TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

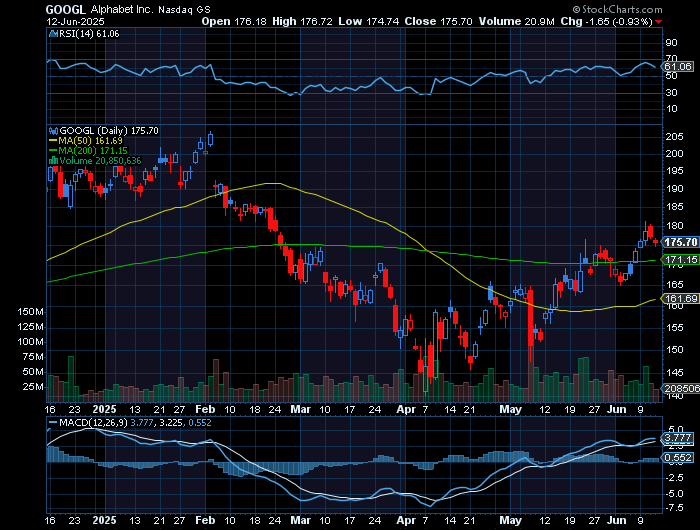

Alphabet Inc. (GOOGL)

Riding the AI Wave to a 186%

Options Victory

Thursday, June 12, 2025

by Ian Harvey

Alphabet Inc. (NASDAQ: GOOGL) continues to impress investors with strong growth across AI, cloud computing, and core services like Google Search and YouTube.

A recent weekly call option trade recommended by Weekly Options USA yielded a 186% gain, underscoring bullish momentum driven by stellar earnings, major cloud deals like the OpenAI partnership, and positive analyst outlooks.

Join Us and Get the Trades - More

setups coming... Stay tuned!

"GOOGL Soars: AI Wins, Cloud Deals, and a 186% Options Payday"

Alphabet Inc. (NASDAQ: GOOGL), the powerhouse behind Google, YouTube, Android, and the rapidly scaling Google Cloud, has recently delivered a stellar return for savvy traders. A weekly call option recommended by Weekly Options USA - executed on May 19, 2025—has already yielded an impressive 186% profit, showcasing both the power of short-term trading strategies and the strength of Alphabet’s long-term fundamentals.

This article explores why this options trade was made in the first place, why it paid off so quickly, and what analysts are saying about GOOGL's future.

The Setup: Why the Weekly Call Option Was Executed

Weekly Options USA recommended the GOOGL $170 call expiring June 27, 2025 for $4.25. This was not a gamble—it was a strategic bet on strong fundamentals and momentum:

- Strong Q1 2025 Results: Alphabet posted a 12% YoY revenue increase to $90.2 billion and a 49% surge in EPS to $2.81, smashing expectations.

- Google Search and YouTube Strength: Despite AI competitors, Google Search reported 2+ billion active users monthly, and YouTube Shorts and Podcasts saw 20% growth in engagement.

- Cloud Momentum: Google Cloud revenue jumped 28% YoY, with operating income surging 142% to $2.2 billion—marking a key profitability milestone.

- AI Dominance: Alphabet’s Gemini 2.5 model, Vertex AI platform, and AI Futures Fund solidified its leadership in artificial intelligence.

These growth drivers created a bullish backdrop, with the stock then trading around $166 and analysts forecasting upside to $199.75 and beyond.

Why the Trade Worked: Alphabet’s Momentum Unleashed

Since the trade, GOOGL stock has surged, driven by both fundamental and market-moving developments:

- New Pixel and Android 16 Features: Boosting consumer interest and hardware sales, especially in Europe and the U.S.

- AI Advancements Across Products: Tools like AI Overviews, Circle to Search, and Clear Voice show AI integration is deepening user engagement and product utility.

- High-Profile Win Over Microsoft: OpenAI’s surprise deal to use Google Cloud infrastructure significantly bolsters Alphabet’s cloud credibility and revenue outlook.

- Shareholder Rewards: A 5% dividend increase and $70 billion share repurchase plan reinforce investor confidence.

- Wall Street Confidence: Multiple firms raised their price targets (e.g., Tigress Financial at $240), with the Zacks Consensus for FY2025 EPS climbing to $9.51 (+18.28% YoY).

Together, these catalysts pushed the stock well above the $170 strike price, enabling the trade to return 186%, far exceeding the original 50% target.

Analysts’ Views: A Cheap Giant With Massive Upside

Wall Street remains bullish on Alphabet, and for good reason:

- Cheapest of the “Magnificent Seven”: With a forward P/E around 18.9, Alphabet trades well below peers like Meta (26.7) and Microsoft (36), despite similar or stronger growth rates.

- Massive Market Opportunity: Google Cloud, with its $49B annual run rate, is becoming a key profit driver. The OpenAI deal adds a marquee client.

- Consistent Earnings Growth: EPS estimates for Q2 2025 are up, suggesting another strong quarter is ahead.

- Institutional Accumulation: Recent 13F filings show increased buying from major asset managers.

Conclusion: Alphabet—A Strategic Play for Traders and Investors Alike

Alphabet’s recent options win is more than a short-term trading success—it’s a testament to the company’s long-term innovation engine. Whether it’s AI, cloud computing, or monetization through YouTube and Google One, Alphabet is well-positioned for continued growth.

With high analyst confidence, a discounted valuation, and ongoing product breakthroughs, Alphabet remains a premier pick for investors. For those seeking dynamic upside with defined risk, weekly options like the May 19 trade offer a compelling strategy.

Final thought? Whether you're trading options or building a long-term portfolio, GOOGL is a stock worth watching—and owning.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from GOOGL

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.