TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

191% Weekly Option Win on Super Micro Computer

Amid Market Mayhem!

What’s Next?

Monday, April 07, 2025

by Ian Harvey

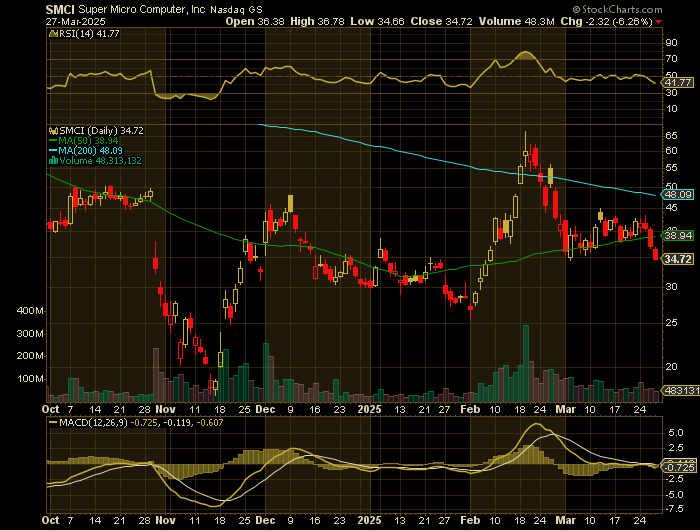

A weekly PUT option on Super Micro Computer (SMCI) — struck at $35 and bought for $2.89 — exploded in value, delivering a 191% gain as tech stocks were hammered in a global selloff.

Here’s what happened:

- SMCI’s decline: Down over 12.9% in a week — and over 70% from its 2024 highs

- Bearish setup: Shrinking margins, legal issues, heavy competition, and lingering accounting red flags

- Macro catalyst: Trump’s surprise tariffs triggered global market turmoil and sent tech stocks crashing

- Trade result: The PUT option skyrocketed as SMCI dropped below $30

The Lesson?

In high-volatility environments, disciplined bearish setups with defined risk

can deliver outsized returns.

Join Us and Get the Trades - More

setups coming... Stay tuned!

In one of the most turbulent trading weeks of 2025, a bold options bet on Super Micro Computer (NASDAQ: SMCI) paid off big — delivering a 191% return in just over four weeks. The winning play? A $35 weekly PUT option expiring April 11, bought for $2.89 back on March 6. By April 4, with SMCI collapsing below $30, the trade rocketed in value.

Result Snapshot:

- Option Entry: $2.89

- SMCI Stock Price on April 4: $29.86

- Option Value: ~$8.42

- Return: +191%

Now, with the dust still settling from a historic global sell-off triggered by new U.S. tariffs, the question isn't how this happened — it's what's next?

Part 1: Why the Put Trade Was Placed

The setup was classic contrarian — a company once riding the AI hype wave suddenly facing mounting headwinds:

- SMCI’s Valuation Bubble: After soaring over 1,000% in 2024, SMCI was trading at unsustainable earnings multiples.

- Margins Cratered: Gross margins had fallen from 18% to just 11.8%, and net margins sank below 6%.

- Red Flags Everywhere: Accounting irregularities, auditor resignations, DOJ/SEC probes, and a massive $1.75B capital raise in March added to bearish conviction.

- Competitive Pressure: Dell and HPE were eating into SMCI’s market share in the booming AI server space.

- Analyst Caution: J.P. Morgan and Goldman Sachs flagged mounting legal and margin risks. Price targets fell as low as $32.

The

Strategy

Buying the SMCI $35 PUT was a tactical play betting on price erosion, amplified

by poor fundamentals, weakening investor trust, and a shaky macro backdrop.

Part 2: The Crash Catalyst – Tariffs & Tech Unwind

The SMCI short thesis found a powerful tailwind in April when Trump’s shock tariffs jolted global markets:

- Dow Plunges Over 4,000 Points in Two Days

- Nasdaq Enters Bear Market (22% Down from Peak)

- China Retaliates, EU & Canada Join In

- Tech Stocks Hammered – SMCI dropped 12.9% in a week

SMCI’s exposure to global tech hardware, its fragile reputation, and export regulation risks turned it into a prime casualty of the sell-off. The timing for the put couldn’t have been better.

Where to Go from Here: Re-Load or Rotate?

With SMCI bouncing near multi-month lows, traders are now asking:

Should I re-enter or rotate into a new opportunity?

Things to Watch:

- Volatility Remains High: The VIX at 45 signals more big swings ahead.

- Sentiment Still Bearish: Short interest on SMCI has ballooned to 22% of float — over $3.89B in value.

- AI Cycle Cooling Off: Data center demand may slow; Microsoft has canceled some projects.

Forward Play Ideas:

- Scalp Volatility: Use shorter-term puts or spreads to profit from sharp price moves.

- Sell Premium: If you expect stabilization, cash-secured put selling at lower strikes ($25–$27.50) could offer yield.

- Watch for Reversal: A reclaim above the 50-day SMA (~$36.89) could shift bias toward bounce plays.

Final Take

The 191% win on SMCI puts wasn’t just luck — it was the result of well-read market signals, technical weakness, and macro risk all converging. The lesson? When fundamentals crack and sentiment turns, even high-flying names can nosedive fast.

Stay nimble. Watch for pattern setups. And don’t be afraid to trade both sides — because in a market this volatile, fortune favors the prepared.

The opportunity is always in the movement—are you ready to take advantage of the next one?

Disclosure: Always manage options risk with protective stops and defined exit plans. As with any trade, past performance is not indicative of future results.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.