TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, February 06, 2023

TAKE PROFIT WHEN AVAILABLE!

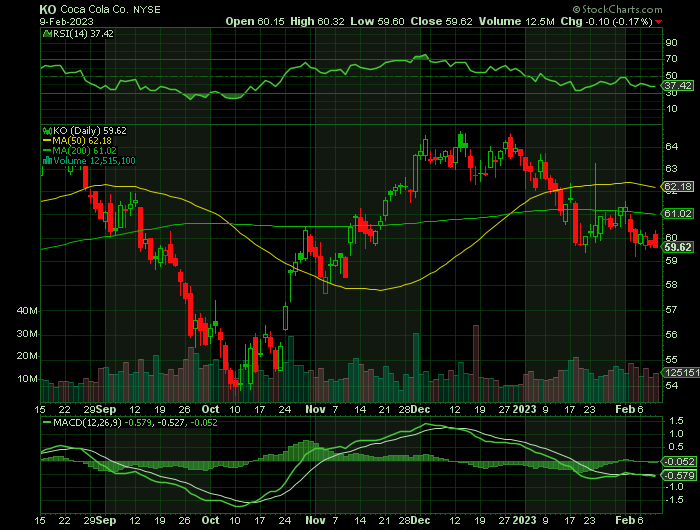

Weekly Options Trade – Coca-Cola Co (NYSE: KO) CALLS

Friday, February 10, 2023

** OPTION TRADE: Buy KO FEB 24 2023 60.000 CALLS - price at last close was $0.94 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

PepsiCo (PEP) shares spiked Thursday after its solid fourth-quarter results also came with the announcement that it will raise its dividend and increase its share repurchase plan.

Now, Coca-Cola Co (NYSE: KO) will present its quarterly results on Tuesday, February 14th, before the market open.

And now, investors feel that a similar scenario could be in store for Coca-Cola.

Coca-Cola is an American multinational corporation best known for its flagship Coca-Cola beverage. KO’s strong brand equity, marketing, research, and innovation help it to garner a market share of more than 40% in the non-alcoholic beverage industry.

Coca-Cola and Pepsi’s business operations are a bit different. Both companies’ core business models revolve around beverage production and distribution, Pepsi also includes food and snack production.

This largely reflects the price difference between the two stocks as shown in the chart below and why Pepsi’s earnings and revenue are significantly higher than Coca-Cola. With that being said, both Coca-Cola and Pepsi are viable consumer staples investments, and monitoring their growth and valuation mostly differentiates which company may be more suitable in investors’ portfolios.

Further Catalysts for the KO Weekly Options Trade…..

There could be increased optimism about Coca-Cola stock prior to earnings, largely due to Pepsi’s Q4 report that saw the company beat on its top and bottom line. Pepsi posted quarterly EPS of $1.67 a share topping estimates by 1.82%. Sales came in at $28 billion, which was a 4% surprise.

Year over year, Q4 earnings were up 9% with sales up 11% from the prior-year quarter. This was despite Pepsi seeing lower sales volume, contrary to net sales increasing. Specifically, among Pepsi’s Quaker Foods North America, sales volume fell 7%.

Earnings Expectations.....

Looking at Coca-Cola, Q4 earnings are projected at $0.45 per share, which would be on par with Q4 2021. Sales for the quarter are expected to be $10.01 billion, up 6% from the prior year quarter.

This would round out Coca-Cola’s Fiscal 2022 with earnings up 7% to $2.48 a share. On the top line, sales would be up 11% for FY22 to $42.86 billion compared to $38.66 billion in 2021.

After wrapping up fiscal 2022, Coca-Cola’s FY23 earnings are forecasted to rise 3% to $2.55 per share with earnings estimate revisions slightly higher over the last quarter. Sales are projected to be up 3% to $44.22 billion. More impressive, Fiscal 2023 would represent 38% growth over the last five years with 2018 sales at $31.85 billion.

Transformation.....

Coca-Cola’s

performances in recent quarters have been benefiting from strategic

transformation and ongoing recovery around the world. The company’s

fourth-quarter performance is expected to have benefited from revenue growth

across its operating segments, aided by an improved price/mix and an increase

in concentrate sales. Underlying share gains in both at-home and away-from-home

channels are also expected to have bolstered the performance.

Recovery.....

The company’s volumes in the fourth quarter are expected to have benefited from the ongoing recovery in markets. Category-wise, volume has been benefiting from growth in trademark Coca-Cola; sparkling flavors; the nutrition, juice, dairy and plant-based beverages; and hydration, sports, coffee and tea categories.

Innovations.....

Coca-Cola’s fourth-quarter results are likely to reflect gains from

innovations and accelerating digital investments. The company has been

witnessing a splurge in e-commerce with the growth rate of the channel doubling

in many countries. KO has been accelerating investments to build strong digital

capabilities. The company has been consistently strengthening consumer

connections and piloting various digital-enabled initiatives through

fulfillment methods to capture the online demand, which are likely to have boosted

fourth-quarter sales.

Sales Growth.....

Coca-Cola has been investing in its markets and brands to support sales growth with higher spending on consumer-facing activities. This has led to higher marketing investments in the past few quarters. Higher marketing spending and an increase in short-term incentives and stock-based compensation are expected to have led to increased selling, general and administrative expenses in the fourth quarter.

Analysts.....

According to the issued ratings of 18 analysts in the last year, the consensus rating for Coca-Cola stock is Moderate Buy based on the current 6 hold ratings and 12 buy ratings for KO. The average twelve-month price prediction for Coca-Cola is $66.90 with a high price target of $76.00 and a low price target of $58.00.

Summary.....

Coca-Cola has an impressive earnings track record, exceeding earnings and revenue estimates in seven consecutive quarters.

In its latest release, the company penciled in a 7.8% bottom line beat and reported revenue 4.4% above expectations.

Coca-Cola shares currently trade at a 23.4X forward earnings multiple, below the 24.7X five-year median and highs of 27.1X in 2022.

Further, the company’s forward price-to-sales currently sits at 5.9X, below the 6.2X five-year median.

Coca Cola’s 50-day moving average is $62.25 and its two-hundred day moving average is $61.15. The Coca-Cola Company has a 1 year low of $54.01 and a 1 year high of $67.20. The company has a debt-to-equity ratio of 1.45, a current ratio of 1.13 and a quick ratio of 0.95. The firm has a market capitalization of $260.29 billion, a PE ratio of 26.08, a price-to-earnings-growth ratio of 3.79 and a beta of 0.55.

TAKE PROFIT WHEN AVAILABLE!

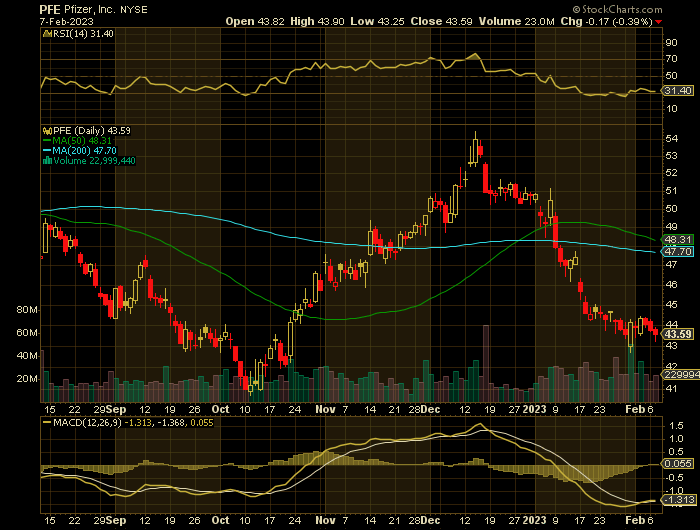

Weekly Options Trade – Pfizer Inc. (NYSE:PFE) PUTS

Wednesday, February 08, 2023

** OPTION TRADE: Buy PFE FEB 24 2023 43 PUTS - price at last close was $0.49 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Pharmaceutical companies that made billions from the pandemic over the past two years selling vaccines and treatments are now up against a steep COVID cliff and investor pressure.

Last year was a stellar one for Pfizer Inc. (NYSE:PFE). The company benefited from strong demand for its COVID-19 vaccine pushing its revenue to more than $100 billion for the first time in its history. But the problem for the stock is that investors have always been looking beyond just COVID, and that uncertainty has led to Pfizer's shares often trading at a discount.

In January, Pfizer announced not only its latest earnings results but also a forecast for 2023, which tells investors what they already knew was inevitable: a sharp decline in sales is coming.

Wells Fargo analyst Mohit Bansal said about Pfizer reporting earnings: "COVID is pretty much out of the models. Pfizer is probably the only one in our coverage where it is still a significant part of it because it was their biggest business last year."

Analyst estimates suggest that Pfizer sales could fall by nearly two-thirds this year due to built up product inventories around the world including in the countries that pay the most. Population immunity from high rates of vaccination and previous infections means that demand for treatments could dip as well.

Pfizer is used to steep revenue drops known as patent cliffs that occur when their exclusivities on big-selling drugs expire and generic rivals move in.

"When you think about traditional drug and vaccine development and longevity of sales, it's usually much more spread out," Morningstar analyst Damien Conover said. "This is very, very concentrated.”

The sudden inflow of revenue should prod companies to strike deals and link up with new partners, he said. BMO Capital Markets analyst Evan Seigerman said companies should use the quick cash for transformative deals.

"Pfizer did these $10 billion deals to build their portfolio and I think they need to do something bigger and more impactful," he said, referring to the $5.4 billion buyout of Global Blood Therapeutics and $11.6 billion purchase of migraine drugmaker Biohaven Pharmaceutical.

Pfizer has been the biggest corporate beneficiary of the pandemic financially; with more than $56 billion in 2022 revenue from the vaccine it developed with German partner BioNTech and from its COVID-19 antiviral treatment Paxlovid.

Pfizer has said it expects that revenue to drop to around $21.5 billion in 2023, although some analysts believe that forecast is overly optimistic.

"We remain skeptical that COVID revenues will grow in 2024 and beyond," JP Morgan analyst Chris Schott said in a research note, adding that vaccination rates could fall even further than the significant decline seen with booster shots in 2022.

Pfizer faces a shift to a commercial market for vaccines this year. Pfizer has struggled to gain traction in the U.S. and the government is no longer purchasing doses, the impact of which remains to be seen.

Pfizer's Bourla previously said he doesn't expect "that people will comply" with booster recommendations.

"Complacency will be getting in the way, so I see that volumes of people that will be getting the vaccines will be less," Bourla said.

Summary.....

A decline in revenue isn't a shock given that concerns surrounding COVID appear to be fading, but the reason for the soft numbers isn't entirely due to demand. CEO Albert Bourla says that there is also a timing issue and that the government simply already has sufficient vaccines on hand. "Much of that demand is expected to be fulfilled by products that were delivered to governments in 2022 and recorded as revenues last year."

TAKE PROFIT WHEN AVAILABLE!

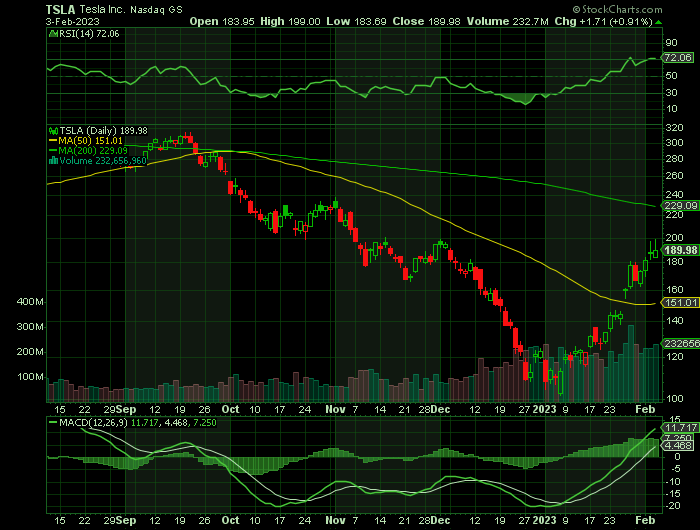

Weekly Options Trade – Tesla Inc (NASDAQ: TSLA) CALLS

Monday, February 06, 2023

** OPTION TRADE: Buy TSLA FEB 10 2023 200 CALLS - price at last close was $4.27 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

The uptrend is showing more signs that it's more than a bear market rally.

Late Friday, Tesla Inc (NASDAQ: TSLA) CEO Elon Musk was found not liable in a class action shareholder lawsuit suit over his 2018 "funding secured" tweets in August 2018, when he said he was mulling taking Tesla private. Musk also tweeted that "investor support" for a deal at $420 a share was "confirmed." Funding was not, in fact "secured," but Musk's attorney argued in San Francisco federal court that, "in that moment he didn't think." TSLA stock rose slightly after hours Friday.

On Saturday, Tesla raised U.S. Model Y prices by $1,000-$1,500, while trimming the base Model 3 by $500. On Friday, the Biden administration revised EV tax credit eligibility, making all Model Y vehicles in the U.S. eligible for $7,500 credits with a price tag of up to $80,000.

Since the end of October and the finalization of Musk’s acquisition of Twitter, the billionaire has been involved in five major companies. Three of them -- Tesla, SpaceX and Twitter -- play highly symbolic roles in their respective fields of activity. The other two companies are Neuralink and The Boring Company.

So, following on from our success with a Tesla call on January 24, and the simple fact that the catalysts keep rolling in for Tesla, let us move forward with this trade.

Back to Weekly Options USA Home Page