TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

220% Profit Using A Micron Technology Weekly Option!

Micron Technology stock is red hot -- more than doubling the stock price performance of the S&P 500 over the past year as investors bet that Micron's high-bandwidth memory (HBM) chips will prove essential to keeping the artificial intelligence revolution going.

Micron moved higher in early Monday trading after the group said it would start ramping up the shipment of a key addition to Nvidia's new AI-focused chips.

This set the scene for Weekly Options USA Members to profit by 220% using a MU Options trade!

Join Us And Get The Trades – become a member today!

Friday, March 15, 2024

by Ian Harvey

UPDATE

Micron Technology stock is red hot -- more than doubling the stock price performance of the S&P 500 over the past year as investors bet that Micron's high-bandwidth memory (HBM) chips will prove essential to keeping the artificial intelligence revolution going.

One analyst who's particularly optimistic about Micron's prospects is Wolfe Research's Chris Caso. On Wednesday, Caso raised his price target on Micron to $120 a share, implying that Micron stock will gain more than 30% over the next 12 months or so.

Why the Micron Technology Weekly Options Trade was Originally Executed!

Micron Technology, Inc. (NASDAQ: MU) moved higher in early Monday trading after the group said it would start ramping up the shipment of a key addition to Nvidia's new AI-focused chips.

Micron, meanwhile, is looking to piggyback on the spending surge as part of a developing deal with Nvidia that will see its high-bandwidth-memory, or HBM, chips embedded in the new H200 semiconductors.

The HBM3E will consume 30% less power than rival offerings, Micron said, and could help tap into soaring demand for chips that power generative AI applications.

Micron told investors in December that the shipments could generate "several hundred millions of dollars of HBM revenue in fiscal 2024," with continued growth in 2025.

Nvidia which crushed Wall Street's earnings forecasts last week and predicted better-than-expected near-term sales tied to the ongoing surge in AI demand, will start delivering a new, more powerful chip to customers later in the spring.

The new chip, the H200, nearly doubles the inference performance of H100, Nvidia told investors last week, as it looks to cement its position as the most important player in the AI infrastructure market.

Nvidia will use the chip in its next-generation H200 graphic processing units, expected to start shipping in the second quarter and overtake the current H100 chip that has powered a massive surge in revenue at the chip designer.

"I think this is a huge opportunity for Micron, especially since the popularity of HBM chips seems to only be increasing for AI applications" said Anshel Sag, an analyst at Moor Insights & Strategy.

Demand for HBM chips, a market led by Nvidia supplier SK Hynix, for use in AI has also raised investor hopes that Micron would be able to weather a slow recovery in its other markets.

"The world has reached the tipping point of [a] new computing era," Nvidia's chief financial officer Colette Kress told investors last week. "The $1 trillion installed base of data-center infrastructure is rapidly transitioning from general purpose to accelerated computing."

The Micron Technology Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy MU MAR 22 2024 95.000 CALLS - price at last close was $2,75 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MU Weekly Options (CALL) Trade on Tuesday, February 27, 2024 for $3.00.

Sold HALF the MU weekly options contracts on Friday, March 08, 2024 for $9.60; a potential profit of220%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Micron Technology.....

Micron Technology, Inc. was founded in 1978 by four friends in the basement of a dentist's office. The company was focused on making DRAM memory chips and began work on its first fabrication plant in 1981. Micron Technology came out with its first product a few years later and made history with the world's smallest DRAM microchip. By 1994 the company had earned a spot on the Fortune 500 and soon grew to be a leader in the microchip industry. Micron Technology went public in 1984 as well and is headquartered in Boise, Idaho.

Among Micron’s many achievements are the first 1-gigabyte DRAM product in 1987 and the shipping of the first 2-gigabyte NAND product in 2004. Among the latest innovations is the DDR5. The DDR5 is the next generation of DRAM chip for the server market and it can provide an 85% increase in the memory performance.

Today, Micron Technologies designs, manufactures, and sells memory and storage-focused microchip products worldwide. Its chips provide not only the power to store information but the foundation for new technologies like AI and 5G. Micron is the 4th largest semiconductor manufacturer in the world with revenue topping $27 billion in 2022. The company is ranked 127th on the Fortune 500 list and counts more than 50,000 patents and growing in the field of semiconductor manufacturing and storage solutions. The company operates in 17 countries with 11 manufacturing sites and employs more than 45,000 people.

The company operates through four segments that include Compute and Networking, Mobile, Storage, and Embedded. These solutions are marketed under the Micron and Crucial brands, as well as through private labels. In regard to the memory chip market, Micron Technologies is the only company offering all three types of memory storage products giving it the broadest portfolio and most experience and seamless interfaces.

The company manufactures memory and storage technologies including DRAM, NAND, and NOR microchips. The DRAM products are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval. The NAND products are non-volatile and re-writeable semiconductor storage devices The NOR memory products are non-volatile re-writeable semiconductor memory devices that provide fast read speeds.

Micron Technologies memory products are in demand by industries ranging from the cloud server to enterprise, client, graphics, and networking markets, as well as for smartphone and other mobile-device markets including EVs and self-driving cars.

Among the more visible of Micron Technologies products are its line of SSDs and component-level solutions for the enterprise and cloud, client, and consumer storage markets. Often seen in movies and TV, these small-sized memory storage and transport devices can be as small as a key fob.

Further Catalysts for the MU Weekly Options Trade…..

"AI workloads are heavily reliant on memory bandwidth and capacity, and Micron is very well-positioned to support the significant AI growth ahead through our industry-leading HBM3E and HBM4 roadmap, as well as our full portfolio of DRAM and NAND solutions for AI applications,” said Micron's chief business officer, Sumit Sadana.

Micron said its HBM addition not only improves performance, but also helps reduce overall power consumption, a key factor in enabling AI strategies to develop given their massive computing needs.

HBM is one of Micron's most profitable products, in part because of the technical complexity involved in its construction.

The company had previously said it expects "several hundred million" dollars of HBM revenue in fiscal 2024 and continued growth in 2025.

The International Energy Agency notes that data centers and their network offshoots consume around 1.5% of all global computing power. And that tally is expected to grow rapidly over the coming years as hyperscalers overhaul their

Other Catalysts.....

Micron, which reports second quarter earnings on March 20, told investors in December that it expected to post a loss of around 28 cents a share. Group revenue were forecast in the region of $5.3 billion, thanks to what it saw as improving demand linked to the surge in AI-related technologies.

"We are in the very early stages of a multiyear growth phase catalyzed and driven by generative AI, and this disruptive technology will eventually transform every aspect of business and society," said Micron CEO Sanjay Mehrotra.

"Memory is at the heart of GPU-enabled AI servers, and we are already seeing strong demand driven by early deployment of AI solutions, which will only accelerate over time," he added.

Universal Flash Storage.....

Micron Technology announced today that it is delivering qualification samples of an enhanced version of its Universal Flash Storage (UFS) 4.0 mobile solution with breakthrough proprietary firmware features delivered in the world’s most compact UFS package at 9x13 millimeters (mm). Built on its advanced 232-layer 3D NAND and offering up to 1 terabyte (TB) capacity, the UFS 4.0 solution provides best-in-class performance and end-to-end innovation, enabling faster and more responsive experiences on flagship smartphones.

Micron UFS 4.0 accelerates data-intensive experiences with up to 4300 megabytes per second (MBps) sequential read and 4000 MBps sequential write speed, twice the performance of previous generations.1 With these speeds, users will be able to launch their favorite productivity, creativity, and emerging AI apps more quickly. Large language models in generative AI applications can be loaded 40% faster2, resulting in a smoother experience when initializing conversations with AI digital companions.

“Micron’s latest UFS 4.0 solution enables world-class storage performance and reduced power in the world’s smallest UFS package,” said Mark Montierth, general manager and corporate vice president of Micron’s Mobile Business Unit. “Supercharged with breakthrough firmware advancements to keep smartphones running like new, Micron UFS 4.0 raises the bar for mobile storage with enhanced performance, flexibility and scalability to accelerate the rollout of generative AI-capable smartphones.”

AI…..

Micron Technology announced today that Samsung has incorporated Micron’s low-power double data rate 5X (LPDDR5X) memory and Universal Flash Storage (UFS) 4.0 mobile flash storage into select devices in the Samsung Galaxy S24 series, which introduces powerful artificial intelligence (AI) to mobile users around the world. The Galaxy S24 series is underpinned by Samsung’s suite of generative AI tools, Galaxy AI, which helps amplify experiences from enabling barrier-free communication to maximizing creative freedom.

As these data- and energy-intensive features push the limits of smartphones’ hardware capabilities, Micron’s LPDDR5X memory and UFS 4.0 storage provide critical high-performance capabilities and power efficiency to deliver these AI experiences at the edge. Select Samsung Galaxy S24 devices across the S24 Ultra, S24+ and S24 models are shipping with LPDDR5X and UFS 4.0 — the most recent innovations in Micron’s robust mobile portfolio. Micron’s LPDDR5X is the industry’s only mobile-optimized memory offering the advanced capabilities of the 1β (1-beta) process node, while Micron’s UFS 4.0 offers leadership performance and power to store growing amounts of data in today’s AI-driven smartphones.

“Micron’s advanced portfolio of memory and storage solutions were selected to power the innovative Galaxy AI capabilities Samsung is pioneering in the new Galaxy S24 series,” said Mark Montierth, corporate vice president and general manager of Micron’s Mobile Business Unit. “By delivering the critical performance and energy efficiency needed at the edge, Micron’s LPDDR5X and UFS 4.0 solutions are unlocking an unprecedented level of AI-enabled capabilities for Galaxy users.”

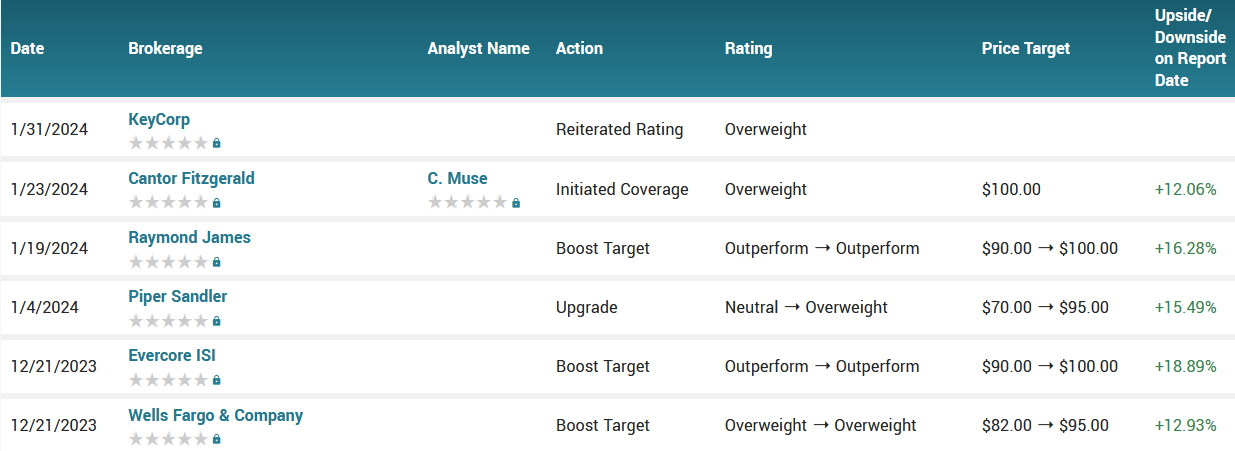

Analysts.....

According to the issued ratings of 25 analysts in the last year, the consensus rating for Micron Technology stock is Moderate Buy based on the current 1 sell rating, 2 hold ratings and 22 buy ratings for MU. The average twelve-month price prediction for Micron Technology is $94.95 with a high price target of $115.00 and a low price target of $65.00.

Summary.....

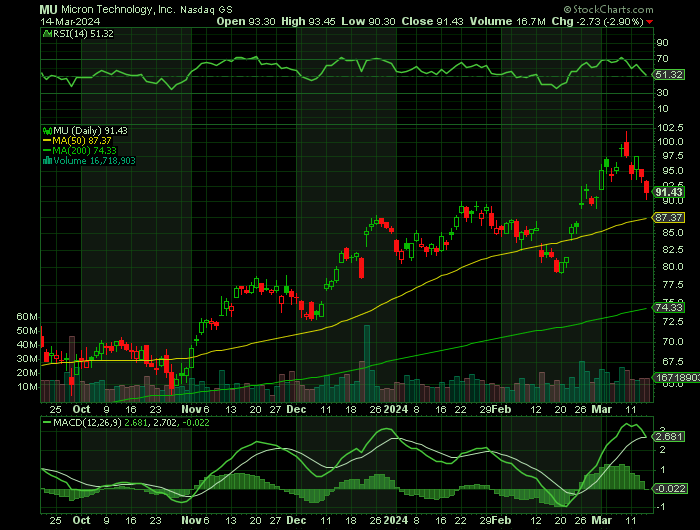

Micron Technology shares opened at $89.46 on Tuesday. The firm’s 50 day moving average is $84.70 and its two-hundred day moving average is $75.73. Micron Technology has a 52 week low of $52.76 and a 52 week high of $92.35. The firm has a market capitalization of $98.76 billion, a P/E ratio of -14.25 and a beta of 1.24. The company has a current ratio of 3.53, a quick ratio of 2.14 and a debt-to-equity ratio of 0.29.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICRON TECHNOLOGY

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.