TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

CRM EARNINGS DATE NOVEMBER 30, 2021

CRM Earnings Date November 30, 2021

Salesforce.com (NYSE:CRM) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday, November 30, 2021.

expectations for crm EARNINGS DATE NOVEMBER 30, 2021

The consensus earnings estimate for CRM earnings date November 30, 2021 is $0.92 per share on revenue of $6.79 billion; but the Whisper number is higher at $1.02 per share.

The company's guidance was for earnings of $0.91 to $0.92 per share. Consensus estimates are for earnings to decline year-over-year by 47.73% with revenue increasing by 25.30%.

Short interest has decreased by 3.7% and overall earnings estimates have been revised higher since the company's last earnings release.

about salesforce (crm)

Salesforce pioneered selling software under a subscription model. Its software helps businesses organize and handle sales operations and customer relationships. The company has expanded into marketing, customer services and e-commerce.

Salesforce.com went public in 2004. Its software as a service (SaaS) model was revolutionary because it used a subscription-based method to sell customer relation management (CRM) software, which was a relatively new development at the time.

Yet Salesforce's systems quickly gained popularity because they allowed smaller companies to compete more effectively against their larger competitors by giving them sales and customer service tools that leveled the playing field. The cost and complexity of such software was typically beyond the means of small- and medium-sized businesses, but Salesforce's software brought it within reach of everyone.

17 years later, and Salesforce.com is now the undisputed industry leader, accounting for almost $1 of every $5 spent globally on CRM. That's more than the amount spent on CRM solutions from Oracle (NYSE:ORCL), SAP, Microsoft, and Adobe combined.

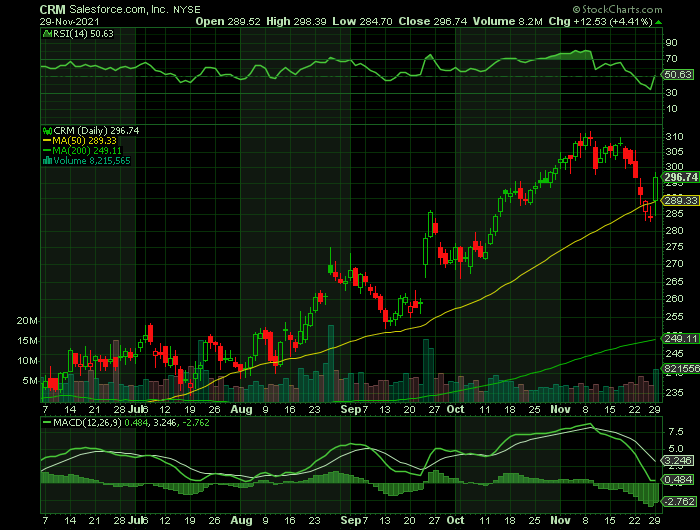

CRM stock had gained about 35% in 2021 as of Nov. 19. Salesforce stock has since dipped from an all-time high of $311.75 on Nov. 19.

influencing factors leading up to

crm EARNINGS DATE NOVEMBER 30, 2021

Analysts' Thoughts on CRM Earnings Date November 30, 2021

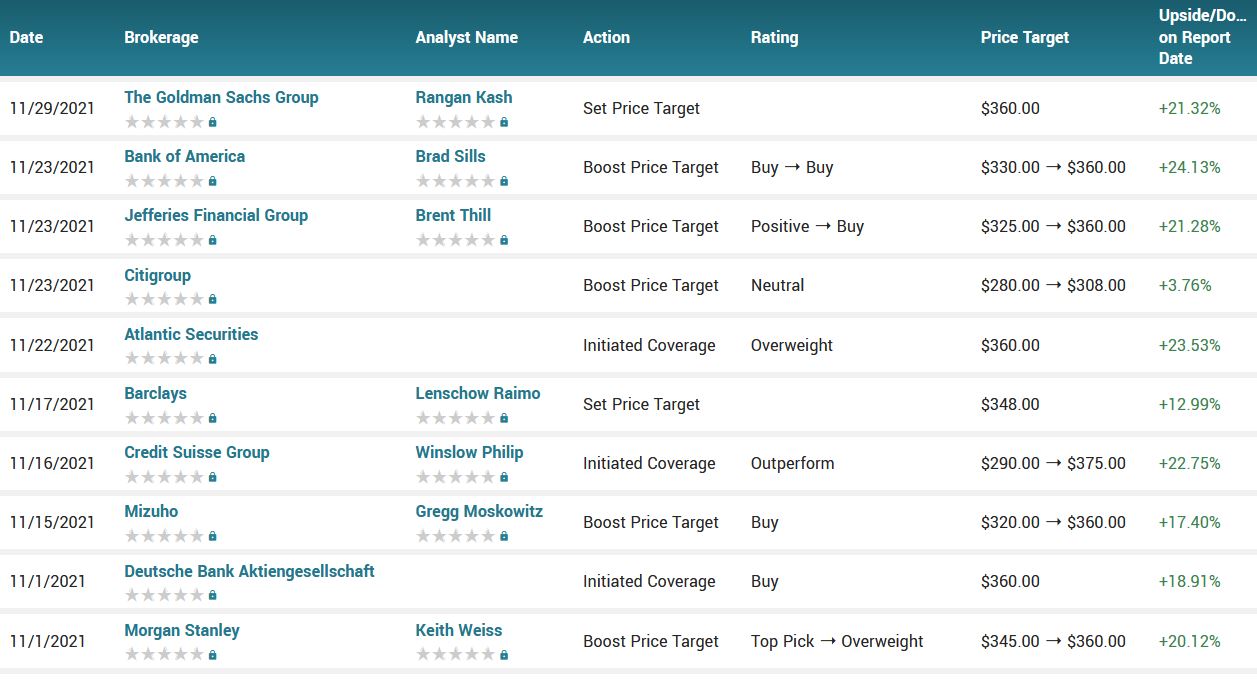

Salesforce(CRM) has been getting plenty of positive attention ahead of the CRM earnings date for its fiscal 2022 third-quarter (which ended Oct. 31). That earnings report will be released on Tuesday, November 30, 2021. Earlier this month, Salesforce stock garnered buy ratings and price target hikes from analysts at Credit Suisse, Deutsche Bank, and Morgan Stanley.

The quote below is from Morgan Stanley analyst Keith Weiss who said in a report that Salesforce stock is well positioned based on a survey of spending priorities for chief information officers.

"Salesforce's core portfolio squarely addresses CIO's top priorities for digital transformation," Weiss said. "Our survey bolsters confidence in industry growth forecasts as marketing, CRM and customer service ranked highest among priorities. Meanwhile, we see momentum building in the market addressed by Slack as businesses implement tools to better collaborate and improve productivity while working remote in the 'new normal' post Covid."

Also, on Monday analyst Patrick Walravens of investment research firm JMP Securities reiterated Salesforce as a buy and boosted his price target to $350 from a previous $320.

Ahead of the CRM earnings date of November 30, 2021, the consensus rating for Salesforce.com stock is “Buy.” This is according to the issued ratings of 40 analysts in the last year, based on the current 6 hold ratings, 32 buy ratings and 2 strong buy ratings for CRM. The average twelve-month price target for salesforce.com is $323.87 with a high price target of $375.00 and a low price target of $242.00.

Optimism Beyond the CRM Earnings Date November 30, 2021.....

Back in September, Salesforce once again increased its revenue guidance for its fiscal 2022 to a range of $26.25 billion to $26.35 billion. It also provided an initial forecast for its fiscal 2023, projecting revenue in the $31.65 billion to $31.80 billion range, which would amount to growth of about 21% over fiscal 2022's expected sales.

Revenue Forecast …..

Salesforce revenue is forecast to more than triple from $12.3 billion last year to more than $43.3 billion in 2026 with net profits effectively doubling.

Analysts do see the CRM leader's stock as fairly priced around $303 per share, as they have set a price target of about $320 per share. The upside potential of the consensus price target is just 5.5% today. This is despite Salesforce trading north of 120 times trailing earnings, 66 times estimates, and 54 times the free cash flow it produces.

That mismatch between exciting business growth and modest price target upside suggests that the sales and earnings growth being forecast could lift Salesforce stock substantially from here. The evidence of this may be seen following the upcoming CRM earning date.

IN CONCLUSION

Regardless of the outcome from the report of CRM earnings date November 30, 2021, the future for CRM appears to be on a strong upward trajectory.

Going forward, management expects to generate over $50 billion in revenue during fiscal 2026, implying top-line growth of at least 18% over the next 4.5 years.

This company is a key enabler of digital transformation and remote work, and both trends should be tailwinds in the years ahead. That's why this growth stock could be a winner, both leading up to this CRM earnings date and beyond.

Back to Weekly Options USA Home Page from CRM Earnings Date November 30, 2021

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.