TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

86% Profit As C3.AI Stock continues to Surge!

Is There More To Come?

Join Us and Get the Trades!

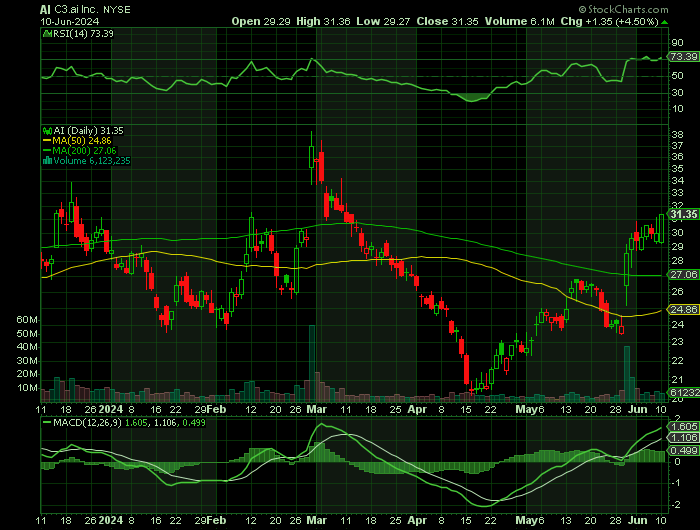

Shares of C3.ai (NYSE: AI) have soared over 20% since the company reported its fiscal fourth-quarter earnings on May 29. The enterprise artificial intelligence (AI) Software Company saw strong revenue growth and issued upbeat guidance.

C3.ai operates in the rapidly growing AI software market, projected to grow from $22.6 billion in 2020 to $126.0 billion by 2025 at a CAGR of 41.2%.

This set the scene for Weekly Options USA Members to profit by 86% using an AI Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, June 10, 2024

by Ian Harvey

UPDATE

C3.ai (NYSE: AI) shares soared over 20% since the company reported its fiscal fourth-quarter earnings on May 29. Previously the shares of C3.ai had underperformed the broader market so far this year and were up just 6.4%. They were actually negative for the year until the May 29 release of its fiscal 2024 fourth-quarter results.

C3.ai sells enterprise AI software, a market expected to proliferate in the long run. Precedence Research estimates that the enterprise AI market could go from generating $7 billion in annual revenue in 2022 to $270 billion in 2032. This explains why C3.ai's software solutions are gaining solid traction.

The company struck 191 agreements with clients in the previous fiscal year for its offerings, an increase of 52% from the previous year. These agreements point toward a healthier future for C3.ai and should ideally help the company sustain the acceleration in its revenue growth.

C3.ai ended the previous quarter with a 20% year-over-year jump in revenue to $86.6 million. For comparison, the company's year-over-year revenue growth stood at 18%, 17%, and 11%, in the preceding three quarters.

C3.ai management forecasted $84 million to $89 million in revenue in the current quarter. That would be a 20% jump over the prior-year period's figure at the midpoint.

Analysts forecast the company's earnings to increase at an annual rate of 50% for the next five years considering the huge opportunity it is sitting on in the AI software market.

The C3.ai Weekly Options Potential Profit Explained.....

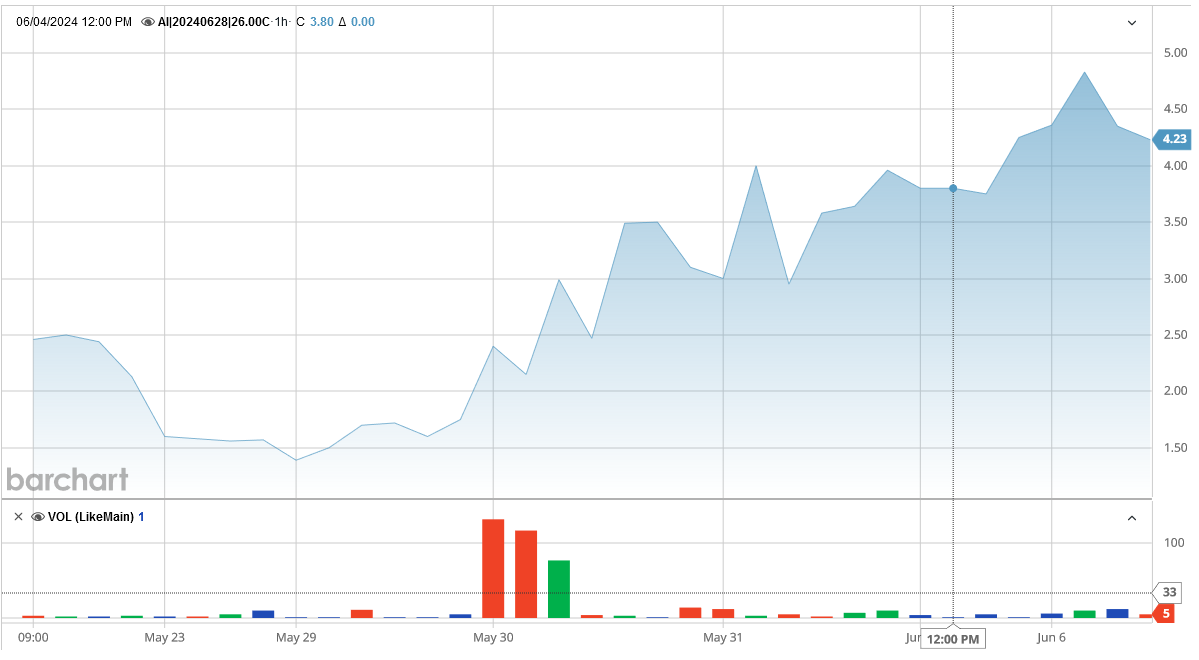

** OPTION TRADE: Buy AI JUN 28 2024 26.000 CALLS - price at last close was $2.72 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AI Weekly Options (CALL) Trade on Tuesday, May 21, 2024 for $2.60.

Sold half the AI Weekly options contracts on Friday, May 31, 2024 for $4.00; a potential profit of54%.

Sold the remaining AI Weekly options contracts on Friday, June 07, 2024 for $4.83; a potential profit of 86%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Why the AI Weekly Options Trade was Originally Executed!

Trade Analysis

C3.ai Inc (NYSE: AI) was the world's first

enterprise AI company when it was founded in 2009. It delivers AI-as-a-service

by providing businesses with advanced, turnkey AI applications to accelerate

their adoption of the technology. Initially focused on energy management

solutions, the company has evolved to incorporate IoT and now generative AI

into its offerings. With a market cap of $3.1 billion, C3.ai is positioned for

significant growth as AI technology continues to expand globally.

Current Situation

C3.ai operates in the rapidly growing AI

software market, projected to grow from $22.6 billion in 2020 to $126.0 billion

by 2025 at a CAGR of 41.2%. Despite flat revenue growth in recent years, the

company has maintained a fair profit margin and a debt-to-equity ratio close to

0.00, indicating strong financial health. The market has high expectations for

C3.ai's future growth potential.

Key Insights from Earnings Call

C3.ai's earnings report is set to be

released on May 29, 2024. Analysts expect the company to post earnings of

-$0.31 per share, marking a year-over-year decline of 138.46%. However, revenue

is expected to be $82.72 million, indicating a 14.23% increase compared to the same

quarter of the previous year.

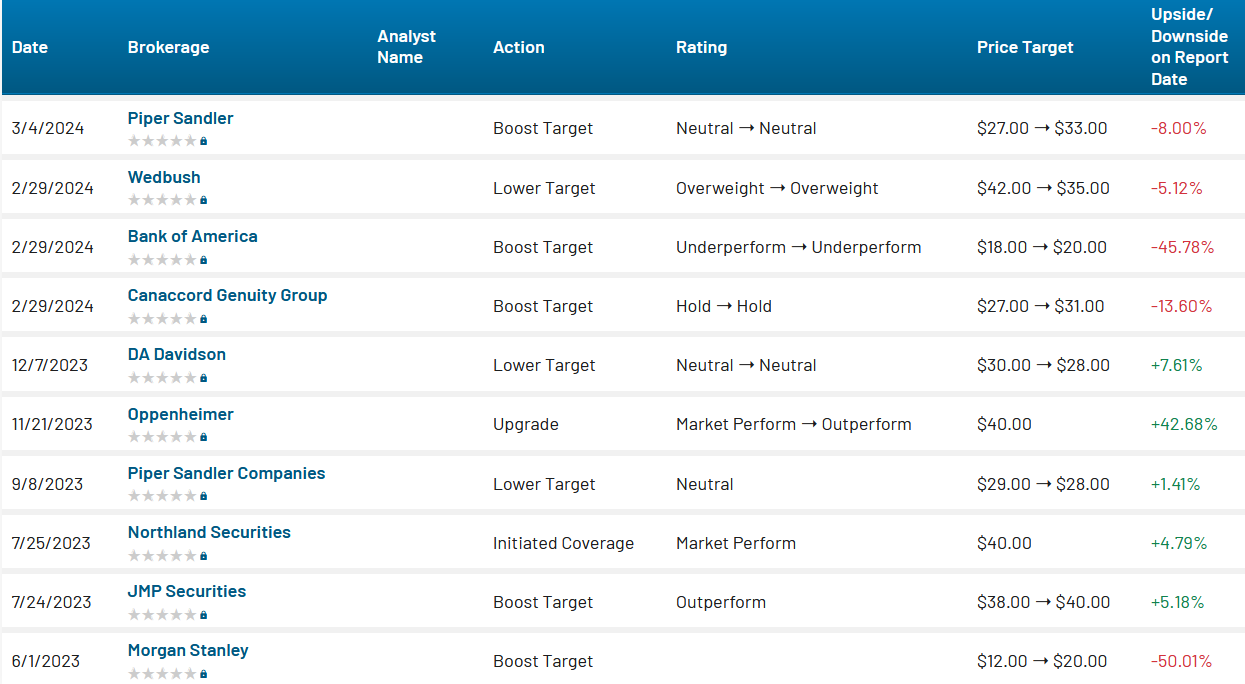

Analyst Reactions

According to research

reports from nine Wall Street equities analysts, the average twelve-month stock

price forecast for C3.ai is $31.50, with a high forecast of $40.00 and a low

forecast of $20.00. The consensus rating for C3.ai stock is Hold, based on one

sell rating, five hold ratings, and three buy ratings.

Company Overview

C3.ai is a leading enterprise software

company offering AI solutions to optimize operations and improve

decision-making across various industries, including manufacturing, healthcare,

energy, and financial services. Founded by Thomas Siebel, a renowned technology

entrepreneur, the company went public in December 2020, raising $651 million in

its IPO.

Catalysts for the Trade

C3.ai has several growth opportunities,

particularly in the healthcare and energy industries. The company has partnered

with energy giants like Shell and Enel to improve operations and reduce carbon

emissions using AI. Additionally, C3.ai is expanding into new geographic

markets and investing in R&D to enhance its AI technology.

Other Catalysts

At the end of fiscal 2023, one customer

accounted for 35% of C3.ai's revenue, likely Baker Hughes. This long-standing

relationship is set to continue, with options to extend the contract beyond

June 2025. Analysts and investors will closely monitor C3.ai's performance in

its upcoming earnings disclosure.

Technical Analysis

- Market Capitalization: $3.22 billion

- PE Ratio: -11.33

- Beta: 1.74

- 52-Week Low: $20.23

- 52-Week High: $48.87

- 50-Day Simple Moving Average: $25.17

- 200-Day Simple Moving Average: $27.23

Summary

C3.ai is well-positioned for growth in the

expanding AI software market. Despite facing competition from industry giants

like IBM, Microsoft, and Google, the company has significant opportunities in

healthcare, energy, and new geographic markets. With strong financial health

and strategic partnerships, C3.ai is a compelling option for investors.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from C3.ai

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.