TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

175% Profit As Walmart Stock Surges On Earnings!

Is There More To Come?

Join Us and Get the Trades!

Wal-Mart Stores Inc. (NYSE:WMT) is one company that has survived the emergence and dominance of e-commerce businesses and yet managed to keep growing.

WalMart shares surged on Thursday, pushing the retailer’s market value over $500 billion for the first time, after it posted stronger-than-expected first-quarter earnings and boosted its annual sales and profit forecasts.

This set the scene for Weekly Options USA Members to profit by 175% using a WMT Monthly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, May 16, 2024

by Ian Harvey

UPDATE

Wal-Mart Stores Inc. (NYSE:WMT) shares surged on Thursday, pushing the retailer’s market value over $500 billion for the first time, after it posted stronger-than-expected first-quarter earnings and boosted its annual sales and profit forecasts.

Its shares climbed 7%, the most since March 2020, to close at an all-time high of $64. The stock jump added roughly $34 billion in value, giving the company a market capitalization of $515.8 billion.

Walmart gave an optimistic outlook after topping analyst earnings and revenue views, with e-commerce sales continuing to see robust growth.

Analysts expected Walmart earnings to rise 7% to 53 cents. Revenue was seen growing 5%, year over year, to $159.51 billion.

The Bentonville, Ark.-based company reported adjusted earnings of 60 cents per share, up 22% from the prior year's Q1. Revenue rose 6% to $161.51 billion. Walmart reported for the first quarter, ended on April 30, of its fiscal year 2025.

Global e-commerce sales surged 21%, year over year. But that was down from a 26% gain a year ago. Same-store sales, excluding fuel, rose 3.8%.

The company said it continues to draw more frequent and new shoppers amid price inflation.

Walmart now expects to hit the top end or to slightly top its prior full-year EPS and revenue guidance. It expects EPS of $2.23-$2.37 for the year and net sales growth of 3%-4%.

Why the Walmart Weekly Options Trade was Originally Executed!

Wal-Mart Stores Inc. (NYSE:WMT) is one company that has survived the emergence and dominance of e-commerce businesses and yet managed to keep growing. It remained relevant by expanding the e-commerce segment and using its physical stores to fulfill online orders. Walmart is investing heavily in the e-commerce segment and has already seen the returns on its investment.

In the first-quarter results, the company beat expectations and raised the full-year guidance. It saw a 2.4% rise in revenue to hit $141.6 billion, and the membership revenue increased by 10.5%. Its e-commerce sales grew 1%. The management raised the guidance due to an increase in earnings and an improvement in the grocery business.

Walmart’s long-term strategy is to increase Walmart+ subscribers, where it offers discounts and free deliveries, and it has added streaming services to the plan to compete with Amazon (NASDAQ:AMZN) Prime.

With an increase in subscribers, the company will be able to see an improvement in the bottom line. It has achieved success in the grocery segment, and this is one area that will continue to grow, no matter the market situation. However, an improvement in consumer spending could benefit Walmart in the long term.

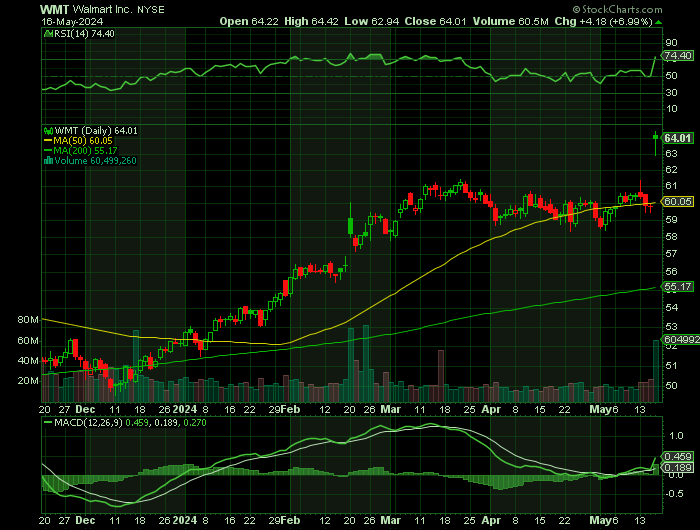

Trading at $60 today, the stock is up 14% year-to-date and 17% in the past 12 months. It is one of the best retail stocks to buy this month. The steady revenue growth and the growing international business make Walmart a resilient stock to own. On top of that, it boasts a dividend yield of 1.39%, making it attractive for passive income investors.

The Walmart Monthly Options Potential Profit Explained.....

** OPTION TRADE: Buy WMT SEP 20 2024 65.000 CALLS - price at last close was $1.28 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the WMT Monthly Options (CALL) Trade on Tuesday, May 14, 2024 for $0.97.

Sold half the WMT Monthly options contracts on Thursday, May 16, 2024 for $2.67; a potential profit of175%.

(This result will vary for members depending on their entry and exit strategies).

Holding remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Walmart……

Walmart Inc. is the world’s biggest company by revenue and its largest employer with over 2.2 million globally. It is a general merchandise discount retailer founded in 1962 by Sam Walton and remains a very tightly-held family-owned company to this day. At last look, the Walton family and its heirs owned more than 50% of the company through the family-holding company Walton Enterprises and individual holdings. As of October 2022, the company operated nearly 10,600 stores in 24 countries under 46 different banners. For example, Walmart de Mexico is the Mexican branch while Flipkart Wholesale is the company’s operations in India.

Sam Walton began his crusade to undercut retail competitors began in the early 1950s. He opened the first Wal-Mart Discount City store in 1962 and was able to leverage the brand to great success. It became a publicly traded company in 1972 and was the US's most profitable retailer by 1988. The chain went nationwide in the early 1990s and expanded to international markets soon after that. While the company has seen some success outside the US, those remain limited, and the US is the primary market and produces well over 60% of the revenue and earnings.

Today, the company operates through three segments that include Walmart U.S., Walmart International, and Sam's Club. The stores offer groceries, health, beauty, apparel, footwear, household, furniture, automotive, electronics and recreational products among others. In addition, the company offers a wide variety of ancillary services that include automotive repair, tire change, vision/eyeglass services and financial services that include gift cards, prepaid wireless, check cashing and money transfers. Sam’s Club, launched in 1989, is the company’s membership club brand. It is the second-largest membership club in North America and about 12% of Walmart’s total revenue.

Walmart is a Dividend Aristocrat with nearly 50 years of consecutive annual dividend increases to its credit. Based on the 2022 financial metrics, the company is capable of sustaining another several decades of increases at a low single-digit pace. Once a laggard in ESG, Walmart is now a leader in environmental, social, and governance issues. The company’s efforts include increasing the efficiency of its truck and vehicle fleets to include the upgrade to electrification or hydrogen fuel cells. In terms of hydrogen fuel cell vehicles alone, the company had upgraded more than 9,500 of its warehouse and facility service machines to fuel cells as of mid-2022 and was also working to electrify its vehicle fleets.

Further Catalysts for the WMT Weekly Options Trade…..

Walmart

likely benefited from same-store sales momentum amid a strong pricing position

in the first quarter, Deutsche Bank said in a note emailed Monday ahead of the

big box retailer's May 16 print.

The brokerage increased its same-store sales estimate to 3.5% and said the

buy-side whisper is between 3% and 4% growth. Deutsche Bank rates the retailer

at buy with a $70 price target on the stock, which implies roughly 16% upside,

analyst Krisztina Katai wrote.

"Despite a volatile consumer spending backdrop, increased concerns on the

health of the low-end consumer, and the relative resiliency of shares of

(Walmart), we approach its (first-quarter) print with optimism," she said.

Other Catalysts.....

The

company's strong pricing position is likely aided by incremental rollback

activity while its premium private label push is expected to lead to volume

growth and stickiness among higher-income households, according to Deutsche

Bank.

The first-quarter performance is projected to show evidence that Walmart's

"recent share gains are sustainable," Katai said. Walmart in February

guided for first-quarter constant-currency sales growth of 4% to 5% and

adjusted earnings per share of $0.49 to $0.52 post common stock split. The

consensus is for revenue of $158.14 billion and normalized EPS of $0.52,

according to a Capital IQ survey.

Deutsche Bank doesn't expect Walmart to update its full-year guidance until the

second-quarter print but believes there's merit for a modest raise. The

company's initial guidance was perceived to be conservative, according to the

report.

Walmart guided for fiscal 2025 constant-currency sales growth of 3% to 4% and

adjusted EPS of $2.23 to $2.37 post-split. Wall Street's modeling for revenue

of $670.15 billion and normalized EPS of $2.37 for the ongoing year.

Walmart's late-April announcement that it will shut all 51 of its health

centers will serve as an additional tailwind to the company's profit and loss

statement in the second half of the year, according to Katai.

Analysts.....

Walmart, the Consumer Defensive sector company, was revisited by a Wall Street analyst yesterday. Analyst Seth Sigman from Barclays maintained a Buy rating on the stock and has a $60.00 price target.

Seth Sigman has given his Buy rating due to a combination of factors, primarily Walmart’s strong market share momentum and its robust positioning in a challenging retail environment. His analysis indicates that Walmart is achieving consistent growth, outperforming other retailers who anticipate a more significant change in their sales trajectories. Sigman believes that Walmart will meet or possibly exceed its earnings guidance for the year, thanks to solid gross margins and strategic investments, despite experiencing some pressure on ticket sizes due to a mix of product pricing.

Furthermore, Sigman notes that Walmart is seeing an uptick in transaction volumes, indicative of market share gains across various consumer cohorts and product categories, including essential areas like grocery and health/wellness. While general merchandise faces deflationary pressures, these are expected to subside in the second half of the year. Additionally, promotional activity has increased, with vendor support, which should help sustain the company’s competitive edge. Despite the rising inflationary pressures on consumers, particularly those with lower incomes, Walmart’s market share story appears to be gaining strength, which underpins Sigman’s positive outlook on the stock.

In another report released yesterday, Evercore ISI also maintained a Buy rating on the stock with a $66.00 price target.

According to the issued ratings of 29 analysts in the last year, the consensus rating for Walmart stock is Moderate Buy based on the current 4 hold ratings and 25 buy ratings for WMT. The average twelve-month price prediction for Walmart is $61.94 with a high price target of $75.00 and a low price target of $55.00.

Summary.....

Walmart has a debt-to-equity ratio of 0.46, a quick ratio of 0.24 and a current ratio of 0.83. The firm has a market cap of $487.35 billion, a P/E ratio of 31.61, and a P/E/G ratio of 3.95 and a beta of 0.49. The firm’s 50 day simple moving average is $60.17 and its 200 day simple moving average is $56.24. Walmart Inc. has a 1-year low of $48.34 and a 1-year high of $61.65.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from WALMART

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.