TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

244%

Profit

On SentinelOne

-The

Stock That Provides Protection!-

SentinelOne Inc (NYSE: S) is actively expanding its product line and entering new partnerships, such as the recent collaboration with Advantage in New Zealand. This move, along with ongoing enhancements to its Singularity Platform, underscores its commitment to maintaining a competitive edge in the cybersecurity market.

SentinelOne has achieved fast revenue growth adding new 60 enterprise customers paying more than $100,000 annually to reach a total of 1,193.

The stock is up 8.3% since earnings results and traded as high as $21.16.today.

This set the scene for Weekly Options USA Members to profit by 244% using a S Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, July 01, 2024

by Ian Harvey

UPDATE

Cybersecurity continues to be one of the fastest-growing segments within software as more companies are turning technology company, therefore, facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance.

With roots in the Israeli cyber intelligence community, SentinelOne Inc (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber-attacks.

SentinelOne reported revenues of $186.4 million, up 39.7% year on year, topping analysts' expectations by 2.9%.

“We delivered an extraordinary 40% revenue growth and our first ever quarter of positive free cash flow, a significant milestone in our growth journey,” said Tomer Weingarten, CEO of SentinelOne.

SentinelOne has achieved fast revenue growth adding new 60 enterprise customers paying more than $100,000 annually to reach a total of 1,193.

The stock is up 8.3% since the results and currently trades at $20.36.

The SentinelOne Weekly Options Potential Profit Explained.....

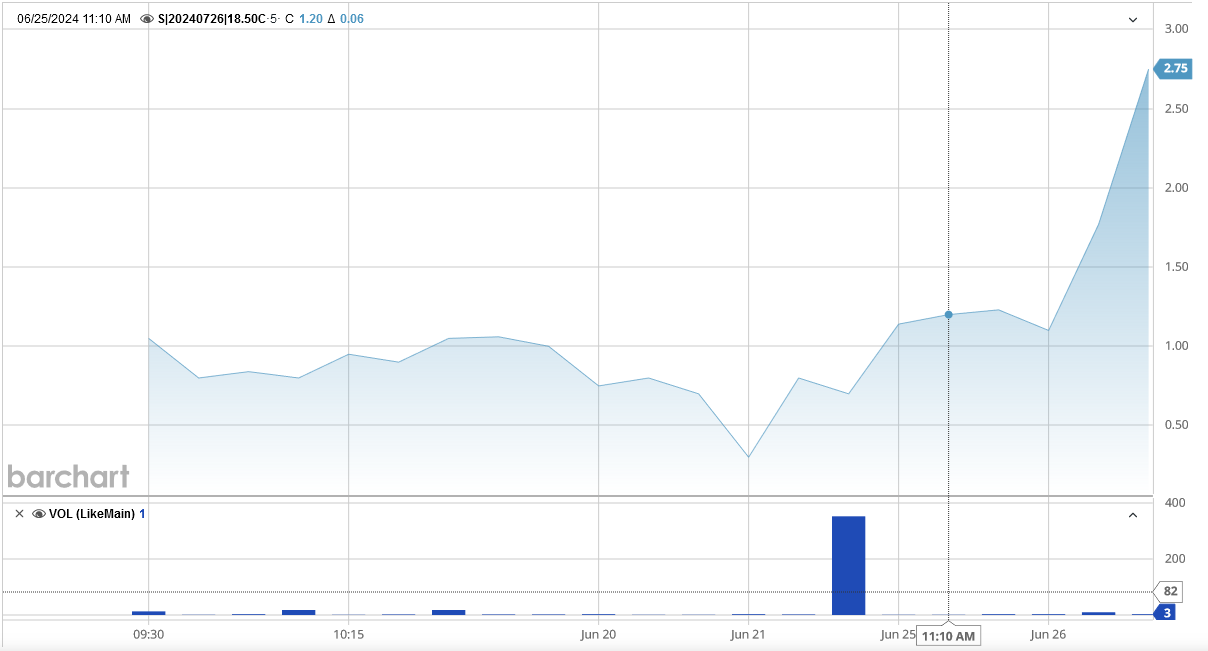

** OPTION TRADE: Buy S JUL 26 2024 125.000 CALLS - price at last close was $1.02 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the S Weekly Options (CALL) Trade on Monday, June 17, 2024 for $0.80.

Sold half the S Weekly options contracts on Monday, July 01, 2024 for $2.75; a potential profit of 244%.

(This will vary for members depending on their entry and exit strategies).

Holding remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

Why the SentinelOne Weekly Options Trade was Originally Executed!

Trade Analysis

SentinelOne Inc (NYSE: S) is a leader in the cybersecurity sector, providing a comprehensive SaaS solution. Despite a 32.43% decline over the past year, the company's innovative technology and recent strategic partnerships position it for potential rebound and growth.

Current Situation

SentinelOne is actively expanding its product line and entering new partnerships, such as the recent collaboration with Advantage in New Zealand. This move, along with ongoing enhancements to its Singularity Platform, underscores its commitment to maintaining a competitive edge in the cybersecurity market.

Key Insights from Earnings Call

The company has consistently surpassed earnings expectations for four consecutive quarters, demonstrating robust financial health and operational efficiency. The recent revenue growth of 39.70% quarter-over-quarter further validates the increasing market demand for SentinelOne's offerings.

Catalysts for the Trade

The introduction of SentinelOne's Singularity Cloud Workload Security for Serverless Containers represents a significant advancement in protecting cloud environments. This innovation is likely to capture a substantial market share, enhancing the company's growth trajectory.

Further Catalysts for the Trade

Advanced AI Integration and Market Expansion

SentinelOne's recent developments in AI-driven security solutions, including the integration of Purple AI, are set to revolutionize threat detection and response capabilities, potentially increasing the company's market share and investor interest.

Analyst Reactions

Wall Street analysts are optimistic about SentinelOne's prospects, with a consensus price target of $25.08, suggesting a significant upside from the current levels. The strong buy and buy ratings from analysts underscore confidence in the company's future performance.

Company Overview

Founded in 2013 and based in Mountain View, California, SentinelOne Inc. has evolved significantly, continuing to lead with its AI-powered Singularity Platform. This platform's autonomous capabilities are crucial for comprehensive cybersecurity across endpoints and cloud environments.

Technical Analysis

- Market capitalization: $5.72 billion.

- PE ratio: -18.04.

- Beta: 0.59.

- 52-week low: $13.87.

- 52-week high: $30.76.

- Fifty-day simple moving average: $20.69.

- Two-hundred-day simple moving average: $23.82.

Summary

This trade aims to capitalize on the potential upside of SentinelOne, driven by its innovative AI capabilities and recent strategic initiatives. The company's strong performance and analyst support further bolster the case for this options trade.