TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

379% Profit Using An Alphabet Inc (NASDAQ: GOOG)

Weekly Option!

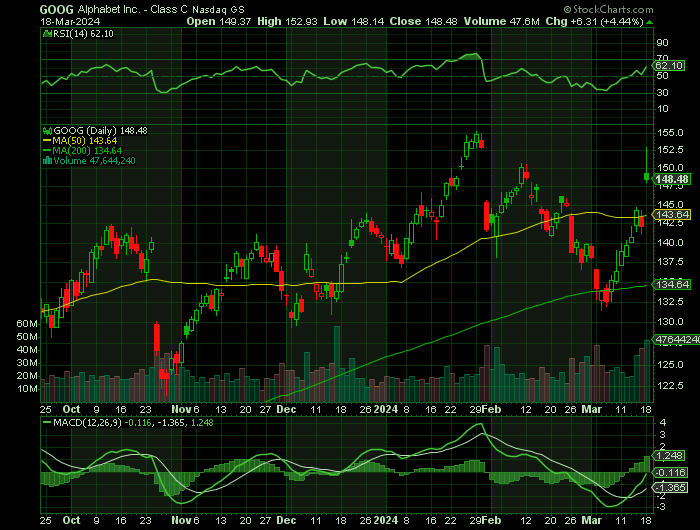

The shares of Google-parent Alphabet Inc (NASDAQ:GOOG) closed the trading day up $6.31 (+4.44%) higher to trade at $148.48, after the Bloomberg report revealed that Apple is talking over licensing Google's Gemini artificial intelligence (AI) engine for future iPhones.

Alphabet potentially enters a new phase of growth -- driven by AI. And this should build on the solid foundation the company has put into place over the years, growing earnings into the billions of dollars and establishing a secure moat.

This set the scene for Weekly Options USA Members to profit by 379% using a GOOG Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, March 18, 2024

by Ian Harvey

UPDATE

According to a report from Bloomberg, Apple (AAPL) is currently in talks with Alphabet Inc (NASDAQ: GOOG, GOOGL) to use its generative AI engine, Google Gemini, in iPhones.

Oppenheimer Senior Analyst of Emerging Technologies and Services Martin states, “for the partnership to be successful for both companies it will require a lot of nuance on how the large language models or gen AI functions will be implemented because it can augment search capabilities, but there are also a large number of applications it can use. One example would be simulating communication to copilot for the productivity applications from Apple, similar to Microsoft's (MSFT) implementation of copilot for its Office suite."

The shares of Google-parent Alphabet Inc (NASDAQ:GOOG) closed the trading day up $6.31 (+4.44%) higher to trade at $148.48, after the Bloomberg report revealed that Apple is talking over licensing Google's Gemini artificial intelligence (AI) engine for future iPhones.

Why the Alphabet Inc (NASDAQ: GOOG) Weekly Options Trade was Originally Executed!

Alphabet Inc (NASDAQ: GOOG, GOOGL) potentially enters a new phase of growth -- driven by AI. And this should build on the solid foundation the company has put into place over the years, growing earnings into the billions of dollars and establishing a secure moat.

The moat, or competitive advantage, is Alphabet's brand strength in the search market -- "Googling" things has become part of people's routines. Google Search has steadily held more than 90% of the global search market, and due to this already impressive market position and Alphabet's investment in AI, that's unlikely to change.

So, how is AI helping Alphabet keep its leadership? The company recently launched Gemini, its most powerful AI model yet, and the Gemini update -- and Alphabet is using its AI platform across its businesses from cloud services to search.

AI is helping search to produce better results than ever, adding new elements such as summaries and links that offer various perspectives on the subject. And AI also is helping advertisers seamlessly create their campaigns. These two points are key because they strengthen the case for advertisers to keep coming back to Alphabet -- and Google ads make up the lion's share of Alphabet's revenue.

Also, Google Cloud has great momentum and significant growth potential. The revenue growth rate has been getting higher in recent times. In the most recent quarter, Google Cloud revenue jumped 25%.

The Alphabet Inc (NASDAQ: GOOG) Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy GOOG APR 05 2024 145.000 CALLS - price at last close was $3.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the GOOG Weekly Options (CALL) Trade on Friday, March 15, 2024 for $1.92.

Sold half the GOOG weekly options contracts on Monday, March 18, 2024 for $9.20; a potential profit of379%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Alphabet Stock (NASDAQ:GOOG).....

Alphabet Inc. is a holding company formed in 2015 with the restructuring of Google. The move was made to allow the company more flexibility in its business pursuits and to create more transparency in the core Google business. Google, which began as a simple search engine, is now synonymous with the Internet, cloud, and services related to each. Today, Alphabet is the 3rd largest tech company globally and the G in FAANG.

Google began in 1996 as a research project into Internet search. Founders Lary Page and Sergey Brin thought there was a better way to search and rank web pages than simply counting the number of times a keyword was used. The original algorithm was called Page Rank and the system Back Rub but those monickers did not last long. The new system instead determined a page's relevance by analyzing the websites that linked back to it. The more websites with higher rankings linking back to the original site the better.

The original prototype of the Google search engine was launched in 1997. The name Google was chosen because it is a very large number and refers to a large amount of information a Google search can provide. If not for an investment Andy Bechtolsheim, co-founder of Sun Microsystems, the company may never have incorporated and become the behemoth it is today.

The company grew over the next few years, changed its headquarters to Palo Alto and then began selling ad space. It was the shift to an ad-based and supported model that provided the income and earnings to grow the company to its current size. Advertising still makes up more than 80% of the revenue. In 2000, the company became the default search engine for Yahoo! and then in 2004 Google went public.

At the time of the IPO, company founders and then-CEO Eric Schmidt agreed to work together for the next 20 years. While that did not come to pass, the trio helped get the company on its current path. In the time since the IPO, Google has not only grown to surpass 3 billion daily searches and 1 billion unique monthly active users it has also acquired other businesses to enhance that growth. The two most notable are the acquisition of Youtube (which is included in the ad-generated revenue) and Motorola. The addition of Motorola was strategic in many ways that include the acquisition of intellectual property and better positioning in patent and other disputes with other tech companies.

Alphabet now operates in 3 core segments providing Internet and Internet-based services globally. Those segments are Google Services, Google Cloud, and Other Bets. The Google Services business is the core Google business and includes search, ads, Google Home, and Youtube among others. The Google Cloud segment is a host of cloud-based services for businesses and individuals that include software suites, security, and cloud-based operations. The Other Bets segment includes a variety of applications and services that do not have a direct bearing on the core business and/or are immaterial to revenue on an individual basis.

Further Catalysts for the GOOG Weekly Options Trade…..

Alphabet said that its AI expertise helped it to expand its cloud work with many top companies in the quarter including McDonald's and Verizon. The cloud business offers customers a variety of AI strengths -- from the Vertex AI Platform to train and deploy AI models to a coding companion and hardware for AI workloads. And these are just a few examples.

We're in the early days of AI growth, with some analysts predicting the market will reach more than $1 trillion by 2030. Alphabet, already a powerhouse in its market, is well positioned to benefit from this once-in-a-generation technological revolution -- and that makes Alphabet, at its price today, a once-in-a-generation investment opportunity.

Other Catalysts.....

Alphabet happens to be the cheapest constituent when using the forward P/E ratio within the Magnificent Seven.

Alphabet's foundational operating segment continues to be Google. With a nearly 92% share of worldwide internet search, Google is the logical go-to for advertisers looking to target their message(s) to specific consumers. More often than not, this will give Google exceptionally strong ad-pricing power.

In addition to Alphabet's advertising segments benefiting from long-winded economic expansions, Google Cloud looks like a force to be reckoned with. After years of operating losses, Google Cloud delivered its first operating profit in 2023.

Cloud service margins are considerably more robust than advertising margins, and enterprise cloud spending is likely in its early innings. In short, this segment may be Alphabet's prime source of cash-flow growth throughout the remainder of the decade.

Safer Browsing.....

Google announced a major change to its Safe Browsing feature in Chrome today that will make the service work in real time by checking against a server-side list -- all without sharing your browsing habits with Google.

Previously, Chrome downloaded a list of known sites that harbor malware, unwanted software and phishing scams once or twice per hour. Now, Chrome will move to a system that will send the URLs you are visiting to its servers and check against a rapidly updated list there. The advantage of this is that it doesn't take up to an hour to get an updated list because, as Google notes, the average malicious site doesn't exist for more than 10 minutes.

The company claims that this new server-side system can catch up to 25% more phishing attacks than using local lists. These local lists have also grown in size, putting more of a strain on low-end machines and low-bandwidth connections.

Google is rolling out this new system to desktop and iOS users now, with Android support coming later this month.

Analysts.....

According to the issued ratings of 5 analysts in the last year, the consensus rating for Alphabet stock is Buy based on the current 5 buy ratings for GOOG. The average twelve-month price prediction for Alphabet is $146.33 with a high price target of $170.00 and a low price target of $123.00.

Summary.....

Shares of Alphabet have gained +51.2% over the past year, and are significantly better than the S&P 500 index's +31.9% gain. The company’s robust cloud division is aiding substantial revenue growth. Expanding data centers will continue to bolster its presence in the cloud space. Further, major updates in its search segment are enhancing the search results.

Moreover, Google’s mobile search is gaining solid momentum. Additionally, strong focus on bolstering generative AI capabilities should aid business growth in the near term. Alphabet’s deepening focus on wearables category remains a tailwind.

Alphabet’s strong efforts to gain foothold in the healthcare industry are other positives. Also, its expanding presence in the autonomous driving space is contributing well.

Shares of GOOG traded up $3.57 during midday trading on Thursday, reaching $144.34. The company had a trading volume of 36,092,172 shares, compared to its average volume of 23,051,324. Alphabet Inc. has a 1-year low of $93.04 and a 1-year high of $155.20. The stock has a market cap of $1.79 trillion, a PE ratio of 24.40, and a P/E/G ratio of 1.28 and a beta of 1.05. The company has a quick ratio of 2.10, a current ratio of 2.10 and a debt-to-equity ratio of 0.05. The business’s 50 day moving average price is $143.42 and its 200 day moving average price is $138.50.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ALPHABET

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.