TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, MAY 17, 2021

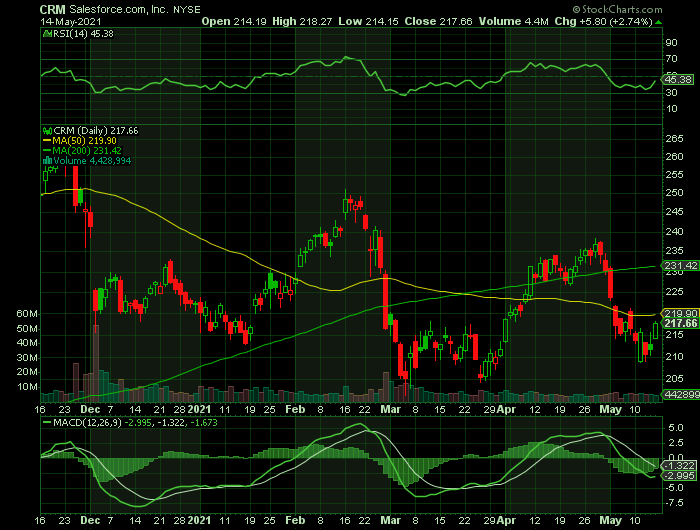

Another Weekly Options Trade on Salesforce.com, inc. (NYSE:CRM) Calls

Thursday, May 20, 2021

** OPTION TRADE: Buy CRM MAY 28 2021 225.000 CALLS at approximately $5.00.

(Some members have asked for the following.....

Place a pre-determined sell at $10.00.

Include a protective stop loss of $2.00.

Prelude.....

Tuesday saw our CRM options trade climbed slightly.

READ the article “Salesforce Upgraded – Shares Move Higher!”

NOW…..

Yesterday saw CRM jump on an upgrade.

This morning, futures are in the red and seem to be sinking further, therefore a great opportunity to enter a new CRM trade at a great price.

The catalysts from the original trade are still in place.

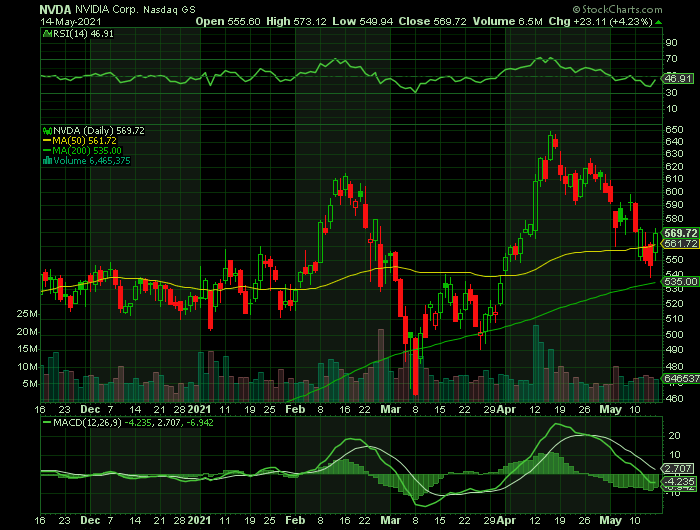

Another Weekly Options Trade on NVIDIA Corporation (NASDAQ:NVDA) Calls

Thursday, May 20, 2021

** OPTION TRADE: Buy NVDA MAY 28 2021 580.000 CALLS at approximately $11.00.

(Some members have asked for the following.....

Place a pre-determined sell at $22.00.

Include a protective stop loss of $4.40.

Prelude.....

Tuesday saw our NVIDIA options trade play out before falling back again.

READ the article “NVIDIA Provides Quick Profits Using Weekly Options!”

NOW…..

Yesterday, the market opened in a negative way and further pushed NVIDIA stock downwards.

However, the market rebounded and NVIDIA recovered somewhat.

This morning, futures are in the red and seem to be sinking further, therefore a great opportunity to enter a new NVIDIA trade at a great price.

The catalysts from the original trade are still in place.

NOTE: You should be able to enter the trade at a much cheaper price during the trading day then that suggested.

Weekly Options Trade – NVIDIA Corporation (NASDAQ:NVDA) Calls

Monday, May 17, 2021

** OPTION TRADE: Buy NVDA MAY 28 2021 600.000 CALLS at approximately $9.20.

(Some members have asked for the following.....

Place a pre-determined sell at $18.40.

Include a protective stop loss of $3.70.

Prelude.....

The maker of graphics and high-performance computing chips NVIDIA Corporation (NASDAQ:NVDA) reports earnings next Wednesday, May 26, 2021, after the market closes.

NVIDIA is a market-leading provider of graphics processing units (GPUs) and AI solutions. Its brand name has become synonymous with best-in-class graphics in video games and high-performance computing in data centers. In fact, NVIDIA has over 90% market share in the supercomputing accelerator market.

Last year this semiconductor company strengthened its position with the acquisition of Mellanox, a provider of high-performance networking solutions. NVIDIA CEO Jensen Huang noted that this move creates "significant product synergies," allowing the company to take a more holistic approach to data center hardware design.

NVDA stock has had a tumultuous eight months. This year alone, NVDA has gone on several runs, followed by steep drops. Shares have ranged in price; from a low of $462 in March to an all-time high close of over $645 in mid-April. Currently trading in the $560 range — off April’s mark by about 13% — and approaching a first-quarter earnings report that’s expected to be a blockbuster, seems to be a good time for this options play.

Major Catalysts for This Trade.....

1. Earnings on Wednesday, May 26, 2021.....

Nvidia is expected to release its Q1 fiscal 2022 results on May 26. Previously, though, the company had already issued revenue guidance of $5.3 billion for the quarter, plus or minus 2%.

On Apr. 12, however, Nvidia announced that revenue for the quarter is tracking above those projections. In addition, the company noted that it has sufficient supply on hand to support sequential growth beyond Q1 — no small feat during a global chip shortage.

2. Influence of Nvidia.....

Together, NVIDIA and Mellanox power eight of the top 10 supercomputers in the world. Even more impressive, Italy's CINECA has selected NVIDIA GPUs (and Mellanox networking) to power the world's fastest AI supercomputer, the Leonardo. Once built, the system will deliver 10 exaflops of performance, making it nearly 19 times faster than Japan's Fugaku, which currently tops the list of the world's fastest supercomputers.

According to Cathie Wood's ARK Invest analysis, accelerators like NVIDIA GPUs will displace central processing units (CPUs) as the dominant processors in data centers by 2030, growing at 21% annually over that period. That opens the door to a $41 billion market opportunity for the chipmaker.

Additionally, factoring in other use cases like enterprise and edge AI, management believes its total addressable market in the data center sector will actually hit $100 billion by 2024.

3. Arm-based Tegra.....

NVIDIA's Arm-based Tegra CPUs power infotainment and navigation systems for high-end automakers like Audi and Lamborghini. They also power its Drive onboard computers for autonomous vehicles.

NVIDIA generated 3% of its revenue from automotive chips last quarter. That's just a tiny sliver of its business, and the unit faced severe headwinds last year as the pandemic disrupted the production of new vehicles. The global semiconductor shortage could further delay that recovery.

But after those headwinds wane, NVIDIA's automotive business should recover and gradually account for a larger slice of its revenue. Until then, NVIDIA should continue to generate high double-digit percentage revenue and earnings growth as it sells more gaming and data center GPUs.

4. Cryptocurrency......

Cryptocurrencies are hot once again, which means that demand for graphics processing units (GPUs) for crypto mining rigs is through the roof. Nvidia has been through this cycle before and learned a painful lesson. Crypto miners can be big business, but they compete against NVDA’s core customer base for graphics cards. That results in bad PR when stock runs out. Plus, the crypto market can dry up without warning. In 2018, this effect hammered NVDA stock when miners suddenly stopped buying.

This time, though, the company is doing things differently and managing the crypto market much more carefully. Acknowledging mining as an actual line of business, NVDA created a GPU specifically for that market. Additionally, it took measures to prevent miners from snapping up all its new consumer GPUs. New graphics cards will automatically throttle performance if used for crypto mining.

Nvidia’s new RTX 3000 series GPUs are still in short supply, but consumers aren’t competing against crypto miners to buy them now. Meanwhile, the new crypto cards are selling better than expected. In its Q1 earnings update, the company noted that it has already sold $150 million worth, compared to the projected $50 million.5. Acquisitions.....

Salesforce is in the midst of acquiring enterprise communications platform Slack Technologies in a $27.7 billion cash-and-stock deal. Assuming the deal closes, Slack will provide Salesforce with a jumping-off point to cross-sell its CRM solutions to small-and-medium-sized businesses.

5. Grace.....

This product is a custom designed, Arm-based processor aimed at data centers. NVDA says that its first data center CPU is optimized to deliver 10 times “the performance of today’s fastest servers on the most complex AI and high performance computing workloads.”

Of course, Nvidia has always been about GPUs, so its first data center CPU is a shot across the bow of PC processor leaders. If Grace lives up to claims, it has the potential to significantly grow Nvidia’s data-center market. Back in Q4, that market brought in $1.9 billion.

6. Gaming.....

Nvidia announced new devices across its portfolio and launched a new bit of gaming software. To begin with, the company unveiled a new wave of gaming laptops, flaunting its latest GPUs. This was followed by the reveal of new collaborative laptops with the likes of Dell (NYSE: DELL) and other consumer hardware names. On top of all that, Nvidia GPU owners now have access to GeForce NOW, powering optimal cloud gaming experiences.

Analysts’ Opinions.....

Baird analyst Tristan Gerra rates the stock an Outperform (i.e. Buy) along with an $800 price target, which implies ~45% upside. The bull thesis is based on "Nvidia’s strong near-term positioning in AI data center markets and longer-term opportunities across many accelerated computing applications."

"As Nvidia increasingly moves to platform solutions targeting and enabling all AI markets, while diversifying its architecture offering, the company is poised to over time dominate data center. Omniverse gives us an early glimpse of a virtual 3D world which Nvidia is at the forefront and ultimately yielding to a matrix computing world. More near term, GTC-announced foray into CPUs will expand Nvidia's computing TAM," Gerra opined.

Overall, no fewer than 27 analysts have put reviews on NVDA on record, and of those, 24 are to Buy against just 3 to Hold. NVDA shares are selling for $550.34; the average price target of $682.20 implies an upside of 24% from that level.

Summary.....

NVDA stock has appreciated well over 1200% over the past five years. The company’s strategy and execution bodes well for the long-term growth prospects of the stock.

For the most part, Nvidia does not seem to be slowing down one bit. While demand for its wares continues to surge from the gaming and crypto-mining markets, the company continues to innovate.

Weekly Options Trade – Salesforce.com, inc. (NYSE:CRM) Calls

Monday, May 17, 2021

** OPTION TRADE: Buy CRM MAY 28 2021 220.000 CALLS at approximately $5.70.

(Some members have asked for the following.....

Place a pre-determined sell at $11.40.

Include a protective stop loss of $2.30.

Prelude.....

Salesforce.com, inc. (NYSE:CRM) stock is down, but is certainly not out. Since the start of the year tech stocks have taken two legs down, in late February and now, in early May. CRM stock has joined the party both times. It’s down 3% on the year, while the average S&P stock is up 11%.

The performance is almost identical to that of Apple, the market’s largest company, only slightly more pronounced.

It’s due to investors rotating out of expensive stocks and into those benefitting from the end of the pandemic or Biden’s Administration’s infrastructure plans. Even with this latest fall, Salesforce stock sells at 49 times earnings.

When the pandemic was on, investors piled into the few names that were making money, and cloud application stocks like Salesforce were among those names. CRM stock peaked at $281.25 per share in late August into early September. Over the last year you’re still up 32%.

About Salesforce.com.....

Salesforce pioneered the software-as-service business model under the leadership of founder and CEO Marc Benioff, who founded the company in 1999. Benioff has exhibited a talent for business since he was very young; while in high school, he sold his first app to a computer magazine for $75.

When he was 15, Benioff founded Liberty Software, a one-man company making games for Atari 800. While studying at USC, Benioff took a summer internship with Apple, working as a programmer in the Macintosh division under Steve Jobs himself. This was a profoundly inspiring experience for Benioff.

After a successful career at Oracle from 1986 to 1999, Benioff launched Salesforce.com and with it a new business paradigm for the industry. Salesforce.com's key advantage was that the software was accessed through a web browser and delivered entirely online, which was truly revolutionary at the time.

The company has delivered vigorous growth rates through both organic growth and acquisitions, and management has done a great job at expanding the addressable market and producing all kinds of opportunities for cross-selling. Financial performance has been outstanding over the long term and the company still has ambitious plans for expansion going forward.

Major Catalysts for This Trade.....

1. Earnings on Thursday, May 27, 2021.....

CRM is projected to report earnings of $0.88 per share, which would represent year-over-year growth of 25.71%. Meanwhile, the Consensus Estimate for revenue is projecting net sales of $5.88 billion, up 20.9% from the year-ago period.

For the full year, the Consensus Estimates are projecting earnings of $3.44 per share and revenue of $25.7 billion, which would represent changes of -30.08% and +20.94%, respectively, from the prior year.

2. Polen Capital, an investment management firm Thoughts.....

Polen Focus Growth Fund, in its Q1 2021 investor letter, mentioned salesforce.com, inc., and shared their insights on the company. salesforce.com, inc. is a San Francisco, California-based software company that currently has a $195.3 billion market capitalization. Since the beginning of the year, CRM delivered a -4.79% return, while its 12-month gains are up by 23.66%. As of May 13, 2021, the stock closed at $211.86 per share.

Here is what Polen Focus Growth Fund has to say about salesforce.com, inc. in its Q1 2021 investor letter:

"We opportunistically increased our weighting in Salesforce.com. After management announced the company would acquire Slack for approximately $28 billion, a high purchase price, shares came under significant pressure.

We believe the Salesforce-Slack strategic vision is on point, and although the purchase price is high in absolute dollars, it represents less than 15% of Salesforce’s market capitalization. We maintain an optimistic view of Salesforce’s business, its competitive positioning within enterprise software, and the rationale behind the Slack acquisition. We expect continued earnings and free cash flow growth many years into the future."

3. Continued Growth.....

Although estimates vary, the consensus is that CRM remains a double-digit growth opportunity. CRM software is used by consumer-facing businesses to handle the logging of customer information, oversee online marketing campaigns, address service issues, and can even predict which customers might purchase new products and services. CRM is a logical choice for retail and service-based companies, but is finding a home in areas you might not expect, such as healthcare and financial companies.

4. Dominant Position......

Salesforce is absolutely dominant when it comes to providing cloud-based CRM solutions. An IDC report showed that it held almost a 20% share of global CRM revenue in the first-half of 2020. Its four closest competitors don't even add up to salesforce's share on a combined basis.

5. Acquisitions.....

Salesforce is in the midst of acquiring enterprise communications platform Slack Technologies in a $27.7 billion cash-and-stock deal. Assuming the deal closes, Slack will provide Salesforce with a jumping-off point to cross-sell its CRM solutions to small-and-medium-sized businesses.

6. Digital 360 for Industries.....

Last month, the company introduced Digital 360 for Industries. The platform helps companies deliver better experiences faster with industry apps and developer tools. It can be deployed for consumer, health care, and financial services segments among others.

Analysts’ Opinions.....

- Zacks Investment Research lowered salesforce.com from a “hold” rating to a “sell” rating and set a $232.00 price objective on the stock. in a research note on Monday, March 1st.

- Nord/LB lowered salesforce.com from a “buy” rating to a “hold” rating in a research note on Wednesday, March 24th.

- The Goldman Sachs Group upgraded salesforce.com from a “buy” rating to a “conviction-buy” rating and set a $315.00 target price on the stock in a research note on Monday, March 8th.

- Piper Sandler decreased their target price on salesforce.com from $242.00 to $240.00 and set a “neutral” rating on the stock in a research note on Thursday, March 4th.

- Finally, Wolfe Research started coverage on salesforce.com in a research note on Wednesday, April 28th. They issued an “outperform” rating and a $270.00 target price on the stock.

One investment analyst has rated the stock with a sell rating, eight have issued a hold rating, twenty-six have issued a buy rating and three have issued a strong buy rating to the company’s stock. salesforce.com has a consensus rating of “Buy” and a consensus target price of $268.49.

Summary.....

According to CEO Marc Benioff, salesforce is on track to grow its full-year sales from $21.25 billion in its latest fiscal year to north of $50 billion in five years. That's growth investors should gladly sign up for.

Back to Weekly Options USA Home Page