TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

52% Profit In Less Than 1 Hour,

Using A Coinbase

Global Weekly

Option!

Coinbase Global Inc (NASDAQ: COIN) one of the hottest stocks of the past year, still has room to run, according to some analysts.

Investment bank Raymond James is the latest Wall Street firm to revise its negative rating of the shares of crypto exchange Coinbase, after surging exchange-traded fund (ETF) inflows triggered a rally in the stock and bitcoin {{BTC}} pushed to all-time highs.

This set the scene for Weekly Options USA Members to profit by 52%, In Less Than 1 Hour, using a COIN Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, March 13, 2024

by Ian Harvey

UPDATE.

Coinbase Global Inc (NASDAQ: COIN) one of the hottest stocks of the past year, still has room to run, according to some analysts. Coinbase Global stock has been one of the top performers of the last 12 months, defying skepticism that it would thrive during a regulatory crackdown on digital assets.

A couple factors are helping drive the gains…..

- The approval of the first exchange-traded funds to hold Bitcoin, a long-sought goal of crypto proponents, as well

- as a growing belief that institutions and financial advisors are on the cusp of adding digital assets to their portfolios en masse.

Why the Coinbase Weekly Options Trade was Originally Executed!

On Mar 11, the largest crypto-currency Bitcoin (BTC) achieved a milestone trading above 72,000 for the first time. Bitcoin recorded its all-time high at 72,841.37. The cryptocurrency market started 2024 on a positive note after an impressive rally last year.

The much-hyped reformation in the cryptocurrency space took place on Jan 10. The U.S. Securities and Exchange Commission (SEC) approved rule changes to allow the creation of spot Bitcoin exchange-traded funds (ETFs). As many as 11 spot Bitcoin ETFs were launched in January.

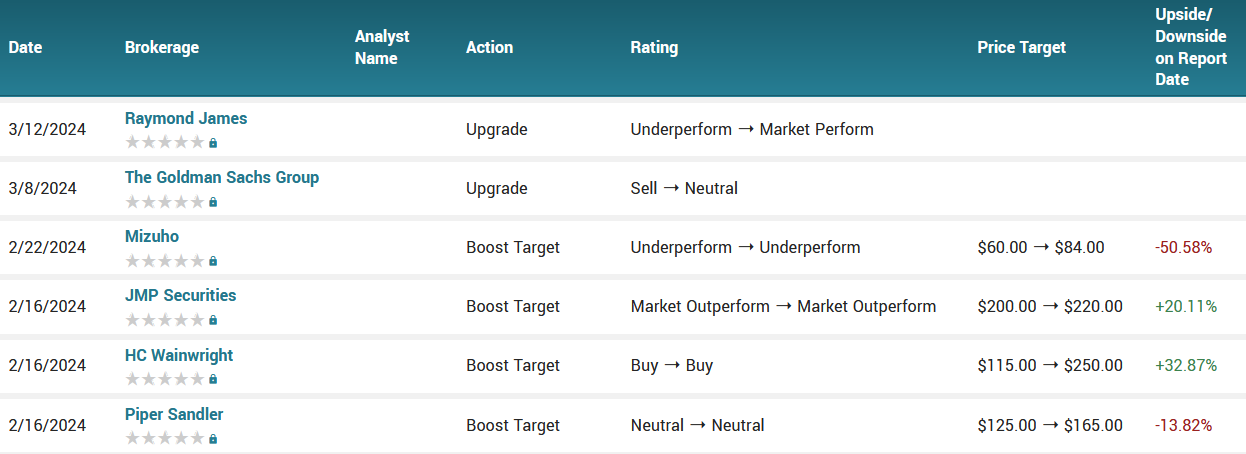

Investment bank Raymond James is the latest Wall Street firm to revise its negative rating of the shares of crypto exchange Coinbase Global Inc (NASDAQ: COIN), after surging exchange-traded fund (ETF) inflows triggered a rally in the stock and bitcoin {{BTC}} pushed to all-time highs.

While Raymond James said its long-term bias on Coinbase remained negative, the firm admitted to underestimating the impact that spot ETF inflows would have on the valuations of cryptocurrencies, particularly bitcoin.

Raymond James upgraded the stock to market perform from underperform. Coinbase shares closed 0.8% higher at $256.14. The changes and commentary were contained in a research report published Tuesday.

Despite the upgrade, the firm maintained a cautious tone.

“We continue to have substantial doubts about the firm’s long term earnings prospects given what we view as an essentially commoditized client offering, a tenuous long-term earnings outlook for cryptocurrency valuations that appears to be largely premised on the Greater Fool Theory rather than inherent value, and meaningful regulatory risk,” analysts led by Patrick O’Shaughnessy wrote.

Remember: We are playing this trade short-term!

“We would suggest that the longer this crypto rally persists, the greater the odds that a competitor attacks Coinbase with a disruptive pricing strategy,” the authors wrote.

Until ETF flows taper or reverse, the stock’s positive momentum is likely to persist, the report added.

The Wall Street investment bank Goldman Sachs last week abandoned its bearish stance on Coinbase shares, upgrading the stock to neutral from sell, citing higher crypto prices and increased retail participation.

After soaring 157% in 2023, Bitcoin has railed more than 65% year to date. It continues to hold a lot of potential. The SEC’s latest decision is likely to turn out to be a landmark, positioning the entire crypto space as an integral component of mainstream finance.

The game-changing decision of the SEC will allow individuals, money managers and other financial institutions to get exposure to the world’s largest cryptocurrency without having to own it.

The COIN Weekly Options Potential Profit Explained.....

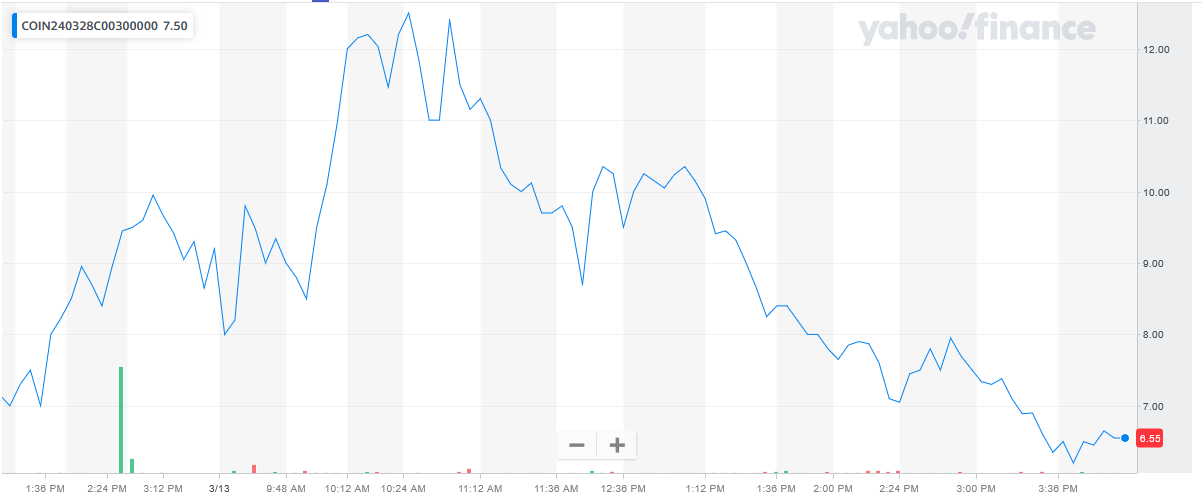

** OPTION TRADE: Buy COIN MAR 28 2024 300.000 CALLS - price at last close was $9.20 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the COIN Weekly Options (CALL) Trade on Wednesday, March 13, 2024, at 9:31, for $8.20.

Sold the COIN weekly options contracts on Wednesday, March 13, 2024, at 10:25, for $12.50; a potential profit of52%.

(This result will vary for members depending on their entry and exit strategies).

Re-bought COIN Weekly Options (CALL) Trade on Wednesday, March 13, 2024, at 3:45, for $6.20.

Don’t miss out on further trades – become a member today!

About Coinbase Global.....

Coinbase Global, Inc. is among the world’s largest and foremost cryptocurrency exchanges. The company provides financial infrastructure and technology for the cryptocurrency economy in the United States and internationally. Coinbase Global, Inc. was founded in 2012 and is based in Wilmington, Delaware.

The company began with the idea that anyone, anywhere should be able to buy and sell Bitcoin and it has grown in tandem with the cryptosphere. Coinbase Global IPO’d in early 2021 and listed more than 100 million verified individual users less than a year later. Assets on the platform fluctuate based on the value of the cryptocurrency market but are counted in the $100’s of billions. The company employs roughly 5,000 people and serves clients in more than 100 countries. The company lists more than 200 assets for trading and over 350 for custody purposes.

The company is led by Bryan Armstrong. Armstrong is a co-founder, Chairman of the Board, CEO, and president of Coinbase and the driving force behind the business. One of his many innovations is making Coinbase Global, Inc a “remote-first” business which means there is no official corporate headquarters. The company operates offices in 12 cities around the world, however, and leases space when there is a concentration of employees in a new area.

Coinbase Global, Inc offers a range of tools for traders and investors. The company offers a primary financial account in the crypto-economy for businesses and consumers alike. The primary account, often referred to as a wallet, allows owners to buy, sell, trade, send, and receive cryptocurrencies supported by the platform. Coinbase Global supports well over 200 different cryptocurrencies and the number is growing so the potential application is very broad. New users may also earn free cryptocurrencies by participating in the company’s education program. The program informs users of new cryptocurrencies and rewards them for their time.

Further Catalysts for the COIN Weekly Options Trade…..

The next Bitcoin halving will occur in April 2024. When this occurs, the reward for mining new blocks is halved, making it more challenging for miners to earn net Bitcoins. Historically, this event has led to increased scarcity and has driven up the value of Bitcoin due to reduced supply.

Several research firms have said that this is just the beginning of the Bitcoin rally. Standard Chartered expects Bitcoin will reach $100,000 by the end of 2024. Research firm Fundstrat has provided a target range of $116,000 to $137,000 for this year. Hedge fund SkyBridge predicts $170,000 by April 2025.

Furthermore, VanEck estimated a medium-term target of $350,000 for Bitcoin. Connors's firm has estimated that in base-case, Bitcoin will reach $110,000 in 2024 and $140,000 the next year. However, according to the firm’s best-case scenario, the cryptocurrency will hit $180,000 in 2024 and $450,000 in 2025.

Other Catalysts.....

Coinbase Global Inc., the largest US cryptocurrency exchange, said it plans to offer $1 billion in convertible senior notes to repay existing debt and for general corporate purposes.

The notes maturing in 2030 will be sold through a private offering to institutional investors, Coinbase said in a statement Tuesday. Coinbase also expects to grant a 30-day option to allow the purchase of up to an additional $150 million of the securities to cover over-allotments. The notes will be convertible into cash, shares of Coinbase’s Class A common stock, or a combination, at the company’s election.

Coinbase intends to use the proceeds to repay at maturity, or repurchase or redeem prior to maturity, its outstanding 0.50% convertible senior notes due 2026, 3.375% senior notes due 2028, and 3.625% senior notes due 2031. The general corporate purposes uses may include working capital and capital expenditures, and to pay the cost of the capped call transactions.

Analysts.....

According to the issued ratings of 21 analysts in the last year, the consensus rating for Coinbase Global stock is Hold based on the current 4 sell ratings, 8 hold ratings and 9 buy ratings for COIN. The average twelve-month price prediction for Coinbase Global is $128.19 with a high price target of $250.00 and a low price target of $36.00.

Summary.....

Coinbase is an indirect beneficiary of the new spot Bitcoin ETFs. That's because Coinbase is a custodian for many of the new ETFs, including the highly successful ones launched by BlackRock and Ark Invest. This new custodial fee income is going to boost Coinbase's subscription and services revenue. Over time, this will help to level out the company's revenue during rough market patches.

This nontrading-related revenue is actually a fast-growing category for Coinbase, and also includes stablecoin revenue and blockchain rewards revenue.

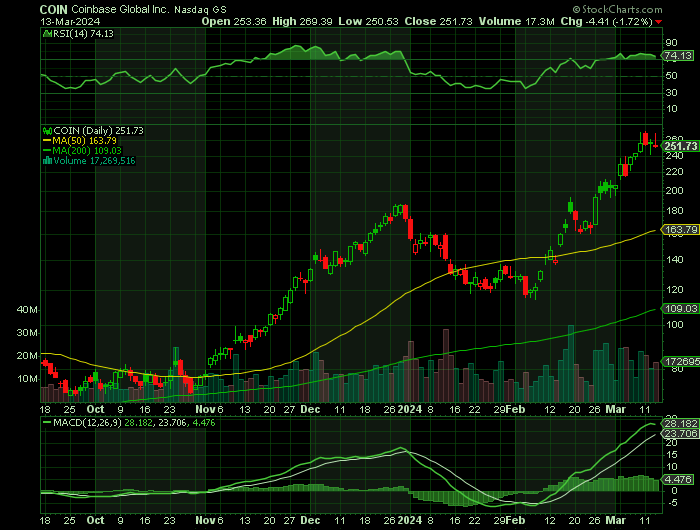

Coinbase Global has a 50-day moving average of $161.84 and a 200 day moving average of $123.51. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 0.47. The stock has a market capitalization of $62.06 billion, a PE ratio of 948.67 and a beta of 3.36.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from COINBASE GLOBAL

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.