuclear fuel to global utilities from North America to Asia.

Crucially, Cameco’s stake in Westinghouse Electric strengthens its foothold in advanced nuclear technologies, including small modular reactors (SMRs)—a segment poised to revolutionize the power grid and data center infrastructure, particularly in AI-driven sectors.

Policy Support Driving the Sector

Recent executive orders from U.S. President Donald Trump have galvanized the nuclear sector. These include mandates to:

- Streamline nuclear regulatory approvals to 18 months.

- Expand uranium mining and enrichment capacity.

- Deploy 10 large-scale nuclear reactors domestically by 2030.

Westinghouse is now seen as the front-runner for these projects, further bolstering Cameco’s long-term earnings prospects. Analyst Jed Dorsheimer of William Blair even described Westinghouse as the “top pick” for the construction mandate, underscoring Cameco’s exposure to a $74 billion nuclear expansion plan.

Investor Confidence and Future Growth

Cameco’s Stellar Financial Trajectory

With over $25 billion in market cap, Cameco enjoys institutional ownership exceeding 70%, reflecting deep investor confidence. Analysts forecast an 85% CAGR in EPS through 2027, supported by uranium prices expected to double from $70 to $140 by that year.

Despite trading at a premium multiple, analysts argue that Cameco’s consistent earnings, uranium pricing power, and strategic alliances justify the valuation. Its 447% five-year total shareholder return affirms the company's ability to deliver for long-term holders.

Conclusion: A Winning Play—Now and for the Future

The 136% gain from the weekly call option on Cameco is more than just a trading victory—it's a reflection of the company’s unique position at the nexus of geopolitical change, green energy demand, and technological innovation. With analysts raising targets, Westinghouse expanding its global footprint, and governments doubling down on nuclear, Cameco’s outlook is as bright as ever.

Whether you're a tactical trader or a long-term believer in nuclear energy, Cameco offers a compelling story of growth, stability, and profit—and this week’s successful options trade is just the beginning.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from CAMECO

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.