TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

143% Profit Using A Taiwan Semiconductor Weekly

Option!

Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM) has rallied almost 30% this year, riding on the market obsession over generative AI powered by Nvidia’s earnings.

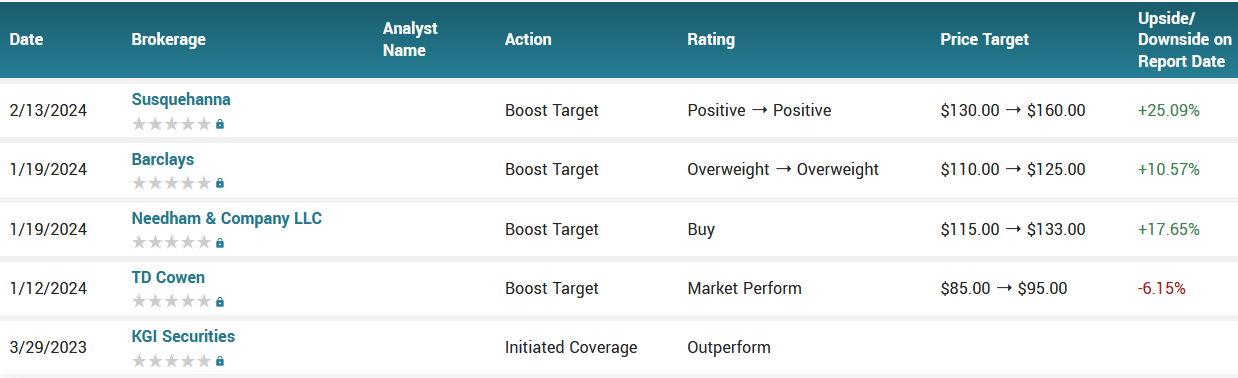

TSM recently received another price target hike from Bernstein Research. The investment firm maintained an "outperform" rating and set a new price target of $150 from $125 previously.

This set the scene for Weekly Options USA Members to profit by 143% using a TSM Options trade!

Join Us And Get The Trades – become a member today!

Thursday, March 14, 2024

by Ian Harvey

UPDATE.

TSM recently received another price target hike from Bernstein Research. The investment firm maintained an "outperform" rating and set a new price target of $150 from $125 previously. With TSMC's stock price at $139.44, that new target represents a 7.6% jump over the next 12 to 18 months.

One reason for the upgrade comes from the belief that Intel outsourcing some of its production to TSMC, as it is better known, is helping the latter grow stronger over the next couple of years. While Intel may move some production in-house in a few years, the near-term impact is a plus for TSMC.

2024 is a year of recovery for the company, as its high-performance computing (HPC) chips benefit from the boom in artificial intelligence (AI) applications. This is proving a boon and helping replace slowing smartphone demand. A lot of news in recent months, including TSMC's monthly sales data and industry data, points to a strong year of growth for the company.

Why the Taiwan Semiconductor Weekly Options Trade was Originally Executed!

On Monday, the Semiconductor Industry Association (SIA) trade group reported that global semiconductor sales in January 2024 declined slightly in comparison to December 2023 (down 2.1%), but increased dramatically in comparison to the year-ago period. January 2024 sales totaled $47.6 billion, up 15.2% year over year from January 2023 -- the largest year-over-year increase in monthly sales seen since May 2022, the association noted.

The SIA described January's results as a strong start to the year, and predicted that as 2024 progresses, semiconductor sales worldwide will continue to grow double-digits over 2023 numbers. For the time being at least, it seems a lot of this growth is being concentrated among just a handful of companies -- Nvidia and its contract manufacturer Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM) being notable winners -- such that it's not 100% certain that each and every individual semiconductor stock can be expected to grow this year.

The SIA report noted that semiconductor sales growth was fastest in China (sales up 26.6% year over year) and second-fastest in the U.S. (sales up 20.3%) -- influencing the price of TSMC stock prices: the U.S. Chips Act.

"Close to $30 billion" worth of U.S. government subsidies awarded to semiconductor manufacturers under the Chips Act will "start flowing in the next few weeks." Again, it's not 100% certain at this time who will benefit from this largesse. TSMC is "likely" to receive subsidies under the Chips Act.

TSMC has rallied almost 30% this year, riding on the market obsession over generative AI powered by Nvidia’s earnings. It is scheduled to report its monthly sales on Friday.

The Taiwan Semiconductor Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy TSM APR 05 2024 145.000 CALLS - price at last close was $5.40 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

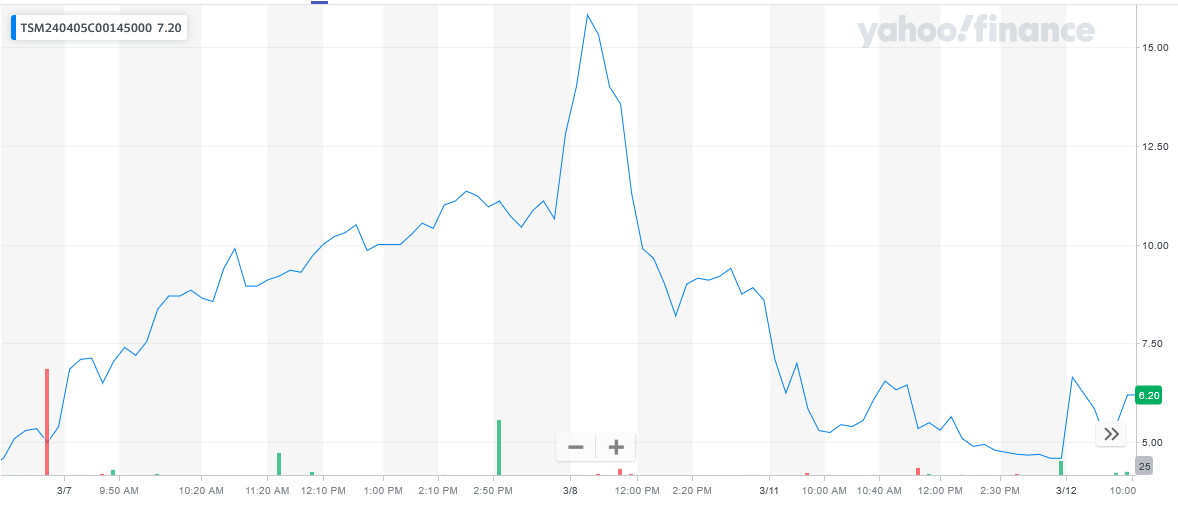

Entered the TSM Weekly Options (CALL) Trade on Thursday, March 07, 2024 for $6.50.

Sold the TSM weekly options contracts on Friday, March 08, 2024 for $15.80; a potential profit of143%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About TSM…..

Taiwan Semiconductor Manufacturing's has obtained lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger. Last month, rival Intel, one of the last chipmakers that manufactures its own chips, admitted that it had run into a design flaw for its 7 nm manufacturing process, and would be falling some 12 months behind schedule. Intel had already ceded the leading-edge node lead to TSM in 2018, and that lead only seems to be getting bigger.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

Further Catalysts for the TSM Weekly Options Trade…..

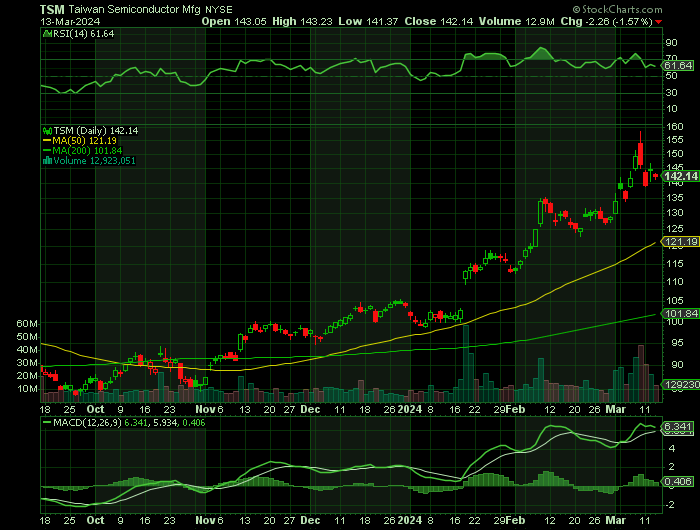

TSMC, whose chips are used by some of the world’s most advanced AI processors, gained further traction this week by rising more than 10% to a fresh record following the advance in its client Nvidia Corp. The rally has brought its 14-day relative strength index to over 82, making it one of the most overbought stocks in Asia based on this technical indicator.

“Consumers and business communities’ confidence in GenAI’s added value justifies any potential price increase,” said Bloomberg Intelligence analyst Charles Shum. The next valuation re-rating catalyst for the company is an exponential growth of generative AI used in devices like smartphones and computers, he added.

The world’s top chip foundry jumped as much as 4.6% to NT$769 in Taipei on Thursday. Other chipmakers in Taiwan also edged higher, as MediaTek Inc. closed 3.4% up and ASE Technology Holding Co. climbed 9.7% to a fresh record.

Other Catalysts.....

AI stocks are soaring again this year as recent results from companies like Nvidia (NASDAQ: NVDA) and Super Micro Computer have blown past analyst estimates as cloud infrastructure companies and AI start-ups dramatically ramp up spending on AI hardware. The fervor for AI stocks has gotten so heated that even stocks that Nvidia has invested in, like Soundhound AI, have surged when the news of Nvidia's stake broke.

Those soaring stock prices have led some to fear that an AI bubble is forming. Wharton professor Jeremy Siegel said that a speculative bubble could be starting in stocks like Nvidia, and other respected investors like Jeremy Grantham and Jeffery Gundlach have made similar proclamations.

The magnitude and sustainability of the current wave of demand for AI infrastructure is realized by this quote from Taiwan Semiconductor Manufacturing (NYSE: TSM) founder Morris Chang.

At a recent conference in Japan, Chang described the demand his company is seeing from customers for AI computing power, saying: "They're not talking about tens of thousands of wafers. They are talking about fabs, [saying] 'We need so many fabs. We need three fabs, five fabs, 10 fabs.' Well, I can hardly believe that one."

The report, which was originally in Nikkei, said that Chang also said he believed demand was somewhere between tens of thousands of wafers and 10 fabs

Demand.....

As demand for AI chip manufacturing grows, TSMC occupies an increasingly enviable position, as it is by far the biggest manufacturing partner for industry suppliers like Nvidia. In some ways, it's the only game in town.

TSMC's dominant market share at a crucial position in the AI supply chain also gives it significant market power, and it should be a winner no matter what happens in the AI revolution. The company only needs demand for chips to grow, and it's clear now that running generative AI applications comes with massive computing needs.

Analysts.....

JPMorgan Chase & Co. hiked its target price for TSMC by 10% Wednesday, calling the stock an “enabler for almost all AI processing at the data center and the edge.” AI-related revenues should surge by one fourth by 2027 and the company should maintain its lead in developing some of the advanced chips, analysts including Gokul Hariharan wrote in a note.

According to the issued ratings of 5 analysts in the last year, the consensus rating for Taiwan Semiconductor Manufacturing stock is Moderate Buy based on the current 1 hold rating and 4 buy ratings for TSM. The average twelve-month price prediction for Taiwan Semiconductor Manufacturing is $128.25 with a high price target of $160.00 and a low price target of $95.00.

Summary.....

Shares of TSMC have already gained 29% this year after climbing 39% last year, and it's well positioned for further gains as it trades at a reasonable valuation and has a huge profit margin.

Taiwan Semiconductor Manufacturing traded up $6.60 during midday trading on Wednesday, hitting $141.57. 22,179,707 shares of the stock were exchanged, compared to its average volume of 14,673,958. The company has a market capitalization of $734.24 billion, a price-to-earnings ratio of 26.06, and a P/E/G ratio of 3.12 and a beta of 1.15. The company has a current ratio of 2.40, a quick ratio of 2.13 and a debt-to-equity ratio of 0.26. Taiwan Semiconductor Manufacturing Company Limited has a one year low of $81.21 and a one year high of $144.00. The business has a 50-day moving average price of $116.85 and a two-hundred day moving average price of $101.77.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TSM

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.